Bank of America officials reveal which coin “will be the Visa of the cryptocurrency world”

Experts at financial conglomerate Bank of America have given altcoin Solana the “honour” of comparison with the world’s largest payment system. According to them, the cryptocurrency has enormous potential, which will make it a serious competitor to Etherium in the future and reach new records in the number of active users. Let’s talk about the situation and its importance in more detail.

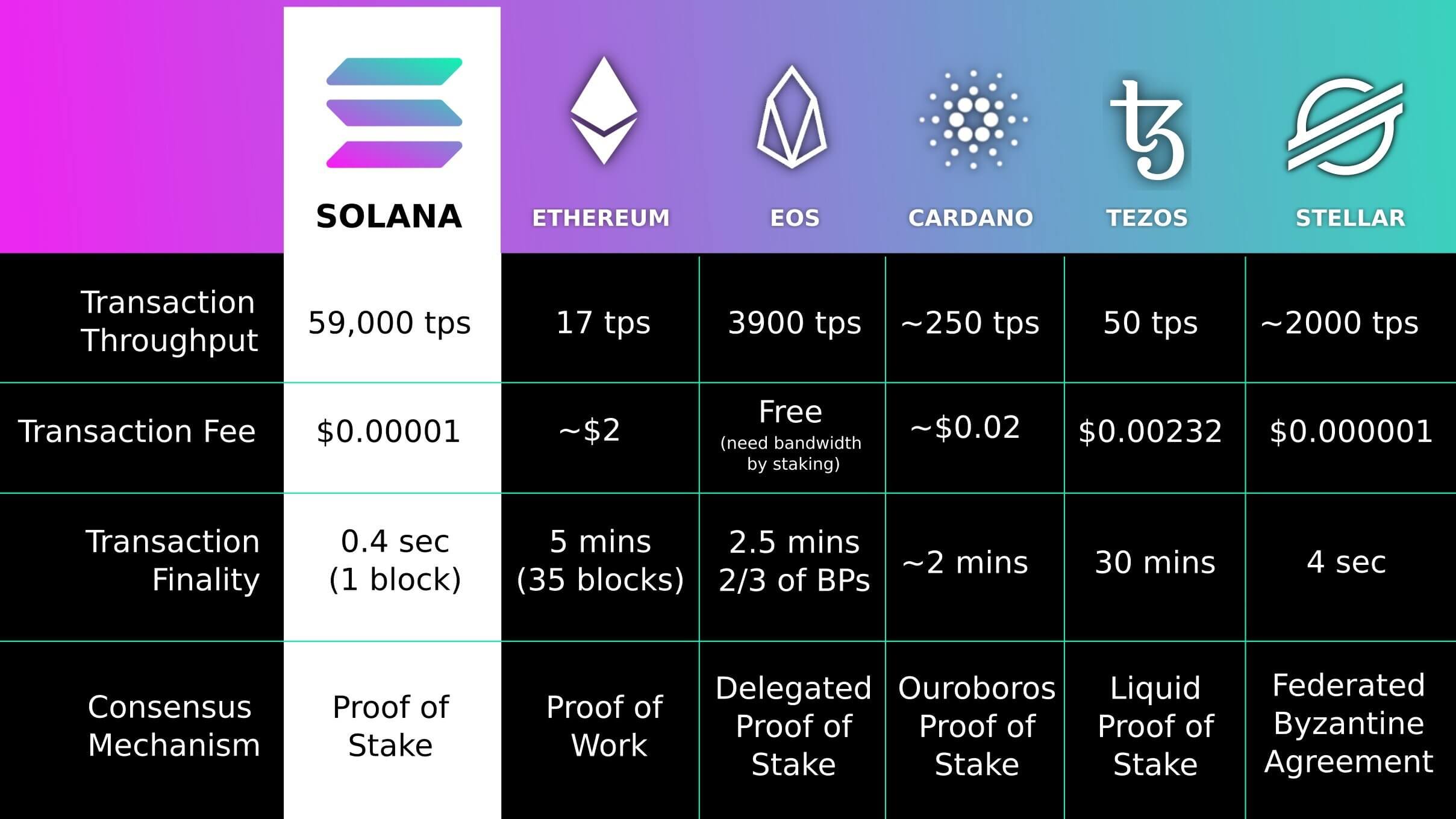

We note that comparisons between different blockchains are heard regularly – and in different ways. For example, the day before, CoinMarketCap analysts shared a graph of the average fees of different coin networks. While the average fee for interacting with the Ethereum blockchain is $46, in the case of Solana the figure is 0.025 cents. In other words, it is very profitable to use the SOL network.

Graph of the average fee in different blockchains

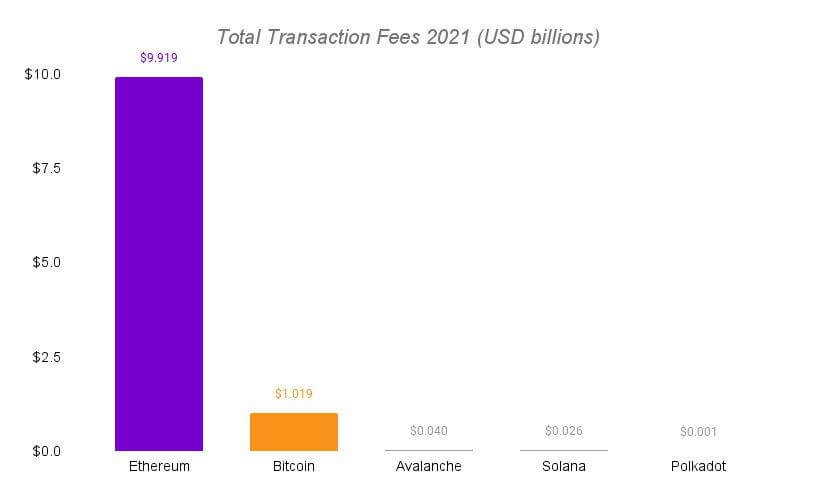

At the same time, other analysts told how much users paid for using different networks in 2021. In other words, they calculated the total amount of fees paid. In this case, Etherium also ate the most users’ money.

The amount of commissions spent on different blockchains in 2021

As Bank of America analysts point out, the role of the Solana network will soon increase significantly.

A better future for Solana

Here is a quote from crypto analyst Alkesh Shah, a research publication from the bank, in which the expert shared his vision of what is happening in the world of digital assets. Decrypt cites the relevant replica.

Solana could become a Visa in the digital asset ecosystem.

Accordingly, bank representatives believe that Solana's current features are enough to become one of the most popular blockchains in the world for making payments. We believe this is indeed the case, as transfers on the network go through in a matter of seconds, and transaction fees are not even close to the price.

There is, however, a downside to this. In particular, Solana has recently fallen victim to detractors who overload the blockchain and make it unavailable for use. Consequently, the network is down during such times.

It is important to note that something similar happened to Etherium in the autumn of 2016. These events were called the Shanghai attack, after the city where the developer conference was held at the time.

Comparing the capacity of different blockchains

To prove his point, Shah cited statistics on decentralised applications based on the altcoin. It currently underpins more than 400 active applications. At the same time, the analyst compares Etherium to blockchain for “high-value transactions, information storage and identity”.

The number of transactions per second (TPS) possible in blockchains is often compared to that of large payment systems. Visa claims it can theoretically process at least 24,000 transactions per second, although the average figure hovers around 1,700 transactions. Etherium has the lowest TPS of the three, at just 17 transactions per second. This is very low given the fact that Ether is the most popular marketplace for decentralised applications and NFT tokens.

That's why the network is constantly overloaded and fees are getting incredibly high. Note that with the move to Ethereum 2.0, the blockchain's throughput will be increased through so-called sharding.

By its own estimates, Solana outperforms Ether and Visa, with a theoretical limit of 65,000 TPS with a fraction of a cent commission. However, this fact also brings with it some disadvantages, notes the expert. Here’s his cue.

Solana prioritises scalability, but the relatively less decentralised and secure blockchain has its drawbacks, as evidenced by the network’s performance problems since its inception.

Note that Solana has indeed been criticised for its lack of decentralisation. The reason for this is the severe hardware requirements needed to run a network node. Not all coin enthusiasts can afford such devices.

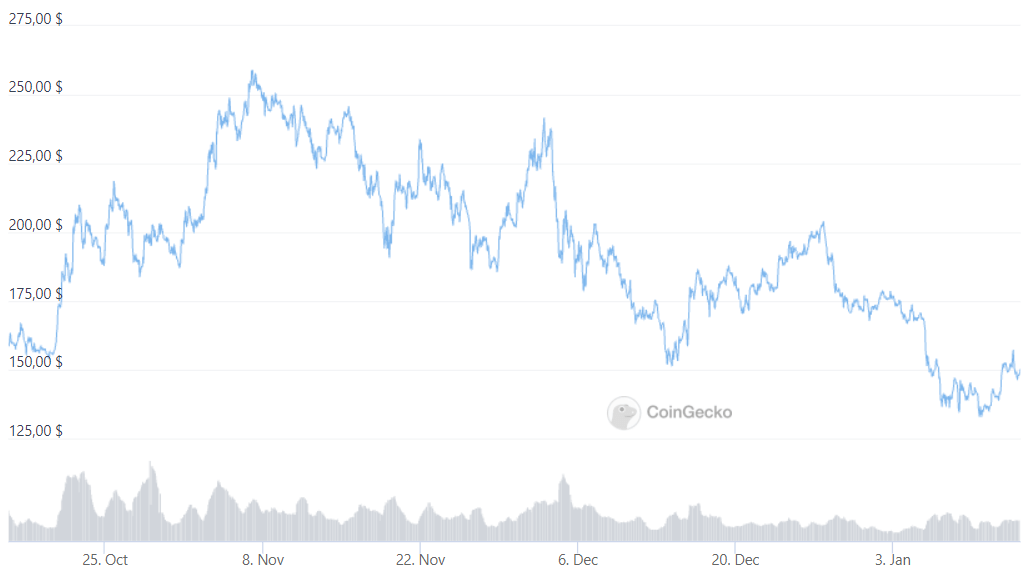

Solana exchange rate over the last 90 days

Finally, Shah noted the project’s great promise.

Its ability to provide high throughput, low cost and ease of use makes it an optimised blockchain for consumer use cases like micropayments, decentralised finance, NFT tokens, decentralised Web3 generation networks and gaming.

Anatoly Yakovenko, CEO of Solana Labs

We think the point of view of banking analysts does overlap with reality. In this case, they chose a popular decentralized network that has cheap and fast transfers, in addition, blocks are created here much faster than in Bitcoin or Efirium networks. So it is likely that in the future, as blockchain becomes more popular, it will actually be used for payments.

What do you think about that? Share your opinion in our Millionaire Crypto Chat. There, we will talk about other topics related to the blockchain and decentralisation industry.