Bitcoin’s share of total cryptocurrency payments is falling. What is this due to?

BitPay, one of the largest cryptocurrency payment platforms, has published a report on a new trend in digital asset transactions. It turns out that Bitcoin’s share of such transfers is falling, with the major cryptocurrency gradually being replaced by promising altcoins. On top of that, the trend shows an increased desire among market players to accumulate BTC rather than spend it. Let’s take a closer look at the situation.

As a reminder, BitPay is a popular American company that helps businesses with cryptocurrency payments. The platform processes payments in coins at a fixed rate and then also converts them into fiat currencies. In this way, customers can spend their crypto, while businesses will receive national money, which is much easier for them.

Payment in cryptocurrencies

In this regard, BitPay’s statistics are noteworthy. Well, the changes in them clearly demonstrate the trends in the digital asset industry.

What’s happening in the cryptocurrency market

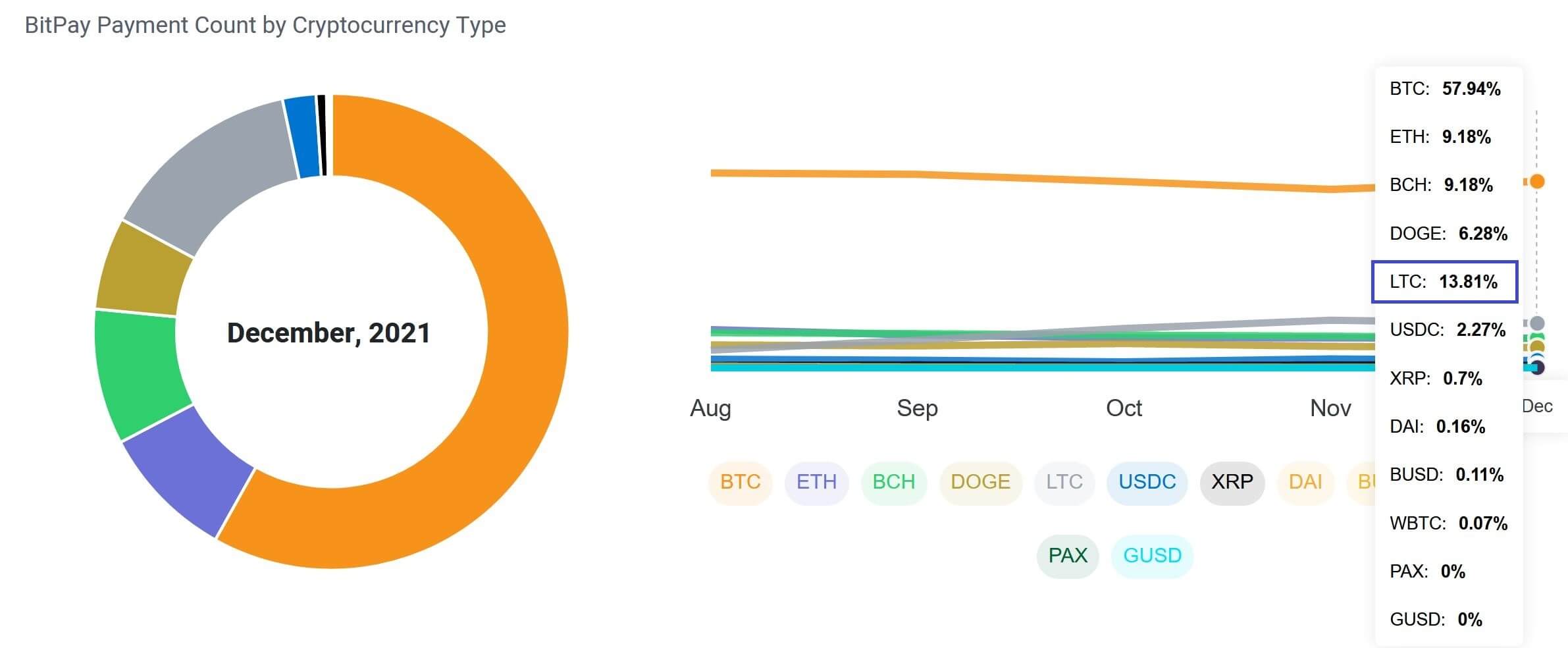

According to Cointelegraph sources, Bitcoin’s share of transactions for interactions with various businesses has fallen from 92 percent to 65 percent in the past two years. Another 15 per cent of the payments sphere is taken up by Etherium. At the same time, altcoins like Litecoin and Dash have increased in popularity when it comes to cryptotransactions.

As a reminder, LTC and DASH are old cryptocurrencies that have been around for many years. As such, their rise in popularity seems amusing - especially given the existence of modern blockchains like Avalanche, Solana and Fantom. However, here it all comes down to the coins that BitPay directly supports.

Share of coins in the total number of transactions through BitPay

Since November, companies have been using stabelcoins more frequently for cross-border transfers. The growing popularity of stabelcoins has partly contributed to the use of altcoins for payments. Dogecoin, for example, rose to fame last year thanks to its prominent fan base along the lines of Tesla CEO Ilon Musk.

And while Bitcoin’s price has risen by around 60 per cent in 2021, most holders of the major cryptocurrency would now prefer to use it as a long-term investment rather than as a payment instrument. This makes sense – Bitcoin is noticeably behind blockchain networks such as Solana or Cardano when it comes to bandwidth and fees.

In other words, transfers in BTC take much longer than with other popular coins. The same goes for commissions, which in the Bitcoin network are much higher than the already mentioned Solana and Avalanche. As a result, we expect the role of the main cryptocurrency directly as a means of payment to diminish in the future. It will be more actively hoarded, while other coins will be more frequently used directly for daily use.

Bitcoin and Etherium

Another interesting news of the week is the auction of a rare diamond called The Enigma from Sotheby’s. The gem weighing 555.55 carats will be available to buy at the auction house for Bitcoin, Etherium, or USDC.

The Enigma

The prerequisite for such a decision was the successful sale of another 101.38-carat diamond last year for the equivalent of $12.3 million. Then an anonymous buyer bought the gem for cryptocurrency. Sotheby’s officials are confident that demand for their lots from wealthy cryptocurrency enthusiasts will only grow, so they see great promise in further promoting digital assets as a means of payment.

We believe that Bitcoin's role as a payment medium without regard to the Lightning Network will indeed diminish in the future. There are still enough different blockchains in the niche right now that allow for instant and cheap payments. It's more convenient for customers because they don't have to wait and spend on fees.

Therefore, in the future, BTC could well turn into full-fledged digital gold, which will only be hoarded. Such a scenario seems quite likely.

What do you think about it? Share your opinion in our millionaires cryptochat. There, we’ll talk about other similar topics that affect the decentralized finance industry in one way or another.