Revenues at Coinbase fell 75 per cent in the last quarter. What caused the decline?

The largest US cryptocurrency exchange, Coinbase, has reported its revenues for the past third quarter of this year, bringing the total to $406 million. That’s almost 500 percent more than in the third quarter of 2020, but 75 percent less than in the second quarter of this year. Still, between April and June 2021, Coinbase reported revenues of $1.6 billion. Let’s talk more about what’s happening and its importance.

Note that cryptocurrency exchange Coinbase representatives often comment on what’s happening in the coin and blockchain industry – including former ones. The day before, Balaji Srinivasan, former CTO of the crypto exchange, attended the Solana Breakpoint event and emphasised that the cryptocurrency community should stop paying attention to the struggles with crypto in individual states.

Instead, they should switch to a global, international scale – allegedly so they can do much more to develop the digital asset niche. Balaji advised against China, which is supposedly already closed to the coin industry.

How much does Coinbase earn?

It’s worth noting that most crypto financial companies largely reported lower revenues in the third quarter compared to the second quarter. As Coinbase CFO Alesia Haas points out, the third quarter was a period of major correction in the industry and a drop in trading volumes at Coinbase in particular.

It really is. It all started here in May 2021, when Bitcoin plummeted from $59,000 to $30,000. We have detailed the events of that day in a separate piece.

At the same time, a correction phase began, which has been dragging on for several months. The market was actively falling until at least mid-summer, which made many investors afraid to take positions and afraid to trade. And because they made fewer trades and for smaller amounts, all this had an impact on exchanges' fees and revenues.

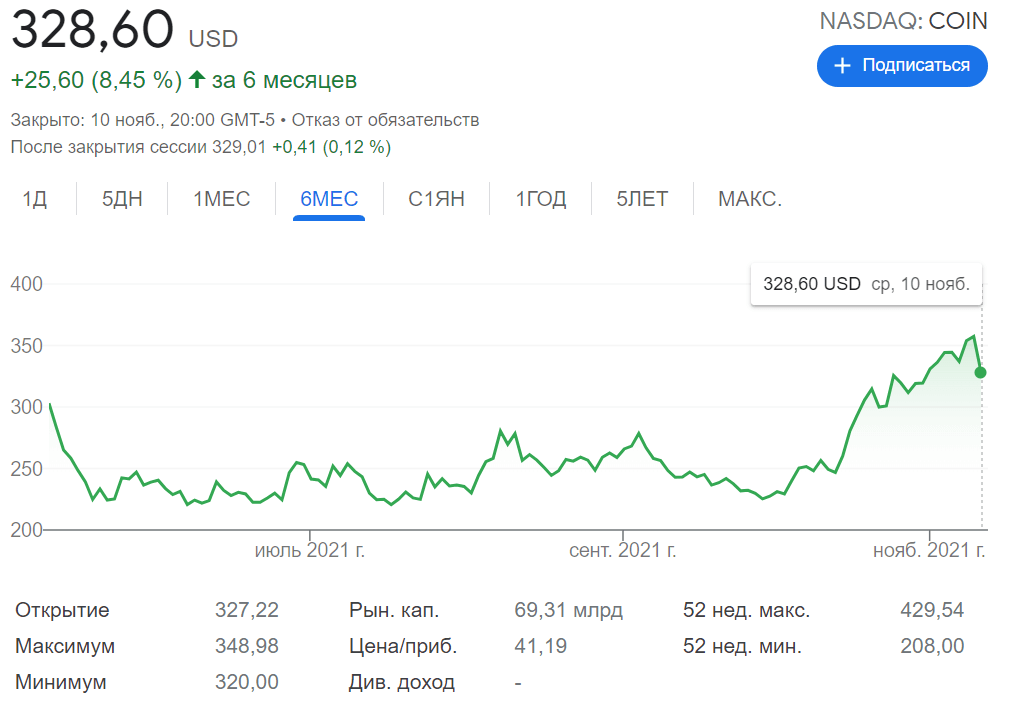

The negative news about Coinbase badly affected its share price under the ticker COIN. Their price plunged 13.24 per cent after the announcement of the quarterly earnings report. COIN is currently trading at $328.6. Over the past 24 hours, the decline has been 8.06 per cent.

COIN price trend over the past six months

In comparison, Square, which offers customers Bitcoin trading through its Cash App, reported a 23 percent drop in revenue over the same period. Robinhood’s performance is far worse, with a 78 per cent drop compared to the second quarter of this year.

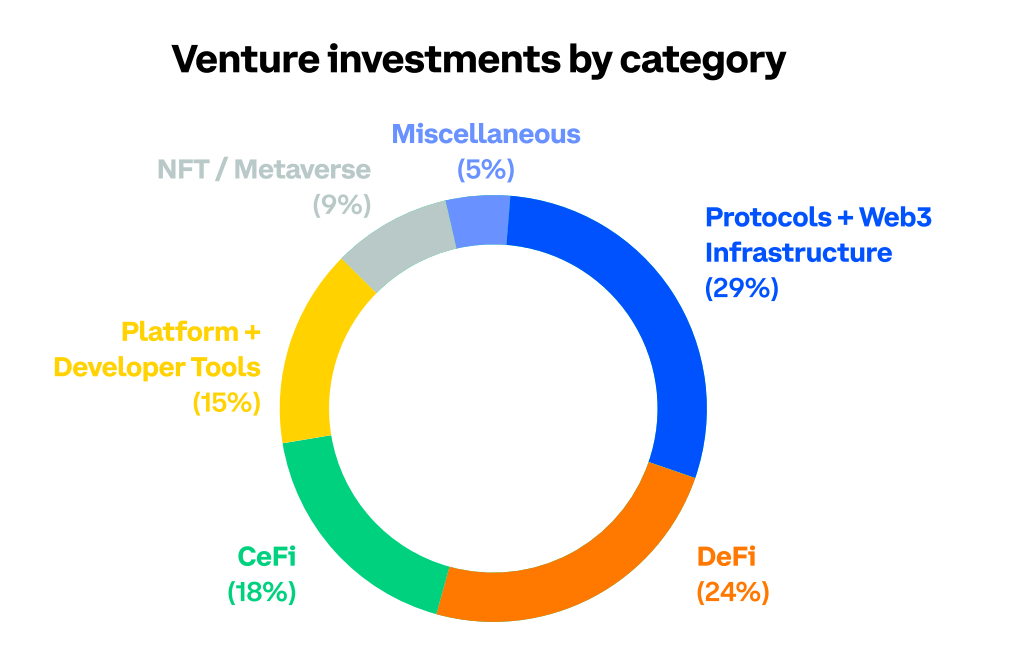

Categories of projects on Coinbase with a share of institutional investors

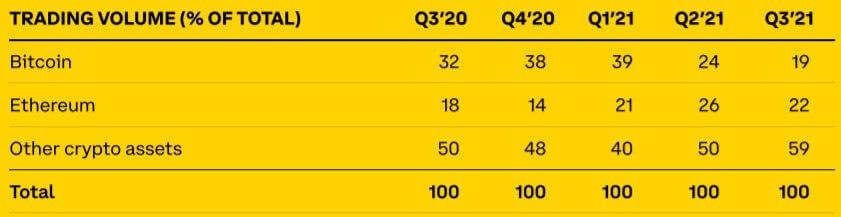

According to Decrypt, Bitcoin and Etherium are no longer leading in terms of trading volumes and commissions on Coinbase. Whereas in the second quarter their share of total revenue was 24 percent and 26 percent, respectively, in the next three months it dropped to 19 percent and 22 percent for BTC and ETH. Coinbase users are now most interested in altcoins, with many of them listed on the exchange this very year. However, in the context of individual cryptocurrencies, Bitcoin and Etherium are clear winners.

Importantly, Etherium's share of trading volume in the platform's total has surpassed that of Bitcoin for the second consecutive year. Accordingly, investors are now more interested in ETH, which has become the home of the NFT token industry and decentralised finance.

Share of various cryptocurrencies in Coinbase trading volumes

We believe that the overall financial performance of Coinbase and the other trading venues is in the normal range. Still, the behaviour of their customers reflects the state of the market, and the latter was far from good in the third quarter of 2021. Accordingly, the drop in yields indicates only that BTC and other coins were not particularly attractive to traders. And the situation will clearly be better in the final quarter.

Look for even more useful information in our millionaires’ cryptochat. There we will talk about other topics related to blockchain and decentralisation.