The OpenSea platform reimbursed its customers almost 2 million dollars in losses. What caused them?

Trading platform OpenSea reimbursed 750 ETH or approximately $1.8 million to users who mistakenly sold their NFTs for much less than their minimum price. To recap, those transactions were due to a bug in OpenSea itself, so the refund was a very logical move by the exchange’s management. However, unique tokens will not return to their former owners because of this in any case. We tell you more about what is happening.

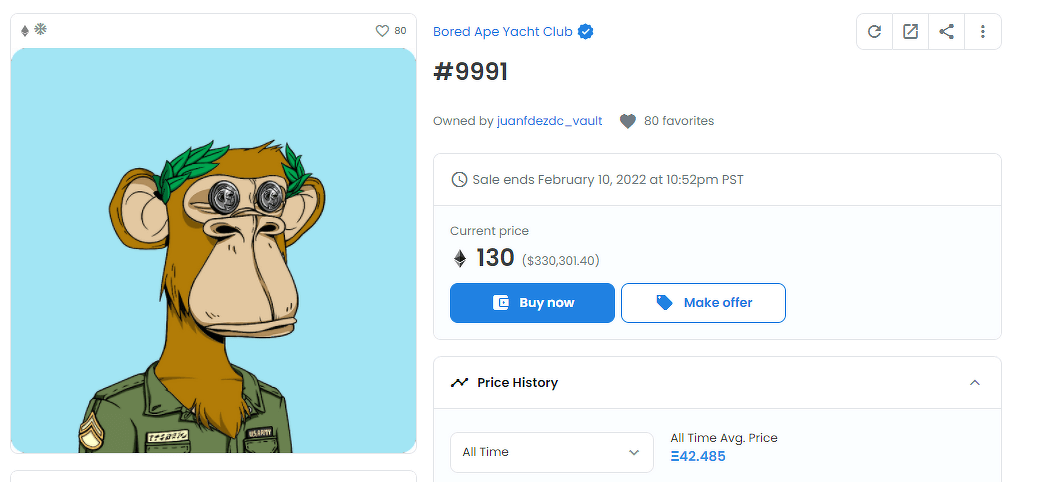

Recently, several OpenSea users have complained that their popular NFTs from haip collections like Bored Ape Yacht Club (BAYC) have been bought at old and lower listed prices. That is, the unique tokens were trivially left “hanging” on the exchange to be sold at the user’s long-cancelled price. However, because of the bug, an anonymous buyer, who thus acquired many NFTs well below their minimum value, was still able to conduct a transaction.

And the situation became quite widespread - and the popularity of NFTs was to blame. As a reminder, representatives of the Nansen analytics platform recognised the unique tokens as a real hit last year. And for several months, interaction with them cost users even more than traders on the decentralised exchange Uniswap. Read more about the situation in a separate article.

Why complain about the OpenSea platform

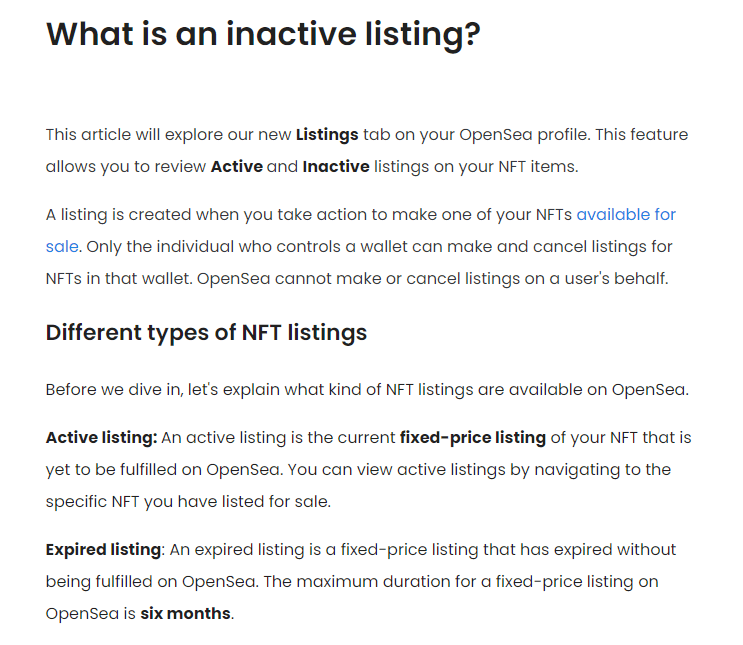

The above-mentioned bug has existed for quite a long time. Basically, it boils down to the fact that to cancel a token listing on OpenSea you need to conduct a separate transaction and, accordingly, pay funds for the transaction. But previously – before OpenSea introduced selectable expiry dates for listings – many NFT holders already had tokens on the platform. For them, a cancellation transaction had to be done manually if the user didn’t want their NFT to be sold. Many of them either forgot or were not aware of this subtlety at all.

One of the tokens from the BAYC series which was sold well below its minimum price

Other users, on the other hand, sought to avoid paying the gas fee, which can often run into hundreds of dollars per transaction, and eventually found a “loophole”. It turns out that if they transferred NFT to a second wallet and then sent the token back to the first wallet, it disappeared in the OpenSea user interface from being available for sale.

But in the blockchain itself – that is, in its smart contracts – NFT could still be bought. It was just that the buyer now had to interact not with the platform, but with its smart contract directly. According to Decrypt, after the scandal surrounding the loss of tokens at such low prices, the OpenSea developers upgraded the platform and all those affected were compensated for their losses.

An article appeared on the OpenSea blog that explains the problem of the platform’s vulnerability

Now OpenSea has sent out a warning to all its users asking them to cancel “any inactive listings of their tokens for sale”. These instructions, however, have only made matters worse. A Twitter user nicknamed dingalings warned his followers that improperly cancelling a token listing on the platform could only make things worse. Here’s his rejoinder, in which a representative of the blockchain community shares details of the state of affairs.

Please move your NFTs to another address first and cancel the listing from the original address before forwarding the NFTs back.

In other words, he has made it clear that token listings can only be definitively cancelled from the address from which they were originally held. Otherwise, the risk of losing the digital asset at the old price will remain.

Buying digital assets

Unfortunately, a cryptocurrency enthusiast under the nickname Swolfchan followed the instructions incorrectly and lost his NFT token from the BAYC series for just 6 ETH or almost $15,000. To recap, the lowest value of BAYC collection representatives exceeded a hundred ether the day before, so now OpenSea will have to “liquidate the consequences” of these misunderstandings as well.

We believe that this situation both proves the popularity of NFT tokens and reminds us of the newness of the industry. Obviously, as these assets become more popular, such misunderstandings will increase. Therefore, the management of the various trading platforms will have to work hard to normalise the situation.

Look for even more interesting things in our millionaires cryptochat. There we will talk about other topics related to the blockchain and decentralisation industry.