Major crypto investors are ending their profit taking. What does this mean for Bitcoin in 2022?

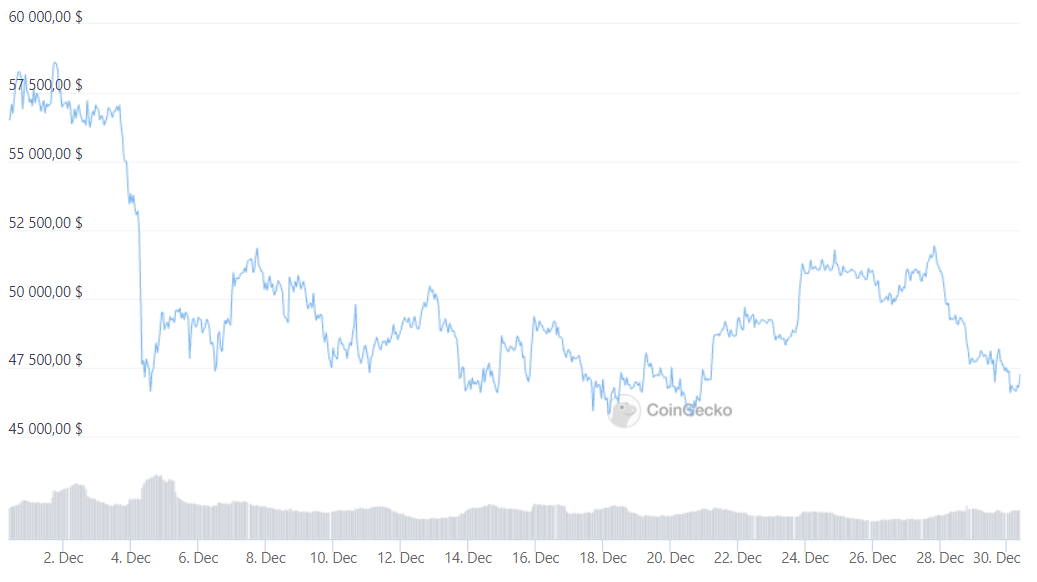

In early December, Bitcoin began to plummet a few weeks after reaching another all-time high of $69,000. By the beginning of the new year, BTC had failed to show a strong growth, but the market situation may soon change dramatically. This is the opinion of Real Vision CEO and cryptocurrency investor Raul Paul. We tell you more about the situation.

This morning, Bitcoin is valued at $47,000. Meanwhile, overnight, the cryptocurrency fumbled for a local bottom at $45,900. This was followed by a rebound on the hourly chart of BTC – though not particularly sharp yet.

Bitcoin’s hourly chart

Although the main cryptocurrency has not been looking its best lately, experts expect a sharp turnaround in early 2022. That’s the view held by Raul Paul.

What will happen to Bitcoin?

According to Paul, the pressure on Bitcoin’s price will soon be significantly reduced by sellers, because big investors represented by institutional institutions – that is, professional investors – have almost finished selling their coins. Still, by the end of the year the big players tend to lock in their profits. And that’s why the situation in BTC trading has been devoid of momentum, CEO Real Vision noted in a recent interview.

Considering that most of the coin sales in December were made from wallets that had been accumulating bitcoins over the summer, everything really points to the fact that the whales had an excuse to lock in profits rather than deliberately crashing the market. Here’s Paul’s quote on the matter, in which he shares his view of the market situation. The replica is published in Cointelegraph.

The question remains – are they done with selling coins? It seems that they really are, because last week the market was “wobbling”, which was the traditional last period of the year when everyone closed their positions.

Consequently, the investor is confident that the big players want to lock in profits purely because of the time of year. And that sounds like the truth. Because, for example, it is the period when Americans start to account for all their transactions for further payment of taxes.

@RaoulGMI answers quickly. Not this time. He needed 6 seconds before answering “Why #DAO is so sexy” but the answer was brilliant.

Less than 30 minutes until the premiere starts. Today, at 19:00 CET, on our Youtube channel:https://t.co/lq96tZHfwq@Arscryptopia @stakeborgdao pic.twitter.com/4rgIev1XLw

– StakeBorgDAO (@stakeborgdao) December 26, 2021

Bulls should look forward to the first quarter of 2022, when cryptocurrencies are likely to show good growth, according to Paul. The big players will return to trading and there is no reason for them to play down the value of Bitcoin just yet, the expert said.

Bitcoin price over the past month

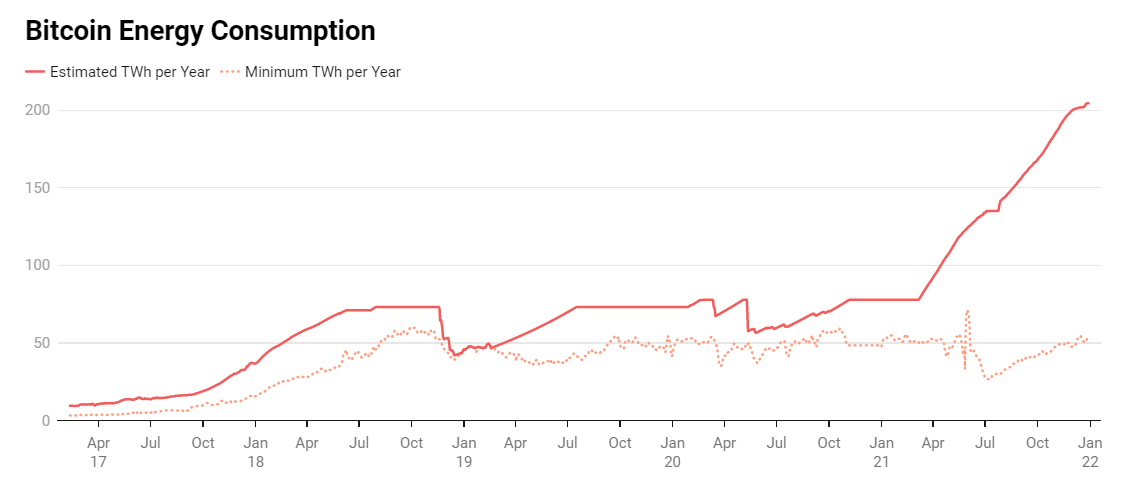

This process could be hampered by a new wave of criticism of the cryptocurrency’s over-powered network, which has not been a secret for years. However, miners have no reason to “apologise” for their activities – according to Anthony Pompliano, a well-known cryptocurrency enthusiast and host of the author’s podcast. The day before, he stated that all the important things and innovations in the world require a lot of energy anyway.

What’s more, he believes that people often compare Bitcoin’s energy consumption to traditional currencies like the US dollar in the wrong way. Here’s his rejoinder.

There is a linear relationship between energy consumption and the dollar system: we need to consume more energy to support more users and transactions, more data centres, more bank branches, more ATMs.

Bitcoin network energy consumption over several years

In other words, cryptocurrencies as an important part of the financial revolution “deserve” their share of the global power consumption trend. Yes, miners and others in the industry need to find ways to reduce the negative impact on the environment, but the “Bitcoin is too expensive” argument alone is worthless. Especially considering what prospects BTC has opened up to the world since its launch.

We believe that the correction phase of the cryptocurrency market after BTC hit a high of $69,000 is so far in line with its normal timing. Still, it happened in early November, which means Bitcoin has been trying to find the bottom and move up for a month and a half. We would like to believe that in this case, the experts will be right and the market will indeed resume the bull run in early 2022.

What do you think about this? Share your opinion in our millionaire cryptochat. There we will talk about other topics related to the world of decentralisation and digital assets.