Analyst reveals whether a bear market for cryptocurrencies has begun

Cryptoanalyst and Hypersheet founder Willie Wu is confident that Bitcoin is still not in a bearish trend, i.e. in a long-term decline phase. To back up his point, Wu points to the cryptocurrency’s fundamentals and activity in its blockchain. The expert is confident that so far, even the high panic in the market amid the current market collapse cannot be an unambiguous sign that BTC will allegedly only fall further. We tell you more about the analyst’s point of view.

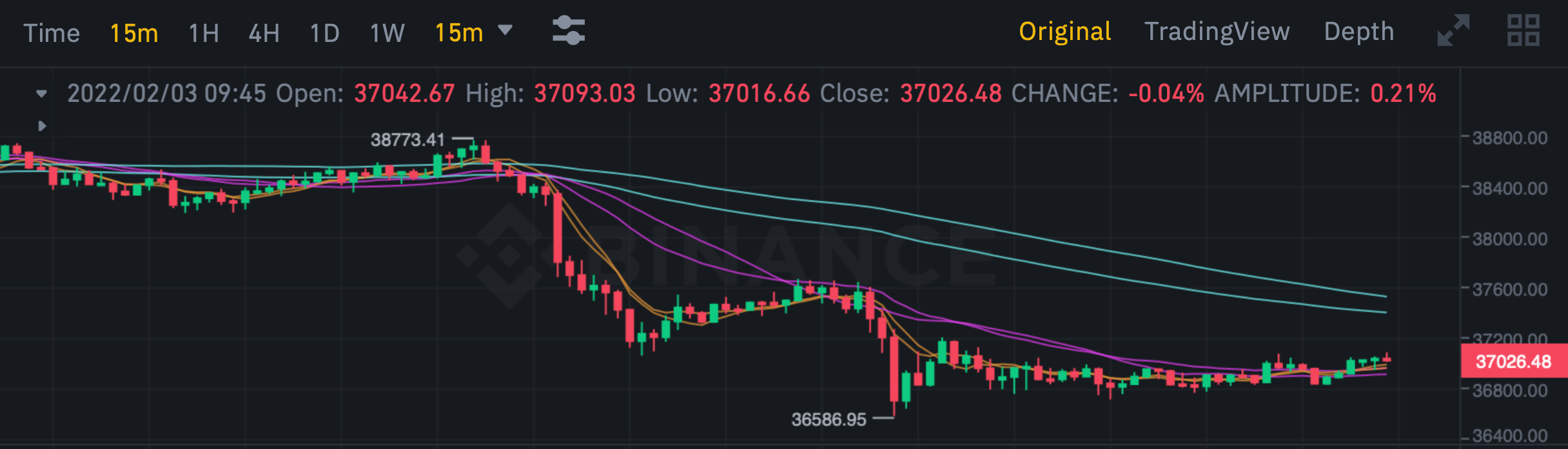

We note that what is happening with Bitcoin right now does not look good. Specifically, the cryptocurrency slumped to a local low of $36,586 tonight. Meanwhile, just yesterday afternoon, the coin was near $39,000.

Bitcoin 15-minute chart

However, experts don’t see anything wrong with what’s happening and are counting on further positivity.

What will happen to Bitcoin in the future?

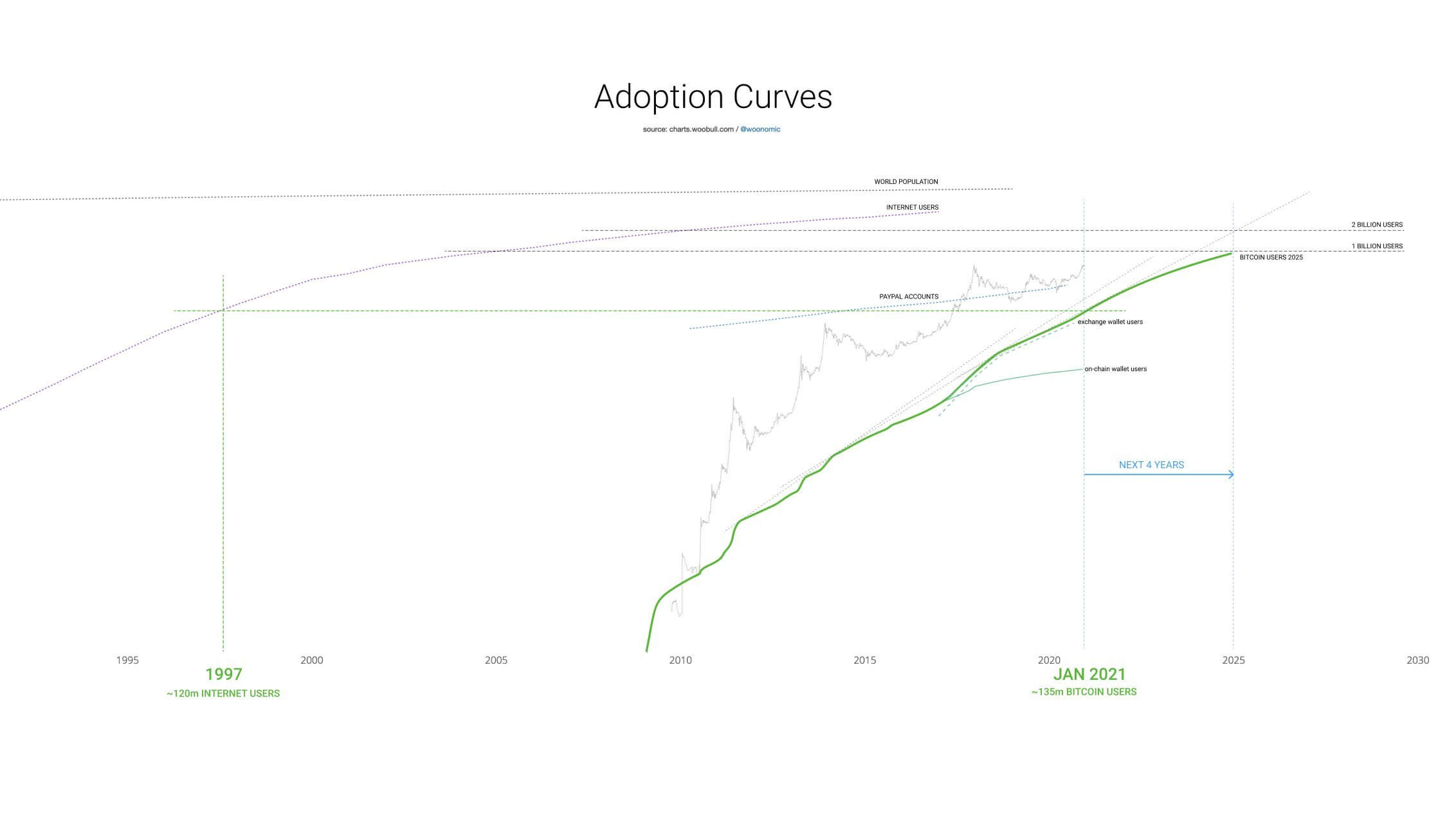

Willie Wu was a guest on a recent edition of the What Bitcoin Did podcast with host Peter McCormack. In his interview, the analyst referred to figures like the number of long-term Bitcoin holders, i.e. cryptocurrency wallets with BTC in their account that haven’t moved in over 5 months, as well as the growing adoption of the cryptocurrency around the world.

Here is his quote in which the expert shared his view of the current situation. The replica was published by the news outlet Cointelegraph.

Structurally, judging by blockchain’s performance, this is not the kind of bear market. Although I would say we are at the peak of fear among traders. There is no doubt that people are really scared, which tends to be seen as a profitable investment opportunity.

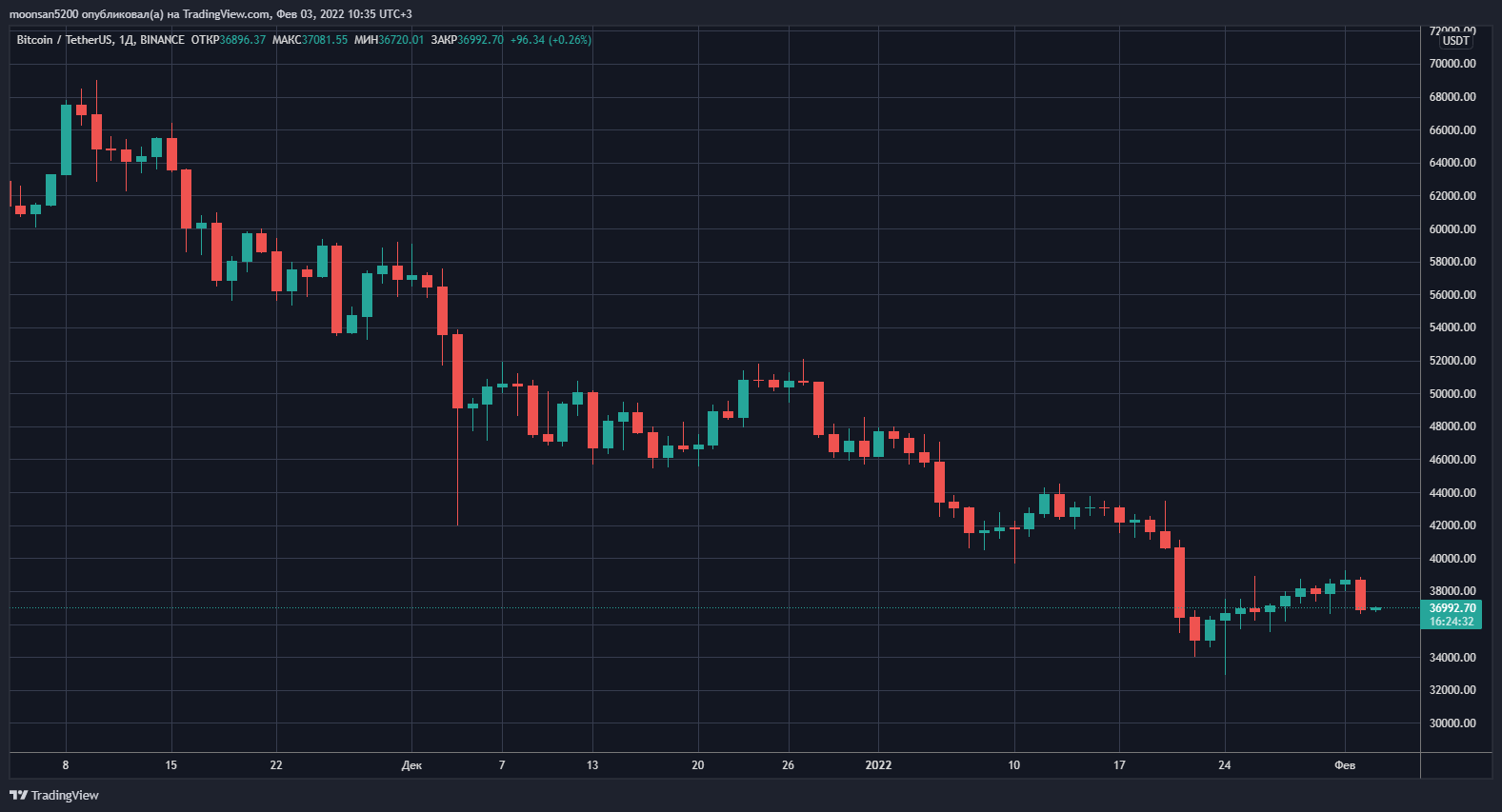

That is, Wu is confident that corrections of this magnitude very rarely end with a continuation of the fall rather than a rebound. He also does not expect BTC to collapse as far as $20,000, as such a decline would be similar to the 2018 "cryptozyme". As a reminder, a correction of a similar magnitude took a full year back then. At the same time, only a few months have passed since Bitcoin reached its all-time high in the fall of 2021, so the likelihood of a rebound remains indeed high.

Bitcoin adoption chart compared to PayPal and the Internet

By today, Bitcoin’s price has fallen nearly 44 per cent from its all-time high of $69,000. According to Wu, the growing influx of individual traders and the rollout of Bitcoin futures markets over the past few years has significantly changed the market structure of the industry. The expert continues.

You know, if you study blockchain activity between 2019 and 2020, you’ll see that investors have mostly accumulated coins, but without significantly affecting their price. The whole point is that at that time, BTC pricing began to be dictated by cryptocurrency futures traders.

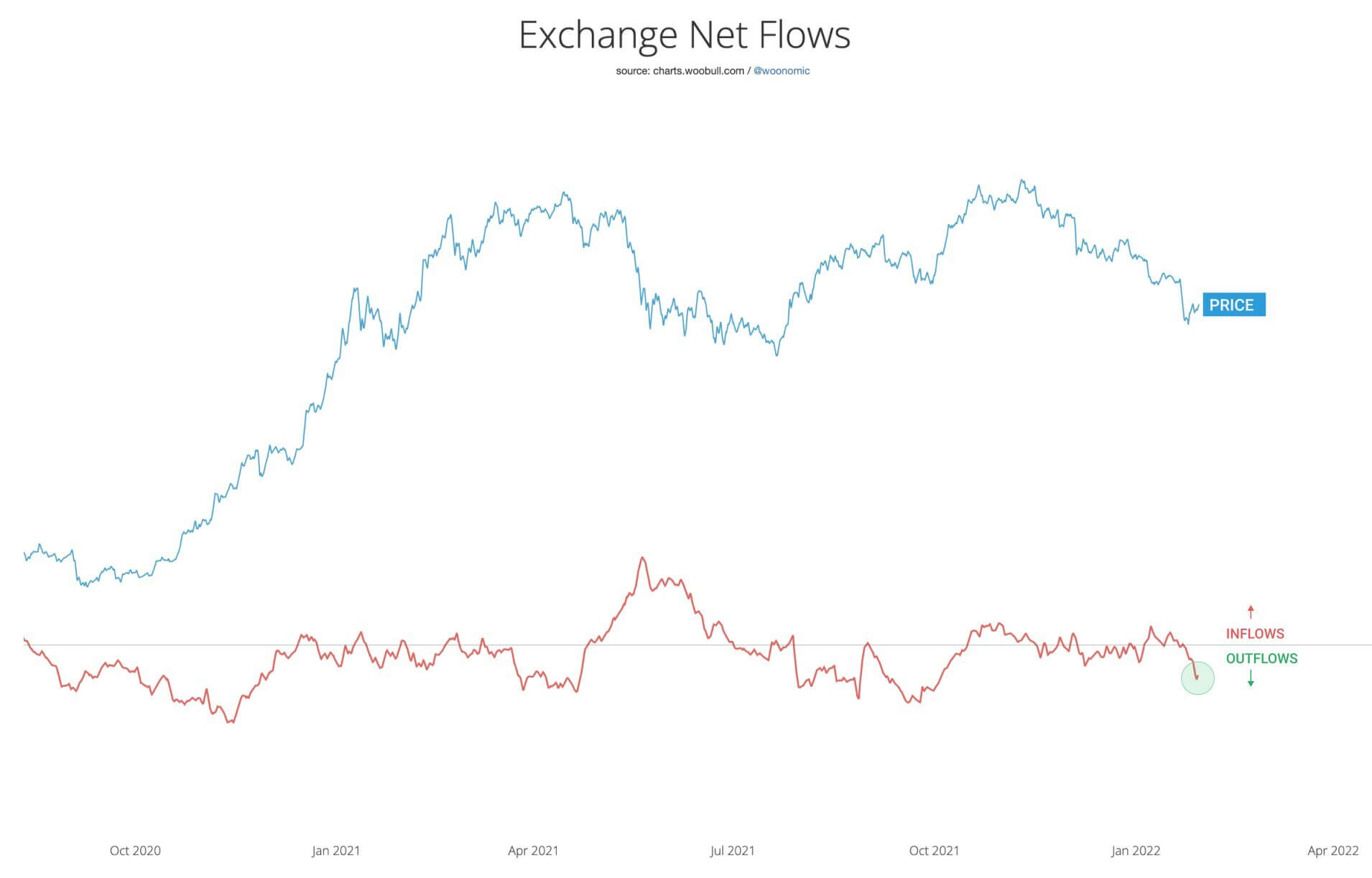

BTC outflows from cryptocurrency exchanges amid cryptocurrency prices

The analyst cited a large number of long-term investors and their stable level of bitcoin accumulation as the main reasons for continued optimism.

Most of the coins have been sitting on cryptocurrency wallets unmoved for more than five months. The people who bought them are not going to part with them at a loss. They are willing to wait for Bitcoin to rise to new all-time highs.

Accordingly, the expert is not counting on a sudden bitcoin plunge to cause a further market crash. In addition, he is confident in the ability of long-term investors to hold their BTC for quite a long time - even at a loss.

Bitcoin’s rise

Wu concluded by noting that a “clear” sign of the start of a bearish trend will be when it is newcomers or those people who have bought bitcoins relatively recently that will be the majority of market players.

In 2018, the bearish trend started at the peak of the number of coins in the hands of newcomers. These guys either sell immediately or sell at the slightest bounce in price, preventing a major new wave of growth from forming.

Bitcoin exchange rate

In the end, the expert's argument boils down to the fact that many cryptocurrency investors have been holding coins for quite some time without taking into account what is happening in the market. Accordingly, they are supposedly willing to wait out more negative market sentiment.

We believe that this view is partially true. However, in the event of a sharp drop in Bitcoin and the coin market in general, investors may still capitulate and sell their savings, thus triggering an even bigger market downturn. Here, the situation is likely to be dictated by global market events, as well as the Federal Reserve's activity. Recall, the main US bank is planning to hold a series of key rate hikes, which may force investors to engage with crypto less actively.

Share your opinion on this in our Millionaire Cryptochat. There, discuss other important topics that affect the world of decentralisation and blockchain.