Major investors are once again interested in Bitcoin. The cryptocurrency is one step away from an all-time high

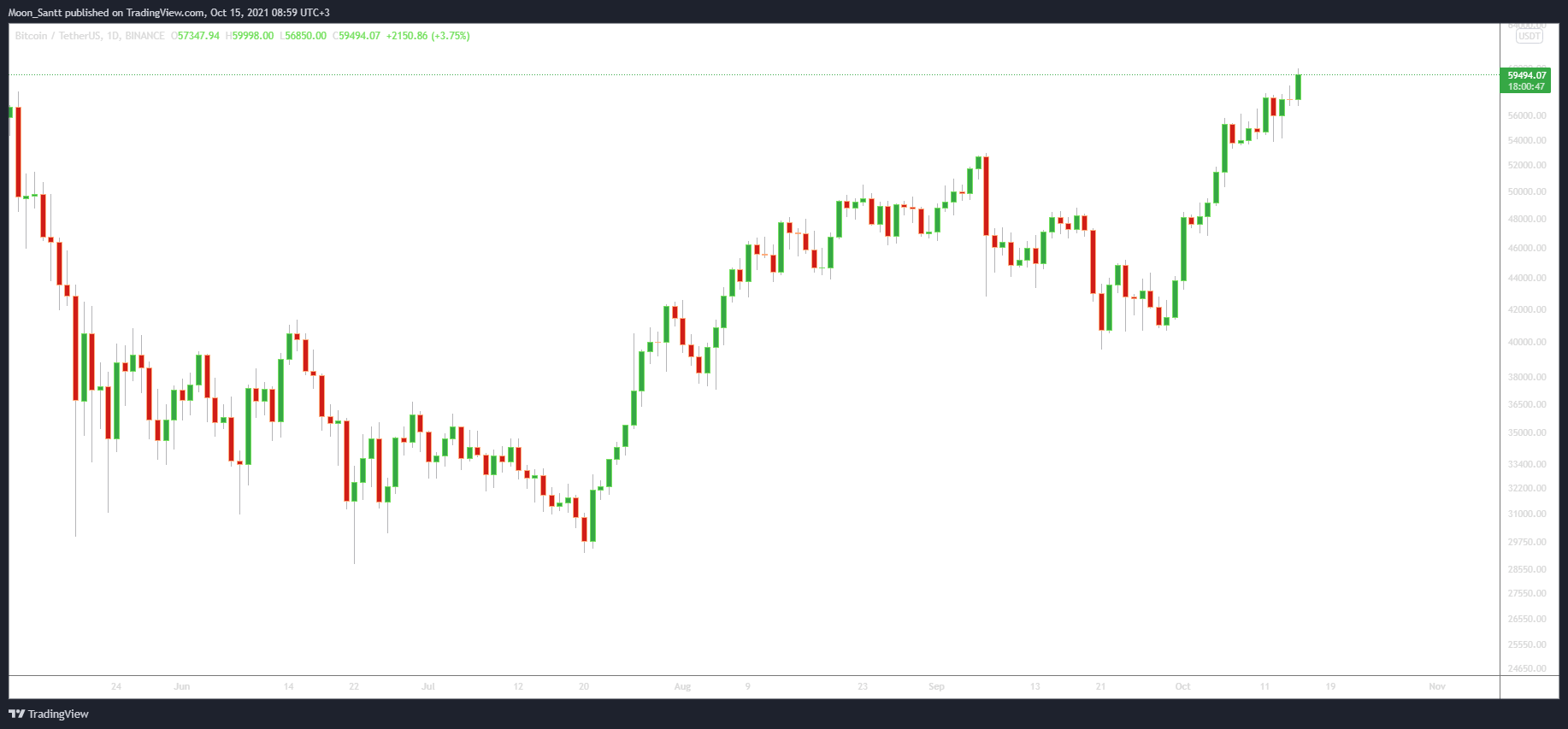

Bitcoin’s fall in September, while it did overshadow the crypto market, it only did so for a short period of time. After reaching a local low, the BTC price has rallied again. Already this month, it has been trading near its all-time high and today it came close to the $60,000 mark. According to analysts at platform Arcane Research, the recent rise in Bitcoin’s price has given more optimism to institutional investors – the industry’s biggest players. We tell you more about what’s happening.

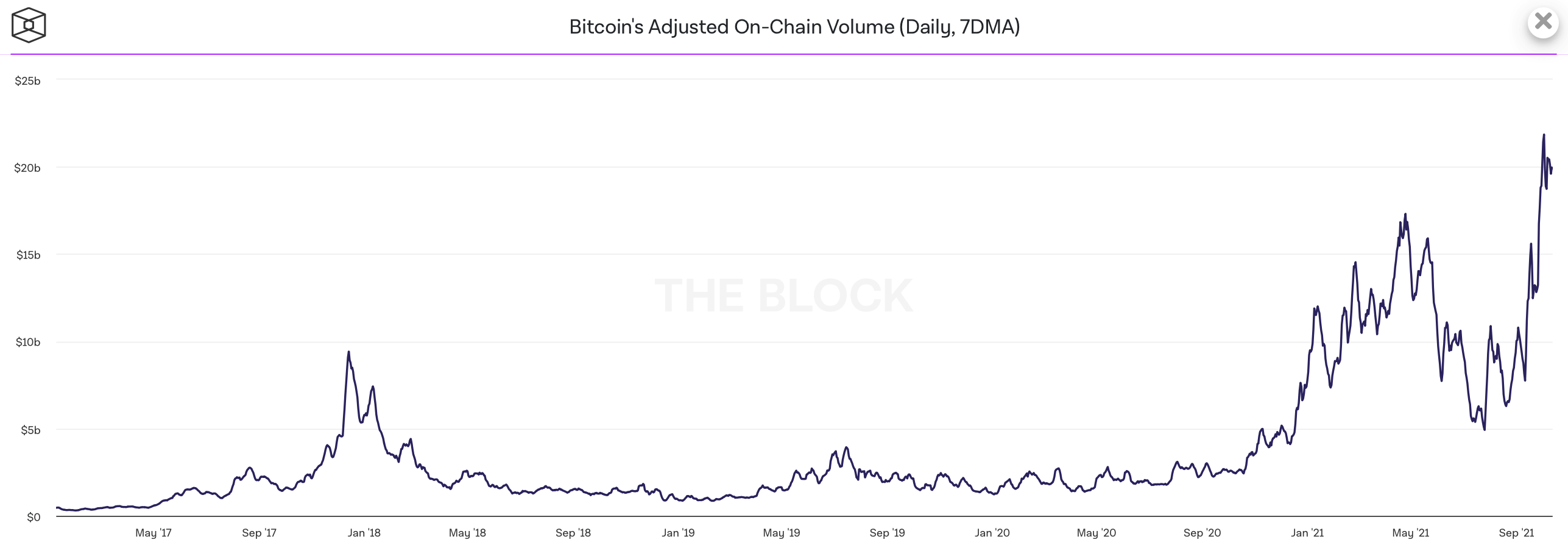

Bitcoin’s popularity amid the cryptocurrency’s rise is having an impact on metrics within its network. In particular, the volume of coins sent on the BTC blockchain is now close to its peak. The current figure is $19.92 billion. This is the equivalent amount of dollars transferred through the Bitcoin network in a 24-hour period.

Volume of transfers on the Bitcoin network

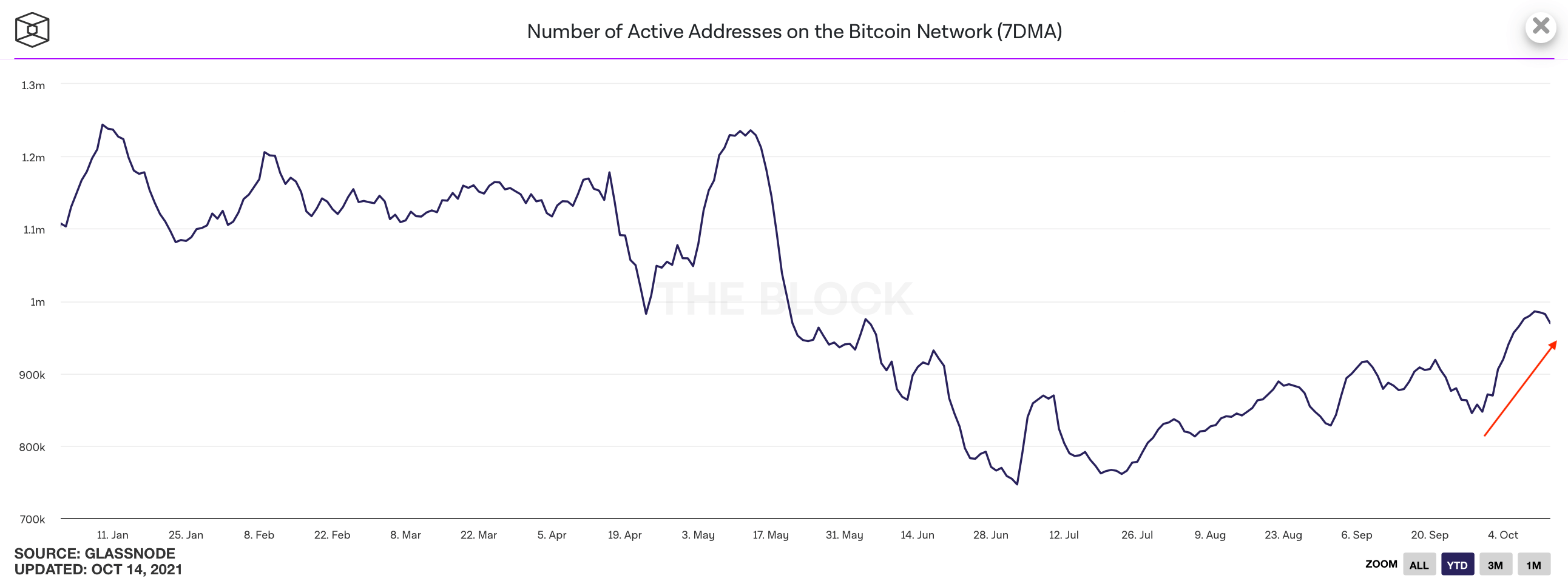

The number of active addresses on the blockchain also increased markedly in October. The last confirmed result was 969 thousand addresses per day.

Number of active addresses in the Bitcoin network

Why Bitcoin is growing again

After Bitcoin broke through two major price resistance levels in early October, the amount of open positions in options contracts on the cryptocurrency reached “levels set on April 15.” This suggests that bullish sentiment is indeed dominant among investors, Decrypt journalists note, which means they expect the cryptocurrency to continue rising.

As a reminder, it was in mid-April that the historical high of the BTC price was set just below $65,000. It was followed by a prolonged drop, caused by negative news about China’s ban on Bitcoin mining, as well as criticism of the Bitcoin mining industry by Elon Musk.

Incidentally, the effects of China’s mining ban are already being felt. The country has lost almost all of its share of the cryptocurrency network’s hashairite – with the US now taking the lead.

Bitcoin price growth

Analysts have also noted growing activity in Bitcoin futures trading on the Chicago Mercantile Exchange (CME). Here, the share of open positions in the trading instrument in the exchange’s total turnover has risen to 17 per cent. Arcane Research CEO Bendik Norheim Shay said that the positive news from the CME particularly clearly signals the “great appetite” of institutional investors for Bitcoin. Accordingly, they see the potential for digital assets to set new rate records.

So what is the reason for the main cryptocurrency’s rapid rise in price? Many experts speculate that it lies in anticipation of the imminent approval of the first Bitcoin ETF in the US. To recap, an exchange-traded fund or ETF is an investment vehicle that allows large investors to earn on the price movements of a digital asset at a lower risk than actually buying or selling coins. Essentially in this case, a cryptocurrency ETF will allow stock exchange participants to make money from Bitcoin movements without owning the coins or being responsible for holding them.

The market awaits the adoption of a Bitcoin ETF

Although the US Securities and Exchange Commission (SEC) has rejected all applications for approval of Bitcoin ETFs for several years in a row, there are rumours in the cryptosphere that the regulator will announce approval of the exchange-traded fund this time, and will do so as early as next week.

Such a scenario was confirmed tonight by news that “Bitcoin futures ETFs have not faced opposition from the US Securities and Exchange Commission”. Accordingly, the adoption of the long-awaited financial instrument now seems even more realistic.

Mention of Bitcoin futures and ETFs

We think the situation in the cryptocurrency industry now looks more positive than ever. It looks like the first Bitcoin ETF will indeed be launched in the US, giving a huge number of investors access to cryptocurrency-linked instruments. This means that in the near future, the digital asset niche could be in for a new batch of capital, which will surely have an impact on the coin's exchange rates.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will discuss other developments in the blockchain and decentralization industry.