Pantera Capital experts believe Bitcoin could rise in value by mid-Spring. Why?

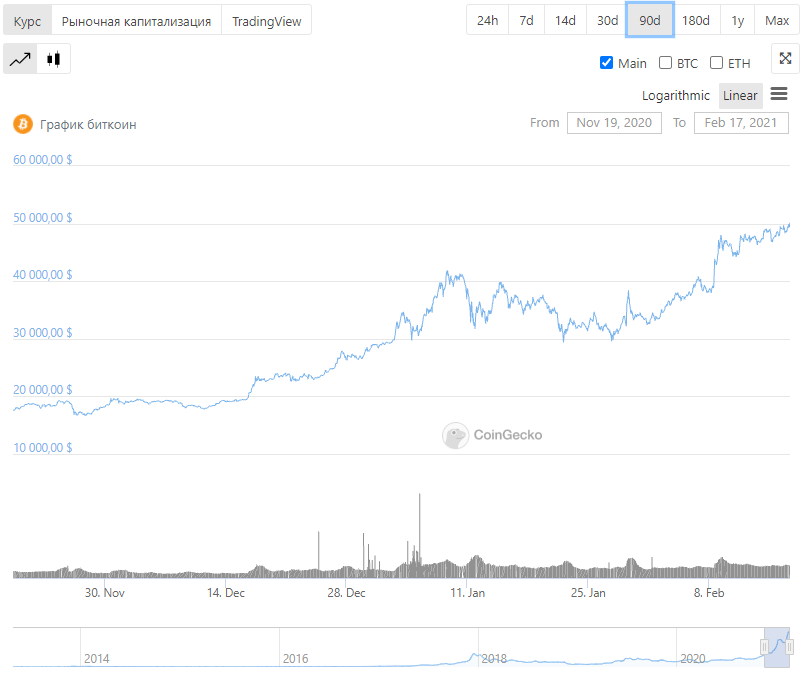

The price of Bitcoin has been falling steadily over the past few months, with the cryptocurrency itself still failing to consolidate above the $40,000 line. According to Pantera Capital analysts, the downtrend will not last long, and the turning point on the chart in this case will be the so-called “tax day”. Moreover, experts expect the prospect of increased independence of the price dynamics of the crypto market from traditional markets. We tell you more about what is happening.

As a reminder, this is not the first time Pantera Capital experts are predicting the further success of cryptocurrencies. For example, back in the middle of the month they called digital assets the best investment for this year. You can read more about this point of view in a separate article.

What will happen to Bitcoin exchange rate

According to CryptoPotato’s sources, many analysts predicted that by the end of 2021 Bitcoin’s value will exceed the $100,000 bar. However, the outcome of the year was just the opposite – the coin quickly fell in value below $50,000. More recently, the war between Russia and Ukraine has been a strong negative factor, which has also led to a marked drop in stock markets.

In a study titled "The Next Mega Deal", analysts at Pantera Capital give their reasons why Bitcoin's rapid bull run could continue as soon as possible. One of the main prerequisites for this is "tax day" in the US, which this year is set for April 18. As a reminder, tax day is the deadline for filing individual income tax returns with the federal government.

Bitcoin price over the past 14 days

Experts note that in 2013, 2017, 2020 and 2021, the price of Bitcoin has risen significantly for about 35 days before the event. However, on the day itself, the cryptocurrency would go into local decline as investors got rid of some of their digital assets to pay taxes. Here’s a rejoinder from the experts, in which they share their views on what’s happening.

It makes a certain amount of sense. Many crypto traders are new to investing. You can imagine a person who buys as many bitcoins as he can. Since he is “all in” on cryptocurrency, the only way to get cash to pay his tax bill is to sell the cryptocurrency. Therefore, the price of the coin falls in the run-up to tax day.

Pantera Capital also touted the Fed’s policy during the COVID-19 pandemic. The company called the massive printing of fiat currencies, Treasury bond manipulation and bond bail-ins a “clearly wrong” combination. It also blamed the US central bank for rising inflation and economic disruption within the US. According to experts, there is a bubble in traditional finance that will burst, after which the Fed will be forced to raise interest rates even higher. Here’s a cue.

There is a very strong belief that the markets are really wrong, and that the interest rate hike that has been pretty obvious is actually not that bad for cryptocurrencies. And compared to other asset classes, it’s really very good for crypto.

In addition to Pantera Capital experts, U.S. Senator from Texas Ted Cruz is also optimistic about the future of Bitcoin. The day before, he said that the cryptocurrency represents freedom and decentralisation. And because no government agency can control the blockchain, Bitcoin has been outlawed in China.

Texas Senator Ted Cruz

Recall that earlier this month, thousands of Canadians protested against government-imposed pandemic restrictions. As a result of the unrest, authorities demanded that financial institutions freeze bank accounts and asked cryptocurrency exchanges to do the same – limiting the flow of funds from cryptocurrency wallets funding the protesters.

To prove that Bitcoin is different from other monetary assets, Cruz cited a letter sent by cryptocurrency company Nunchuk to Canada’s Superior Court.

Our software is free. We don’t collect any identification or user information other than email addresses. Therefore, we cannot freeze our users’ accounts. We cannot prevent them from moving.

The popularity of cryptocurrencies

We believe that sooner or later, the digital asset industry will really grow - especially when markets stop collapsing in the face of what's happening in the world. Right now, digital assets have a strong infrastructure, and decentralised platforms themselves have enough to keep users interested, even during a negative exchange rate environment. Therefore, there is also a chance that this time the bear market cycle will not be as prolonged as in 2018-2019.

Bitcoin is one of the foundations of every citizen’s freedom and financial independence. And this fundamental factor alone is enough for the price of the cryptocurrency to rise in the long term. What do you think about it? Share your opinion in our Millionaire Crypto Chat.