Square is working on a decentralised cryptocurrency exchange. Why is this important?

Twitter creator Jack Dorsey’s financial company Square is expanding support for Bitcoin for its customers. It is now building its own decentralised exchange, which is being developed by programmers at TBD. The platform, called tbDEX, already has a whitepaper released by the developers last week. This is a key document, which contains the basics of the project and describes its differences. We tell you more about what’s going on.

As a reminder, Square is a popular representative of the cryptocurrency industry. First and foremost, it owes its role to platform founder Jack Dorsey, who regularly speaks out in favour of Bitcoin and generally shares the ideals of decentralisation.

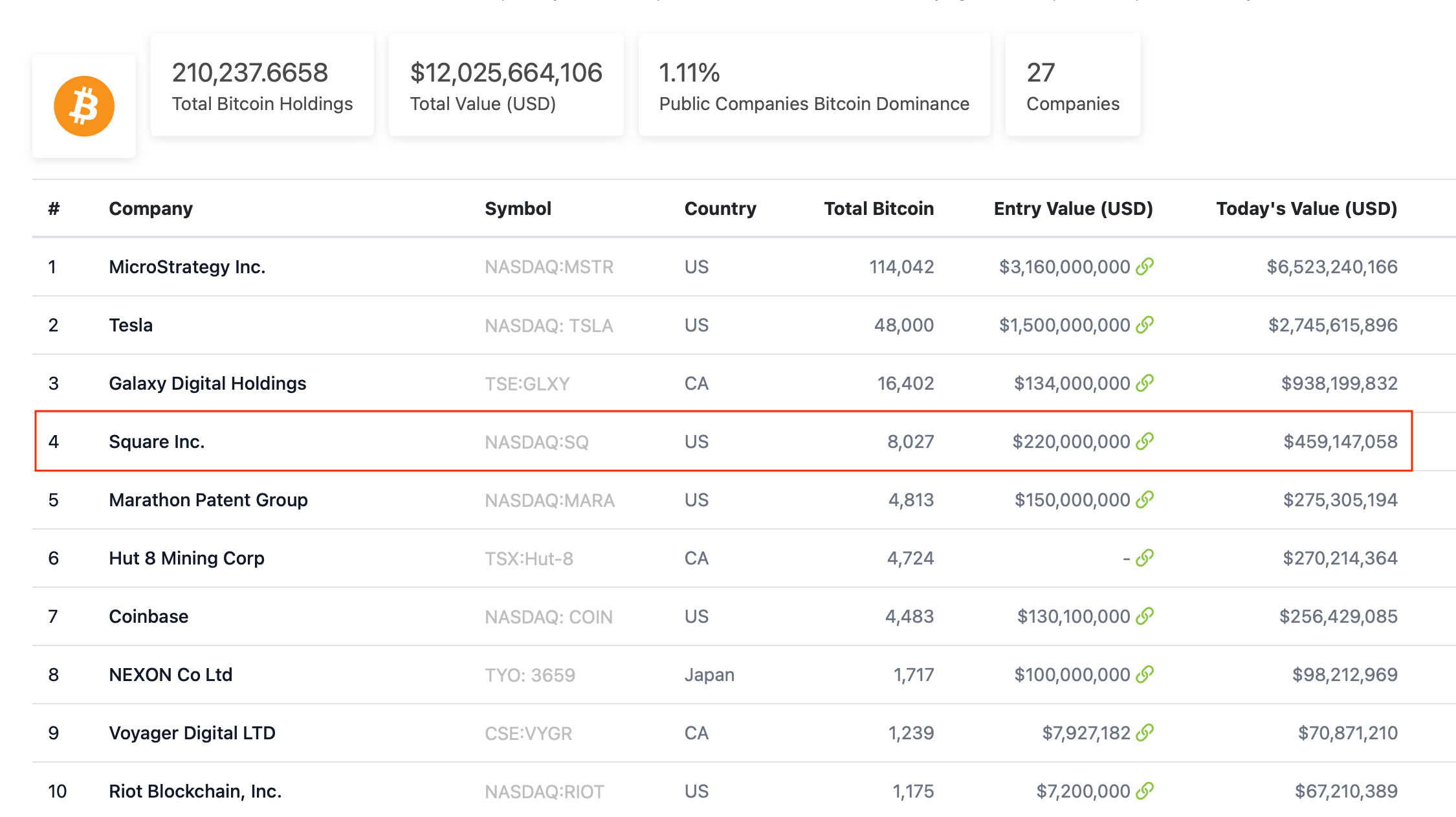

And Square backs up its statements with deeds, among other things. In particular, it ranks fourth among public companies in terms of bitcoin savings. Square has a total of 8,027 BTC, in which it initially invested $220 million. At today’s rate, the investment has already grown to $459 million.

List of public companies with bitcoins in their investment portfolio

The company now wants to expand its presence in the blockchain niche. In July 2021, for example, Jack Dorsey confirmed that Square would create a hardware wallet to store bitcoins. At the same time, he did not announce any timeline for the product launch – and so far we have not seen any mention of it. Well, in October it became known about the company’s desire to create a line of ASIC miners for cryptocurrency mining.

A decentralized exchange for trading cryptocurrency assets will clearly appear faster than the mentioned devices. At least that’s the conclusion that can be drawn from the platform’s published whitepaper.

As a reminder, a gatekeeper is a document in which developers describe the concept of their project, its distinctive features and innovations. In particular, it was with the appearance of the Whitepaper that Bitcoin's life began - it was published by the cryptocurrency's anonymous creator Satoshi Nakamoto. We have been taking apart the main points of the document in a separate piece.

What will Square’s decentralised exchange be like?

The Whitepaper claims that the so-called tbDEX is “a protocol for discovering liquidity and exchanging assets like bitcoins, regular currencies or real goods” on a secure basis. What’s more, the protocol should replace the myriad of intermediaries that dominate many global markets.

Square founder Jack Dorsey

Unfortunately, the developers haven’t yet revealed all the technical details regarding the platform. According to Decrypt, it is still unknown exactly which blockchain it will be built on. And no, tbDEX is unlikely to be based on Ethereum, as in recent months Dorsey has been a strong supporter of Bitcoin, speaking coldly of the largest altcoin.

For example, Dorsey managed to support Bitcoin at a US congressional committee hearing. He did so with a special device that displays information about the major cryptocurrency's network.

Whitepaper tbDEX

Square has become part of the peer-to-peer payments revolution, making it easier for users to send cash from their bank accounts or to small vendors to accept credit card payments. tbDEX intends to extend this mission to the crypto-sphere – it would make digital assets much more popular globally.

Overall, tbDEX could bridge the gap between centralized and decentralized exchanges with the ability to conveniently buy cryptocurrencies directly from a bank card. If implemented on a decentralised basis, with the support of a giant like Square, tbDEX stands a good chance of gaining some market share and finding a following. This in turn would be good for the prospects of the coin niche as a whole, because there would be a lot more investors in this case.

We think Square's initiative is commendable. Even if the platform does not become a giant and push Uniswap out of the top spot of the so-called DEX by trading volume, it will in any case bring new investors into the industry, who will appreciate the prospects of decentralised digital assets and begin their exciting journey in the niche. And so it is to be hoped that the exchange will not get resistance from the government and regulators.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. There we will talk about other topics related to blockchain and decentralisation.