30 per cent of bitcoins bought are now in the red. What does this mean for cryptocurrency?

The previous few weeks have not been the best for Bitcoin investors, as the price of the major cryptocurrency has continued to plummet smoothly towards new yearly lows. According to analysts at the Glassnode platform, about 30 percent of all purchased coins are held at a negative value in cryptocurrency wallets, meaning that selling them right now will bring losses to their owners. Here’s a look at the specifics of the situation.

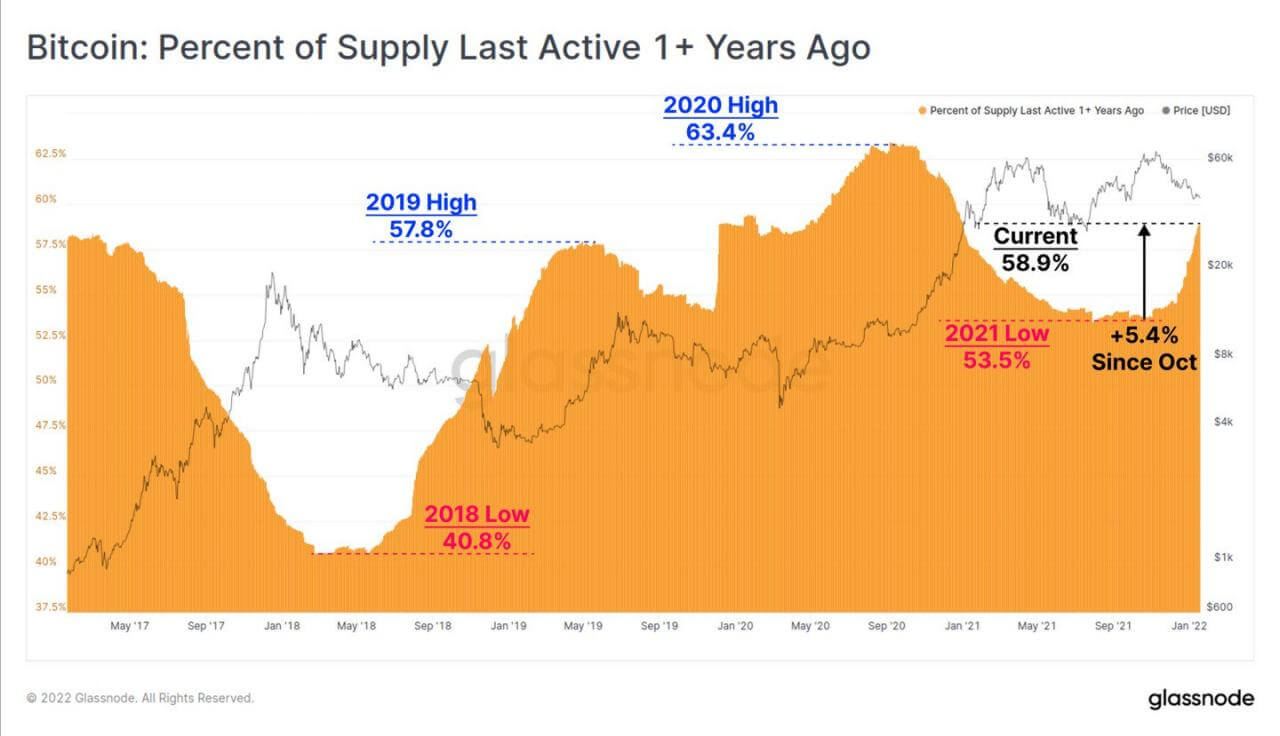

It should be noted that Bitcoin continues to be a desirable asset for investors, who are willing to hold it long enough. For example, the volume of BTC inactive for at least a year has increased by 5.4 percent since October 2021. Accordingly, owners simply left these coins untouched and kept them in their wallets.

At the moment, the share of inactive BTC is 58.9 percent of the total cryptocurrency supply. The maximum for 2020 reached 63.4 percent, which means that the current figures are quite far from the record.

Graph of inactive bitcoins

Which means some investors are holding on to the coins, even despite their far from best rates. Accordingly, they are hoping for an improvement in the future.

What will happen to Bitcoin

Large corrections in Bitcoin’s price are a familiar phenomenon for bull cycles in the crypto market. And this time around, investors are also left hoping for a new wave of growth in the value of BTC in the future. As Glassnode notes, often when the number of “losing” bitcoins reaches 30 percent of the total number of coins in circulation, a new local market surge upwards occurs.

Here’s a rejoinder from analysts on the matter, in which they share their take on what’s happening. The quote is cited by Cointelegraph.

As soon as the bears start to put significant pressure on the market, Bitcoin buyers “protect” an important level of loss-making coins. This has happened at least several times over the past few years.

As a reminder, bears are those investors who bet on a fall in the price of the asset. They use so-called short positions, which allow earning on collapses. That is why the overall market situation is a struggle between bulls and bears.

The level of bitcoin profitability noted by Glassnode

The market’s reaction to approaching the aforementioned level will set the mood for traders and investors for the next few months, experts believe. They continue.

Continued buyer weakness could see those currently holding onto loss-making bitcoins finally sell off. If there is a strong bullish momentum in the market, however, it will give confidence that BTC will continue to rise.

It should be noted that selling cryptocurrencies by the most resilient investors sometimes also turns out to be positive for digital assets. The reason for this is that there are simply no sellers left in the market after that, which means that the increased buyer attention to a certain project starts to seriously increase its value.

According to Cointelegraph’s sources, investors in general should not panic about another Bitcoin collapse just yet. That is the opinion of a popular crypto analyst nicknamed TechDev. The day before, he said that the cryptocurrency’s 40 percent drop from its all-time high of around $69,000 looks like another bullrun rollback.

In other words, he doesn't see anything unusual about what's happening in the market. After all, at least this has happened more than once before. For example, in the summer of 2021 the coin niche was also in recession for a long time, the reason for that was the great collapse in May. Coin holders then also waited a long time for signs of a market rebound and eventually got it.

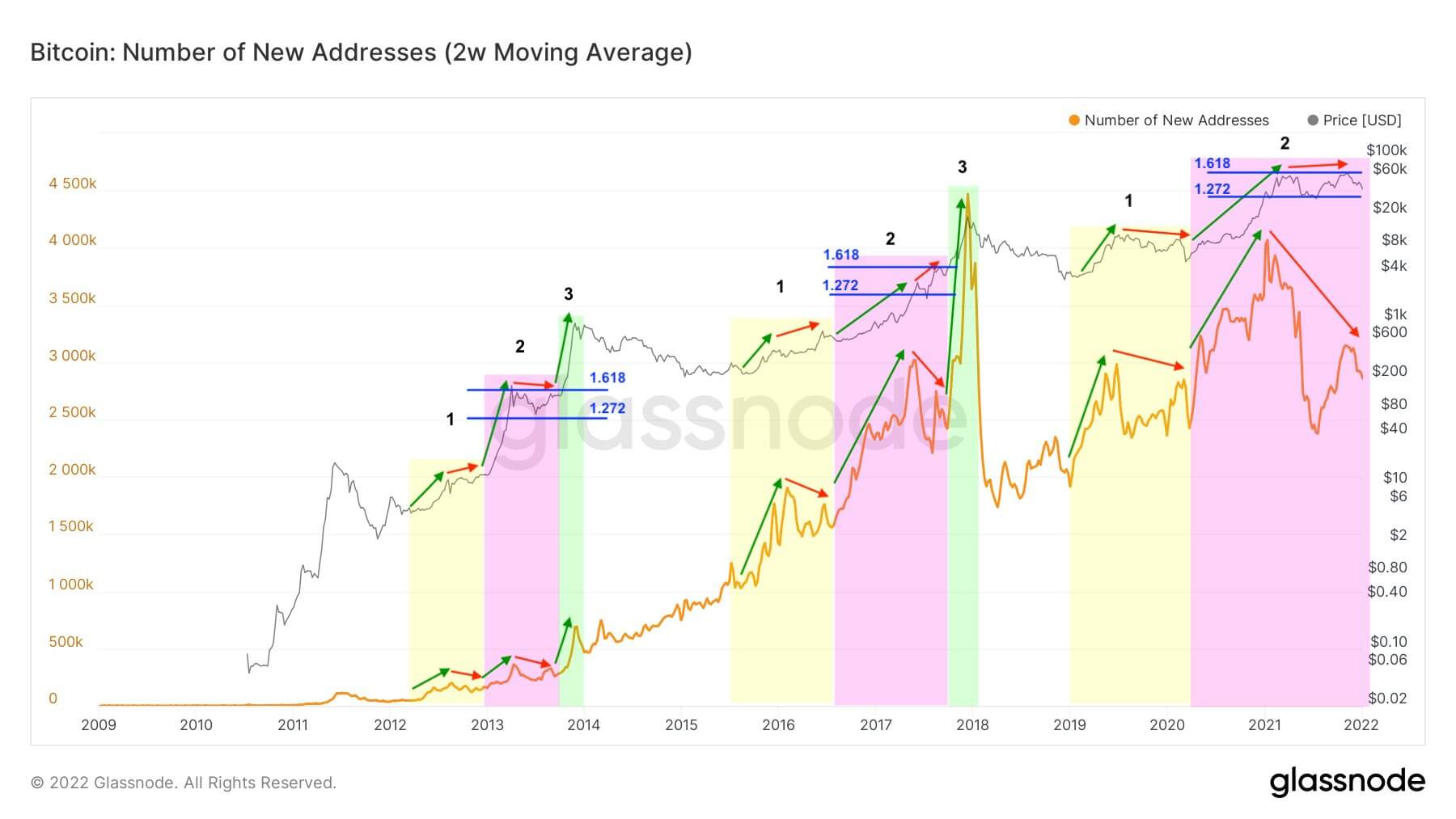

Graph of the number of new cryptocurrencies on the background of Bitcoin price

4 out of 6 such corrections coincided with a short-term decline in new cryptocurrency address growth as well as low trading volumes. The current situation is something similar, with the cryptocurrency remaining above its main support levels for now, analysts report. So, overall, the probability of a rebound soon remains, which is the conclusion drawn by analysts.

We believe that investors' current behaviour shows their confidence in the first cryptocurrency's prospects. Firstly, many of them are holding BTC at a loss, which hints at a belief in further growth of the coin's exchange rate. Second, the number of inactive bitcoins continues to grow, which means some buyers were not planning to part with their crypto in principle. It is to be hoped that this faith in the coin market will pay off, and we will see at least one more major run of it.

Stay tuned for more market news in our Millionaire Crypto Chat. There, we’ll talk about other topics affecting the decentralised finance and blockchain industry.