Edward Snowden fears hype around unique NFT tokens. What is the reason?

Former US National Security Agency official Edward Snowden is concerned about the hype surrounding unique tokens, also known by the acronym NFT. In his view, some individuals or companies may use the growth of the NFT market only for their own enrichment, diverting the focus of market development away from innovation. Snowden stated this during the BlockDown DeData online conference. We tell you more about the celebrity’s position.

It should be noted that Edward often mentions the topic of cryptocurrencies. In particular, at the end of October this year, he criticized a project called Worldcoin. He was referring to the idea of Y Combinator founder Sam Altman, who promised to give a certain amount of new cryptocurrency to anyone who wanted it in exchange for a scan of their eye. Snowden then directly advised people not to get involved with this project and not to “sell” data about their body parts.

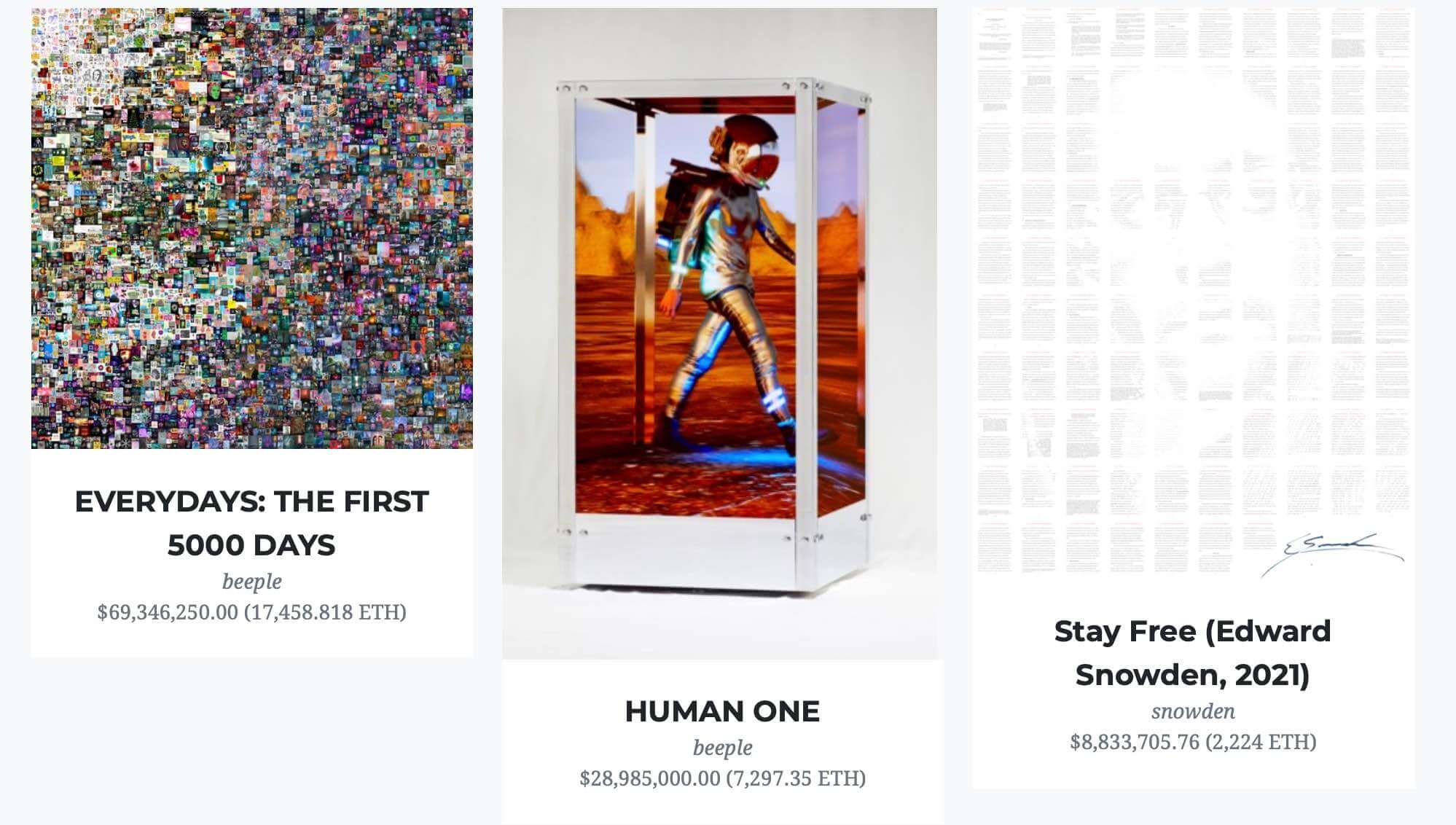

In doing so, Edward also managed to join the NFT trend and sold his own token called “Stay Free”. It ended up being purchased for 2,224 ethers, which is the equivalent of $8.8 million.

According to the CryptoArt platform, this made NFT third in the entire niche in terms of sales amount among artworks. The top three places in the overall ranking look like this.

Top most expensive NFT tokens

And the gold still belongs to the work EVERYDAYS: THE FIRST 5000 DAYS by artist Mike Winklemann under the pseudonym Beeple. It sold for 69.3 million at a Christie's auction.

Ultimately, however, Snowden was concerned about what was happening in the world of decentralised assets. Here are the details.

What’s wrong with NFT?

Some aspects of the development of the concept of meta-universes, where NFT is actively used, seem “horrible, disgusting and threatening” to the entire market. In other words, someone is interested in creating value where there can’t be any, Edward believes. Here’s Snowden’s quote on the subject, published by Cointelegraph.

We have people who are trying to bring an artificial sense of scarcity into the realm of the post-deficit. I think the community should try very hard to steer the arc of development away from introducing artificial and unnecessary demand entirely for the benefit of some class of investors.

That is, Edward hints that some of the things sold in the virtual world are not worth their money. Moreover, they are mistakenly valued highly only because of the limited accessibility that developers have worked hard to achieve. Consequently, most investors should supposedly avoid such apps.

We think Snowden may be right, but the current phase is a normal phase of new technology development, which still includes cryptocurrencies and NFT. So blaming them for their lack of value is like hating Bitcoin for its price volatility.

Former US NSA employee Edward Snowden

Another conference attendee, Ethereum co-founder Gavin Wood, seemed to disagree with Snowden’s claims about NFT. He mentioned that unique tokens have opened up a host of opportunities for content creators who can profitably monetise their activities. However, Snowden countered that NFT purchasers are not buying the final product, but something virtual in a meta-universe whose development is built on promises alone.

I have no problem with, for example, game developers restricting access to their product in the same way they did decades ago. I see NFT as a more flexible way of limiting access to their content.

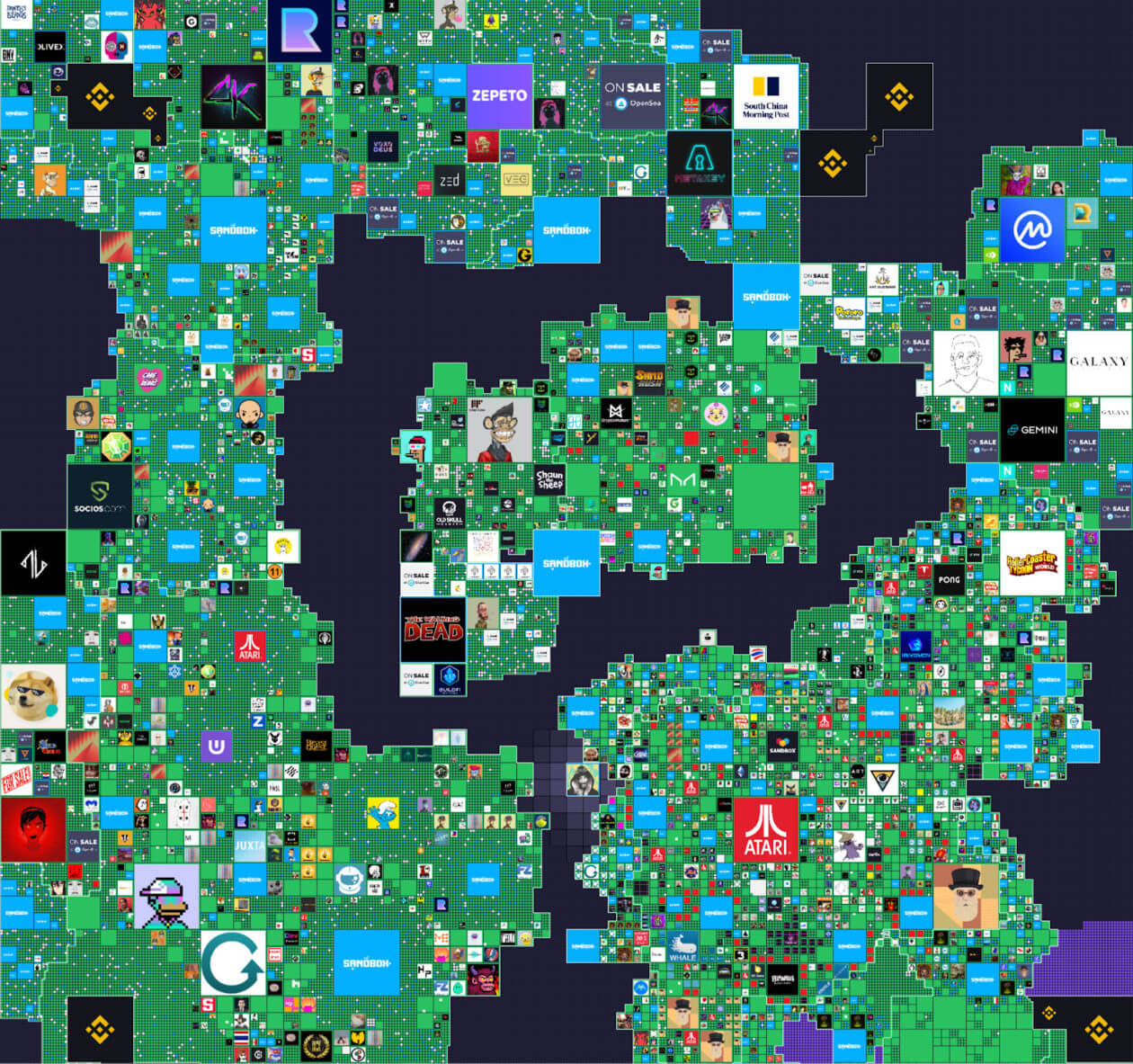

Map of The Sandbox meta-universe, where virtual land plots are sold as NFT

The sale of virtual land in metavillages has already become a notable industry trend – and there’s something disturbing about it. Even virtual space is now becoming a ‘property’ out of the reach of most people. That said, given the high prices of most NFTs, it is indeed the rich investors who profit the most from the development of this trend. Although we assume that with time the sector will become more democratic.

In the meantime, wealthy investors are paying the equivalent of hundreds of thousands of dollars for unique items. For example, the day before an NFT token collector bought virtual land in the Sandbox project. Thus, he will become Snoop Dogg's neighbour. The purchase price in this case was the equivalent of USD 450,000. You can read more about this story in a separate article.

Buying NFT-tokens

We believe that the unique token industry is far from reaching its peak and that new uses for NFTs await in the future. Of course, there is plenty of fraud in the industry - including the activity of investors who buy their own tokens from other addresses - but this is unlikely to be avoided. In the end, the industry seems to have more prospects than negatives. So there's probably not much sense to criticize what's going on here.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There we will talk about other topics that affect the world of decentralized finance in one way or another.