A seasoned cryptocurrency enthusiast lost $10,000 in Bitcoin to a virus. But how?

Cybercriminals are one of the main dangers for cryptocurrency enthusiasts. The day before, American technoblogger and digital asset enthusiast Louis Nel shared the story of a friend of his. The latter lost the equivalent of $10,000 in bitcoins due to malware that got on his computer. We tell you more about the situation.

How to lose money in Bitcoin

Nel shared the story on his Twitter account. Here’s his first post, in which the popular blogger shares details of what happened.

A friend sent 0.255 BTC from his Bitcoin wallet to an exchange. He copied and pasted the wallet address on his computer. Four hours later, he got worried when the funds didn’t arrive at the exchange. It turned out that malware on his computer had intercepted data from the clipboard and substituted the fraudsters’ address instead of the address he needed.

In other words, the user essentially shared their coins with fraudsters on their own, even though they didn't know it. This vulnerability is known as the blind signature problem. It is about signing a transaction on an internet-enabled device, so that the content on its screen can be compromised. That is, the malware shows the desired address in the recipient's address field, but actually sends the cryptocurrency to a completely different wallet. This is a known bug that theoretically threatens all devices - be they smartphones, computers or tablets.

Hardware wallets can be used to insure against such a situation. In the case of already familiar Ledger Nano S, the display of the device is not connected to the Internet, and displays the data that will actually be used during the transaction. Accordingly, the user sees exactly the address with which the interaction will take place.

According to Cointelegraph’s sources, the victim sent coins from the Kraken exchange to South African cryptocurrency exchange VALR. Representatives of the latter confirmed that the bitcoins had indeed not reached any of the trading platform’s addresses. Accordingly, they went to malware developers.

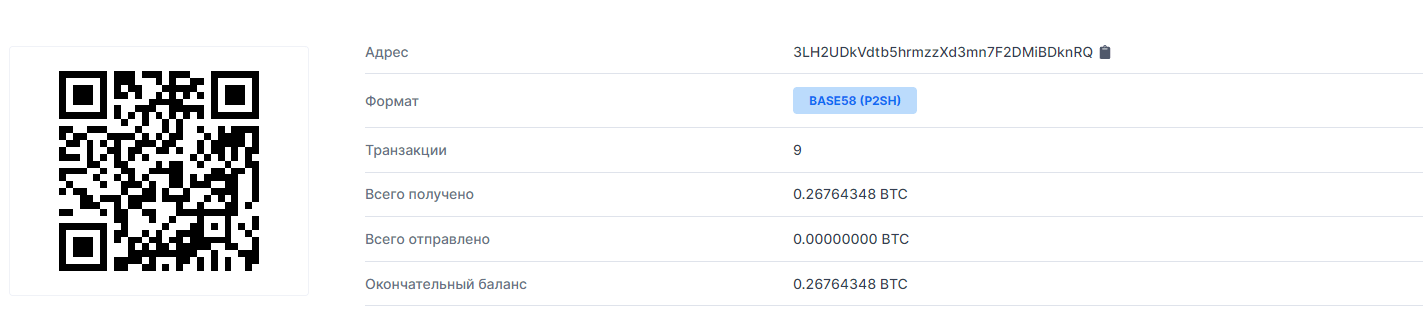

The scammer’s address currently has almost 0.27 BTC in its account, with no coins yet moved.

Fraud address

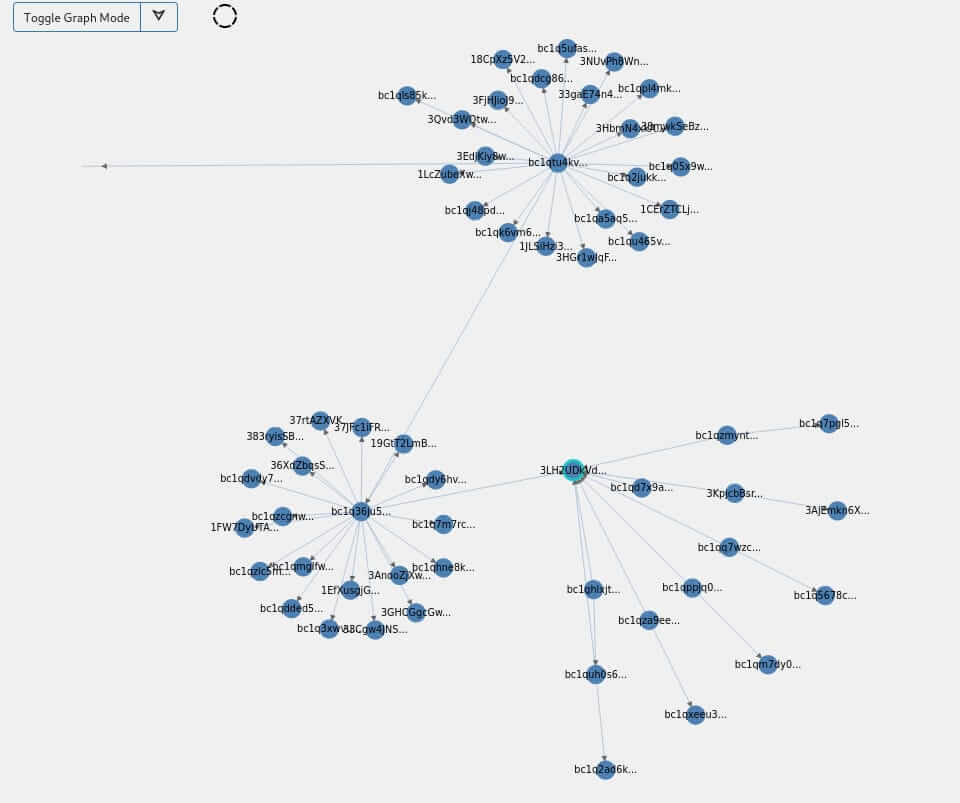

Below you can see a graph of associated wallets.

Count of associated wallets

It would seem that such a simple fraud scheme should only be a problem for beginners. However, the victim of this scam has been active in crypto since 2018 – but even he was “caught” by such an elementary ploy. This incident reminds us once again that in the cryptosphere, one should be very careful about any transactions with digital assets. As well as monitoring the software being installed.

Transactions on the Bitcoin network and other coins are irreversible or “immutable”. This means that once funds have left the wallet, no party can send money back. And while this is one of the virtues of blockchain and decentralised assets in general, it causes problems in situations like this. There is no way for the former owner of the cryptocurrency to get hold of it now.

The only way to remedy this is for the fraudsters to put the coins on an exchange whose management will not only be aware of the situation, but will also keep an eye on the funds being moved. In that case, freezing digital assets is a real possibility – and it has happened before.

This kind of loss of digital assets is extremely painful. Especially considering the fact that many companies are going after BTC and hope to accumulate huge amounts of the first cryptocurrency. These plans were shared the day before by Do Kwon, co-founder of Terraform Labs and the Terra project, which is being positioned as a competitor to Etherium.

Terra itself is a decentralized blockchain platform that specializes in issuing stabelcoin. It is an algorithmic stack called Terra USD (UST), the value of which is backed by the platform's native token under the ticker Luna.

According to Do Kwon, the project hopes to accumulate the equivalent of $10 billion in bitcoins. These will be used as reserves for the project. He believes that this will be the beginning of a “new monetary era of Bitcoin standard”.

The developer explained this decision quite simply. In this case, he said, Bitcoin would be seen as “electronic P2P cash, which is easier to spend, but also more attractive to hold”, that is, to hold for the long term.

Cointelegraph representatives asked Kwon if the statement should simply be seen as an idea. The answer was unequivocal.

I don’t understand the difference. But we are already buying Bitcoin.

Cryptocurrency buyers.

We believe that dealing with substantial amounts of cryptocurrencies does require a hardware wallet that guarantees the veracity of the data displayed when signing transactions. If you don't have one, it's a good idea to at least test transactions by sending small amounts of coins first. If that happens, it will limit your losses and keep most of your savings.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THERE’S EVEN MORE INTERESTING NEWS HERE.