10,000 Bitcoin investors own 27 per cent of all coins in circulation. What does this mean for the cryptocurrency?

The crypto industry, which some believe should fight centralisation and inequality, is itself fairly concentrated in the hands of a narrow circle of individuals. According to a recent case study by the US non-profit organisation National Bureau of Economic Research, less than 1 per cent of crypto holders own almost a quarter of all bitcoins in circulation. We tell you more about the situation.

Note that bitcoins and other coins exist within a framework of transparent blockchains, which anyone can examine what’s going on inside. For example, today we learned about the activation of a BTC address that no one has interacted with for almost nine years.

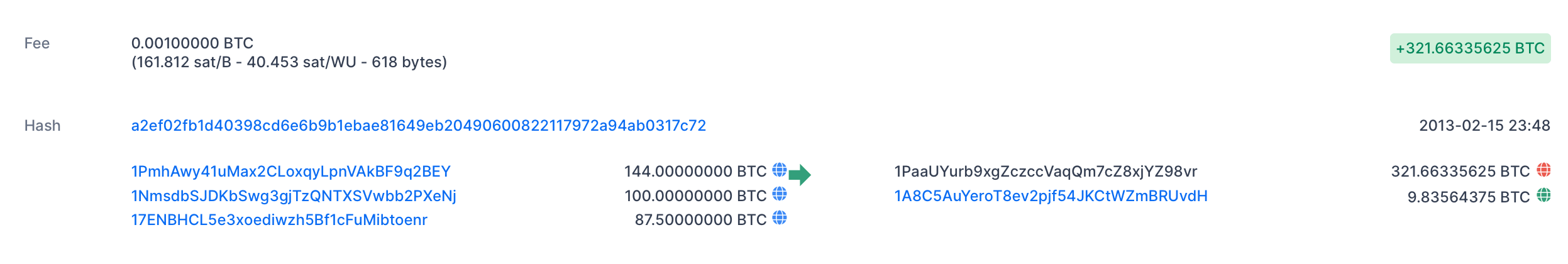

It now holds 321 bitcoins worth $15.1 million. However, in 2013, this cryptocurrency was valued at just $6,594. Here is the very transaction from February 2013, when these coins were transferred to the address.

The transfer of 321 bitcoins in 2013

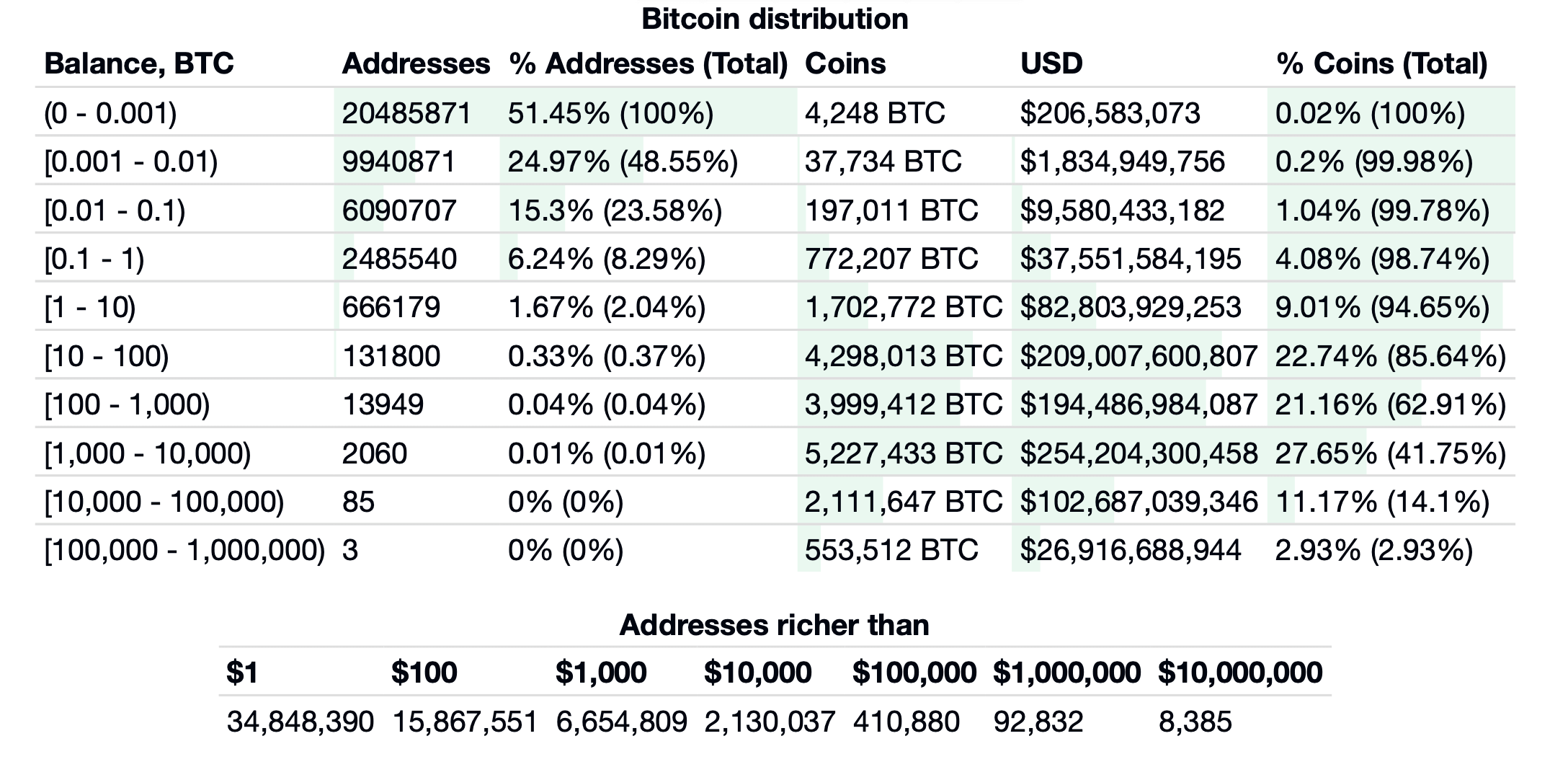

And bitcoin distribution statistics in general are available at any time thanks to resources like BitInfoCharts. For example, there are at least 92,832 dollar millionaires in the network of the first cryptocurrency today. And more than 100,000 bitcoins are in just three addresses.

Allocation of bitcoins between addresses on the network

Because of this, blockchain allows such studies to be carried out without any problems. Here are the results of one of them.

Who has the most bitcoins?

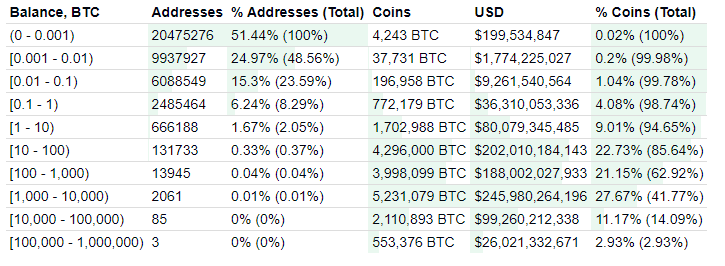

According to analysts, 10,000 holders, or 0.01 percent of all investors, have 5 million BTC. That’s 27 percent of all 18.9 million mined coins currently in circulation. Meanwhile, the total value of bitcoins in their hands equals $232 billion.

The study, conducted by professors of finance Antoinette Schoar of MIT’s Sloan School of Management and Igor Makarov of the London School of Economics, should demonstrate that Bitcoin is not as decentralised as many think. Here’s a rejoinder from the experts, in which they share their view of the current situation in the digital asset industry.

Despite the fact that its concept has been around for 14 years and is still on the hype, Bitcoin is still a very concentrated and centralised ecosystem.

Note that the main Bitcoin document, i.e. its Whitepaper, was published on 31 October 2008. Accordingly, the cryptocurrency concept has only been around for just over thirteen years. Why experts did not specify the exact time of Bitcoin's existence is unknown.

Distribution of coins to wallets of different values

The amount of crypto in the hands of the richest investors is even greater than the dollar savings of the wealthiest class of Americans. Recall that according to the US Federal Reserve, the richest 1 percent of Americans own a third of all wealth.

Quantum Economics founder Mati Greenspan noted in an interview with Cointelegraph that an impressive proportion of the coins are still controlled by an anonymous cryptocurrency creator Satoshi Nakamoto, who is unlikely to ever come forward and use his own bitcoins. In the future, however, Bitcoin distribution should become more decentralised, believes Mati.

Bitcoin distribution will eventually become more decentralised. Conventional currencies, on the other hand, are concentrated among small groups of the wealthiest.

That is, Greenspan believes the current situation is due to the relative newness of digital assets. Still, relatively few people have had time to become familiar with them, so it's too early to expect a "fair" distribution of coins, at least for now.

Cryptocurrency treasure

So far, there are quite a few wallets on the Bitcoin network that hold thousands of coins. These are owned by individual anonymous investors who are unlikely to exchange their wealth for dollars.

We think it's too early to worry about the uneven distribution of coins among cryptocurrency investors because the cryptocurrency niche itself is very young. That means most investors - rich and not-so-rich alike - haven't had time to learn about the world of digital assets yet. So it makes sense that most of the coins are concentrated with people who learned about Bitcoin early on and were able to buy them up (or make them) at a very low price. So there's probably no point in worrying here.

What do you think about it? Share your opinion in our millionaires cryptochat. There we will talk about other topics that affect the blockchain world in one way or another.