Cryptocurrency market capitalisation has plunged $200 billion in a couple of days. What are the experts saying?

Last week was not a good period for the crypto market and the traditional financial system in general. US stock indices fell by an average of 2 percent, oil futures fell by more than 10 percent, and the crypto industry’s capitalisation plummeted by $200 billion. This was caused by another wave of panic due to the rapid spread of a new variant of the coronavirus called B.1.1.529, which was eventually dubbed Omicron. However, not everyone is pessimistic about Bitcoin’s future right now. We tell you more about what’s going on.

Let’s note that the collapse of coins on Friday November 26 was indeed painful. In particular, Bitcoin managed to slide from a peak of $59,398 to a low of $53,500. This can be seen on the cryptocurrency’s hourly chart, which we have already shifted to the right moment.

Bitcoin’s hourly chart

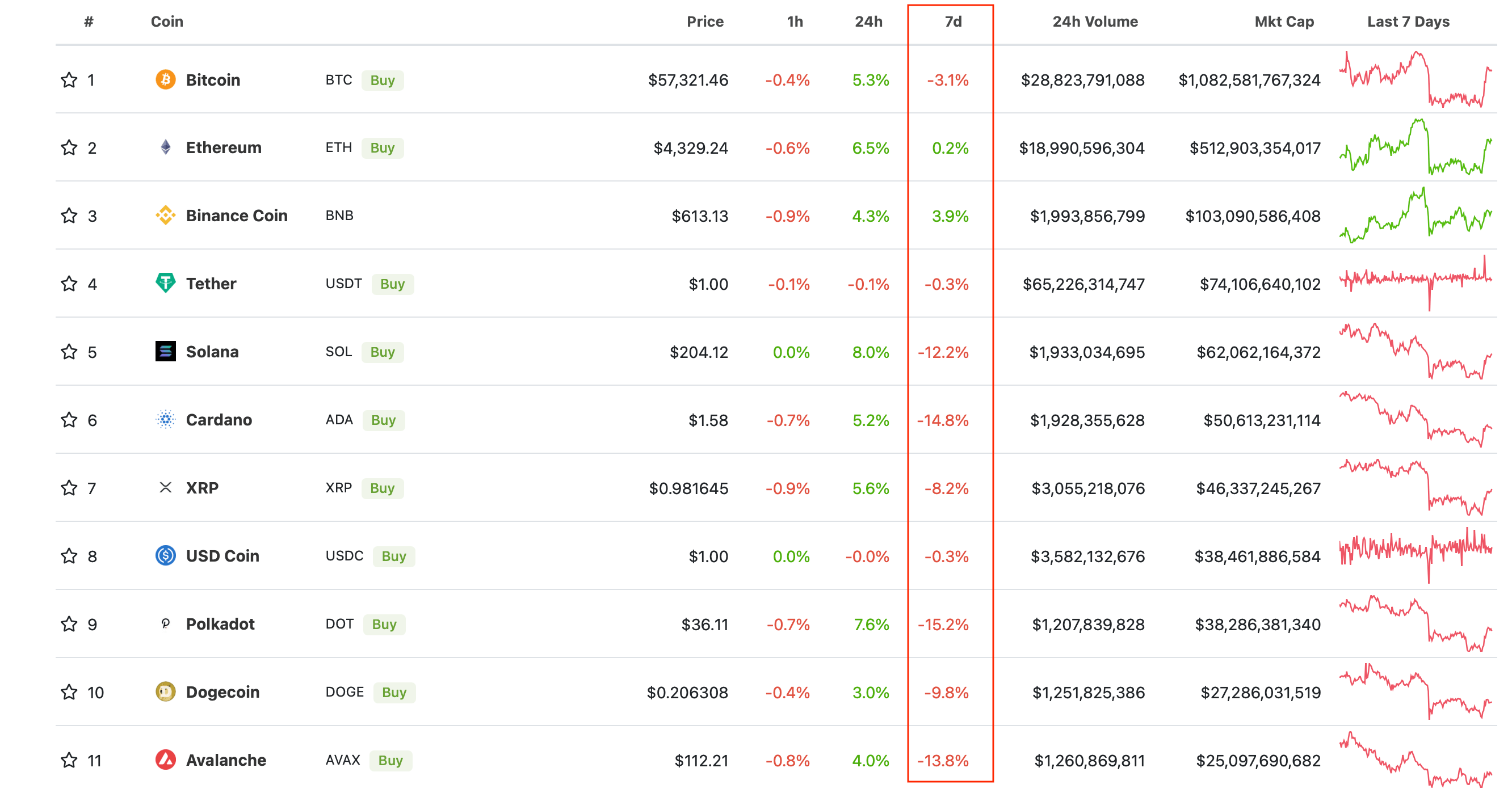

Against this backdrop, many altcoins have still not recovered from the series of Bitcoin collapses. This is particularly evident in the results of their price movements on a weekly scale.

Ranking the top cryptocurrencies by market capitalisation

What will happen to cryptocurrencies?

SkyBridge Capital founder Anthony Scaramucci said in a recent interview that the panic is nothing more than a Black Friday for the markets. Well the collapse of asset prices should be perceived by investors as a good opportunity to invest even more capital. Here is an expert’s rejoinder in which he shares his views on the coin market situation.

If the US Federal Reserve does not yet roll back its stimulus, this collapse is a profitable buying opportunity. Black Friday, all assets are on the sell-off.

Here, the investor notes the activity of the US Federal Reserve, which serves as the nation's central bank. The latter undertook to dramatically increase the amount of money in circulation to eliminate problems in the economy due to the spread of the coronavirus. This has traditionally led to a depreciation of currency in circulation and a rise in prices that has already resulted in a record inflation rate for a month in the USA in the last thirty years.

At the same time Bitcoin not only has a limited maximum supply but also an inflation rate, i.e. the issuance of new coins. They are now at 6.25 BTC per block, which is mined on average once every ten minutes. However, roughly in 2024 that figure will be lowered to the level of 3.125 BTC per block. All of the above features stand in perfect contrast to what is happening in the conventional economy - which is why Anthony suggests getting in touch with digital assets.

SkyBridge Capital fund CEO Anthony Scaramucci

Scaramucci is confident that Bitcoin’s fundamental value isn’t going anywhere, so traders shouldn’t give in to panic. Overreacting to negative news won’t do them any good, the expert believes. Here’s another of his quotes published by the news publication CryptoPotato.

If you believe in the long-term fundamental benefits of cryptocurrencies as much as we do, now is the time to buy. I just think it’s a low-risk decision at this point. Bitcoin and other cryptocurrencies are volatile, which puts many people out of the game. Corrections are also reducing the volume of leveraged positions, which I think sets the stage for growth in the first quarter of next year.

Accordingly, the investor considers the potential of the coins to be sufficient for a noticeable increase in value in the coming months. It will only be possible to verify this statement in practice.

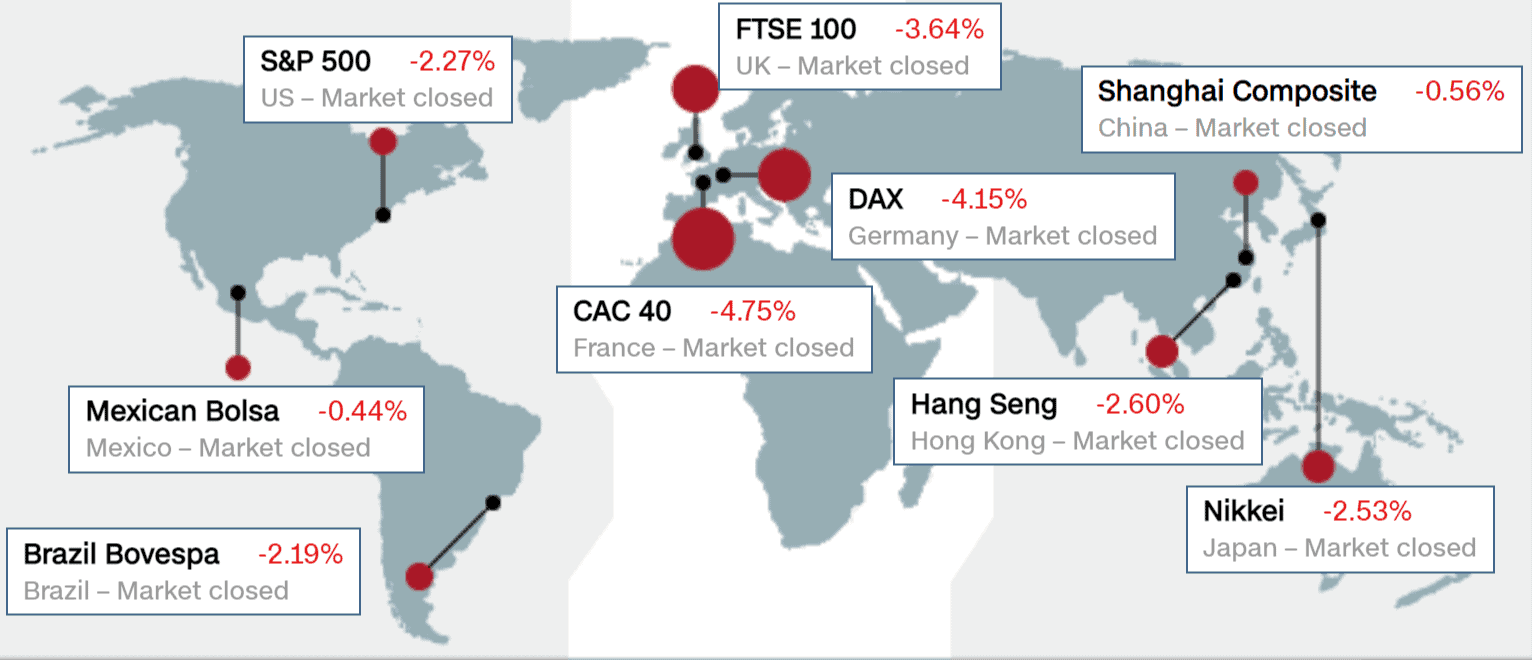

Collapses in trading indices around the world

Anthony Scaramucci is not the only one who remains optimistic about the near-term future of the market. The billionaire and founder of Banco Azteca, one of the biggest banks in Mexico, Ricardo Salinas Pliego, agrees with him. Last week he tweeted very ironically about the problems of the US dollar and called for buying Bitcoin.

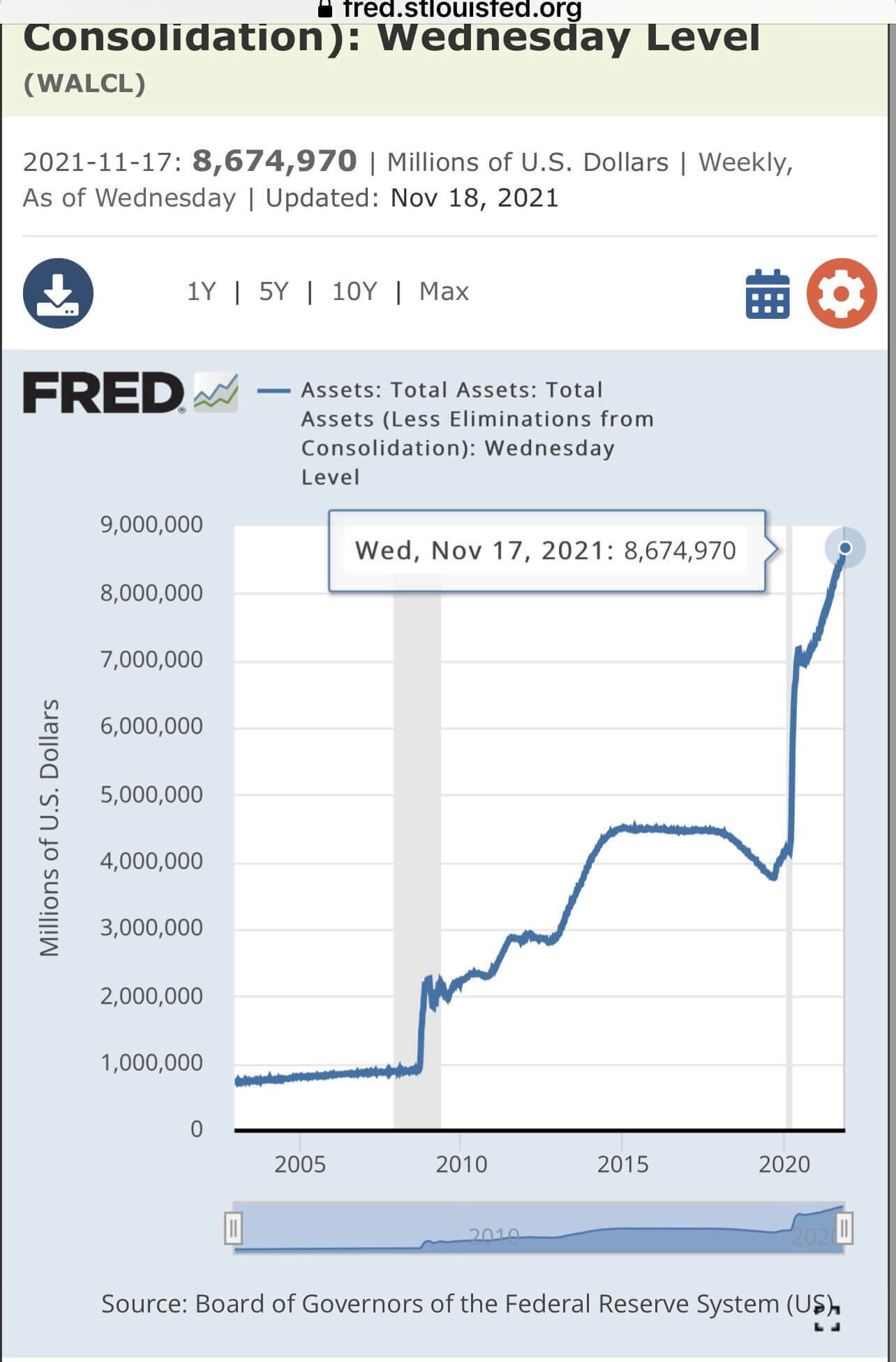

The good old United States is looking more and more like an irresponsible third world country. Wow, just look at the pace of fake money printing. Buy Bitcoin right now.

Mexican billionaire Ricardo Salinas Pliego

Pliego has attached to his message a graph of the increase in the dollar’s money supply caused by the country’s economic stimulus. Recall that the US printed trillions of dollars to ensure that the negative effects of quarantine after the spread of COVID-19 would be eliminated.

Dollar money supply growth

The billionaire's call for cryptocurrency purchases now looks like a fairly logical decision. Dollar inflation is rising every month - and the situation is unlikely to improve even when the Federal Reserve begins to roll back its stimulus programme. Bitcoin, on the other hand, has a good chance of making investors happy for the foreseeable future, thanks to a limited supply of coins.

However, we traditionally don't recommend blindly following investment advice from celebrities. Still, cryptocurrency money should be treated the same as regular money, so the first task for investors should not be to make money, but at least not to lose the volume of invested funds.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There, we’ll talk about other topics affecting the decentralised asset industry.