Experts have called Etherium a more promising investment than Bitcoin. Why?

Bitcoin’s reputation as the crypto industry’s “best” asset could be in jeopardy: at least that’s what Australian researchers Esther Pheles-Viñas, Sean Foley, Jonathan R. Carlsen and Jiri Svec believe. In their recent report analysing recent trends in the crypto industry, they conclude that Etherium could do a better job of “preserving capital” for investors. A key role in the altcoin’s superiority over Bitcoin was played by the so-called EIP-1559 upgrade, integrated as part of the London hardforge in early August. We recount the details of what’s happening in more detail.

As a reminder, London found room for an upgrade that introduced a new commission formation mechanism to the Etherium network. With EIP-1559, a certain amount of ETH is now burned with each transaction. In theory, if the burn rate continues to rise, the maximum supply of Etherium coins will only shrink.

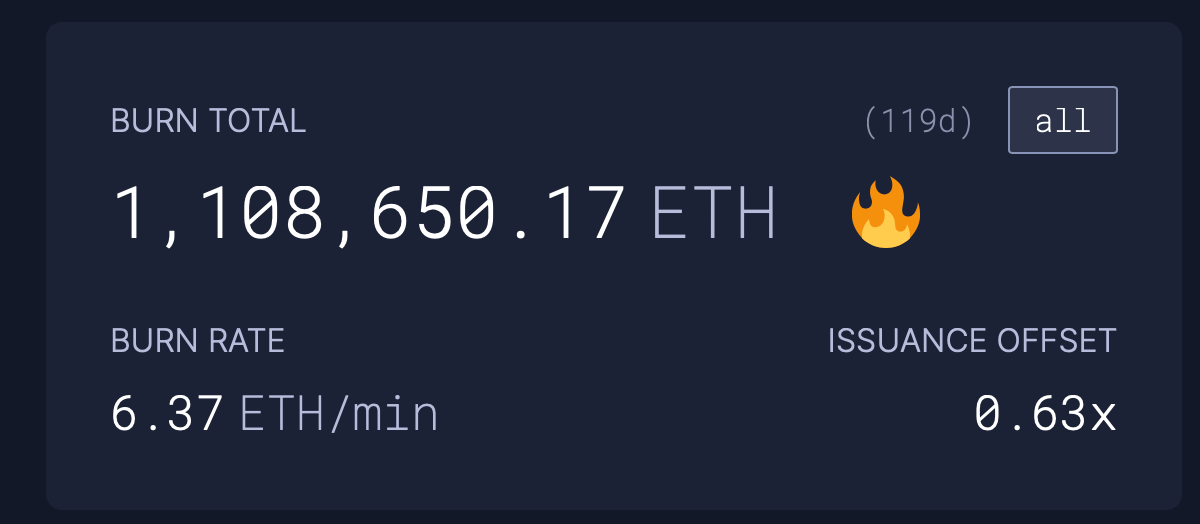

More than 1.1 million ETH have been destroyed in the Etherium blockchain since the network was updated on August fifth. The equivalent of the coins burned has already surpassed the $4 billion level, which means that the amount of cryptocurrency out of circulation is quite serious.

The amount of ETH burned since the integration of the London upgrade

One month after the upgrade, the first deflationary day took place on the Etherium network. This means that on a scale of a day, more coins were extracted from the cryptocurrency’s circulation than were created as rewards for miners. This means that in the context of this timeframe, the number of ETH in circulation has become lower – which is a good thing for the asset.

Etherium

It is this innovation that has become the main focal point for researchers.

Which cryptocurrency is better than Bitcoin

As Cointelegraph notes, by today, about 50 per cent of the coins mined by miners are being burned thanks to transfers on the Ether network. Experts believe that thanks to the steady growth in demand for the Etherium ecosystem in the form of smart contracts and decentralised applications, the aforementioned figure will rise to 100 per cent already in the foreseeable future.

Here’s a rejoinder from the analysts, in which they share their conclusions on the situation.

Looking at Ethereum’s annual issuance rate since the integration of EIP-1559, the expected increase in total altcoin supply is just 0.98 percent. The equivalent figure for Bitcoin is 1.99 per cent over the same period.

In other words, ETH network inflation should be less than Bitcoin's. In addition, the rate could be lower: when the Ethereum blockchain is overloaded due to market crashes, users rush to make transactions, thus increasing the average transaction cost. And that increases the amount of cryptocurrency being burned.

Daily chart of Bitcoin exchange rate

That is, analysts believe that next year, the rate of Etherium mining will be about half the rate of new bitcoin mining. And while the major cryptocurrency is considered the best “safe haven” for capital against inflation due to its limited maximum supply of 21 million coins, Etherium could become a much more attractive investment option in the eyes of market players, according to analysts.

So far, both cryptocurrencies are popular in many countries, as evidenced by another piece of news: this week, Brazilian payments provider MercadoPago, which is a division of MercadoLibre shops, gave its customers the ability to buy, sell and store BTC, ETH and Paxos’ Stablecoin Pax Dollar (USDP). The new opportunities for the payment platform have opened up following a partnership with Paxos, the company announced on its Twitter feed.

Today marks another huge milestone in #crypto. @mercadopago, the largest payments provider in #LatAm, will offer Brazilian customers the ability to buy/sell/hold $BTC $ETH and the Paxos dollar #stablecoin $USDP #PoweredByPaxos https://t.co/Pfo3ZcAwwk

– Paxos (@PaxosGlobal) December 2, 2021

Starting in Brazil, MercadoLibre management plans to “accelerate the democratisation of financial services in Latin America”. As MercadoPago hopes to make cryptocurrencies more accessible to all Brazilians and beyond, we can assume that crypto will soon become legal not only in El Salvador. However, this will depend on the attitude of the authorities towards digital assets.

We believe that Etherium is indeed a more promising platform in the context of the cryptocurrency industry, as there are already a huge number of decentralised applications, NFT tokens and other products based on it. However, Bitcoin is still at the head of the coin market - and other cryptocurrencies depend on its behaviour. This correlation is likely to weaken over time, but it is still too early to talk about ETH making it to the top of the cryptocurrency market capitalization rankings.

Look for even more interesting things in our Millionaire Crypto Chat. There we will talk about other topics that affect the world of decentralized assets in one way or another.