Bitcoin is in a phase of prolonged decline. Will the cryptocurrency start to rise again?

Bitcoin investors are known for their ability to “weather” almost any crisis in the crypto market. In fact, that’s what the so-called “HODL” meme is all about – holding on to their cryptocurrencies until the last minute, hoping for crazy price increases. However, according to analysts at Glassnode, the cryptosphere is not experiencing any extreme turmoil in its current position. At least, that’s what the reserve risk indicator, or R-Risk, suggests. Talk about what is happening and its importance in more detail.

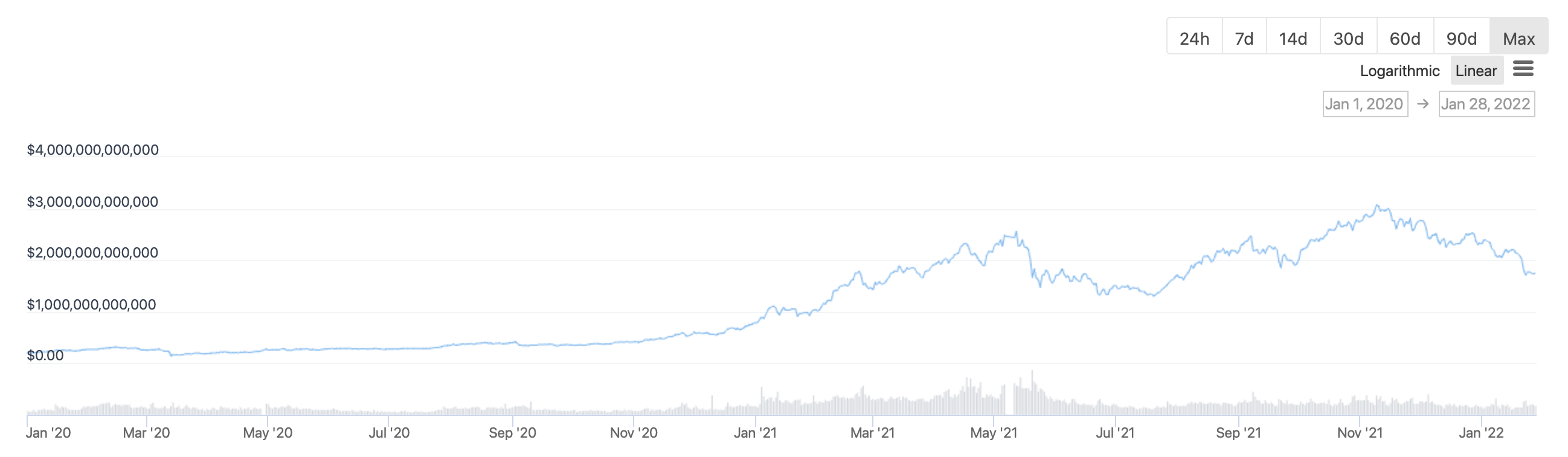

Let's note that the cryptocurrency market has really not been in the best of shape lately. To prove this, just look at the niche market capitalisation graph, i.e. the product of the number of all coins in circulation by their respective exchange rates.

Cryptocurrency market capitalisation graph

Today, the figure stands at $1.74 trillion, with a record of $3.06 trillion set in the first half of November 2021. Accordingly, since then, the value has fallen by 43 per cent – a serious loss for investors.

However, analysts do not believe that the coin market is finished with the growth phase.

What will happen to Bitcoin

Given the reserve risk ratio, analysts at Glassnode argue that the current trends in Bitcoin transactions are not a clear indication that the price has “bottomed out” or the fact that it has previously managed to hit an all-time high. Here is one of their quotes published in the Cointelegraph on the subject.

Low reserve risk values are typical of the middle of bearish and bullish cycles when the price of an asset is declining, but information on blockchain movements indicates investors are reluctant to sell the cryptocurrency.

R-Risk readings

That is, experts say that the current market conditions describe it as not one that has peaked and moved into a decline stage. This is supported by the behaviour of investors who are not willing to sell off their assets.

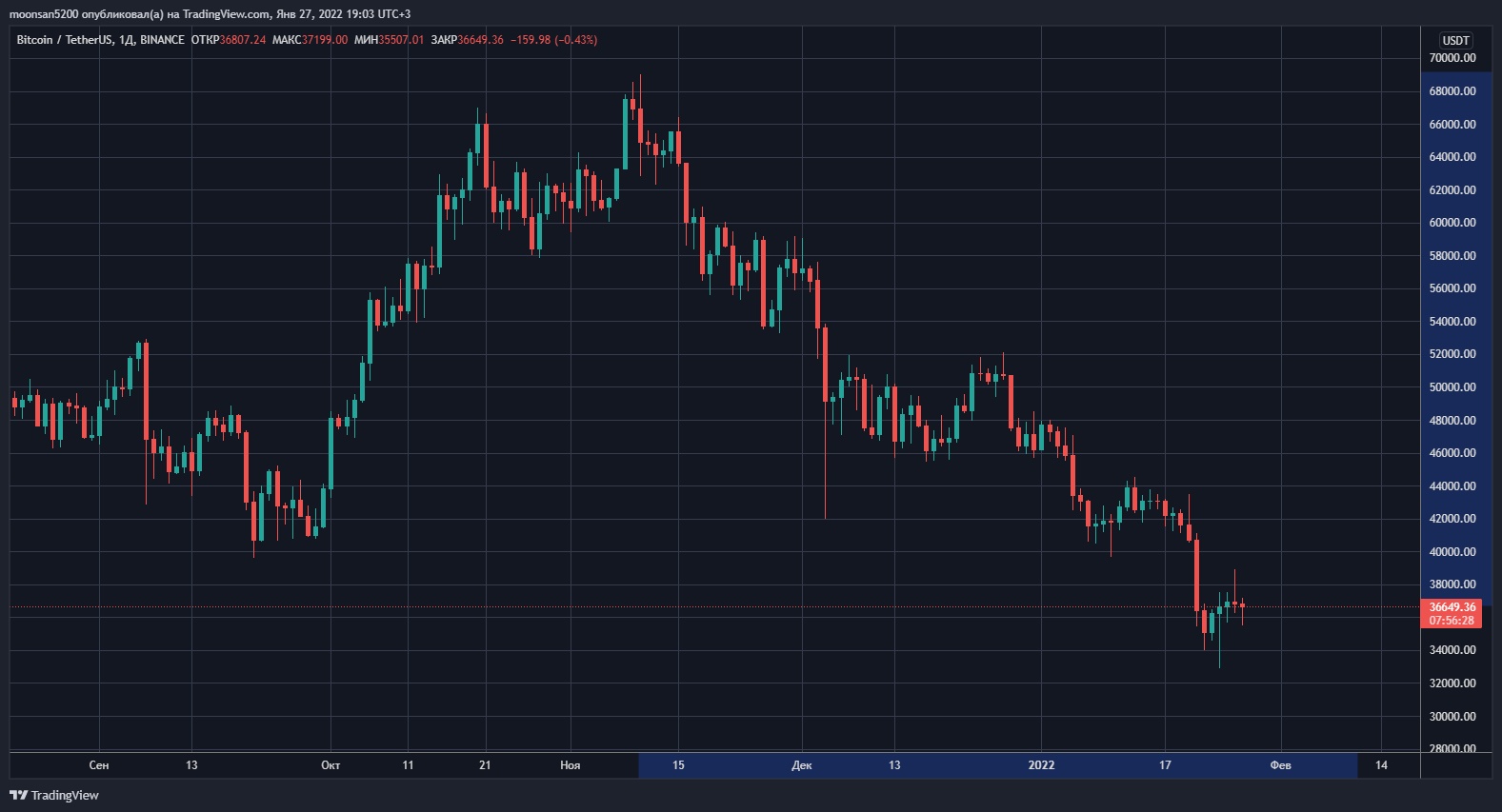

By comparison, after Bitcoin reached the $20,000 level in December 2017, it plummeted by tens of percent in a matter of days. Now, BTC, too, is about 50 percent off its high, but that slump has been gradual. Accordingly, many investors are counting on the coin industry to continue growing - and it is the actions of the majority that will determine the direction of the market going forward.

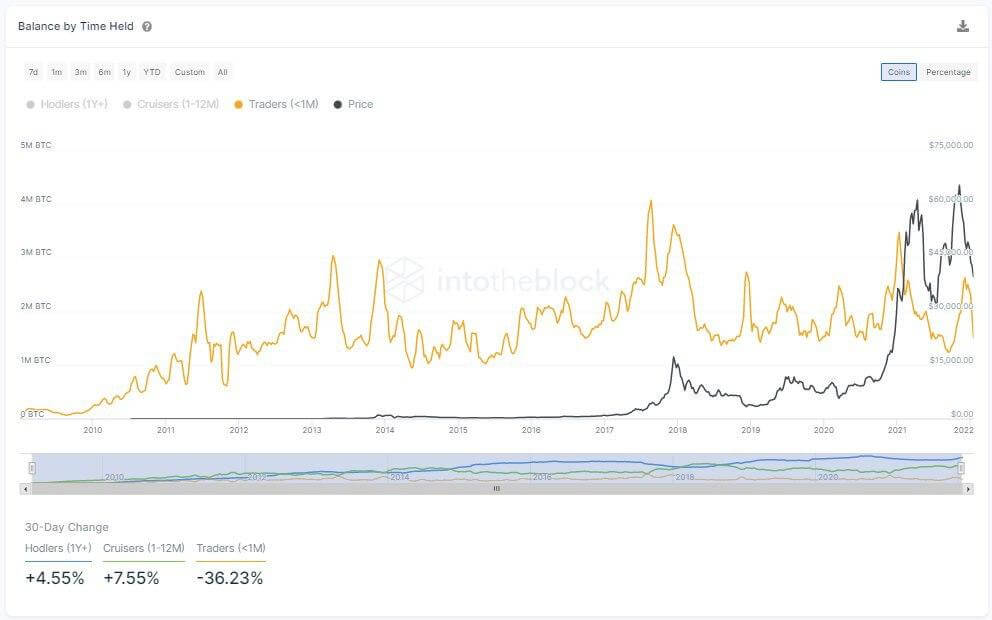

However, there are plenty of sellers in the market as well, with newly minted investors who have purchased BTC over the past month being the most active. According to Glassnode analysts, the volume of coins in their possession decreased by 36 percent in the last 30 days, which means that the market collapse really scared them and forced them to get rid of assets in the negative.

The volume of bitcoins at the disposal of short-term bitcoin holders

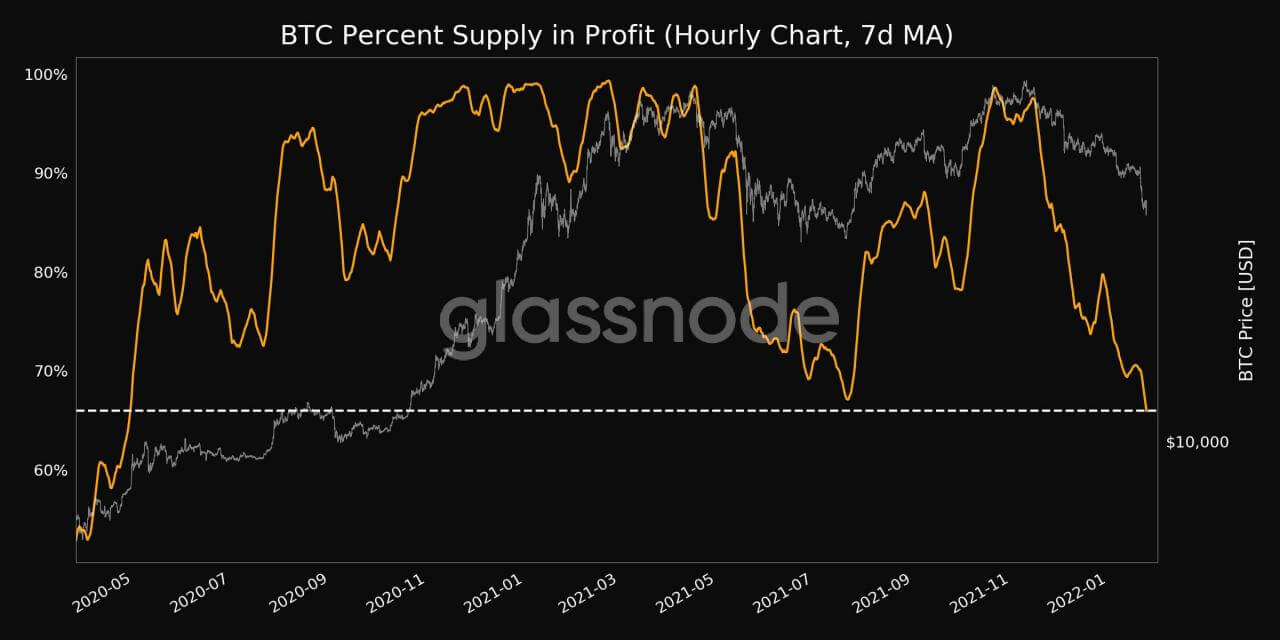

At the same time, the amount of bitcoins that can now be sold on the plus side has fallen to a 20-month low. The figure is around 65 per cent, which means the remaining 35 per cent of investors are holding BTC at a loss, not selling the coins and hoping for a rebound.

Bitcoin’s share of gains

As a reminder, R-Risk takes into account the number of days crypto holders choose not to sell their assets, compared to the current price movement. Among other things, it also indicates “market thinking” at a given price point. The R-Risk is currently in a downtrend and has approached the “pressure” zone of the price.

Since reaching its all-time high, the price of Bitcoin has fallen by almost 47 per cent

Consequently, the market is slowly falling at the moment, with it not yet hitting bottom. But it was also not at its peak last year. That is, if Bitcoin’s price rebounds strongly enough, we have a good chance of seeing a new wave of bull run, during which BTC could break all its previous records, experts say.

We believe that the current situation in the cryptocurrency market really doesn't look like the end of a long rise. And although Bitcoin managed to decline by 50 percent from its peak, the decline was protracted and accompanied by negative news from the Fed, whose representatives plan to seriously influence the economy in 2022. Thus, it is possible that experts' conclusion will be correct and we will see records in the market.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. Talk about other topics related to the world of decentralisation and blockchain there as well.