Binance has published ten fundamental rights for cryptocurrency users. What are they?

The world’s largest cryptocurrency exchange, Binance, has published “Ten Fundamental Rights of Cryptocurrency Users”. The manifesto document calls for the protection of free access to innovative financial instruments for all people, as well as the importance of privacy and anti-fraud. In essence, the publication has no legitimate relevance even within the exchange itself, but it clearly demonstrates what the long-term vision for the digital asset industry is in the eyes of the platform’s management. Let’s take a closer look at the situation.

Traditionally, let’s start with the context. Binance is currently the largest cryptocurrency exchange in the world. It is the leader in trading volumes in all categories and the most popular trading platform among traders and investors.

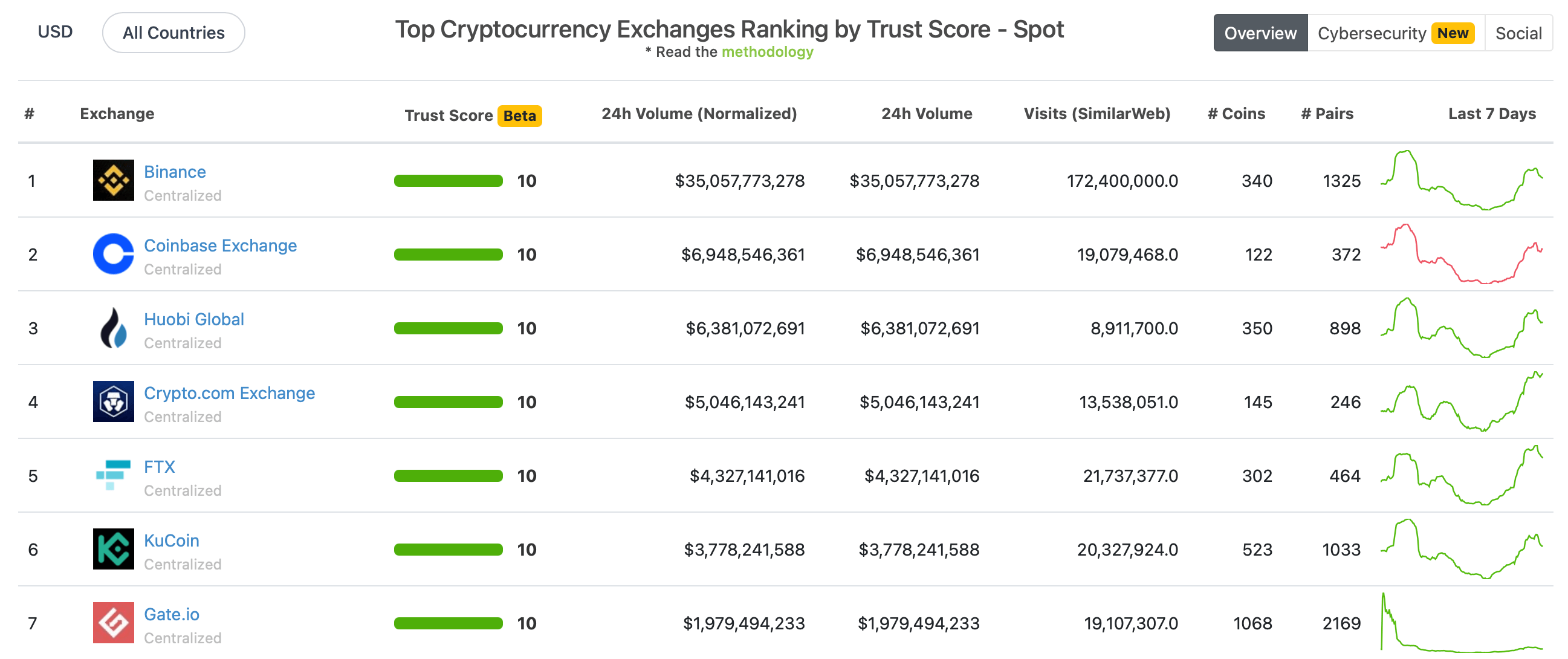

We checked the current data: yesterday the Binance spot market saw transactions worth the equivalent of $35 billion. We are talking about transactions in crypto at market rates. The company’s nearest competitor, US-based Coinbase, had just under $7 billion in volume.

Rating of cryptocurrency exchanges by spot trading

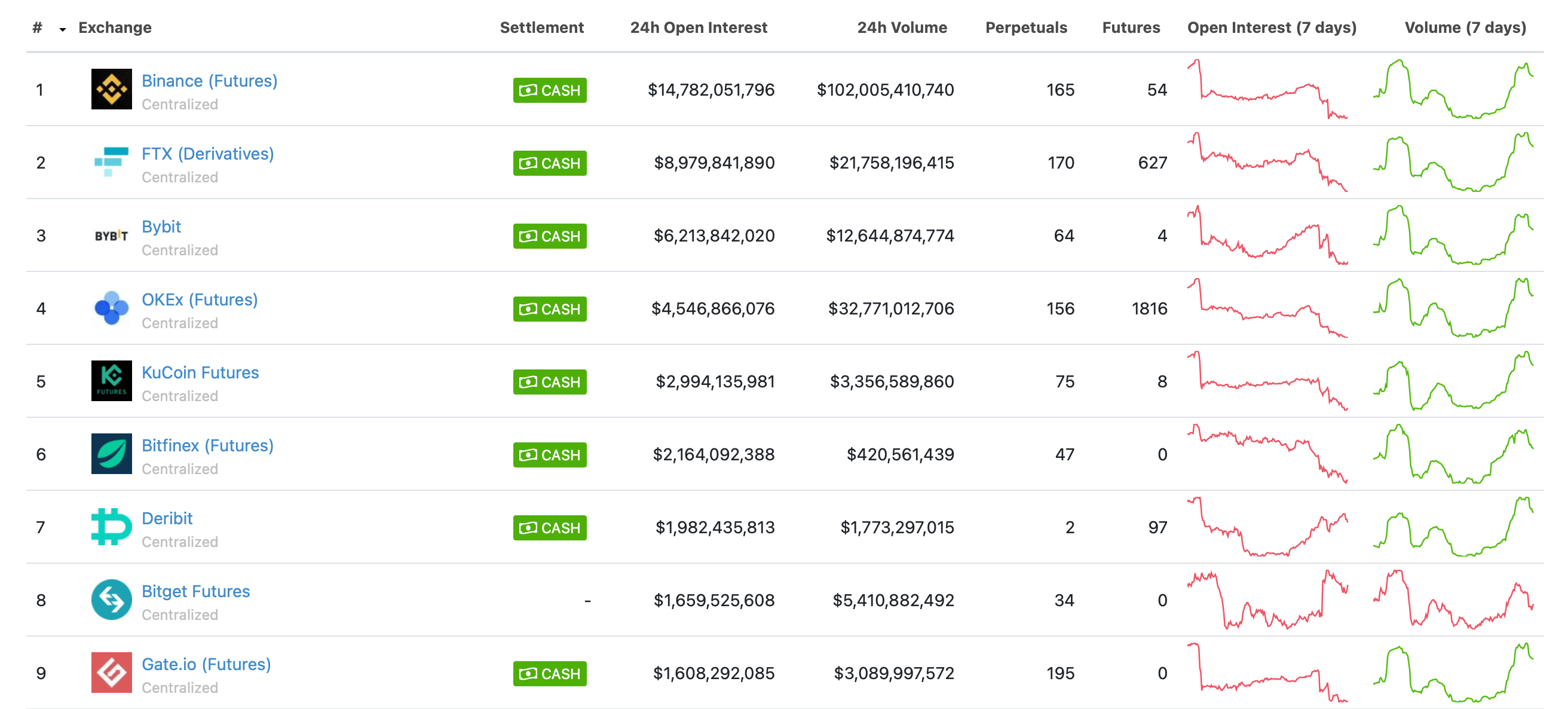

The same goes for the futures-type derivatives market, where Binance also leads the way. The exchange has 102 billion in trading volumes per day. In second place, however, is the FTX platform with 21 billion.

Ranking of cryptocurrency exchanges by derivatives trading

In other words, the cryptocurrency exchange has huge popularity and its management has achieved outstanding success. As such, it is trying to change the perception of the cryptocurrency industry for others outside the niche.

What the Binance exchange is calling for

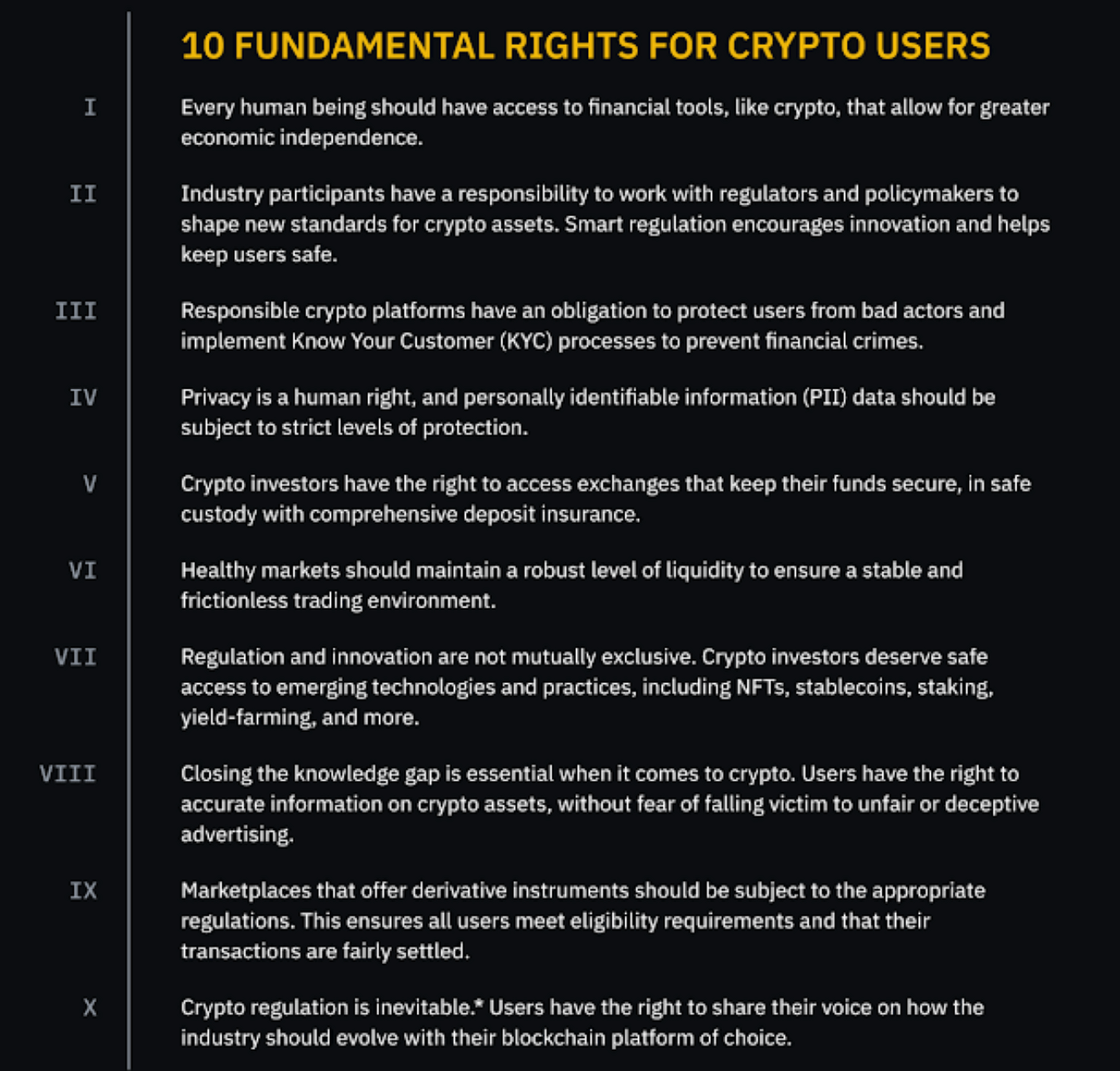

Here is a translation of the exchange’s ten talking points, published in the original by the news outlet Decrypt.

- Everyone should have access to financial instruments like cryptocurrencies that give greater economic independence;

- Industry participants are responsible for working with regulators to create new standards for crypto-assets. A smart regulatory approach promotes innovation and helps protect users;

- Responsible crypto platforms have a commitment to protect their users from fraudsters and implement identity verification rules (KYC) to prevent financial crime;

- Privacy is a human right. As such, personally identifiable data must be strictly protected.

- Cryptocurrency users have the right to access exchanges where their funds are held in a secure vault with comprehensive deposit insurance.

- Healthy markets must maintain a high level of liquidity to ensure a stable trading environment without any problems.

- Regulation and innovation are not mutually exclusive. Cryptocurrency users deserve safe access to the latest technologies, including unique NFT tokens, Stablecoins, staking, income farming and more.

- It is important to fill the knowledge gap about cryptocurrencies. Users have the right to receive accurate information about crypto-assets without fear of falling victim to unfair or misleading advertising.

- Trading platforms offering derivatives must be subject to the relevant regulations. This ensures that all users follow the controls and transaction requirements.

- Regulation of the crypto market is inevitable. Users have the right to share their views on how the industry should evolve with their chosen blockchain platform.

10 fundamental rights of cryptocurrency users

Binance published this list at a time when the company is trying to completely reform its corporate culture and change its image. The reason is strong pressure from financial regulators, who don’t like the excessive decentralisation of the platform’s governance structure.

It looks like the company's management will now do everything it can to become a better crypto platform in the eyes of regulators. As noted in the last "rule" - regulation of the crypto market is inevitable.

Note that the platform has even created a special website with a list of these points. It says that sometimes the headlines mislead newcomers to the cryptocurrency niche, and that there is “a whole world out there” behind the words Bitcoin and Dogecoin. The bottom line is that Binance wants to attract the platform’s “next billion users” and is willing to actively cooperate with regulators to do so.

Binance’s website about cryptocurrency user rights

In addition, the platform has ordered advertisements in popular newspapers. These are the Financial Times, Washington Post and New York Times.

In the Washington Post and New York Times. #Binance pic.twitter.com/7KilRpRYsN

– Binance (@binance) November 16, 2021

We think such actions by the cryptocurrency exchange leader are quite logical - especially given the platform's legal troubles. Binance's management will now actively engage with regulators, making the niche more and more 'law-abiding'. According to Changpen Zhao, the crypto industry cannot grow and become truly mainstream without regulation, which is why the situation is now as it is. Although the wording can be criticized, there is some logic in it anyway.

Look for even more interesting things in our millionaires’ crypto-chat. There we will talk about other related topics that affect the blockchain and decentralisation industry.