Some big crypto investors have put their bitcoins on exchanges. What does this mean?

Bitcoin’s precipitous fall at the end of last week provoked panic not only among individual investors, but also among large traders. That’s the conclusion reached by experts at analytics platform CryptoQuant. According to their recent research, cryptocurrency exchanges have seen tangible bitcoin inflows, which usually indicates negative sentiment among investors. We tell you more about the situation.

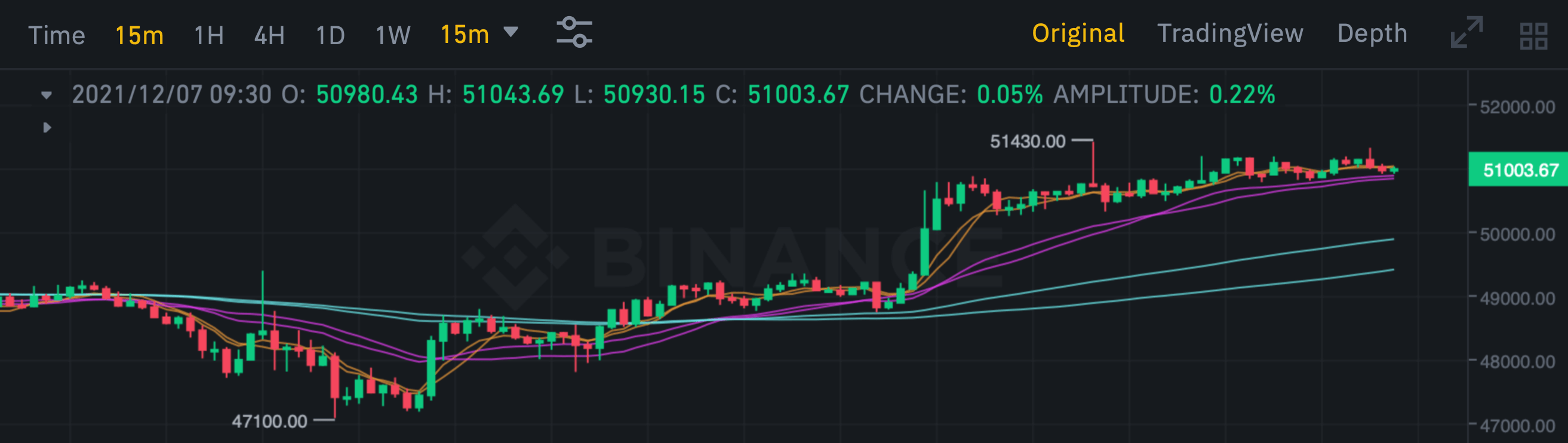

First of all, let's note that Bitcoin is looking pretty good today. Overnight, the cryptocurrency surpassed the $50,000 level and then rushed to a local high in the $51,430 area. The coin is now valued at $51,000.

Bitcoin 15-minute chart

And this is an excellent result considering that on Saturday morning, BTC collapsed to $42,000 as well. As a result, the current behaviour of the major crypto-asset supports experts’ versions that the coin market has not yet moved into a bear market stage, i.e. a long-term drawdown. Well, crypto has the potential for another growth phase.

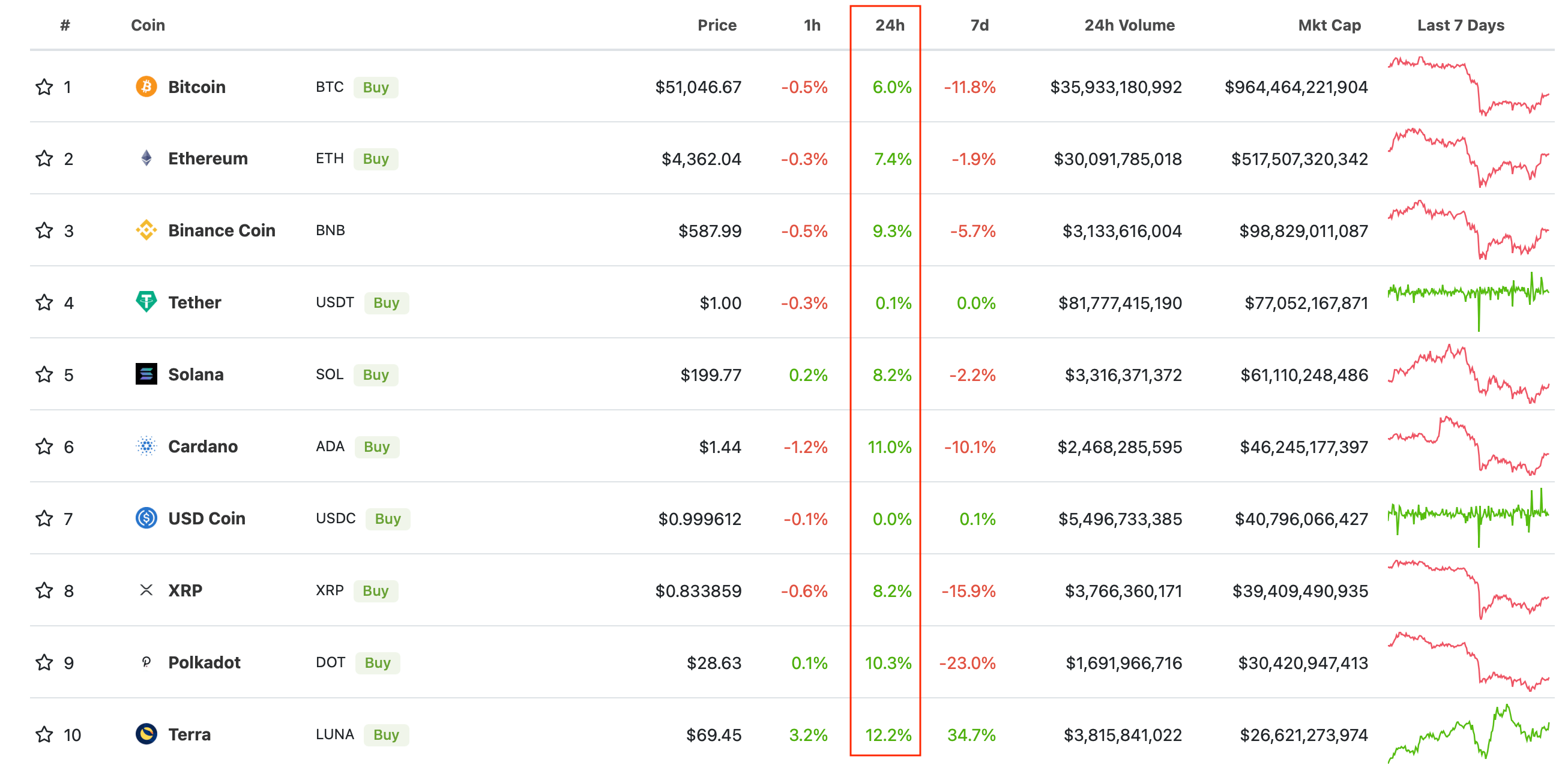

This is also supported by the actions of altcoins. They have shown around a 10 percent gain in the last 24 hours – which is a great result for the day.

Chart of top cryptocurrencies by market capitalisation

However, the actions of some investors the day before contradicted the positive scenario. Apparently, they were ready to get rid of their coins little by little in the absence of bright cryptocurrency market action.

What will happen to Bitcoin?

The short-term price movement is predicted by analysts based on their Whale Ratio indicator. It shows the ratio of the largest inflows and outflows of coins from exchanges. Before Saturday’s drop to $41,900, the indicator rose above the 0.95 level, and by Monday it had stabilised slightly.

Here’s a comment from experts on the matter, in which they share their view of the situation. Their rejoinder is cited by Cointelegraph.

Whales are still depositing BTC on exchanges. Whale Ratio rose again to 0.95.

As a reminder, whales are referred to as large investors with thousands of bitcoins at their disposal. Most often they are wealthy investors who have had time to consider the potential of digital assets early on. However, there are also exceptions in the form of early buyers of BTC, when it was valued at a few dollars or even cents.

Whale Ratio indicator

As noted by analysts, the higher the indicator, the more inflows to exchanges prevail over the volume of coins withdrawals. So far, the situation still looks ambiguous, so the market needs to show something more to clearly indicate the further development vector.

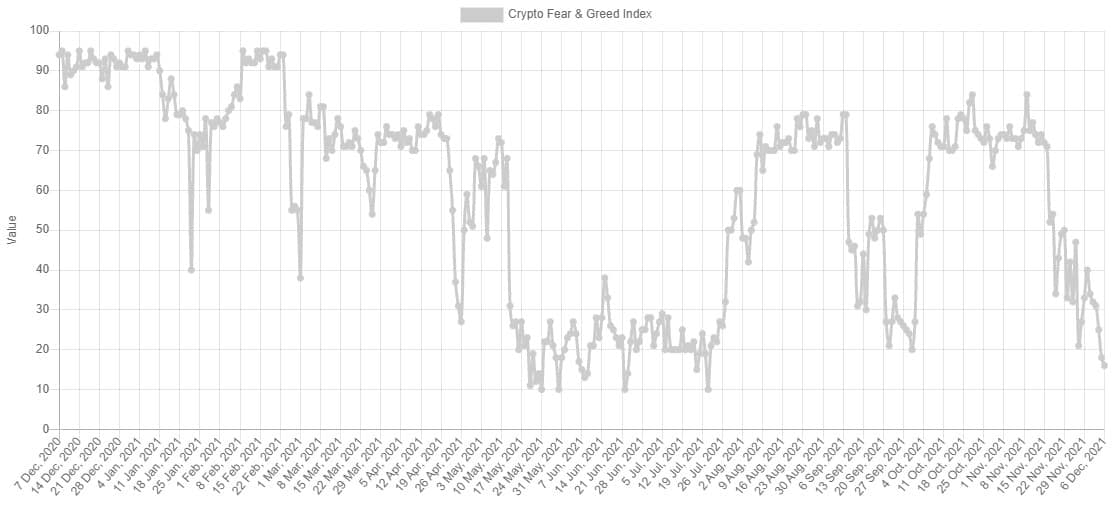

The market sentiment is more accurately reflected by Alternative’s fear and greed indicator. After the collapse it has now fallen to its lowest value in five months. All indications now are that most are experiencing “extreme fear” about Bitcoin’s future. The last time things were this tense was after the collapse of the crypto market in May, when the Chinese government completely banned mining in the country.

Fear and greed indicator dynamics

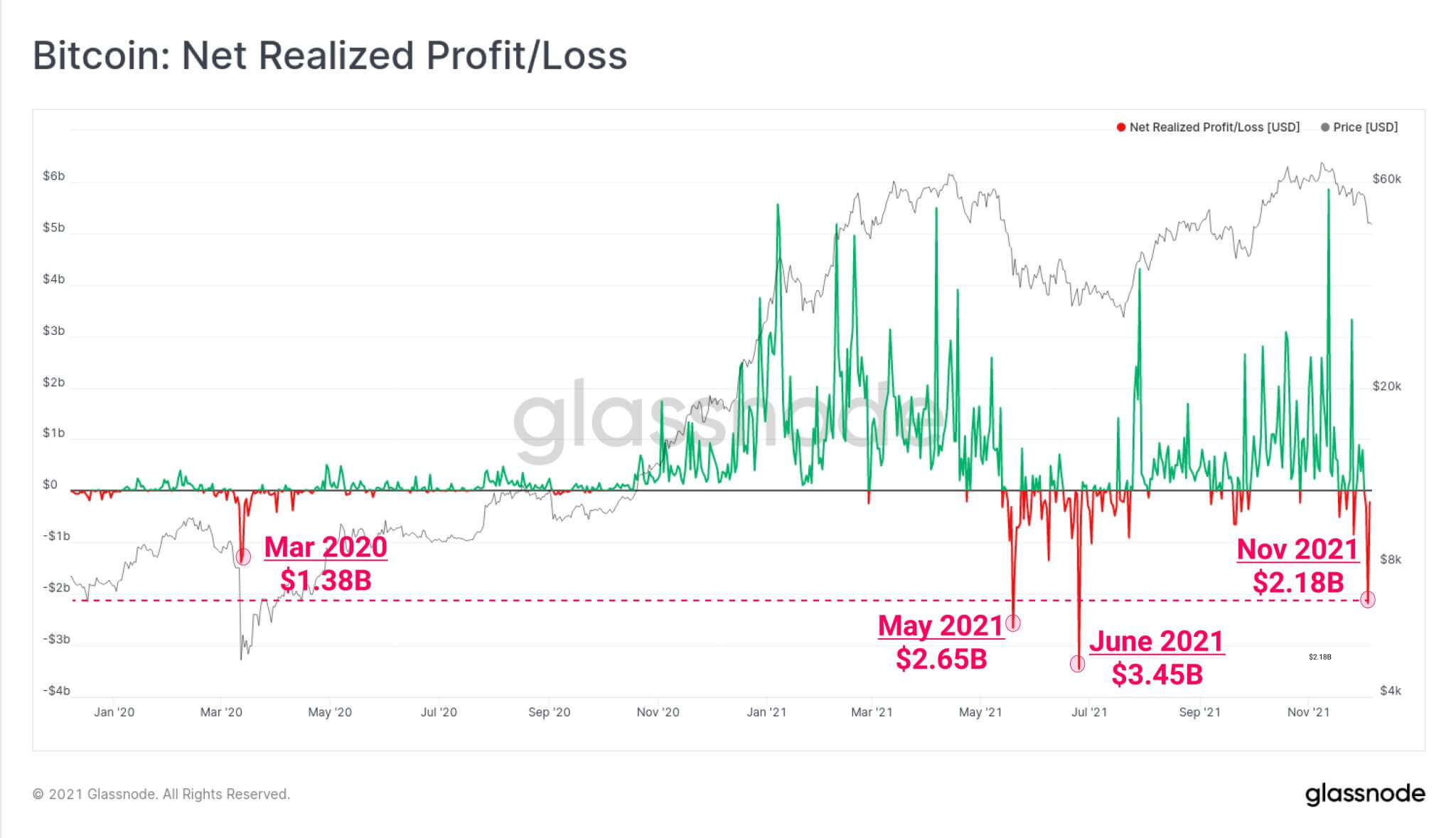

Meanwhile, more cautious investors have already managed to say goodbye to their bitcoins – including at a loss. According to analysts at Glassnode, BTC holders sold $2.18 billion worth of the cryptocurrency at a loss during this weekend’s market slump, and most likely did so out of fear of a further market collapse. As noted by experts, this is the third highest result in the cryptocurrency network’s history.

More impressive figures were recorded in May and June this year – 2.65 and 3.45 billion, respectively. Well, at the time of the market crash in March 2020 due to the panic surrounding the spread of the coronavirus, the amount was equal to 1.38 billion.

Selling bitcoins at a disadvantage

We believe that right now the market is still in a phase of uncertainty. It has certainly recovered slightly, but Bitcoin needs to jump to around $52,000 to $53,000 for more certainty, experts believe. In that case, last Saturday's event will really remain in history as another drawdown on the way to the next price record. However, whether it will be, we will know with time, and moreover, for sure, we are speaking about some months.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There we will talk about other topics related to blockchain, decentralization of finance and digital assets.