Has Bitcoin lost its “digital gold” status after its collapse? Expert’s answer

The recent fall in Bitcoin against the backdrop of an escalating global geopolitical situation has led to pessimism from many experts and investors, who are disappointed in the digital gold status of the cryptocurrency. However, not everyone supports their point of view. For example, the day before, CryptoQuant analytics platform CEO Ki Yong Ju made a very interesting statement about what is happening on his Twitter account. We tell you more about the situation.

As a reminder, Bitcoin is often referred to as digital gold, that is, the precious metal of the digital age. The reason for this is the cryptocurrency's characteristics. First of all, its maximum amount is limited to 21 million coins, and it is impossible to go beyond that limit. In addition, every 210 thousand blocks, or roughly every four years, the rate of new bitcoins decreases by half. In other words, new cryptocurrency becomes rarer.

And because BTC can be easily transferred to residents of other countries anywhere in the world, the cryptocurrency is deservedly called the best alternative to precious metal. In addition, it is much easier to store than bullion.

What’s going on with Bitcoin?

According to Ju, the main cryptocurrency will be considered analogous to precious metal at least as long as it is owned by large companies like MicroStrategy. The head of CryptoQuant also said that his platform has not seen serious volumes of blockchain activity, meaning large institutional investors are still holding onto the BTC they have acquired.

MicroStrategy CEO Michael Saylor

So Ju urges us not to panic and keep an eye on the market. Here is one of his quotes in which he shares his analysis of what is happening. The replica was published by the Cointelegraph news publication.

I would wait at least until Michael Saylor [MicroStrategy CEO – editor’s note] sells Bitcoin. We can recognise in advance the start of a major cryptocurrency sale from the network’s activity data. My view is that Bitcoin is still “digital gold” as long as these entities hold BTC on their balance sheet.

Gold and Bitcoin

MicroStrategy is one of the world’s largest public investors in crypto, owning 125,051 BTC to date with $3.78 billion spent. Accordingly, one bitcoin has cost MicroStrategy an average of $30,200.

The company continues to buy bitcoins even though the cryptocurrency has plummeted over the past few months and continues to trade below $40,000. Earlier, MicroStrategy CEO Michael Saylor said that the uncertainty caused by conflicts between states only underscores the benefits of investing in “clean digital energy”.

Cryptocurrencies

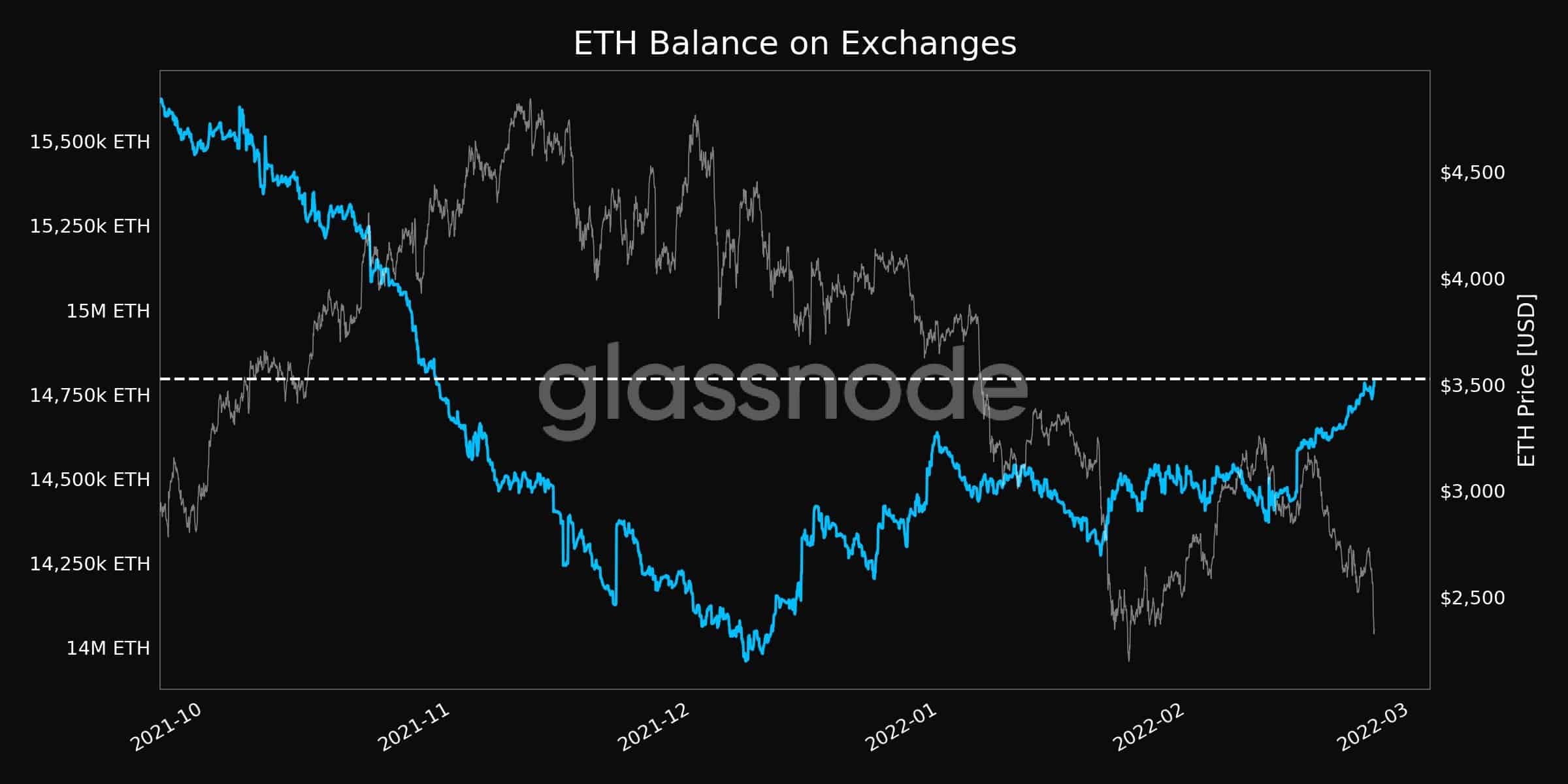

Against the backdrop of the overall market decline, the price of Etherium is also suffering. At the moment it was down to $2,350 after news of the start of the war in Ukraine. Meanwhile, pressure from ETH sellers can only intensify in the near future, with the number of coins on exchanges hitting its highest level in three months. This information was published on the official Twitter account of analytics platform Glassnode.

According to the experts, the volume of this cryptocurrency on the trading floors now stands at 14.79 million ETH. A dramatic shift in the dynamics of this indicator was seen back at the beginning of 2022 and by today, the coins on exchanges are getting more and more every day.

Growth of ETH balance on exchanges

In addition, long leveraged ETH trading positions of over $124 million were liquidated during the day yesterday. This means that seller pressure on the market is still very strong and could prevent any short-term bounce in the price of ETH at this point.

We think the CryptoQuant executive's idea is indeed true. If large companies continue to keep their millions and billions of dollars in Bitcoin, then the cryptocurrency's huge potential is still valid. Accordingly, the coin will also have fewer sellers and more reasons to grow. That said, something suggests that in the event of an even bigger market collapse, the aforementioned giants will only step up their buying.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. Talk about other topics related to blockchain and decentralisation there as well.