The price of Bitcoin has fallen to $35,000. What could be the three main reasons for the collapse?

By the end of this week, the situation in the crypto market had become very tense, with Bitcoin falling to a record low for the past six months. In just a couple of days, the major cryptocurrency has fallen by more than 17 percent. This morning, BTC is trading around $35,570, with the cryptocurrency market as a whole losing more than $500 billion in capitalization. So what caused another collapse? We tell you more about the situation.

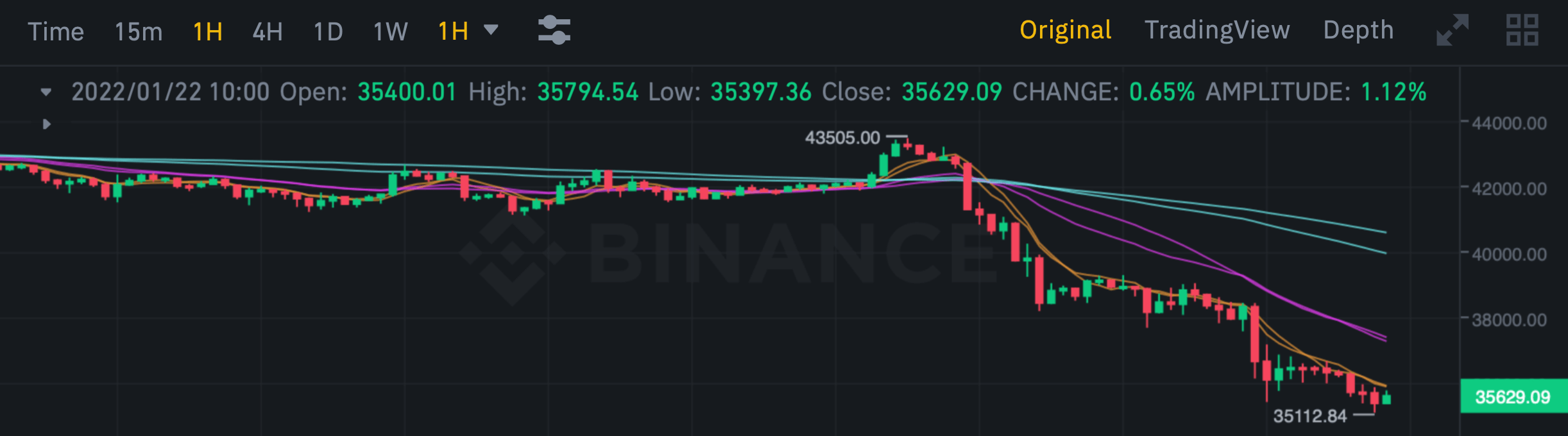

It should be noted that Bitcoin is looking really bad right now. The cryptocurrency fell below $39K, which was considered to be the last serious support level to the $30K mark. Here is the hourly chart of BTC, which shows the serious sagging of the coin.

Bitcoin hourly chart

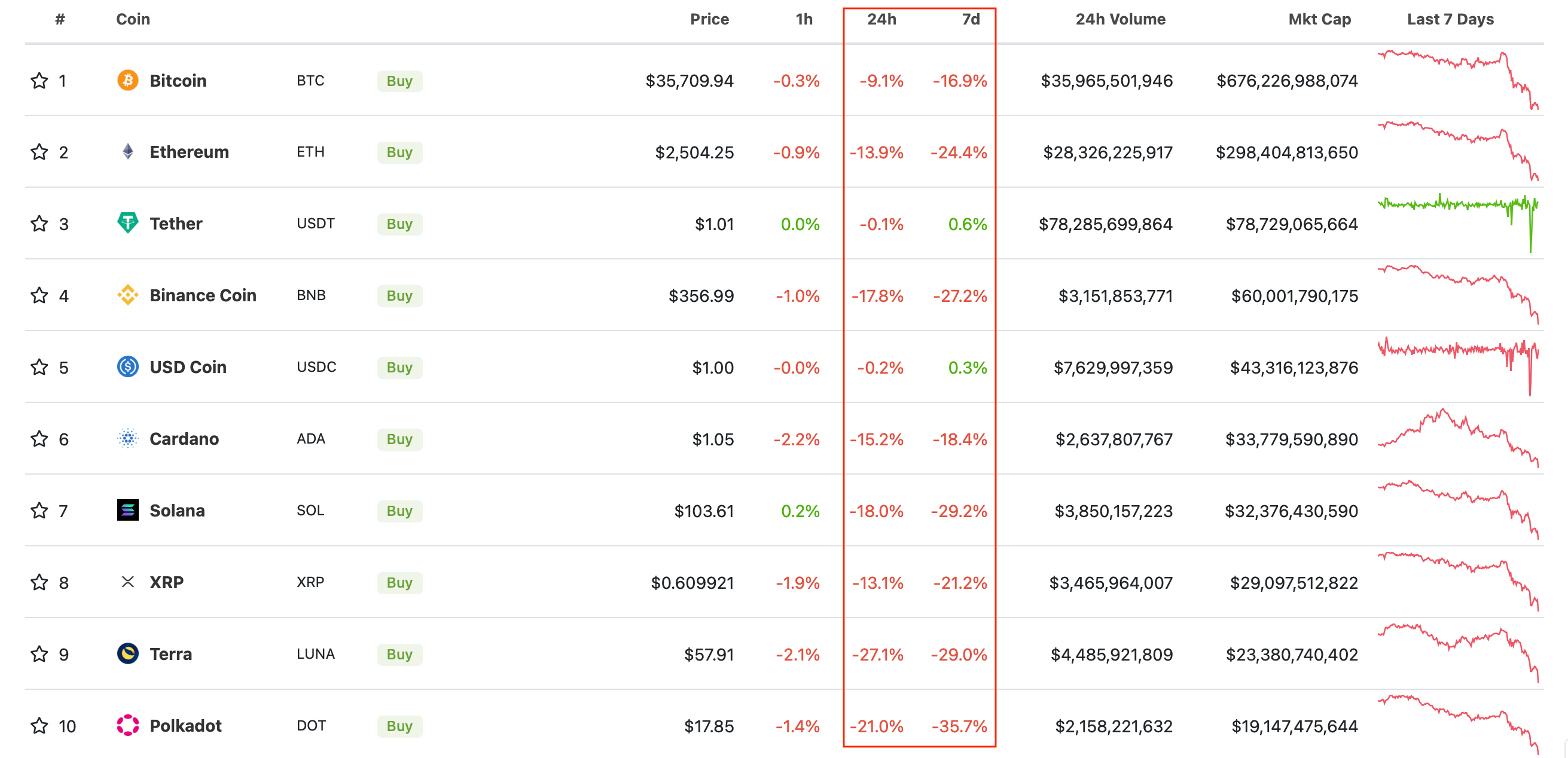

Most of the largest cryptocurrencies by capitalization are also showing serious declines. Specifically, some coins have lost as much as 35 percent of their value during the week and 27 percent during the day.

The largest cryptocurrencies by market capitalisation

Why does Bitcoin continue to fall?

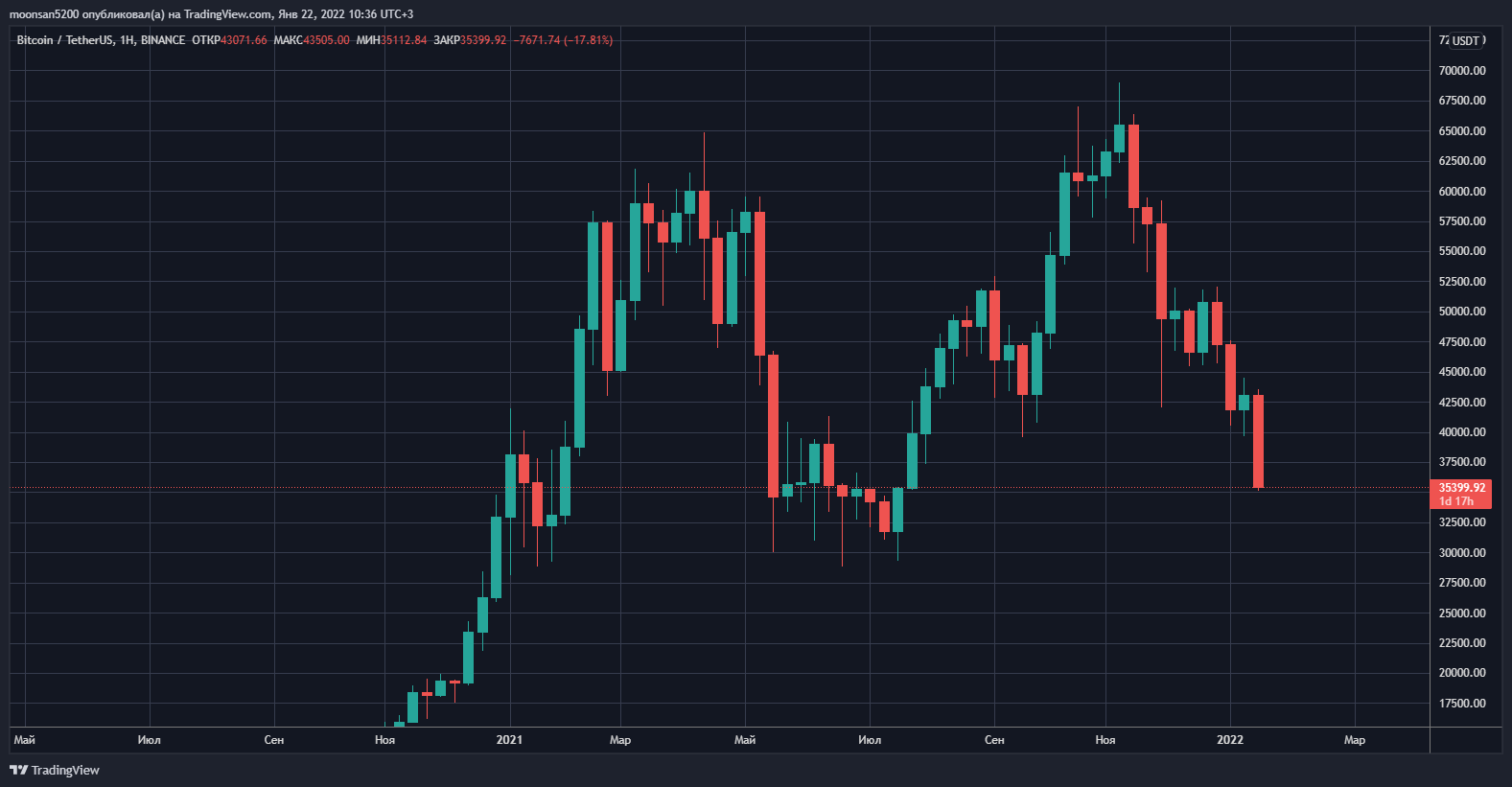

As experts point out, the cryptocurrency market had as many as three sources of negativity this week. First, the collapse is related to the new strategy of the US Federal Reserve, which has said it is ready to roll back stimulus to the US economy due to high inflation. The country’s consumer inflation index has reached record highs, so the Fed will be raising lending rates substantially by the end of 2022.

Consequently, credit will become more expensive and there will be less money in the economy. And that's a good reason for investors to extract their funds from riskier assets, which are cryptocurrencies.

Bitcoin on the scale of a 1-week chart

Such a decision reflects negatively on the cryptocurrency market, which was actively growing just during the emergency measures to support the United States economy. The situation was aptly summarised by Reddit user Juicyjuicejuic. Here is his quote published by Cointelegraph representatives.

Crypto is a great trading tool for the short term, then it quickly turns into a scapegoat for a new economic crisis.

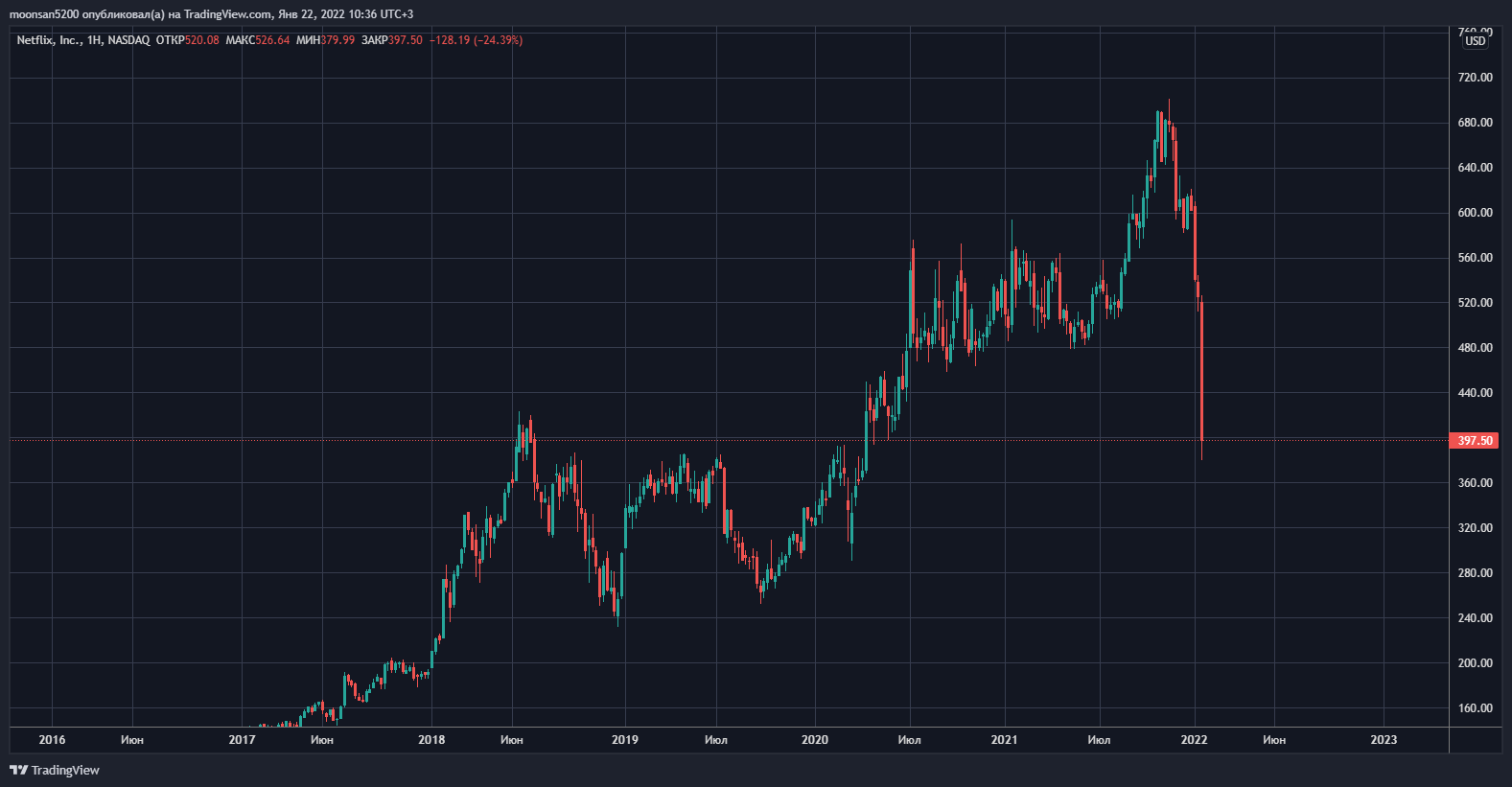

The second reason is directly related to the first, which is Bitcoin’s growing correlation with the US stock market. The US stock market is not having the best of times either, and it is very noticeable. Netflix stock has fallen this month. The faster crypto’s reliance on traditional investment vehicles, the worse Bitcoin will perform during corrections.

Netflix stock on the scale of a 1-week chart

Finally, the third reason is the Bank of Russia’s announcement this week, in which Central Bank officials announced the possibility of a complete ban on mining and cryptocurrency circulation within the country. The ban itself is not yet in place, but even this news is enough to sow panic among both Russian and foreign crypto investors.

Although, as it became known after the publication of the Central Bank's report, the authorities are not going to ban Russian residents from owning coins. This means they will be able to do so with the help of foreign platforms.

The current market correction has been very large, but it does not scare one of the crypto market’s most active supporters, MicroStrategy CEO Michael Saylor. He said in a recent interview that he would not sell his company’s cryptocurrency holdings even in the event of a prolonged bearish trend. As a reminder, MicroStrategy has accumulated 124,391 bitcoins over the past year and a half, with the average purchase price of a coin at $30,159, with some of the coins being purchased with the firm’s debt.

Saylor remains a staunch “bull” – a market participant who expects the Bitcoin price to rise. His beliefs won’t even be hindered by the “crypto-zima”, which is the so-called protracted period of crypto’s decline, which could last for up to several years. Here’s his answer to the question of whether he would sell bitcoins.

Never. No. We are not sellers. We only buy and hold Bitcoin, right? That’s our strategy.

MicroStrategy CEO Michael Saylor

As a reminder, MicroStrategy was the first US public company to officially start buying and holding bitcoins on its balance sheet back in August 2020. Since then, it has accumulated 124,391 BTC, or roughly $5.2 billion in crypto at its current exchange rate.

“Bitcoin could be saved by a radical shift in the asset’s supply/demand ratio. That’s the view held by economist and analyst Lyn Alden. During a debate on the likely causes of the cryptocurrency’s rise on Twitter, she said that further cuts in BTC supply – i.e. storing coins in cold wallets – would lead to a rapid rebound in the cryptocurrency’s price.

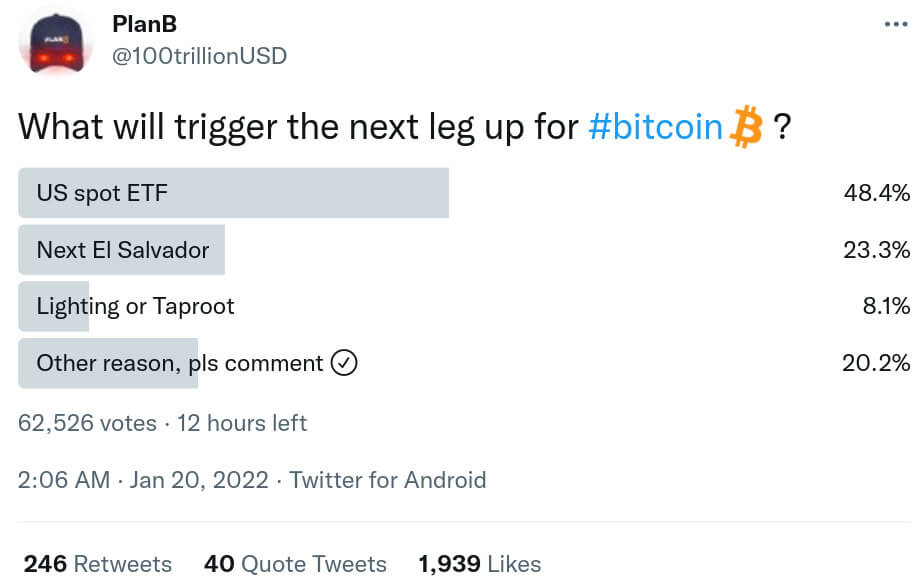

PlanB’s Twitter poll

This commentary was left in response to a poll published by a prominent member of the blockchain community, PlanB. As it turns out, the majority of respondents from its subscribers believe that the main reason for the new wave of acemoon will be the adoption of a spot ETF for Bitcoin in the US.

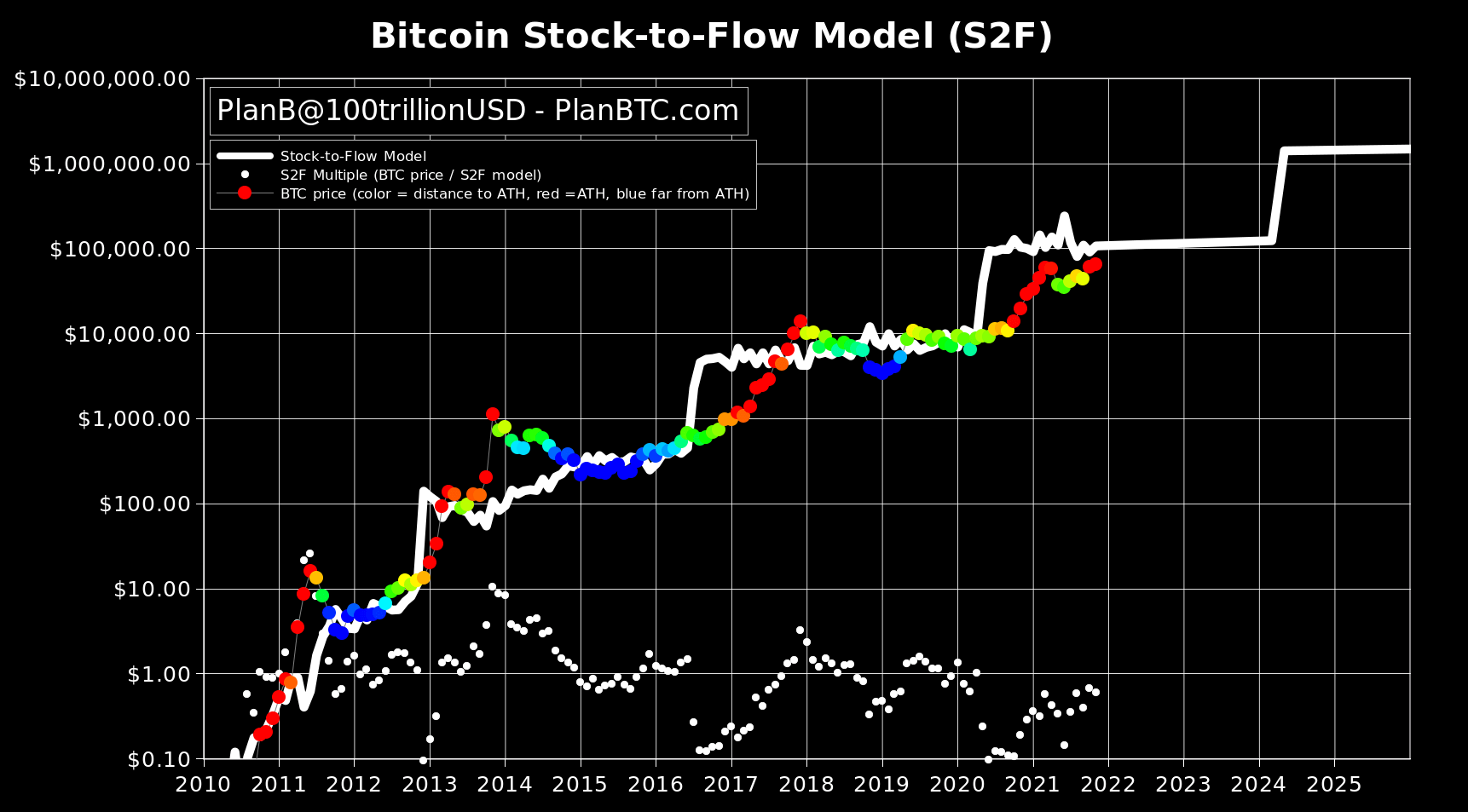

Recall that the host of the Twitter account with the appropriate name actively promoted his model, according to which BTC was to grow to $100,000 as early as December 2021. However, his prediction did not come true, so this character will probably become irrelevant soon.

PlanB’s Bitcoin growth forecast

We think the current situation in the cryptocurrency market looks terrible. Still, cryptocurrencies have lost a significant portion of their price and have seriously spooked investors. However, coins are still able to recover. We want to believe that we will see that soon enough.