The field of unique NFT tokens has reached a new peak in popularity. What’s next?

The hype around NFT has reached its peak, with the number of Google searches for unique tokens and their purchases breaking a new record. In addition, trading volumes on the leading NFT platform OpenSea showed a big surge last week after almost a month of prolonged decline. All this suggests that the area of unique tokens is once again interesting for most individual investors. We tell you about this and other positive news within the cryptocurrency sphere.

Note that there are more than enough new NFT projects now. For example, the day before we learned about the idea of MyEtherWallet representatives to tokenize blocks in the Etherium network. In this way, platform users will be able to buy significant blocks - for example, those on which a certain fork or other important update took place. Read more about the team's project in a separate piece.

NFT at the peak of popularity

The concept of unique tokens has been known in the crypto market for several years, but only this year NFT gained worldwide popularity. Not only crypto-enthusiasts, but also famous billionaires, filmmakers, musicians and content creators are releasing their own token collections.

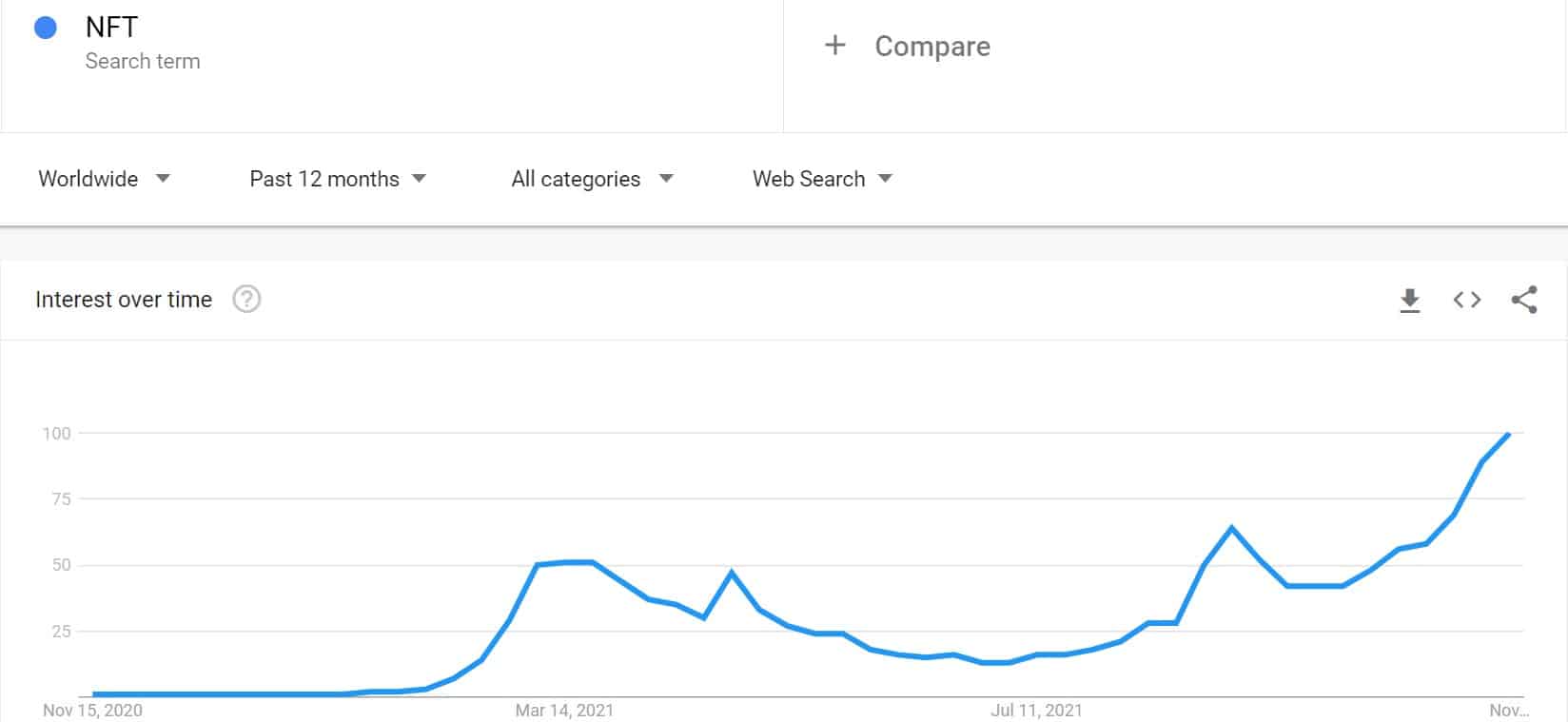

Right now, it looks like the sphere is experiencing its second major wave of growth. Judging by the dynamics of search queries for the term “NFT” on Google, the previous peak in the popularity of unique tokens came in September of this year. The first growth peak was set back in March before the big correction of the crypto market, i.e., its collapse.

Evolution of the number of searches on Google for “NFT”

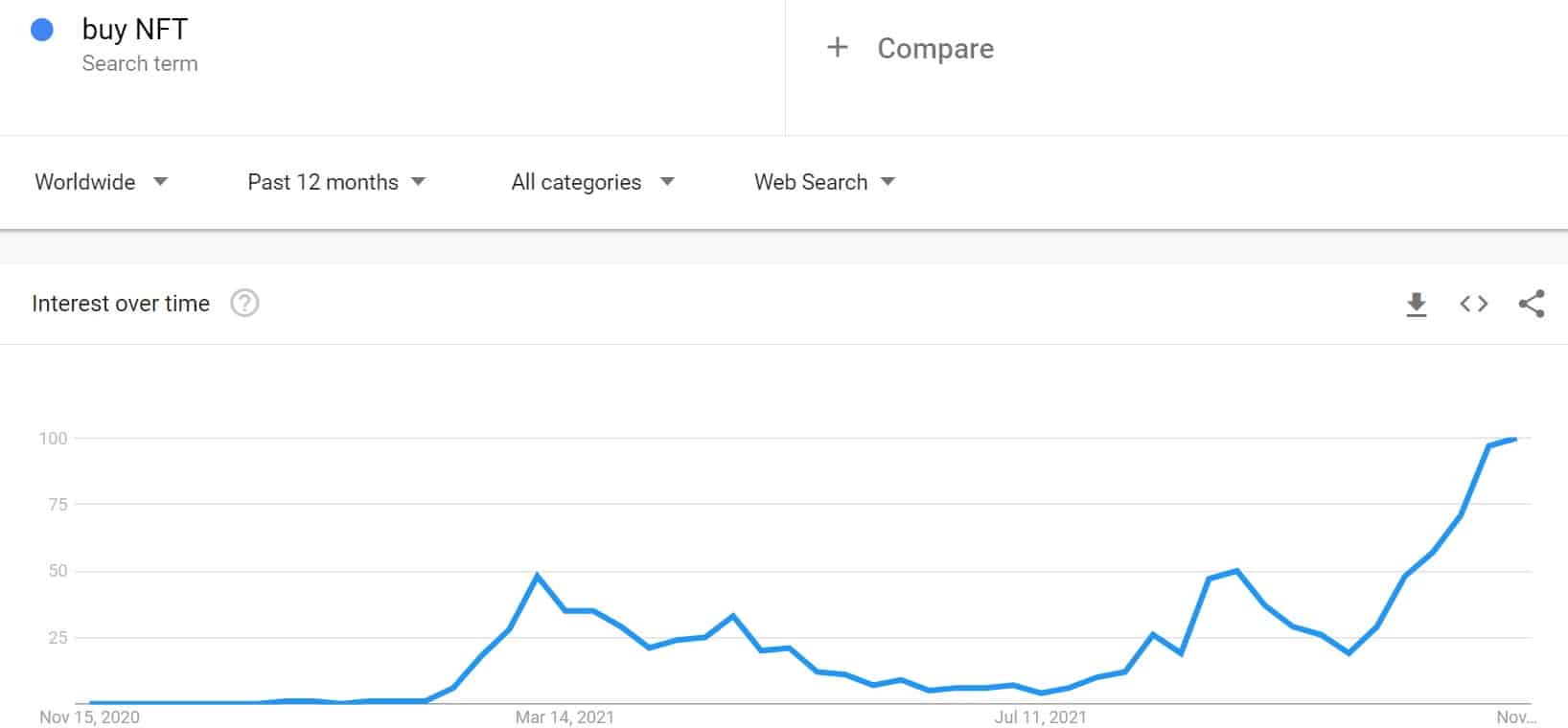

The situation of the query “buy NFT” – that is, “buy NFT” – also coincides with these dynamics, as shown in the screenshot below.

The dynamics of the number of search queries in Google for “buy NFT”

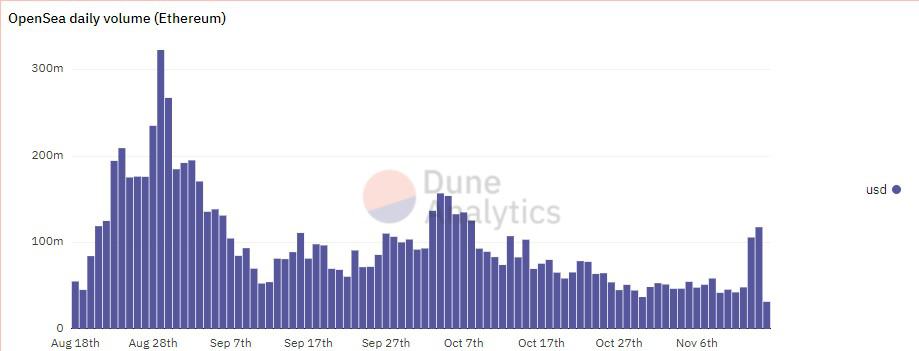

The new records, however, have not been reflected in OpenSea’s trading volumes, according to CryptoPotato. The previous week there was a sharp rise in NFT trading activity on the platform, however the historical record from the end of August this year was not beaten.

Dynamics of trading volumes on OpenSea

To all appearances, the current hype around NFT will continue at least until the next major correction in the market. The experience of May and Bitcoin's big drop showed that when investors panic, low-liquid unique tokens lose value very quickly. Eventually, though, the value returns to normal and even sets new records - especially if they are legendary NFTs like Cryptopunks.

Other companies are moving past the NFT sphere and focusing on mining cryptocurrencies with dedicated equipment, i.e. mining. For example, the day before, one of the largest US mining firms, Marathon Digital, announced the issuance of convertible debentures to raise $500 million in funding. Interest on the securities will accrue semiannually from the maturity date of December 1, 2026. In this way, Marathon’s management hopes to use the debt market to its advantage in order to significantly expand its operations.

The proceeds will be used to buy bitcoins and mining equipment, the firm said. For now, the fundraising plan is still under discussion, but a growing number of factors indicate that it will eventually be accepted for implementation.

As a reminder, almost a month ago Marathon announced approval of a $100 million revolving loan with Silvergate Bank.

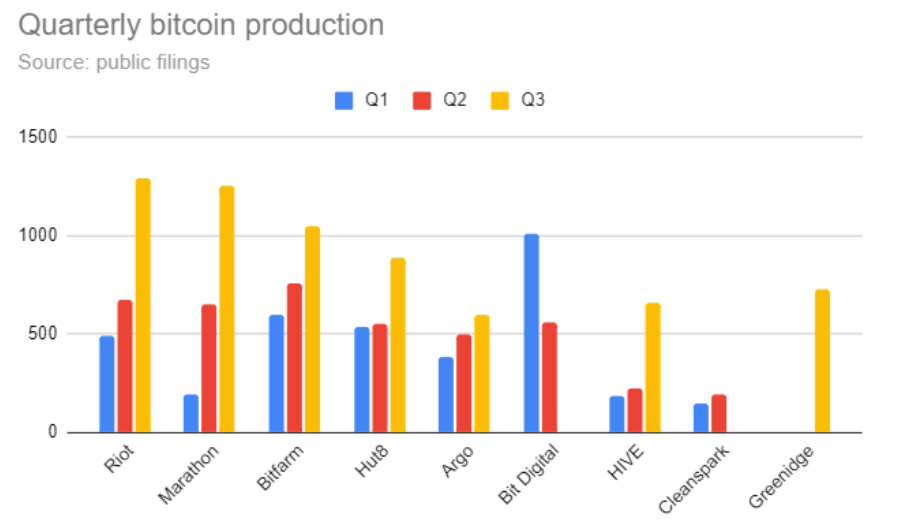

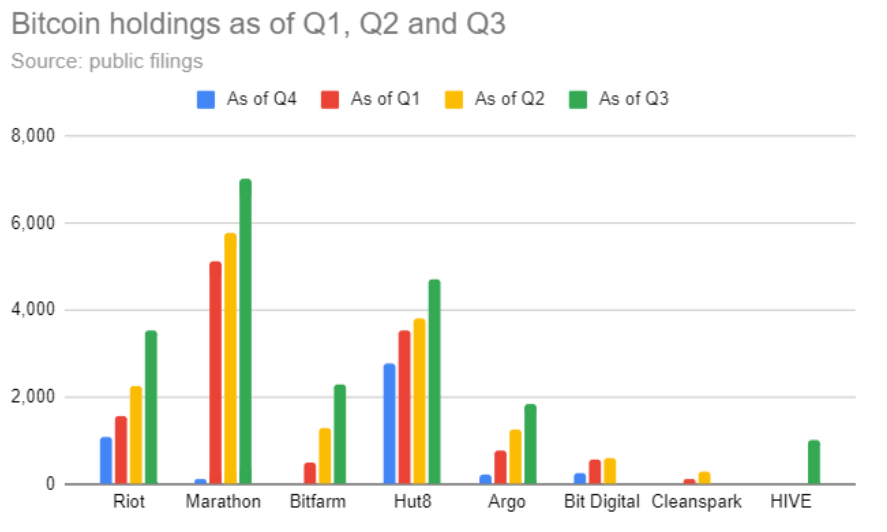

Bitcoin mining dynamics of major US mining companies

Public US mining companies like Marathon, Riot, Bitfarms, Hut8 and Argo have adopted a long-term coin preservation strategy. Since the beginning of this year, they have not sold most of their mined coins, with the expectation that their value will continue to rise. In the third quarter of 2021, the six largest miners held more than 20,000 BTC worth about a billion dollars on their balance sheets.

Amounts of coins accumulated among the largest US mining companies

Marathon is currently the largest holder of BTC among the aforementioned firms in North America. As of the end of October, Marathon had about 7,453 BTC or $490 million in its account – and that includes 4,812 BTC worth $317 million bought directly from exchanges.

We believe that both pieces of news are indicative of a positive trend in the digital asset niche. The industry is evolving in different directions, indicating a wealth of ideas within it. That means there will be more applications for blockchain and various coins, which will only attract new users.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will talk about other topics that affect the world of decentralisation.