The Bitcoin network’s hash rate has approached record highs. What does this mean for the crypto market?

The Bitcoin network’s hash rate has almost set a new all-time high above the all-important mark of 200 hashes per second. This year, we have seen a serious drop of more than twice as much in the face of a total ban on mining in China. As we can see, the hype around crypto is so strong that even such a massive and negative event could not undermine miners’ confidence in their business. That means digital assets continue to be a desirable acquisition for investors. We tell you more about the situation.

It should be noted that miners’ eagerness to mine coins is easy enough to understand, as it brings excellent profits. Particularly, yesterday the income was equal to equivalent of 42.68 million USD – in this case we are talking about total income of all miners during the day.

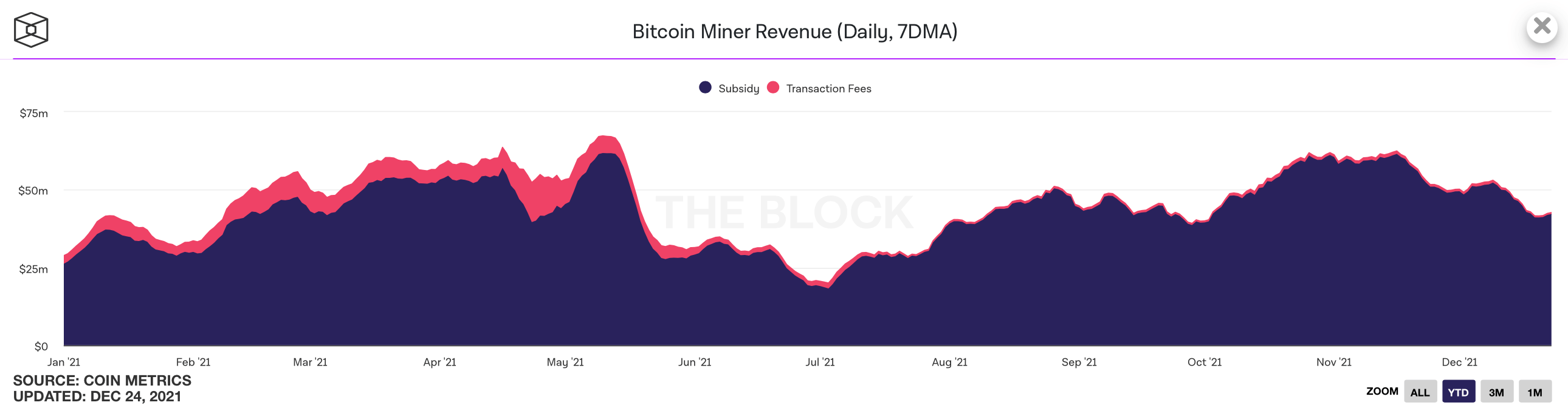

Well, the record figure was $67.34 million on May 10, 2021. Here is the corresponding graph of miners’ earnings since the first of January.

Daily yield of Bitcoin miners

It should be noted that it is possible to mine bitcoins using a video card, among other things. The new payout system for Etherium miners on the 2Miners pool will make this possible. One of the options allows to convert your reward from ETH to BTC and get it exactly in your Bitcoin wallet. And because all that happens automatically, from the outside the process is really BTC mining using video card - though you can't do that directly for years. Read more about the new payout system in a separate article.

How cryptocurrencies are earning

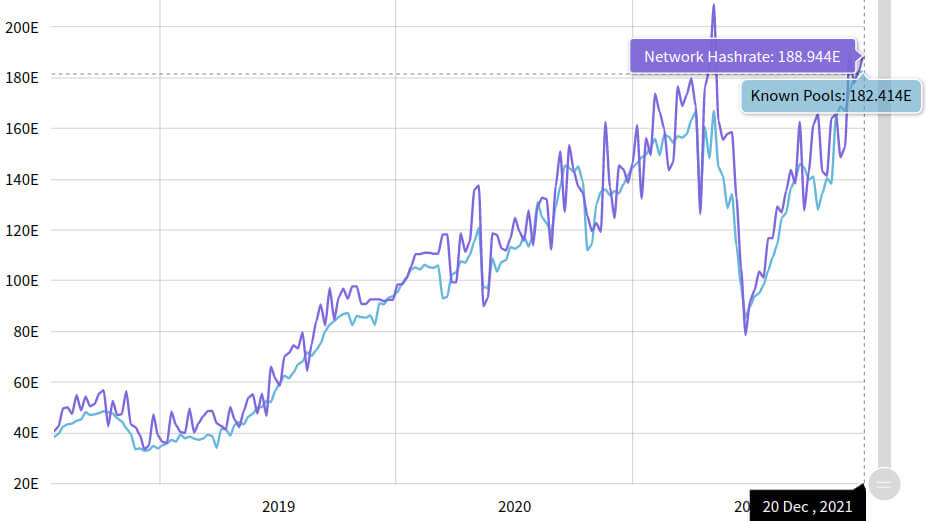

By early December, Bitcoin’s value had begun a rapid decline after peaking at $69,000. But that didn’t stop the hash rate from rising either – as of today, it’s hitting the 188.9 exahex per second zone. Before the ban by the Chinese government, the figure was around 209.3 exahexes per second.

Thus, the hash rate has not only fully recovered from the ban in China, but has also become higher than ever before in Bitcoin's history. In other words, established mining pools now have the largest influx of both individual and large industrial scale miners.

Bitcoin network hash rate

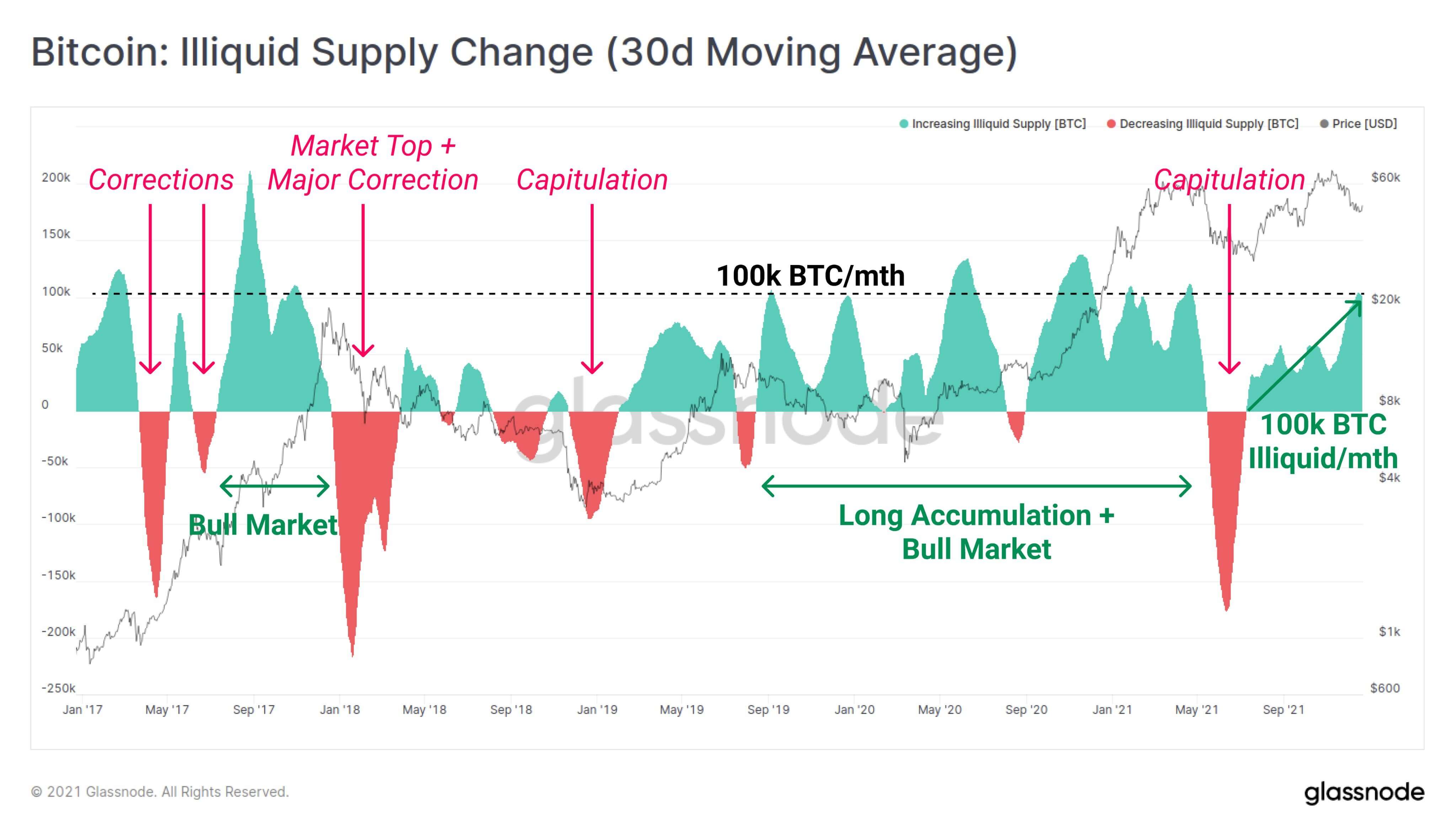

As noted by Cointelegraph, miners themselves are not yet eager to sell bitcoins mined in recent months. That’s the conclusion reached by experts at analytics platform Glassnode. They found that the volume of “illiquid” coins is now increasing by about 100,000 BTC each month. Consequently, these bitcoins continue to be stored in miners’ wallets or are simply sent to addresses that are marked as hoarding – that is, from which virtually no coins are spent.

Bitcoin hoarding by miners

Another positive news this week is the growing demand for cryptocurrency payments among ordinary users. According to a recent survey by payments network Mercuryo, 57 per cent of respondents believe that accepting cryptocurrency payments will give companies a competitive advantage. In addition, more than a third of the firms in the survey reported that their customers have already asked to add the ability to pay in BTC, ETH or another digital currency.

Mercuryo representatives surveyed 501 senior business financial decision makers in the UK. Almost half of the sample were large businesses with more than 250 employees. 40 per cent of respondents were board-level executives and the rest were partners or individual business owners.

Bitcoin is unstoppable!

What’s important is that large companies can increasingly focus on meeting their customers’ demand for digital assets, notes Mercuryo CEO and co-founder Peter Kozyakov. Here is his rejoinder, in which the expert shares his view of what is happening.

Our research shows that 75 per cent of all large companies believe that cryptocurrencies will eventually be integrated into all forms of financial services.

All that said, Bitcoin and altcoin are becoming more than just speculative tools in the hands of traders. They are gaining fundamental value as a means of payment and capital preservation. And that fact is sure to serve as a great condition for the industry to grow in the next wave of the bull run.

We think the recovery of the Bitcoin network's hash rate is a great sign. The phenomenon is once again a reminder of the power of cryptocurrencies and makes it clear that niche bans in certain countries will not put a stop to the development of digital assets. Accordingly, they will continue to evolve, becoming an integral part of people's daily lives.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. There we will talk about other topics related to the blockchain and decentralisation industry.