Analysts tell us what to expect from Bitcoin’s behaviour in the near future

Predictions of a $100,000 price for Bitcoin by the end of this year are unfortunately unlikely to come true. Having set an all-time high of around $69,000 in the first half of November, the cryptocurrency is now hovering around $47,000 with no clear signs of strong demand from buyers. That said, most crypto analysts agree that the current zone on the chart is suitable for a gradual accumulation of the asset. We tell you more about the situation.

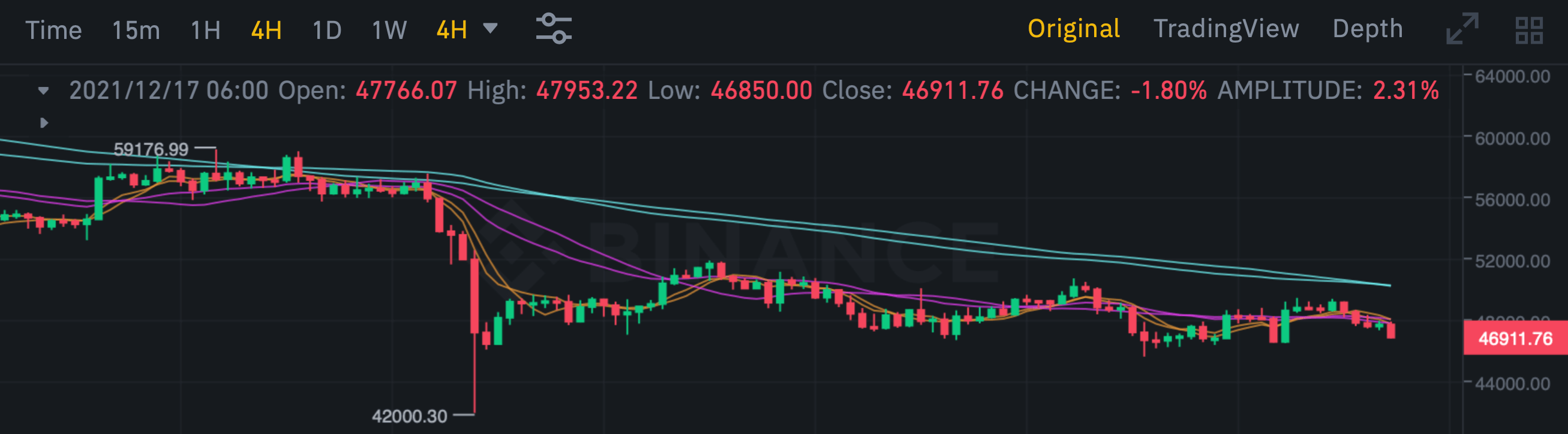

It should be noted that Bitcoin has been relatively stable in recent days, as it is between $45,000 and $49,000. At the same time, relatively recently – on the last day of November – BTC was valued at more than $59 thousand.

Here is a four-hour chart of the cryptocurrency’s exchange rate, which shows the recent actions of the major coin.

A four-hour chart of Bitcoin’s exchange rate

Will Bitcoin rise?

Global markets have been a bit choppy this week as investors around the world were nervous about the Federal Open Market Committee meeting on December 15. However, its conclusion was that the Federal Reserve will leave the current lending rates for now – at least for the near future. At the same time, a gradual phasing out of stimulus measures for the American economy is envisaged for 2022.

Bitcoin price performance over the past few months

A more detailed analysis of Bitcoin’s recent market dynamics was offered by a trader nicknamed John Wick. According to his theory, the recent BTC price movement has created “solid underlying support”, which is represented by the yellow horizontal line in the chart below. Here’s a quote from the expert on this, published by Cointelegraph.

We can expect volatility to rise. The next market set-up I am targeting is the movement of the asset in a tight horizontal channel. This situation is somewhat reminiscent of early June, when a decline in volatility was followed by an explosive rise in Bitcoin.

That is, the expert believes that Bitcoin's value jumps will become less pronounced and the cryptocurrency will become relatively stable. Consequently, it will be a reason for investors to accumulate more coins.

Support line on Bitcoin chart

Crypto analyst Rekt Capital supported this view in a recent statement on Twitter. According to him, market collapses like the ones we saw earlier this month most often precede a new wave of bullruns. Here’s his rejoinder.

In recent years, the price of Bitcoin has corrected by an average of 30-40 per cent in a bullish trend. The cryptocurrency fell 53 per cent in May alone, so a 38 per cent collapse in December is not yet the worst-case scenario.

An analyst nicknamed Crypto Ed_NL said that we could see Bitcoin fall just below $46,000 before a new wave of growth. Here is the expert’s statement.

My expectations for the next few hours: another drop before the Federal Committee meeting, a small rebound and a continuation of the bull run.

Crypto Ed_NL forecast

At last, the last forecast of the user under a pseudonym Crypto Bull God takes into account the fractal formation on the chart which reminds a price movement of BTC in September. That is, the analyst has noticed a similarity in Bitcoin’s current movement with its previous actions. And while that doesn’t guarantee anything, sometimes history does repeat itself.

I’ve been watching this over the last few days. I’m not saying it’s going to happen, but I can definitely see the similarity now compared to what it was in September this year.

Fractal on the Bitcoin chart

The head of the US Federal Reserve, Jerome Powell, left a remark about stabelcoin in his Wall Street Journal interview this week. It wasn’t positive, but it didn’t hint at negativity either. Here’s his quote.

Stablecoins can certainly be a useful and effective part of the financial system serving consumers if they are properly regulated. Right now, there is no such regulation. They have the potential to scale, especially if they are linked to one of the very large existing technology networks.

US Federal Reserve Chairman Jerome Powell

In other words, Powell didn’t “push” the crypto market with his authority. It is possible that a couple of his negative comments could have had a serious impact on Bitcoin’s continued fall. But now the situation is a little clearer – there is no big negative news on the horizon, while buyers are still hoarding BTC, which means that hopes for its growth may very well become a reality soon. However, investors should still make all financial decisions on their own and treat this expert’s view exclusively as a possible scenario, not exclusively the right one.

We believe that Bitcoin's recent behavior cannot be called satisfactory, as the cryptocurrency is firmly entrenched below the $50,000 mark. At the same time, the coin is not falling lower, which means that the sellers' and bears' forces are also running out. Therefore, there is a possibility that the bulls will have the resources to take advantage of it. Only time will give some answers.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There we will talk about other topics related to blockchain and the world of cryptocurrencies.