Long-term Bitcoin holders are actively accumulating coins. What does this mean?

The day before, Bitcoin’s price hit its highest in five months, but that’s still not enough for the cryptocurrency’s long-term holders to start getting rid of their coins. According to analytics platform Glassnode, those cryptocurrency wallets that have not seen any outflows in the last 155 days are currently holding around 13.3 million BTC, or about 70 percent of the circulating coins. Let’s talk more about the role of what’s happening.

It should be noted that historically, major growth phases in cryptocurrencies usually begin with Bitcoin actively growing ahead of the rest of the market. Apparently, the same thing is happening now.

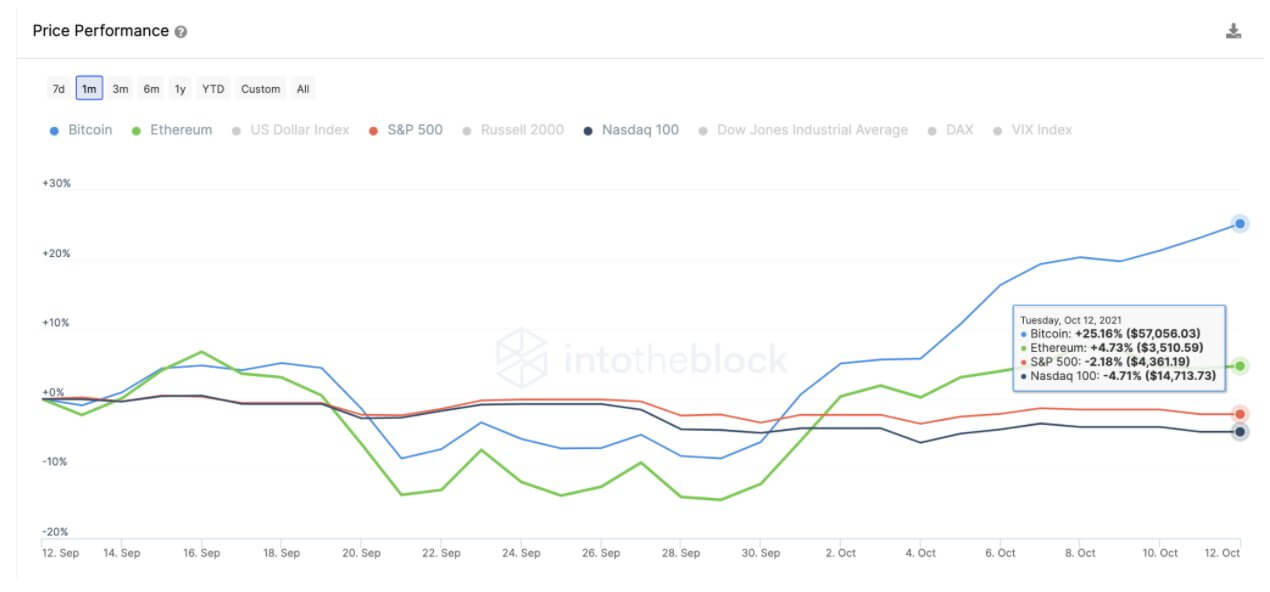

To illustrate, here is a chart comparing Bitcoin, Etherium, the S&P 500 Index and the Nasdaq 100. In recent weeks, it is BTC that has shown a serious superiority in price behaviour.

Comparing the behaviour of different assets

According to analysts, such hints at the niche’s readiness for further growth. Here are the details.

What’s next for Bitcoin

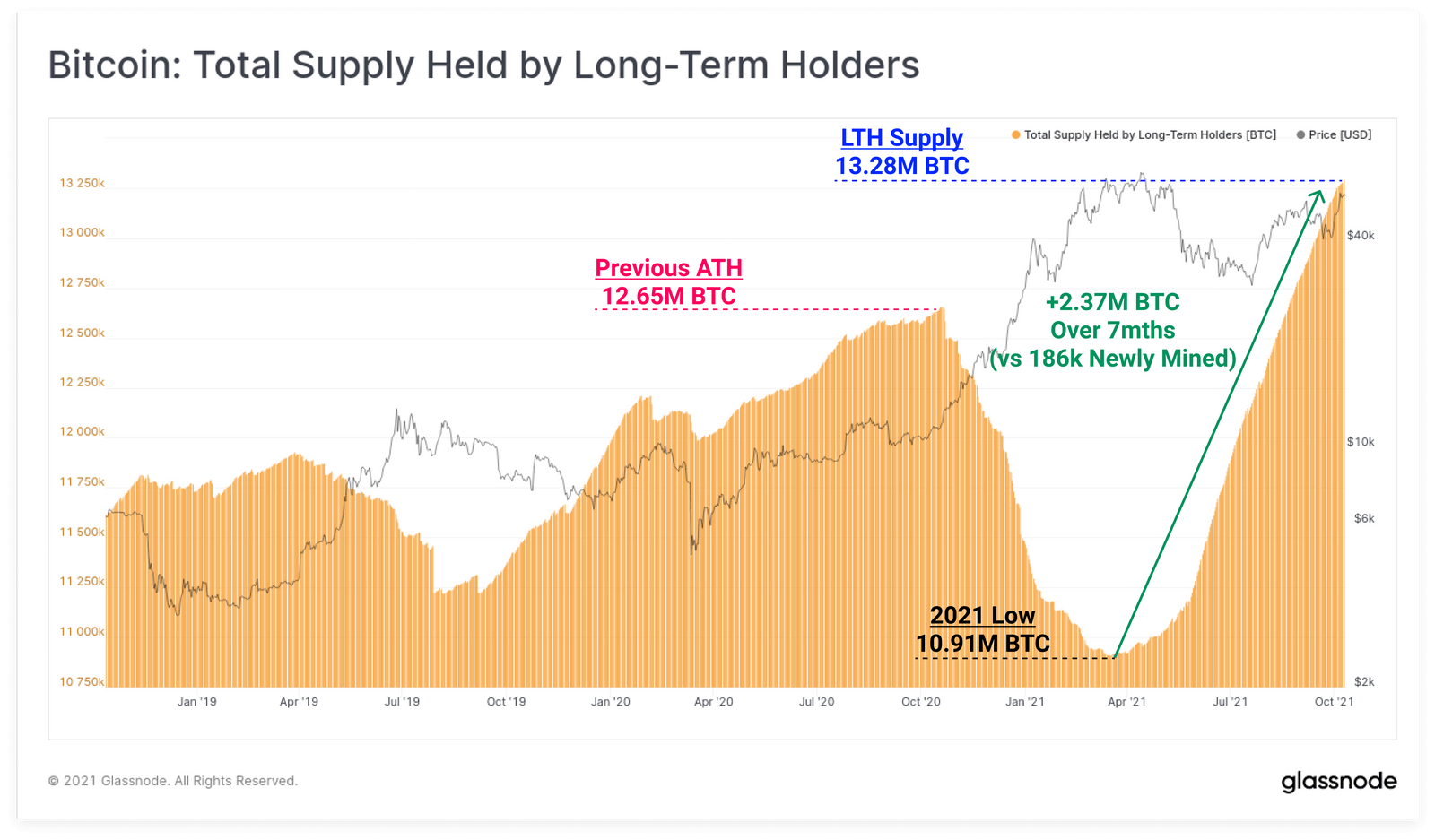

In their latest report, Glassnode experts noted that long-term holders have accumulated at least 2.37 million BTC over the past seven months. At the cryptocurrency’s current exchange rate, that’s about $134 billion. Miners have only mined 186,000 BTC in the same time period, which means the demand for coins is 12.74 times higher than the cryptocurrency’s issuance volume.

Coin accumulation by long-term holders

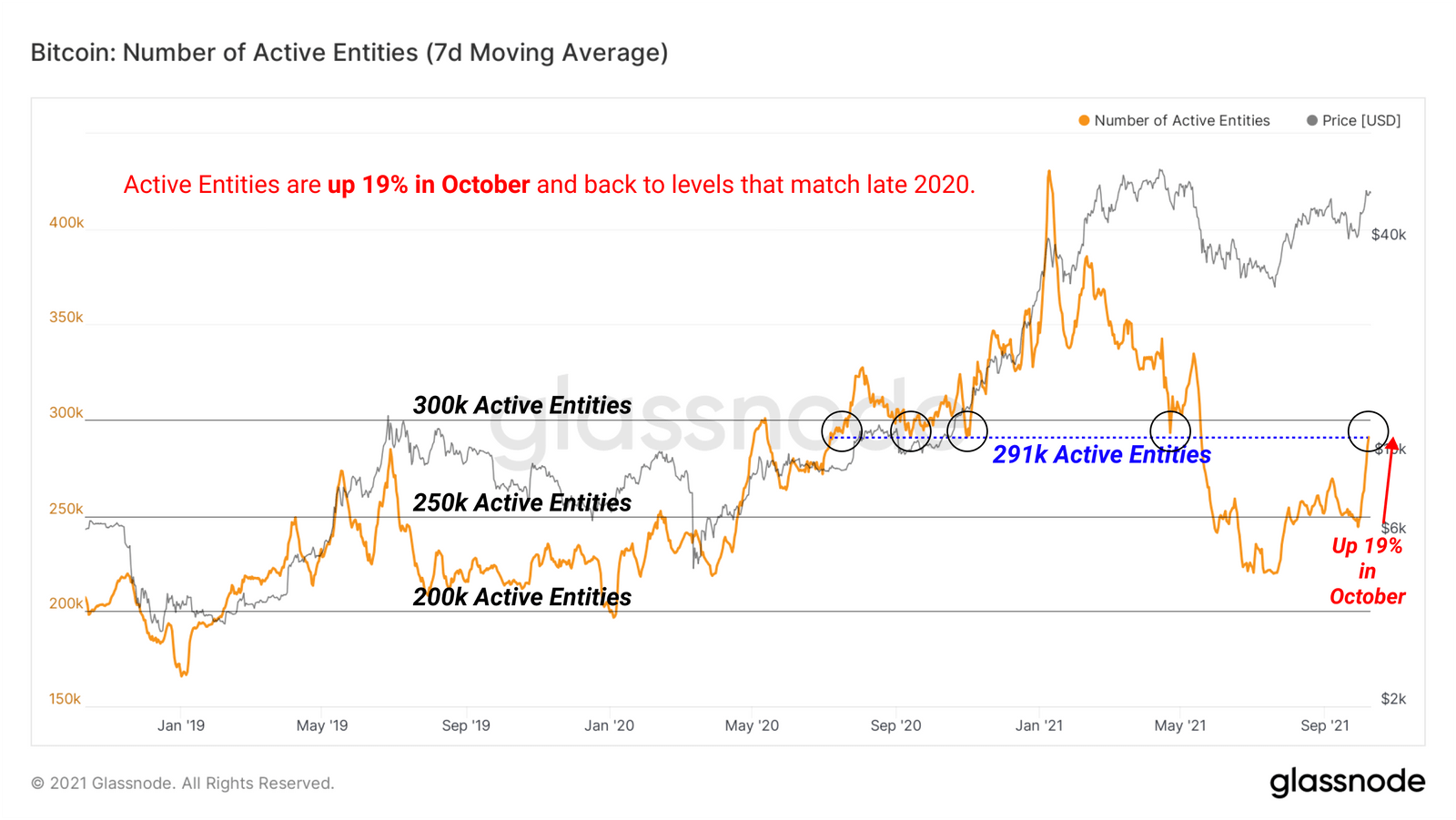

There has also been a surge in blockchain activity. According to Cointelegraph, the number of active Bitcoin addresses rose by 19 per cent to 291,000 units in October alone – the highest it has been since 2020. Here’s what that means according to experts.

The increase in market participant activity has historically correlated with growing interest in the asset in the early stages of a bullish trend.

That is, analysts suggest that what is happening now is a harbinger of a new phase of growth in the cryptocurrency market. At least in the past, such investor activity has led to an increase in crypto-asset prices. At least after a while.

Increase in the number of active Bitcoin wallets

In other words, we are now on the verge of a new wave of Bitcoin growth, which could prove to be unprecedented in its scale, according to analysts. Moreover, the main cryptocurrency could set a new historical high as early as November, according to crypto analyst under the nickname FilbFilb.

His prediction about Bitcoin’s price growth rate is based on a comparison with its dynamics from August to November 2017. As a reminder, it was at the end of this year that BTC set its previous historical high around $20,000. The screenshot below shows that period on the left, while in the middle and right are the 3-day and 1-day charts of Bitcoin at the moment.

A comparison of the three Bitcoin charts

Nevertheless, although Bitcoin is only a few days away from a new high, FilbFilb also does not rule out the possibility of a new local pullback in the price. The main question is to what level can BTC go down in the future? The trader believes that many market players are ready to buy the coin at $48,000. Here’s the trader’s quote.

I think it’s $48k, but so far we don’t have a significant presence of sellers on exchanges, so there’s a 50/50 chance of a pullback.

Accordingly, in this case, things could go without major collapses, as was the case on the day Bitcoin was recognized as official tender in El Salvador. On September 7, 2021, the first cryptocurrency dropped $10,000 in one day.

Please note that any of the above predictions are not bound to come true as what happens in the digital asset market depends on hundreds of factors, many of which turn out to be unpredictable. We therefore recommend that you focus on your own market analysis and use risk mitigating tools.

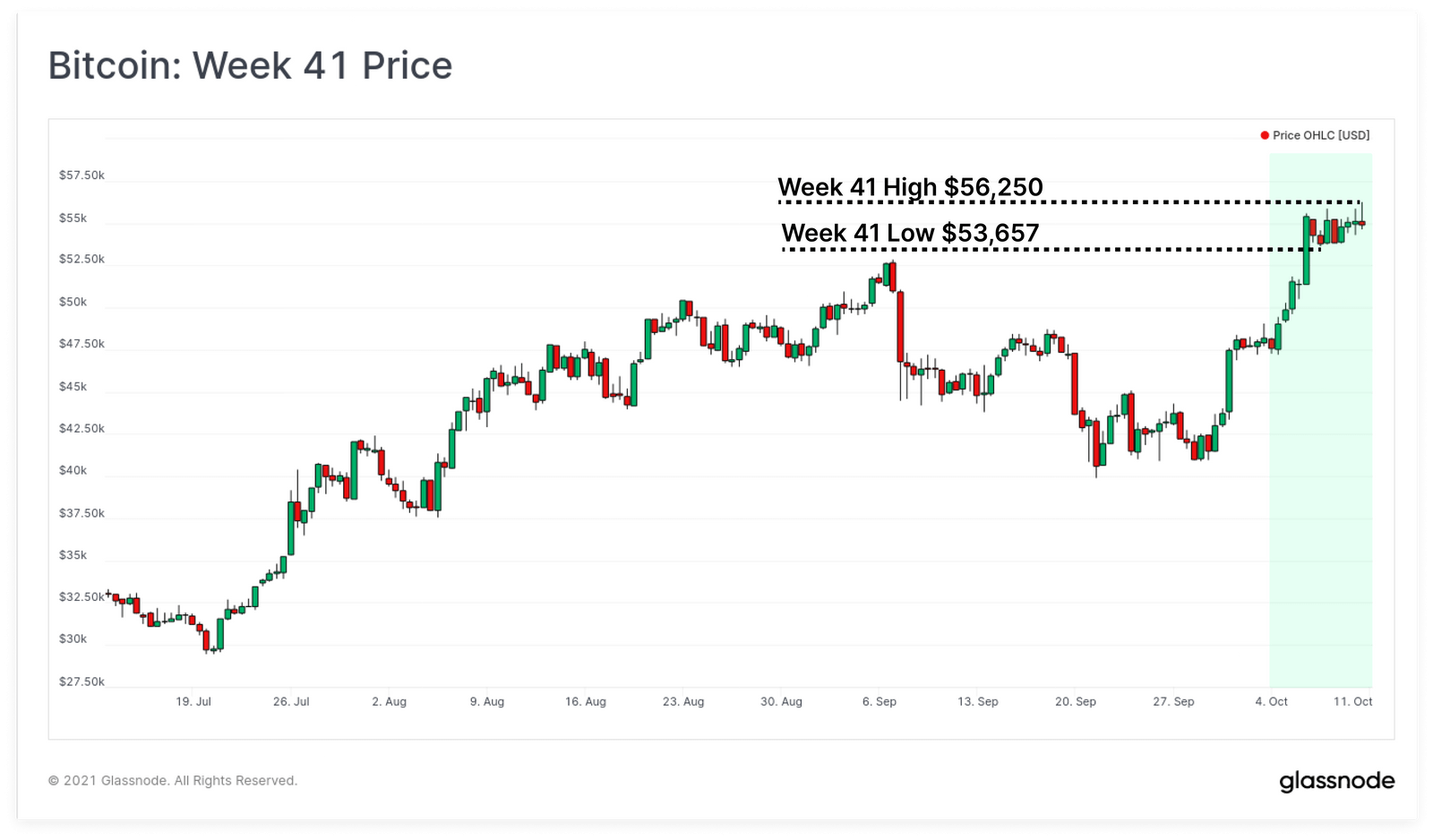

Bitcoin price appreciation

The fourth quarter of the year is traditionally considered a bullish period for the cryptocurrency – this is clearly evident from BTC’s earnings performance in all months of its history. As a result, investors and traders are expecting history to repeat itself, which is why they are opening appropriate positions in anticipation of growth. This, one way or another, affects the value of assets, as their active buying pushes the exchange rate up.

Bitcoin yields by month

We believe that the situation in the cryptocurrency market today does look positive. Investors and traders are noticing this and are therefore making decisions accordingly. So it is possible that the fourth quarter of 2021 could be just as impressive as before.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There, we’ll discuss other important developments related to the decentralisation industry.