Bitcoin has survived its weakest correction of 2021. What to expect from the cryptocurrency in December?

In previous bullish cycles, Bitcoin almost always went into a big correction before the final surge, i.e., a slump in the exchange rate. If history repeats itself, what is happening with BTC looks very interesting. At the very least, the cryptocurrency’s price has already managed to drop 21 percent since it set a historic high of 69,000 on November 10. Overall, this is the cryptocurrency’s “weakest” local correction of 2021, making it likely that it is already coming to an end. We tell you more about what’s going on.

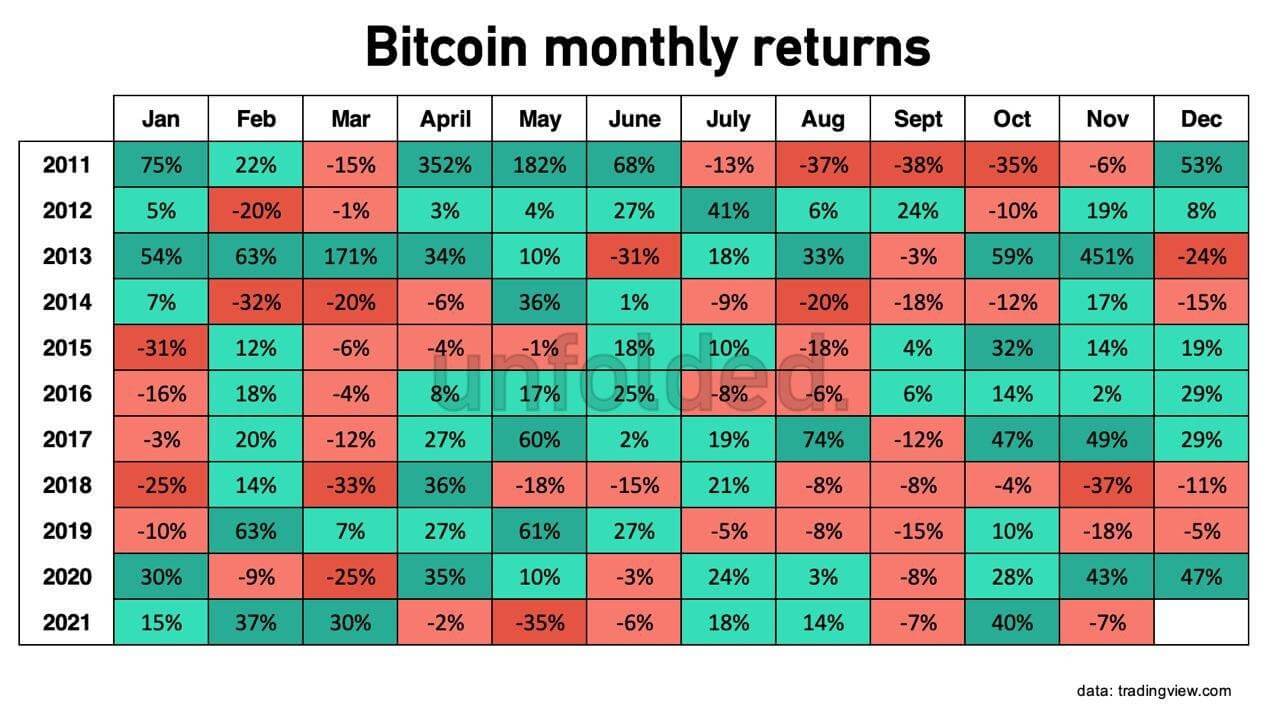

It should be noted that the outcome of November 2021 was indeed not the happiest for Bitcoin holders. Specifically, the cryptocurrency’s exchange rate sagged by 7 percent. At the same time, last year in November, BTC appreciated by 43 percent.

Changes in the Bitcoin exchange rate at the end of the months

It’s important to note, that BTC was still able to set a new historical price high in November – the record was the level of $69 thousand. However, the coin did not stay there for long, so the month turned out to be generally unprofitable. However, experts remind that the previous collapses were noticeably more serious.

What will happen to Bitcoin?

According to Cointelegraph, the cryptocurrency’s biggest plunge this year was between April and July, when the value of BTC plunged more than 53.4 percent. As a reminder, the fall was then triggered by a total ban on Bitcoin mining in China, as well as harsh comments about the coin from Ilon Musk.

At the time, he even hinted opaquely that Tesla might get rid of its Bitcoins - at least in view of the criticism levelled at Ilon by the blockchain community. Read more about this story in a separate piece.

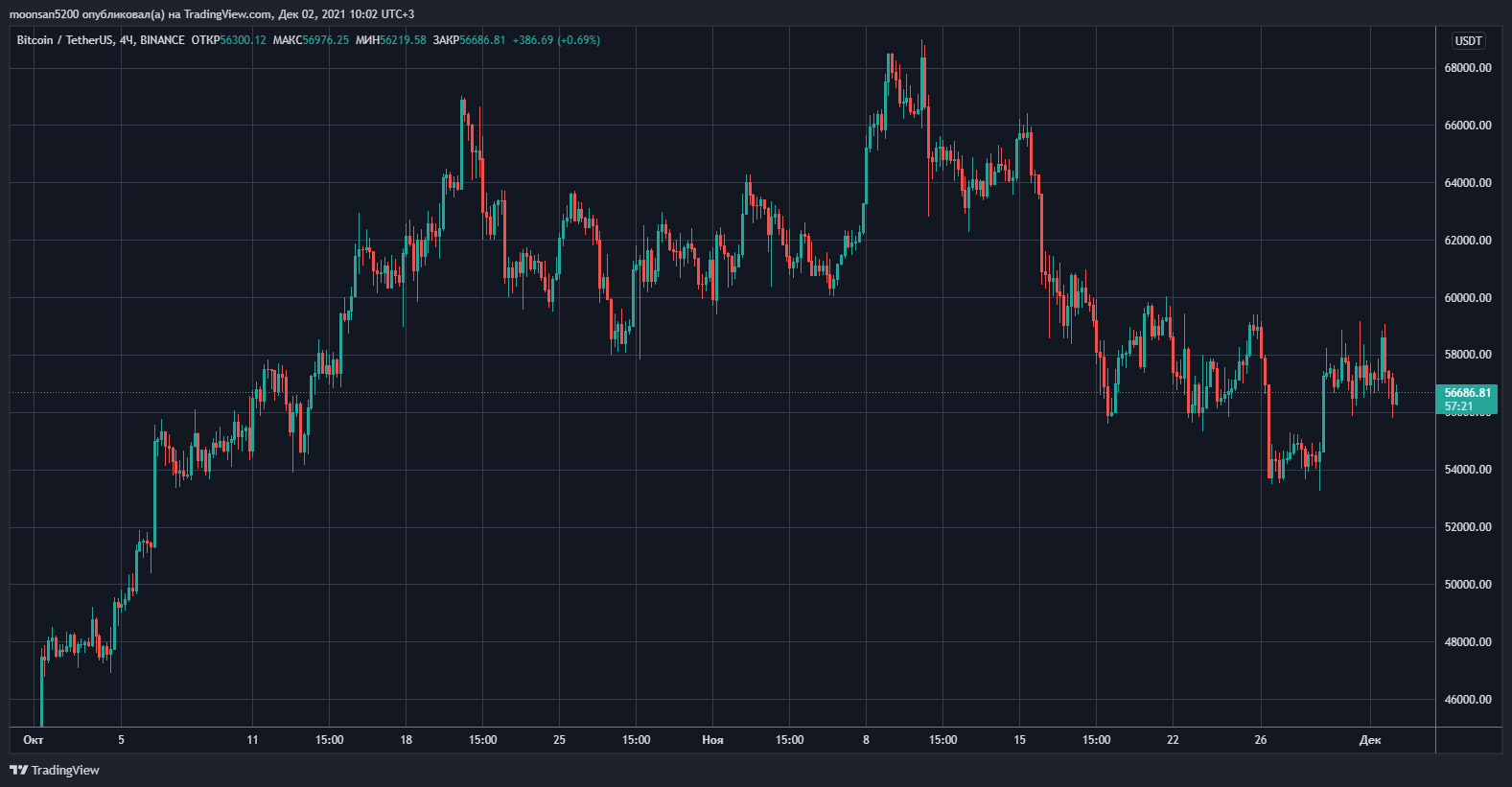

Bitcoin on the scale of the 4-hour chart

Experts at analyst platform Glassnode assure that the current correction, on the contrary, is the weakest this year and is almost over. At the same time, it was regarded by crypto traders “as a commonplace phenomenon” and did not cause a serious panic in the market. Here’s a rejoinder from the experts, in which they shared their views on what’s happening.

Both long-term and short-term holders are now more on the plus side than they were during the September correction, which can generally be seen as a base for asset price appreciation.

Accordingly, the magnitude of the market crash is markedly different.

To illustrate, here is a chart by Glassnode analysts who have studied the events in the coin niche in 2021 and summarised the results. Overall during the current correction, Bitcoin is down 21.8 percent from its all-time high. On top of that we have already experienced a 29.4 per cent collapse in January, 24.2 per cent in February, 26.5 per cent in April, 54 per cent in May-July and 37.2 per cent in September.

Bitcoin’s biggest corrections this year

The current plunge was triggered by negative news about the discovery of a new variant of the coronavirus called Omicron. The rumour that the new strain is allegedly resistant to vaccines and more contagious led to a collapse in the stock market as well as oil indices.

That said, it is important to note that during the 2017 bull run and last year, December was one of the most profitable months, with Bitcoin prices rising by around 20 per cent and 47 per cent respectively during those periods. If the trend repeats, BTC could rise as much as $80,000 by the end of this December.

Bitcoin’s rise

We believe that the cryptocurrency market is bullish, even despite the current rate slump. Accordingly, the likelihood of further growth in the industry is clearly higher than the downside. However, you should invest solely on the basis of your own analysis of what is happening in the digital asset niche. In addition, traders should traditionally not forget risk mitigation and limiting tools - without them, the cryptocurrency journey could be quite short.