A cryptocurrency company has started buying up hundreds of millions of dollars worth of bitcoins. How many coins does it have?

MicroStrategy may soon have a major competitor in terms of bitcoin acquisitions. The company in question is Terraform Labs. Recall that its CEO Do Kwon previously announced a long process of regular cryptocurrency purchases for its reserves, which will be backed by Terra’s UST Stablecoin. Based on information from blockchain observers, the company’s cryptocurrency wallet has already accumulated at least $1.5 billion worth of coins. Here’s a closer look at what’s happening.

Note that it's even possible to get bitcoins today with a 3GB video card. Purely technically it will be mining Ethereum Classic with further automatic conversion of cryptocurrency to Bitcoin, but from the outside it will look exactly like mining BTC on a video card. Read more about the process, settings and other details in our new guide.

Who Buys Bitcoins

According to preliminary information, the aforementioned Bitcoin address belongs to Luna Foundation Guard (LFG), a company associated with the project. As of today, it has accumulated 30727.97959166 BTC worth $1.5 billion.

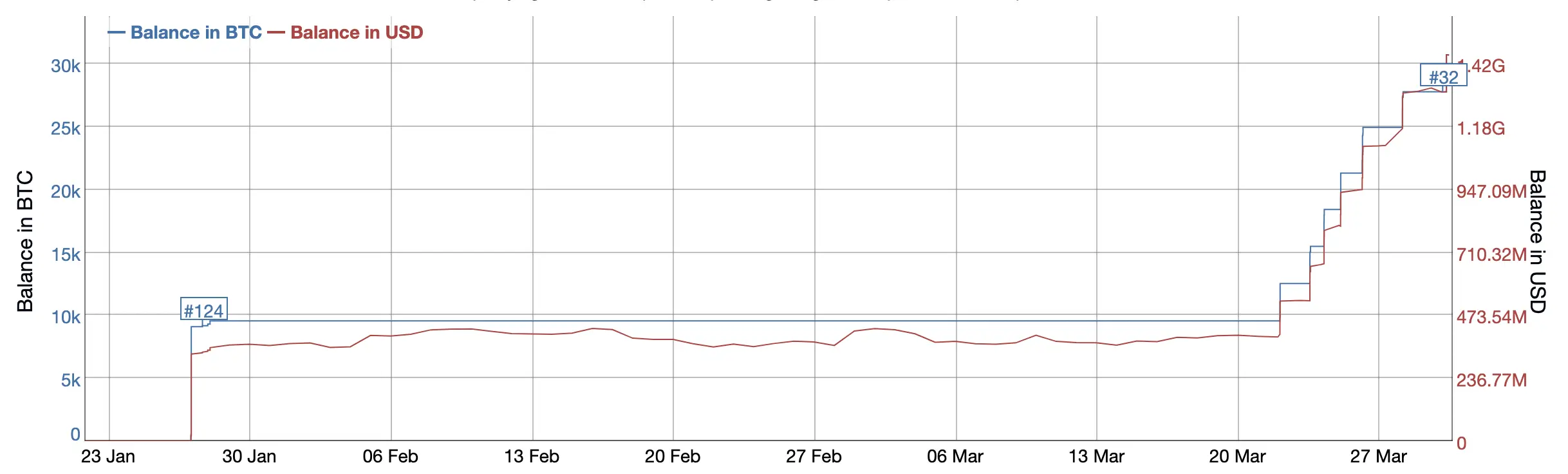

The balance of the Bitcoin address, which is owned by Terra

This Wednesday alone saw another coin inflow of $139 million. Judging by the bitcoin growth chart, the company regularly acquires bitcoins in almost equal amounts.

It's worth showing the rate of coin purchases for clarity. Only at the beginning of last week there were 9.56 thousand bitcoins in the address. Since then, the company representatives have made seven major coin purchases, more than tripling the amount saved.

Progress of bitcoin accumulation

The accumulation process started on January 21, 2022 with a large purchase of 10 thousand BTC. As you can see in the chart above, the company has not sold a single coin yet. That said, it’s unlikely that sales will be recorded in the foreseeable future – bitcoins from the wallet will become the stackablecoin reserve, so it’s critical for Terraform Labs to maintain its volume.

Read also: US treasury secretary recognises the utility of cryptocurrencies for financial innovation. Why it matters.

As noted by reporters at news outlet Cointelegraph, the first round of purchases was followed by a rather long pause, and the accumulation has already continued since March 22. This coincided with Do Kwon’s own statement on Twitter. Recall, according to experts, it was one of the main reasons for the rapid rise in the price of Bitcoin over the past few days.

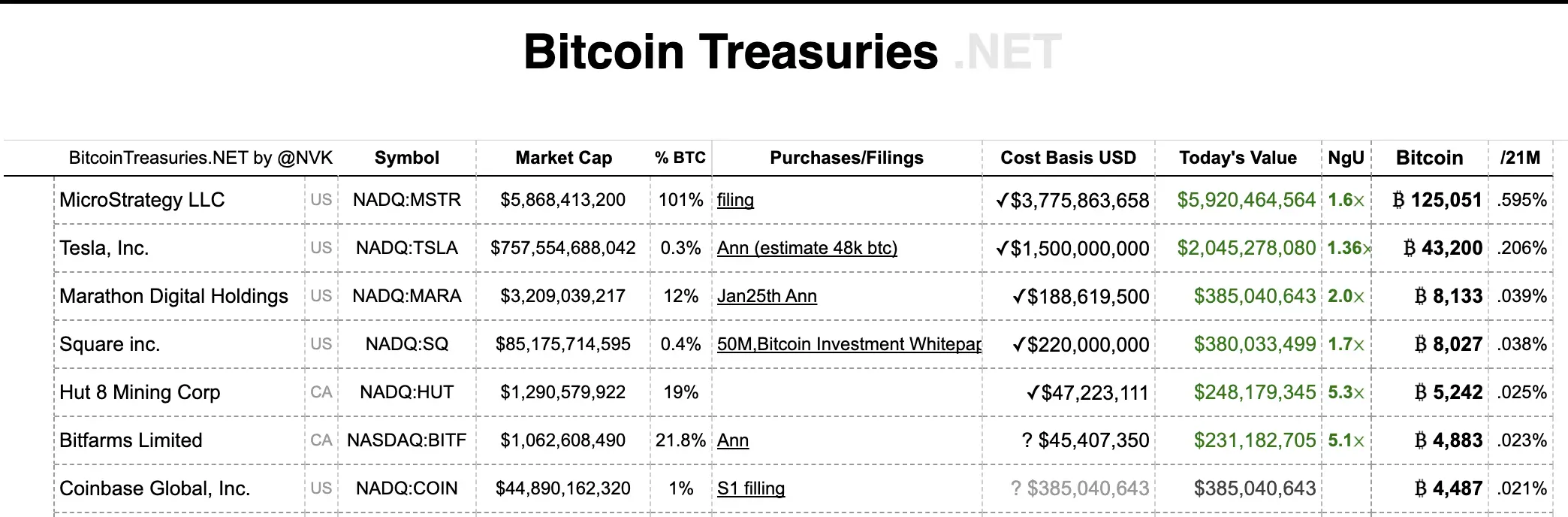

Top public companies by number of bitcoins accumulated

Considering the latest deal, the amount of bitcoins in Terra's possession among public companies is second only to MicroStrategy and Tesla. By the way, MicroStrategy may soon increase its bitcoin holdings. As it became known the day before, its subsidiary called MacroStrategy got a $205 million loan from Silvergate Bank. The funds raised will be spent just to acquire BTC.

At the same time $10 billion may only be a small part of the company’s long-term ambitions. Do Kwon himself later noted that LFG aims to approach and even compete with anonymous Bitcoin creator Satoshi Nakamoto in terms of the number of BTCs in its wallet.

Cryptocurrencies are of huge interest not only to individual companies but also to entire countries. The day before, Kyrgyz MP Karim Khanjeza called for the legalisation of cryptocurrencies in the country during a meeting of the parliamentary committee on law, order and anti-corruption. During his speech, Khanjeza spoke in favour of developing a legal framework for the cryptocurrency market and suggested amending existing draft laws to include virtual assets.

He added that the country was well placed to take advantage of the growing popularity of cryptocurrencies and suggested launching its own national digital currency. He said the government should focus on developing a sovereign national digital currency, which would be under the control of the Central Bank.

Kyrgyz MP Karim Khanjeza

Khanjeza also spoke in favour of hiring highly qualified specialists in the field of blockchain. Recall that this strategy is being followed by the United Arab Emirates to become a regional hub for local crypto start-ups. Kyrgyzstan has positioned itself as one of the cryptocurrency-friendly states with significant progress in regulating the industry. Here, Bitcoin is considered a commodity, and its mining and transactions are allowed under local laws. In addition, in August 2021, the government introduced a national cryptocurrency regulatory mechanism for exchanges, giving them legal status in the country.

We believe that such aggressive high value bitcoin purchases by a company that is also doing it publicly is bound to have a positive impact on the reputation of the cryptocurrency niche. Still, many people are still afraid of digital assets because of their volatility, i.e. sharp price changes. Here, however, the company is willing to put more than a billion dollars on the line because it has no doubts about the future of crypto. Apparently, its example will eventually be followed by other giants with millions of dollars in free assets.

Want to stay up to date on Bitcoin news? Join our millionaire cryptochat. There we will discuss other important developments.