Prominent investor to cut back on gold in his portfolio to buy Bitcoin

The strategy of selling gold to buy Bitcoin is gaining popularity among some investors. These include the Jefferies Group, led by financier Christopher Wood. He is now in the process of closing his position in the precious metal in order to increase his exposure to the cryptocurrency. In doing so, Wood believes that other large financial firms should follow his lead, so as not to miss out on the potential benefits of the growth of the crypto market. We tell you more about what’s happening.

What professionals are investing in

Notably, the head of Jefferies has not always been a Bitcoin fan. He has previously refrained from investing in the cryptocurrency, citing concerns about cybersecurity risks. Like most big players, Wood did change his mind. While he remains optimistic about gold, he also believes that the financial revolution sparked by Bitcoin should not be ignored.

Christopher Wood, head of Jefferies Group

In an address to his investors, Wood said that if blockchain technology succeeds in fundamentally changing the world of finance by eliminating the need for intermediaries, it could also lead to the “demise of the dollar monetary standard.

Jefferies Group

As noted by CryptoPotato journalists, the financier has so far remained a Bitcoin-maximalist – that is, he is not considering adding Etherium and other altcoins to his portfolio. However, he also doesn’t rule out the possibility that ETH could be higher than BTC for the foreseeable future, but the risks so far have kept him from transforming his portfolio. At the moment, Bitcoin’s share of it reaches 10 per cent, while 40 per cent is allocated to gold.

Gold and Bitcoin

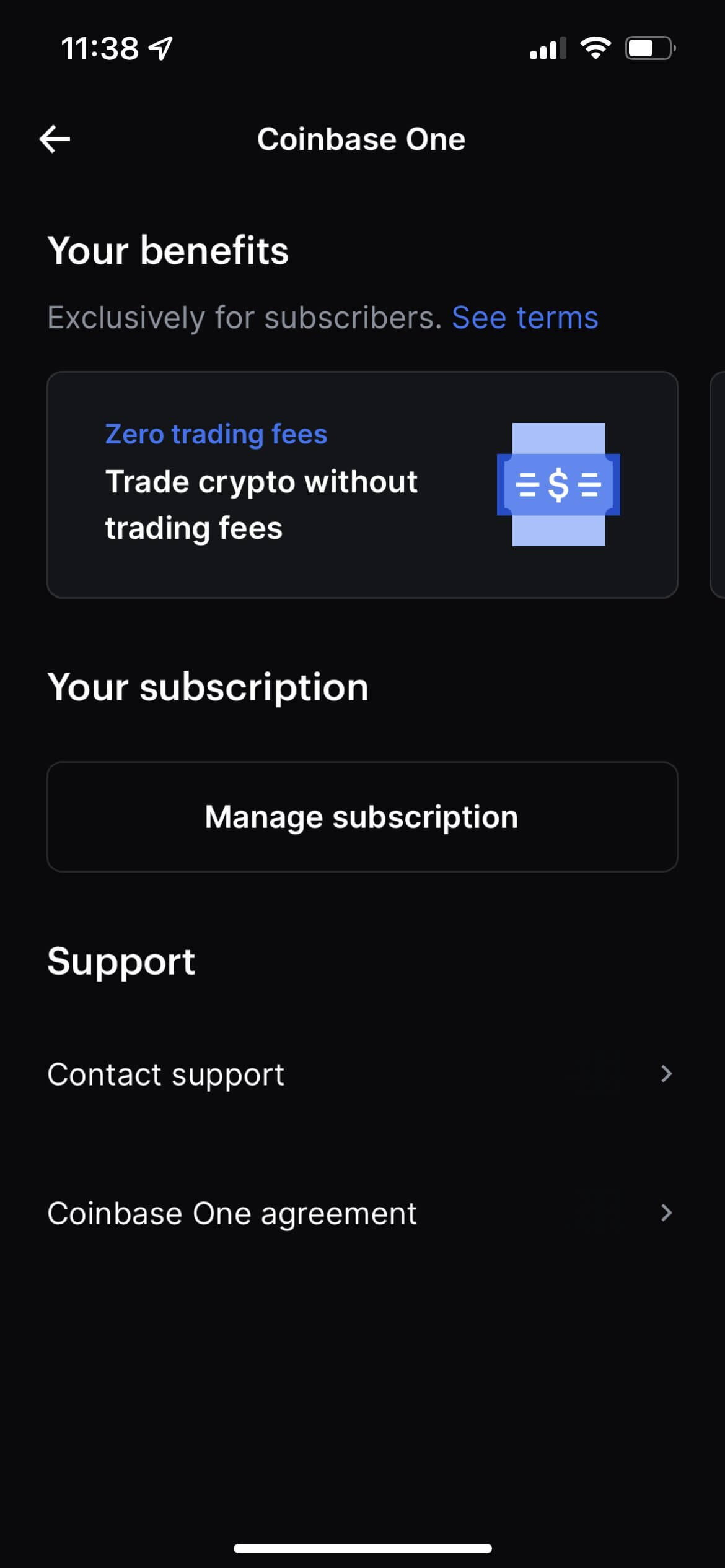

Note that it will soon be easier for big investors to acquire coins. Right now, the largest US cryptocurrency exchange Coinbase is testing a new subscription service for its customers. This information has already been confirmed by representatives of the trading platform after an accidental leak: Coinbase user Tom Winzig gained access to a beta version of the service called Coinbase One. He posted screenshots of the interface on Twitter, showing that one of the main benefits of the new service will be zero transaction fees.

How does Coinbase One work?

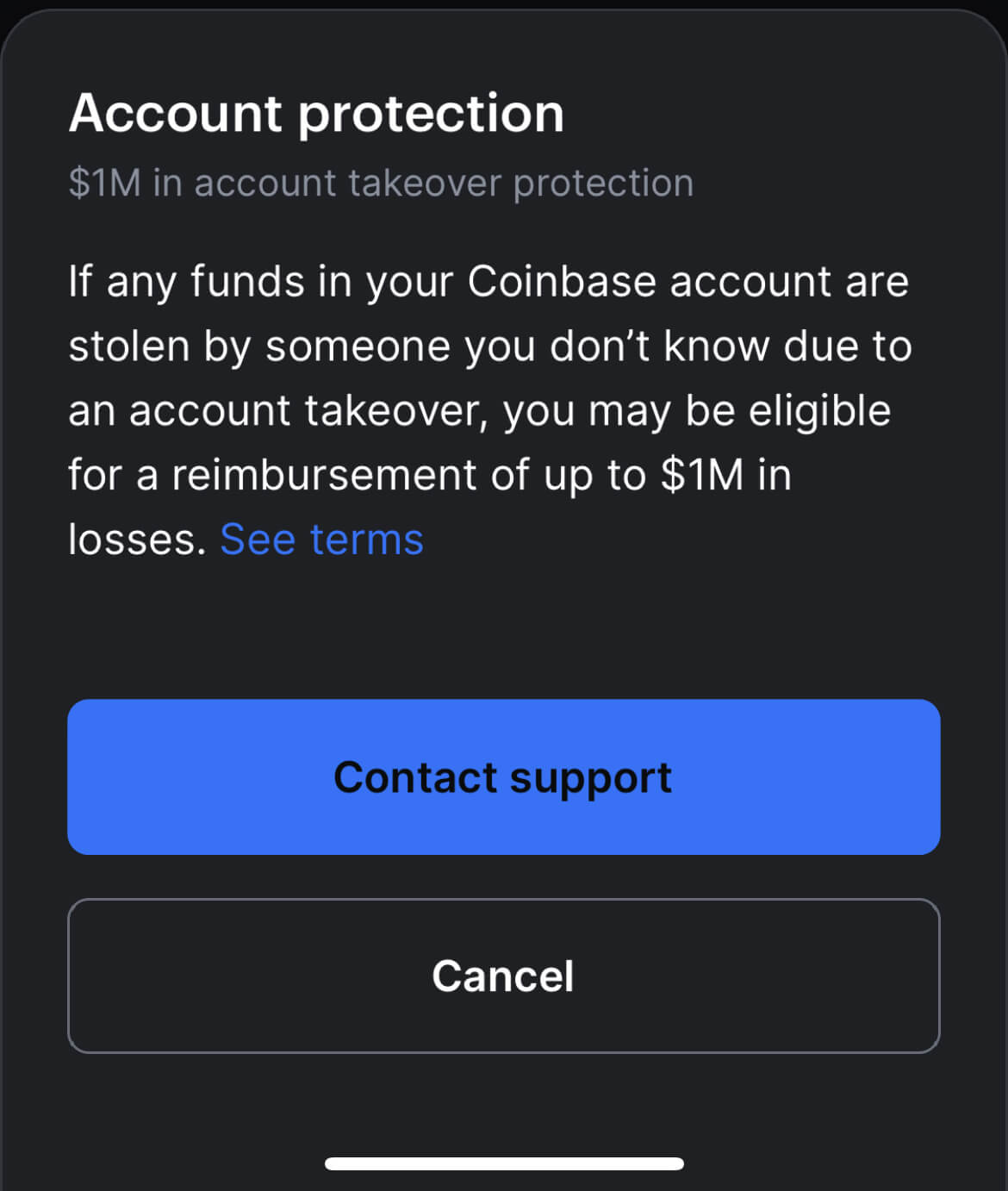

Let’s start with the screenshots posted by a user. From them we found out two main features of Coinbase One: zero trading fees and account insurance worth up to a million dollars. Subscription buyers will get these benefits – though its cost has not yet been disclosed.

Here’s a quote from exchange representatives about the formation of the service’s commissions, published by Decrypt.

Coinbase has begun testing a subscription product for our customers. Customers in the test group will be able to buy, sell and convert digital currencies on the Coinbase platform with no commission per transaction. Although spread fees [the difference between the best selling and buying price – editor’s note] still apply.

Zero commissions in the service

And here’s official confirmation that Coinbase will now take better care of its users’ risks.

If your Coinbase account is hacked with stolen funds, you could be entitled to up to a million dollars in damages.

Account insurance

The last point gives excellent protection to most individual investors who were previously afraid to invest in cryptocurrencies precisely because of the risk of sudden loss of funds. Even today, very few trading platforms offer such guarantees, so Coinbase’s initiative could really attract many new clients to the company’s side.

That said, it's important to clarify that some exchanges already offer almost zero trading fees. In particular, we're talking about Woo X, a platform from renowned traders Kronos Research. However, in order to do so, a certain amount of WOO, i.e. the exchange's native tokens, must be secured.

As such, we can assume that exchanges will move towards lower transaction fees in the near future.

Cryptocurrency traders

We think the desire to sell some gold for the sake of investing in Bitcoin seems quite logical. Especially given the relative stability of the precious metal and the digital asset's ability to significantly increase in value. So, one can only hope that the share of BTC in the portfolio of such big investors will increase in the future.

Look for even more interesting news in our millionaires cryptochat. There we will talk about other topics that affect the world of digital assets.