Goldman Sachs experts explain why mass adoption of cryptocurrencies is no guarantee of Bitcoin price growth

The mass adoption of Bitcoin may not be as good for the cryptocurrency itself in terms of its price. That is the view of analysts at banking giant Goldman Sachs. According to their recent research, the rising popularity of BTC in the world does not mean that the digital asset will also be very expensive. We tell you more about the situation.

As a reminder, the theory about the prospect of an asset's price rising as its popularity increases is quite popular. The logic here is this: Bitcoin's rising popularity will increase the number of people interested in it. This, in turn, will lead to an increase in the number of buyers, who, by buying up the asset en masse, will cause the value of the coin to rise.

Confidence in such a scenario is also added by periodic predictions from prominent representatives of the coin industry. For example, in December 2021, the CEO of renowned fund Ark Invest, Katie Wood, said that Bitcoin has the potential to grow to $500,000. To do so, large investors would only need to transfer five percent of their capital into BTC.

However, analysts at Goldman Sachs disagree with that prediction. In their view, mass popularization of the cryptocurrency may not guarantee the growth of its rate.

What will happen to Bitcoin’s exchange rate

The experts’ statement does not coincide with the popular view that the mass use of crypto will have a very favorable effect on the market as a whole. As a result, Goldman Sachs is confident that expectations will not match reality. Here’s a rejoinder from the experts, in which they share their view of the situation.

While Bitcoin may rise in value, its correlation with other financial markets will also be high. In other words, diversifying an investor’s portfolio with Bitcoin will no longer be as profitable.

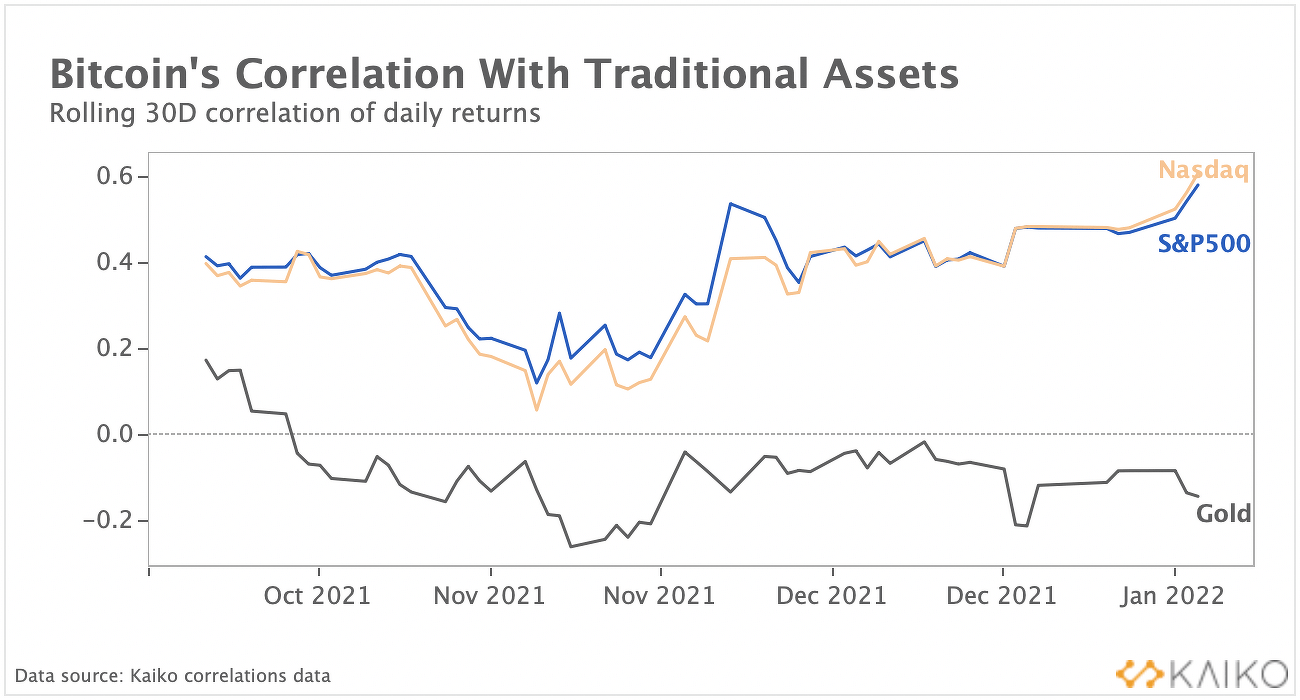

Bitcoin’s level of correlation with traditional assets

According to Cointelegraph sources, study authors Zach Pandl and Isabella Rosenberg describe the mass adoption of the cryptocurrency as a “double-edged sword”. In other words, the more popular Bitcoin becomes, the more its price will coincide with the market dynamics of popular traditional assets – such as stocks. Thus, crypto will lose its “safe investment” status for the duration of the crisis, plus its profitability will drop to a comparable value to the stock markets.

Buying cryptocurrencies

Something similar is already happening now: the correlation between Bitcoin and the main US stock index, the S&P500, has recently multiplied. This can partly explain the cryptocurrency’s prolonged decline since the beginning of the year, which coincided with the US stock market crisis as the US Federal Reserve rolled back its economic stimulus.

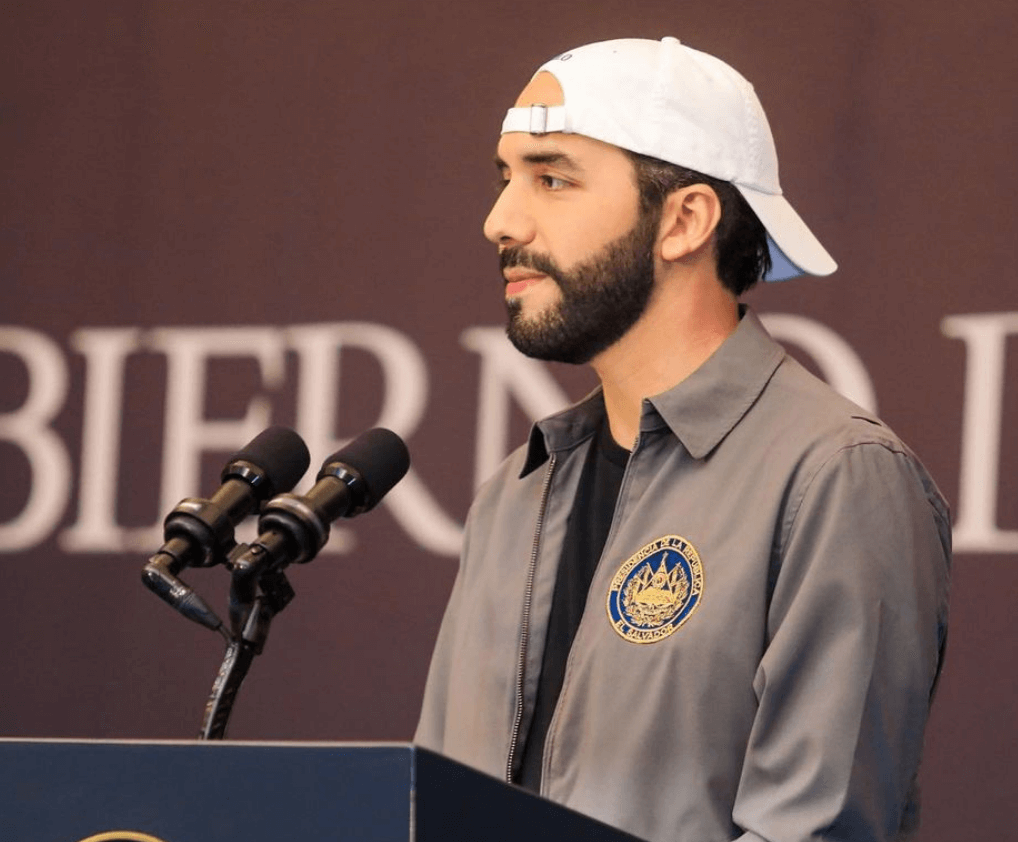

Nevertheless, those wishing to promote the adoption of Bitcoin globally have had their first serious successes in the past year. The major cryptocurrency became official tender in September 2021 in El Salvador, a small Central American nation. And while El Salvador’s President Nayib Buquele has been criticised many times by prominent economists and international organisations for this decision, a significant portion of Salvadorans speak well of Bitcoin.

Here, for example, is a comment from Karen Hernandez, owner of a business selling mobile accessories.

It has been a very, very good experience that has had a positive impact on our sales. Bitcoin has given us the opportunity to reach a new level of business.

El Salvador president Nayib Bukele

And here is a quote from Elizabeth Arevalo, who works in a computer shop.

We help customers a little bit with the use of their cryptocurrency wallet. Once they know how to use it, they buy something from us. It’s a win-win situation.

Unfortunately, from an economic point of view, investing in Bitcoin by the Salvadoran government only brings losses to the country. It’s all about the fall in the value of the cryptocurrency over the last couple of months, with the equivalent of 45-50 percent. And while crypto has brought many positive life changes for some ordinary citizens, on a large scale Bitcoin is still unprofitable for the whole country.

We believe that this prediction may not come true, as previously the surge in crypto's popularity has already led to a significant increase in their value. And it happens every cycle of Bitcoin and other coins without exception. So, there is no reason to assume that crypto will suddenly stop growing.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will discuss other important topics related to the world of decentralized assets.