The number of bitcoins on cryptocurrency exchanges is increasing. What is the reason for this happening?

Over the past few weeks, cryptocurrency wallet balances on exchanges have begun to increase markedly. This is usually considered one of the signs that the crypto market is about to collapse. The logic here is simple – many investors are transferring coins from their crypto wallets to exchanges to sell them sooner. But this time, that prediction might not come true, as the recent rise in trading platform balances has other reasons. Let’s talk more about the situation and its significance.

It should be noted that this situation in general does not correspond to the market trend. Still, bitcoin balances on cryptocurrency exchanges have been steadily declining in recent months, meaning that users have been withdrawing their own coins for long-term storage or for use in various services or platforms.

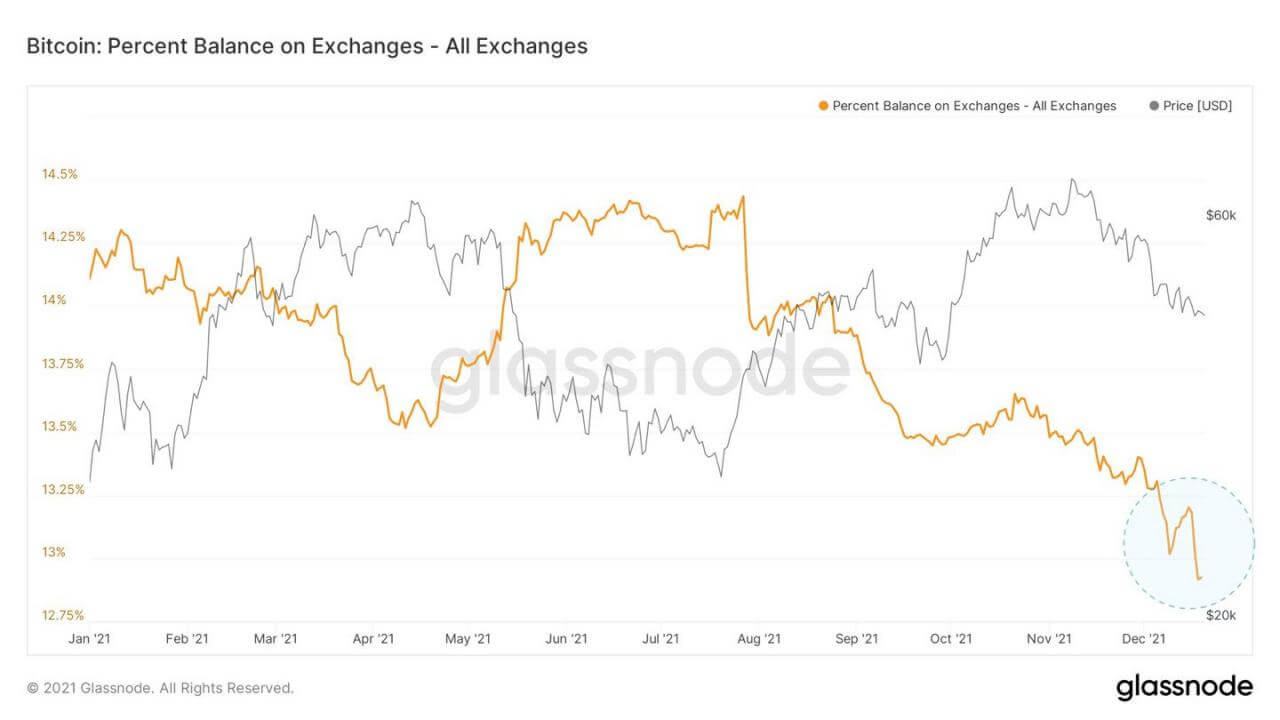

For example, in the middle of the month, analysts said that the amount of BTC on trading platforms had reached its lowest level in the past three years. Accordingly, traders decided to keep their bitcoins outside of centralised platforms. Here is the relevant graph of the figure from Glassnode experts.

Bitcoin balance on cryptocurrency exchanges

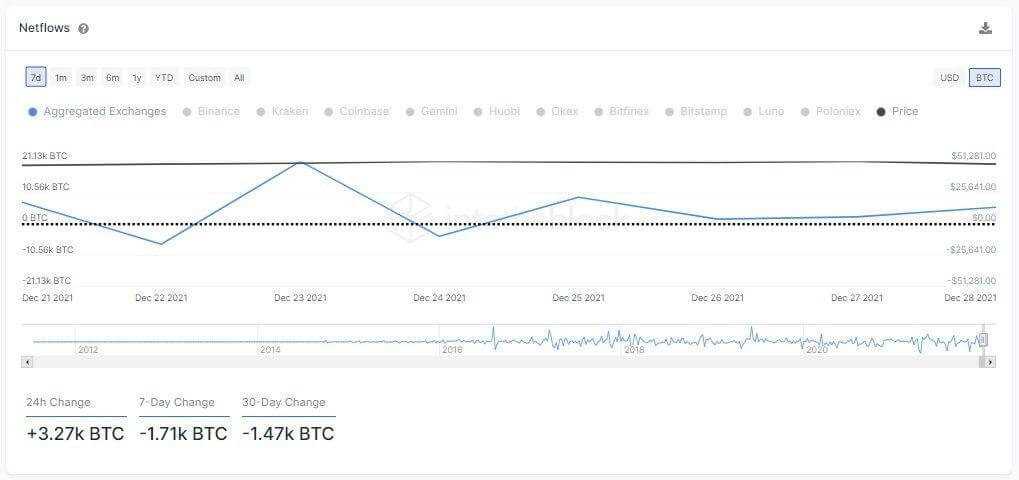

The situation has changed recently. According to IntoTheBlock experts, users have deposited 18,472 BTC on trading platforms since December 25. Which means some of them have decided to get rid of the coins.

Depositing bitcoins to cryptocurrency exchanges

In the end though, such a desire by traders is unlikely to last, analysts believe.

Who is moving cryptocurrencies to exchanges?

According to a crypto analyst from the Glassnode platform under the nickname TXMC, the rise in exchanges’ balance sheets is most likely caused by China’s cryptocurrency ban. Chinese investors are struggling to hold their cryptocurrency assets. In particular, the international offshoot of the Chinese exchange Huobi called Huobi Global banned mainland Chinese citizens from accessing its trading services on 15 December. They now have until the end of the month to sell funds.

Recall, the situation relates to the Chinese government's decision to ban interaction with digital assets for citizens. This decision was announced at the end of September. Since then, various cryptocurrency-related companies have gradually stopped serving residents of that country.

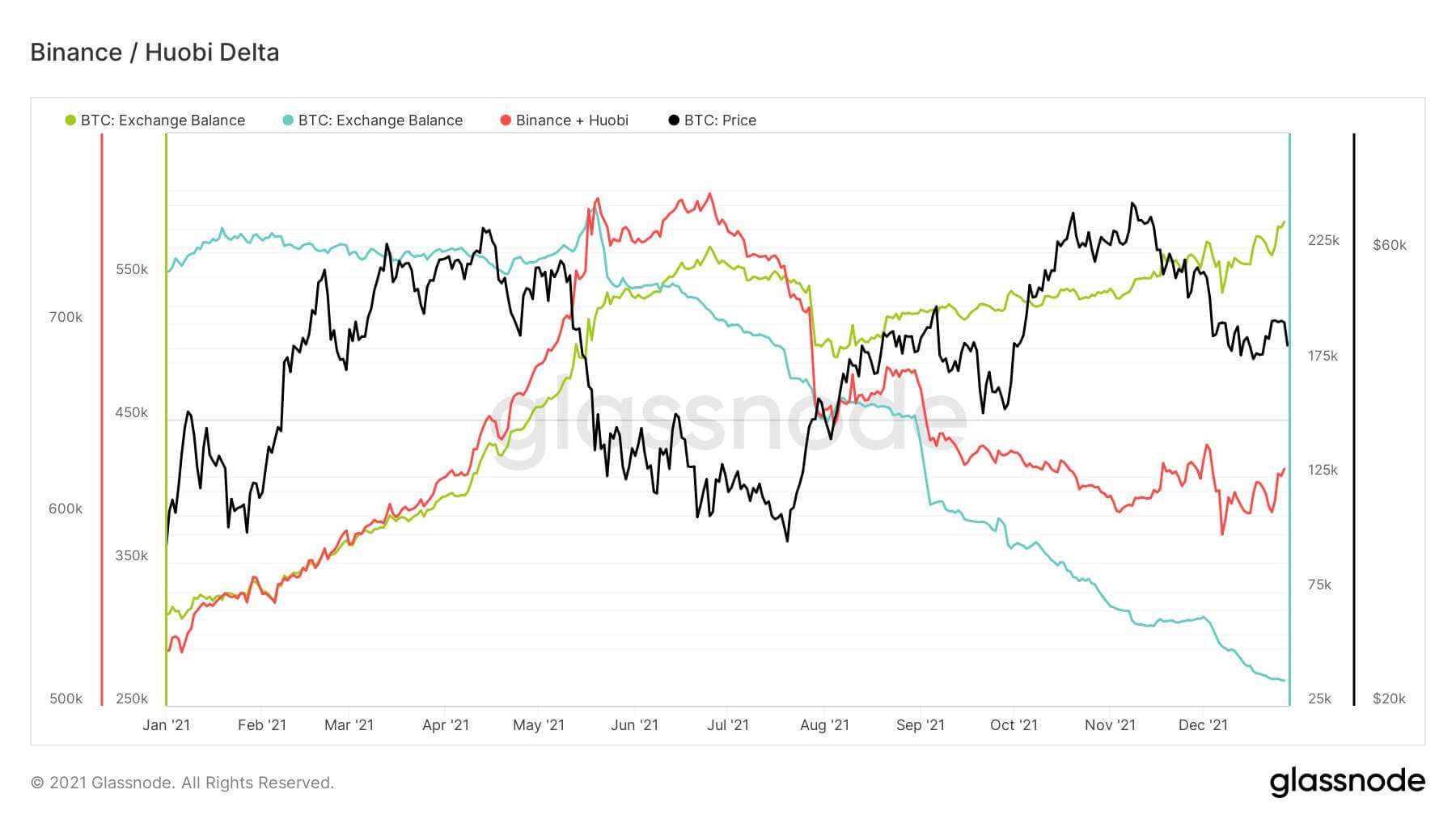

Total bitcoin balances on cryptocurrency exchanges

Here’s an entry from the exchange’s blog, published in Cointelegraph. It outlines new rules for Chinese citizens to interact with the trading platform.

From 16:00 UTC on 31 December 2021, mainland Chinese users can no longer sell their assets or conduct any transactions with RMB. Until the end of this period, all non-cancelled coin sale orders will be automatically closed. Mainland China users are advised to withdraw their digital assets as soon as possible.

As a result of these restrictions, traders and investors from China are being forced to sell their crypto on Huobi en masse or transfer it to Binance. This explains the rise in the exchanges’ balance sheets, experts say.

Accordingly, the overall selling situation is not due to investors’ uncertainty about what is happening in the market or the near-term future of digital assets. It is just that some of them are forced to do so in order to comply with the new regulations of the law.

BTC balance on different exchanges

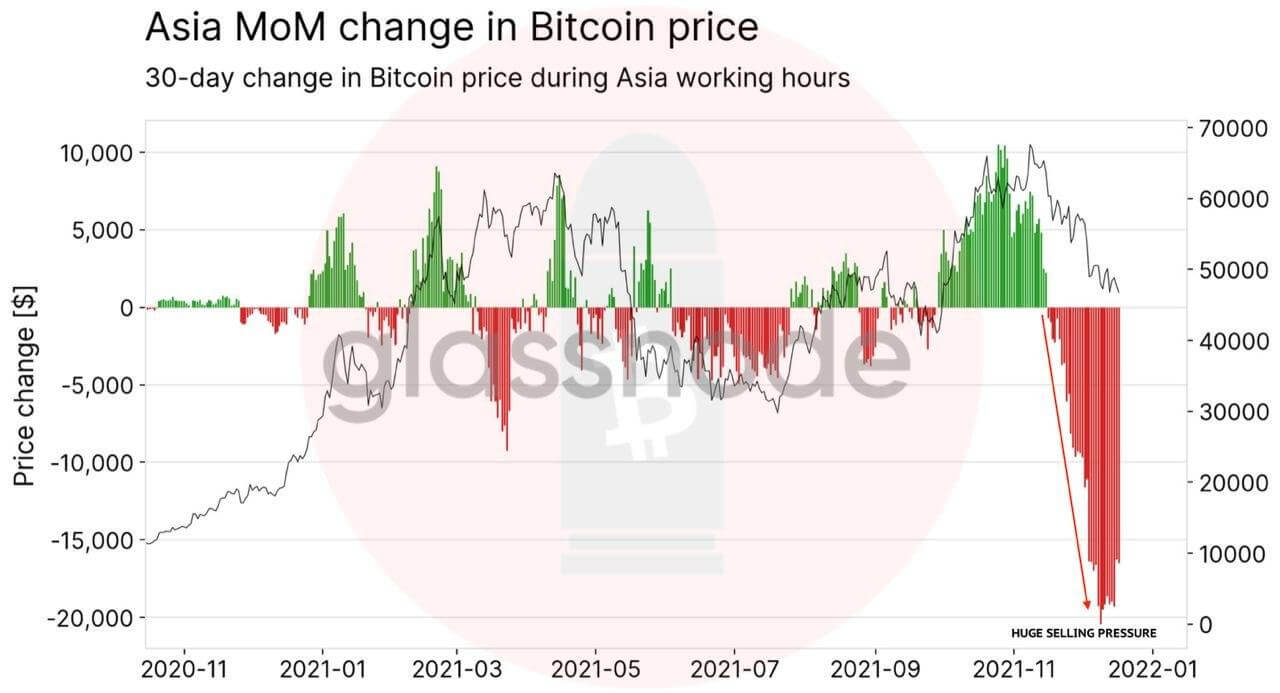

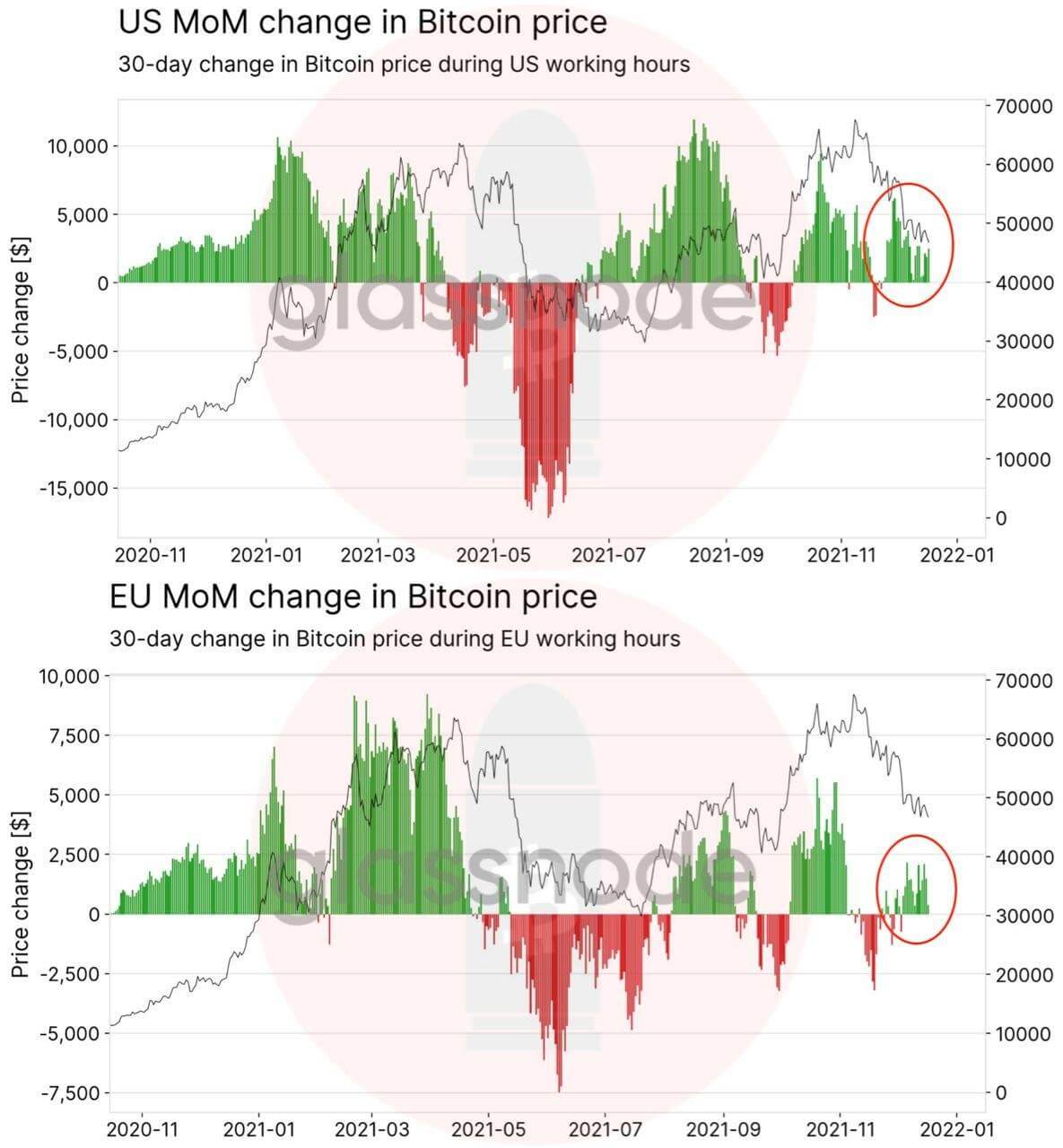

It should be noted that the version of the active sale of bitcoins by residents of China appeared in mid-December. At that time, analysts pointed out that the pressure of BTC sellers was observed precisely during the Asian session. In other words, bitcoins were especially actively sold when China and neighboring countries had a working day. This looks like this on the chart.

Active bitcoin sales in Asia

At the same time, people in Europe and the US were taking advantage of the situation and restocking their own holdings of the coin. This can also be seen on the corresponding chart.

Active bitcoin buying in Europe and the US

We think that the current influx of bitcoins to cryptocurrency exchanges may indeed be explained by activity of Chinese residents, who should get rid of their cryptocurrency holdings by the end of the month. In addition, the version that some investors decided to dump their bitcoins amid a market downturn, i.e. out of fear of further niche declines, is not ruled out. In any case, the bear market has not yet arrived - popular cryptocurrency experts agree.