How much did Tesla earn from its Bitcoin investment?

Tesla held around $2 billion in Bitcoin by the end of 2021, according to official reports. Initially last year, its CEO, Elon Musk, officially announced the giant’s $1.5 billion purchase of BTC and even began accepting it as payment for electric cars. However, a little later, the ability to pay in bitcoins for cars was abolished due to Musk’s concerns about the negative impact of mining on the environment. We tell you more about the situation.

Recall that Elon Musk has been actively supporting Bitcoin in early 2021. Last winter, he also put the hashtag Bitcoin in his Twitter profile description, which attracted a lot of attention to the cryptocurrency due to the abundance of his followers.

Bitcoin in Ilon Musk’s profile description

Over time, however, the entrepreneur’s attitude towards the first cryptocurrency deteriorated due to the negative impact of BTC mining on the environment. As a result, Musk moved on to promote Dogecoin, which at the same time has not been working much lately.

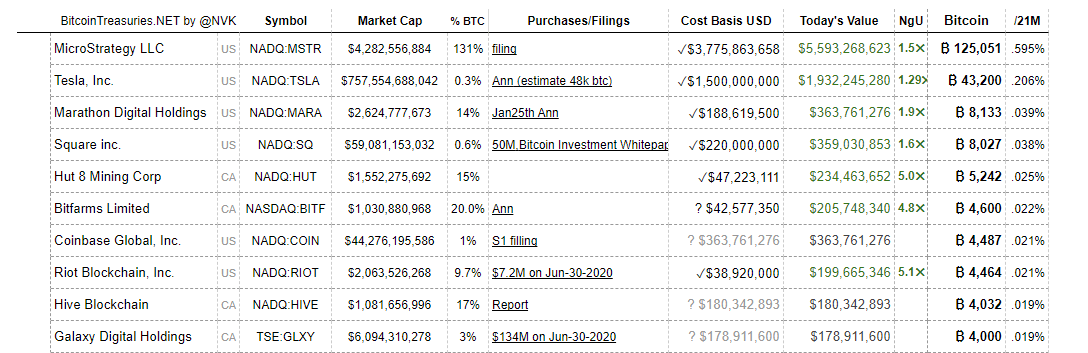

How many bitcoins does Tesla have

According to the Bitcoin Treasuries portal, the electric car maker now has 43,200 BTC on its balance sheet, which at today's exchange rate is the equivalent of $1.898 billion. This puts it in second place in the ranking of the largest institutional BTC holders after MicroStrategy. That said, $1.5 billion was originally invested in crypto. Which means Tesla is in the plus side of the investment anyway.

The so-called “fair market value” of BTC on Tesla’s balance sheet on December 31, 2021 was $1.99 billion, which means it earned the equivalent of $490 million not including the coins sold in April.

According to Cointelegraph’s sources, this is official information from the company’s filing with the U.S. Securities and Exchange Commission (SEC). In addition, according to this document, Tesla sold some bitcoins in March 2021, receiving $128 million for the transaction. In total, it could be argued that the company is now in the black on this investment by about half a billion dollars.

As a reminder, this decision was previously known. Elon Musk announced the sale of the company's 10 per cent Bitcoin savings at the end of April 2021. As Ilon noted at the time, in this way the management of the manufacturer wanted to test the liquidity of BTC as an asset. Simply put, company officials wanted to make sure the cryptocurrency market could handle the sale of a relatively large batch of coins. And since Tesla hasn't had any more sales episodes, the digital asset clearly passed the test set.

Tesla CEO Ilon Musk

Furthermore, according to the report, Tesla recorded a bitcoin impairment loss of $101 million in 2021. Here is a relevant quote about the situation.

Gains are presented net of impairment losses on restructuring and other in the consolidated income statement. As of 31 December 2021, the carrying value of our digital assets was USD 1.26 billion, reflecting a cumulative impairment of USD 101 million.

The reason for this was the drop in the value of the major cryptocurrency. As a reminder, its historical high is exactly $69,000, and it was recorded in the first half of November. Since then, Bitcoin has been in a state of decline, which has been going in stages. However, the coin is now showing signs of turning around. At least today, BTC reached the $45,000 mark, which hasn't happened for quite a while. Here is the daily chart of the cryptocurrency.

Bitcoin’s daily rate chart

As the authors of the Documenting Bitcoin Twitter account rightly pointed out, Ilon Musk’s initiative to buy the crypto ended up being a win-win for the company as a whole. And even in spite of the current sagging coin market.

Had Tesla management left the funds in dollars, their actual value would have fallen to around $1.3 billion by the end of the year due to currency depreciation and rising prices, i.e. inflation. Accordingly, in this case, the company not only made a profit but also had no loss.

Tesla bought $1.5 billion worth of #bitcoin last year and it is now worth $1.9 billion.

If Tesla had kept the $1.5 billion in cash, it would now be worth $1.3 billion.

Smart move, @elonmusk.

– Documenting Bitcoin 📄 (@DocumentingBTC) February 7, 2022

As we’ve already noted, Tesla ranks second among public companies with bitcoins on their balance sheet. Here’s the corresponding ranking.

Top 10 institutional Bitcoin holders

The giant, with Michael Saylor at the helm, has 125,051 BTC on its balance sheet, with a total of $3.78 billion spent on the coins. MicroStrategy last bought the cryptocurrency on the first of February. At that time, Michael reported buying 660 BTC worth $25 million in cash. At the same time, the average value of each bitcoin was $37,865.

At the same time, the average purchase price of each of the 125,051 BTC is $30,200.

MicroStrategy CEO Michael Saylor

We think the actions of Tesla's executives say far more than Elon Musk's criticism of Bitcoin on Twitter in the spring of 2021. Apparently, the manufacturer's analysts believe in the cryptocurrency's great potential and its future development. In addition, they clearly plan to wait for a more impressive BTC price to sell. Still, the peak of $64,000 per BTC in April and $69,000 in November were not enough for that.