Trader explains what to expect from Bitcoin’s behaviour early next year

A crypto trader under the pseudonym Light posted a lengthy story from several posts on his Twitter account. According to him, Bitcoin sellers simply “don’t have the strength” to keep draining the price of the major cryptocurrency. On top of that, Light has summarized the events that have contributed to BTC’s slump of almost 39 percent since it hit another all-time high of $69,000. Here’s a closer look at the analyst’s viewpoint.

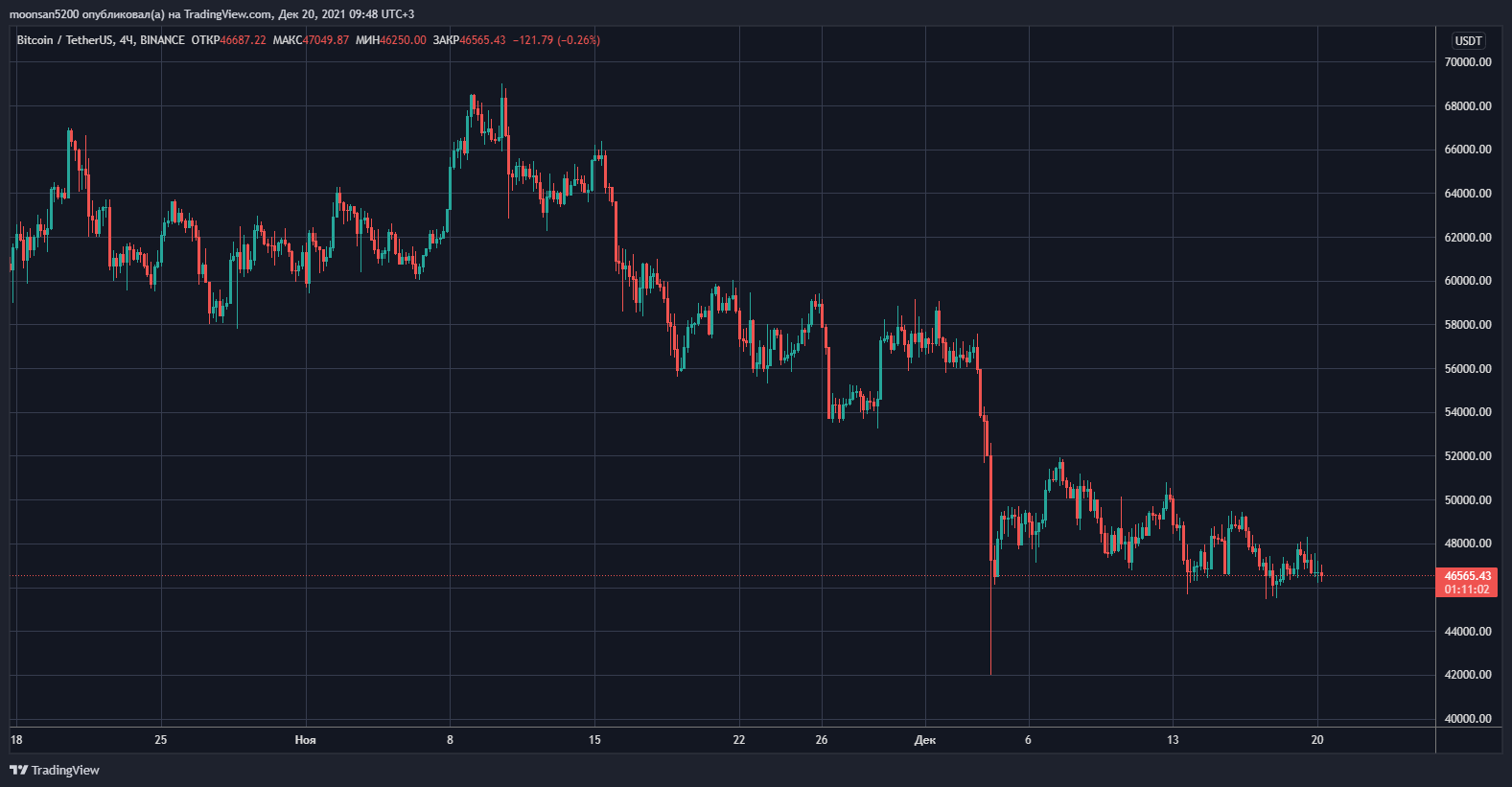

The new week for Bitcoin started without an upside breakout. The cryptocurrency briefly dipped below the $46,000 level and reached a local bottom of $45,750. Be that as it may, BTC is holding steady enough at the $46,000 level and doesn't stay below it for long.

Four-hour chart of Bitcoin rate

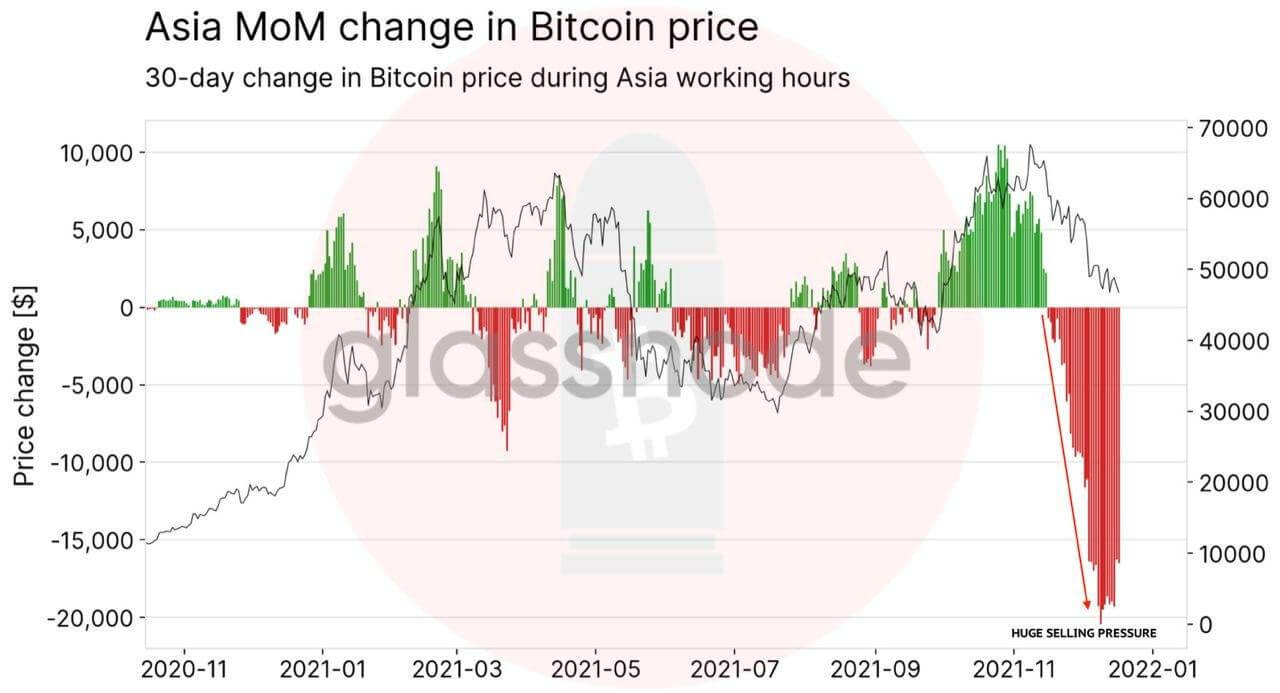

That said, the reason for BTC’s fall could be China. On the eve, analysts noticed that the sellers of the first cryptocurrency are under particularly strong pressure from Asia. There, as a reminder, accounts of Chinese residents should be closed by the end of December. This means investors may well be getting rid of their own cryptocurrency holdings.

What’s happening with Bitcoin in Asia

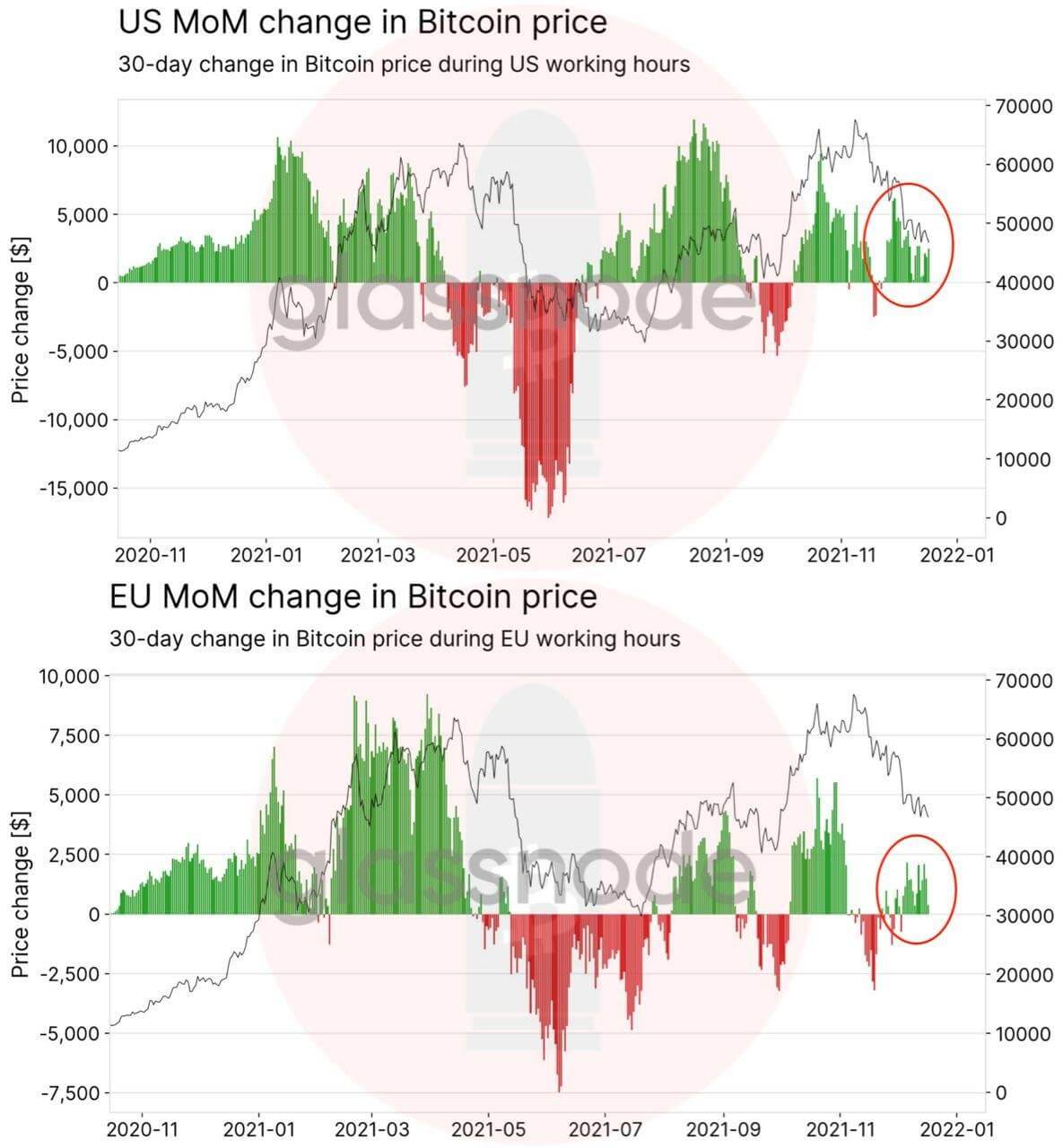

At the same time, however, residents in the US and Europe are adding to their own holdings of coins.

What’s happening with Bitcoin in Europe and the US

What’s next for Bitcoin

The combination of big players has caused many individual investors to now hold bitcoins and altcoins that they acquired at a loss. This trend was evident even before the major cryptocurrency started falling after rising to $69,000, insists Light.

Here’s the trader’s rejoinder, in which he shares his view of what’s happening in the market. The quote is cited by Cointelegraph.

25 percent of open positions in Bitcoin derivatives have been closed or liquidated. Billions of dollars have been lost. Whereas people were simply cautious before, they are now reducing their risks. Those who didn’t understand the market environment a month ago are now panicking.

As a result, the expert makes it clear that the chain of collapses in the coin market has tiresome for traders, who tried to buy assets at the bottom, but ended up with even bigger losses. This eventually forced them out of the market in anticipation of a much larger collapse in the industry. The outlook for the latter, however, remains unclear. Especially when you consider that the most pessimistic traders say that they expect BTC drawdown to 14-20 thousand dollars.

Bitcoin price dynamics on the 4-hour chart

However, it’s already too late to sell bitcoins now. Demand for the cryptocurrency is returning and it can show at least one more wave of growth, the trader believes. Here’s his quote.

While the bulls have been cautious, the bears have been aggressive, pushing fundings into negative territory in some venues and increasing the volume of open positions. The big players, who had reduced their risk around $60k, reversed course and started to “absorb” the panic.

Correspondingly, many professionals, who stake on further growth of the market, decided to use the collapse and also earned on short positions. This had an even stronger effect on the market.

Bitcoin’s share of total market capitalisation

Light summarised that the future of bears is “not as cloudless” as it was at the beginning of the month. Trying to open short positions in Bitcoin now is quite dangerous, because sensing panic in the market, many big players will start buying BTC at an “undervalued” price. In other words, if investors don’t have any deals coming up soon, now it’s better to just watch the market and count on its growth in January, the expert said.

However, the Securities and Exchange Commission (SEC) may once again “spoil the holiday”: the day before, the regulator postponed consideration of two Bitcoin ETFs. Their peculiarity is that they are based on the asset’s spot price – that is, the market price – unlike ETFs already approved, which are based on the price of Bitcoin futures.

SEC

According to Decrypt, the SEC has about 45 more days to review the ETFs from Bitwise Bitcoin ETP Trust and Grayscale Bitcoin Trust. After this period, the regulator can approve, reject or postpone its decision again. It is likely that the latter two options could still negatively impact the market – albeit in a small way.

We believe that it may indeed be too early to put an end to the current bull run for now. Still, cryptocurrencies are still showing good bounces and the market capitalisation as a whole exceeds the $2.2 trillion level. Consequently, there is more than enough money in the niche, which means investors are clearly not going to stop buying coins.

Stay tuned to our millionaire cryptochat. There we will talk about other topics related to the world of blockchain and decentralisation.