Most older investors do not want to sell their bitcoins. What can this lead to?

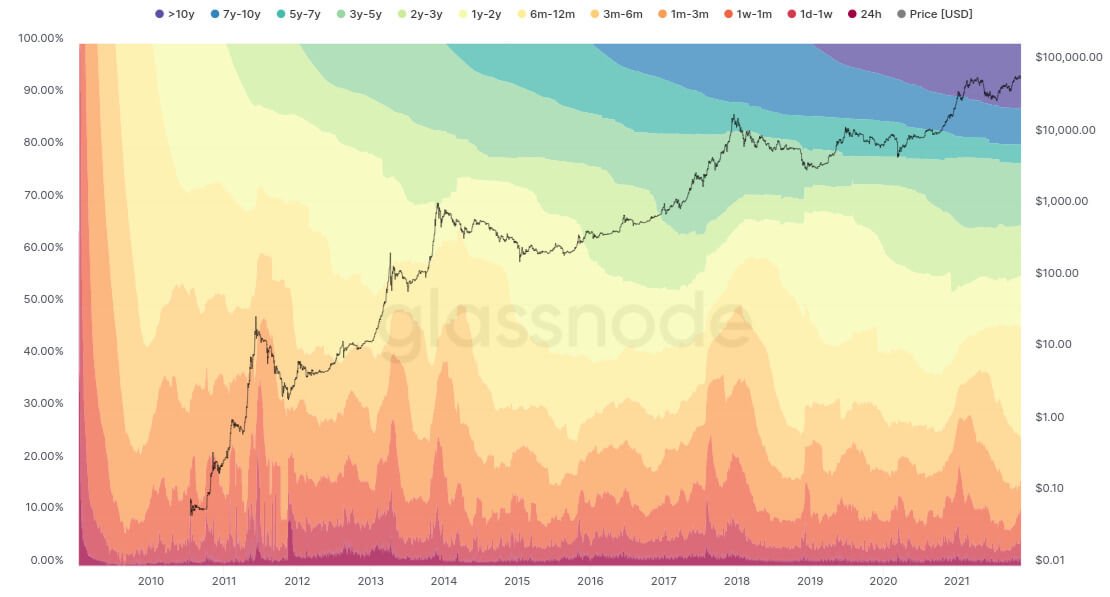

Cryptocurrency investors who bought Bitcoin around its historic 2017 bull cycle high are in no hurry to part with their coins. According to a coin movement indicator called Hodl Waves, bitcoins that have moved between six and twelve in the past month now make up the largest share of the cryptocurrency’s supply. In other words, BTCs bought in late 2020 and early 2021 move most frequently, while other coins move less actively. We tell you more about what’s happening.

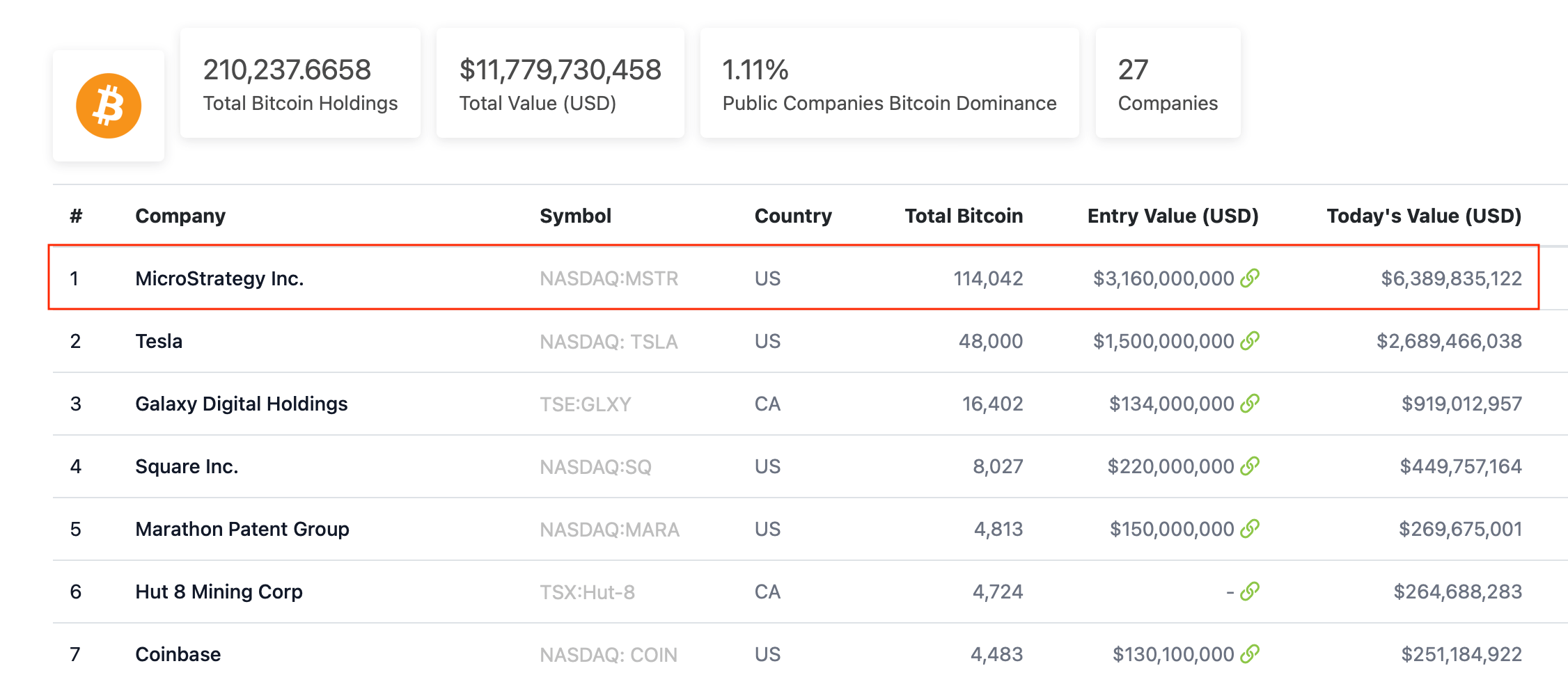

It should be noted that the market is not looking good right now, but many prominent members of the cryptocurrency community advise against it. Specifically, MicroStrategy CEO Michael Saylor, who has over 114,000 BTC in his possession, yesterday advised on Twitter to ignore Bitcoin’s drawdowns and “enjoy the ride” in the cryptocurrency world.

Enjoy the ride. #Bitcoin

– Michael Saylor⚡️ (@saylor) November 18, 2021

However, it’s important to consider here that MicroStategy’s investment was the equivalent of $3.16 billion and is now valued at $6.38 billion.

Ranking of public companies with bitcoins in their investment portfolio

What will happen to Bitcoin

Despite the major cryptocurrency’s meteoric rise in 2021, a notable number of investors are not yet taking profits on it, meaning they are not selling the coins. As a reminder, the Hodl Waves indicator itself tracks the date of last coin movement and displays its share in a handy form on a chart. It shows that the controlled supply of BTC by later investors increased from 8.7 per cent to 21.4 per cent between June and November.

At the same time, bitcoins bought earlier than a year ago remain relatively less active. These readings support the theory that crypto investors are choosing not to sell Bitcoin yet, even though their cryptocurrency transactions are profitable.

Hodl Waves indicator

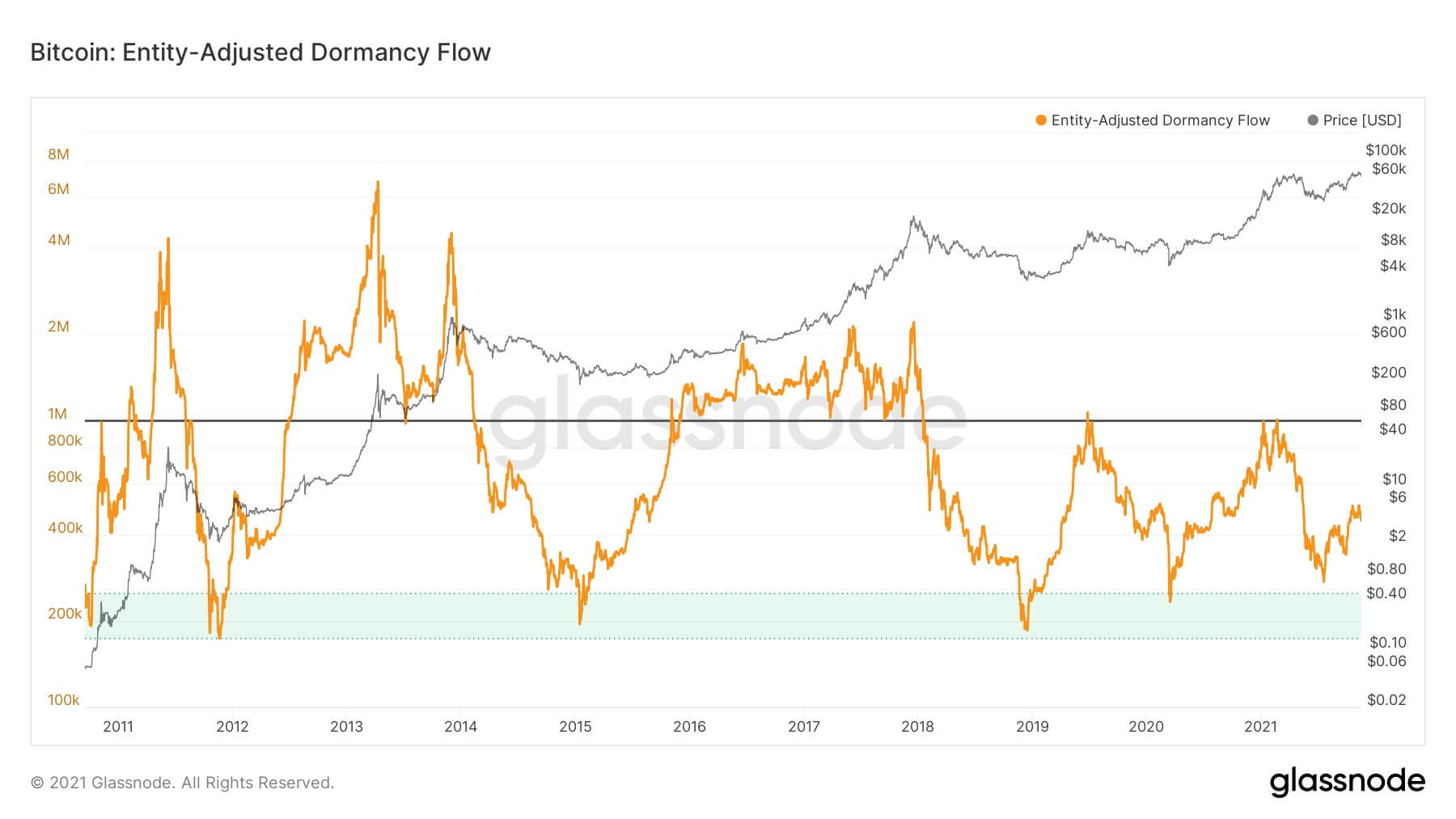

Crypto analyst William Clemente noted that a metric called dormancy flow – that is, Bitcoin’s market capitalisation divided by the coin’s one-year dormancy period – remains relatively low. The higher the value of this metric, the closer the bullish trend is to its end, as most market participants sell coins during this period. And that, consequently, leads to a rapid drop in their prices.

Here is Clemente’s comment on this matter, in which the expert shares his attitude to what is happening. The quote is quoted by Cointelegraph news publication.

Dormancy flow at such a low value suggests that the current bullish trend still has room to grow upwards.

Dormancy flow indicator

It should be noted that most of the cryptocurrency market participants are in a state of panic right now. Yet Bitcoin, after reaching its new price record of $69,000, managed to correct to a price low of $55,600. The cryptocurrency found a local bottom this morning.

A four-hour chart of the Bitcoin exchange rate

Although some analysts still see what’s happening in the market as a healthy correction needed for further niche growth.

At the same time, Bitcoin has become a hotly debated topic in the Argentine government. Earlier, it published a decree that cryptocurrency transactions are now subject to taxation. This was reported by Decrypt.

The exemptions stipulated in the decree and other regulations of a similar nature will not apply where the movement of funds involves the purchase, sale, exchange, brokering and/or any other transactions involving crypto-assets.

Previously, cryptocurrency transactions between individuals in Argentina were exempt from tax and treated as if they were simply transactions in ordinary currency. Now, however, cryptocurrency will come under the country’s law, which in a way is a clear sign of Bitcoin’s acceptance among members of the Argentine government.

This means that the coin industry is now heading towards legalisation and its emergence as a full-fledged asset in today's economy. Recall that this is exactly what the cryptocurrency exchange Binance, which the day before published its ten fundamental rights for users of digital assets, is pushing for. All of them ultimately boiled down to the fact that the niche lacks regulation, which in itself does not preclude innovation. Read more about this topic in a separate piece.

Changpen Zhao, chief executive of Binance

We believe this investor behaviour not only shows their confidence in Bitcoin's future growth, but also reduces the sellers' pressure on the cryptocurrency at the same time. In other words, the less people sell the asset, the less reason for it to collapse. And in the current environment this is very relevant for Bitcoin.