Analysts reveal which regions’ investors are most actively selling cryptocurrencies

Bitcoin and other cryptocurrencies have been behaving ambiguously over the past few days. In particular, BTC showed a number of sharp upward spikes the day before, which ended in equally sharp drops. From this we can conclude that some investors are taking advantage of the exchange rate situation and getting rid of their coins. Where this tendency is the most evident? We tell you.

Let’s note that Bitcoin’s jumps are indeed noticeable. To illustrate, here’s an hourly chart of BTC’s value, where you can see both the stages of the crypto-asset’s rise in value and its dips. We’ve noted the downside moments, which proved to be quite noticeable.

Bitcoin hourly chart

Despite this, the cryptocurrency is looking good today. BTC hit a local high of $43,461 and has tentatively consolidated above $42,000. On the weekly chart, it looks like the coin is once again preparing for a long run.

Bitcoin weekly chart

Be that as it may, so far the situation in the industry doesn’t seem clear. At the very least, there are enough investors in the niche who are keen to sell off their own coins.

Who is buying and selling bitcoins

As Glassnode analysts point out, what’s happening on the Bitcoin network hints that the cryptocurrency market is still bearish, meaning it’s in a decline phase. This trend is being supported by investors from Asia, who are regularly selling crypto-assets. At the same time, the main buyers at the moment are residents of the US and Europe.

Experts determine the activity of a particular region by time. In other words, they take into account working hours, when residents of a particular region are not only awake, but likely to be at work.

Analysts note that BTC is in the tight confines of a price channel from $37,680 to $42,312. That said, today Bitcoin not only made its way to the top of this interval, but also briefly jumped beyond it.

For now, however, experts are in no hurry to talk about moving into a bullish run. Here’s their short rejoinder, cited by Cointelegraph.

Bitcoin’s net usage figures and overall online activity are in the bear market zone, although they are showing signs of recovery.

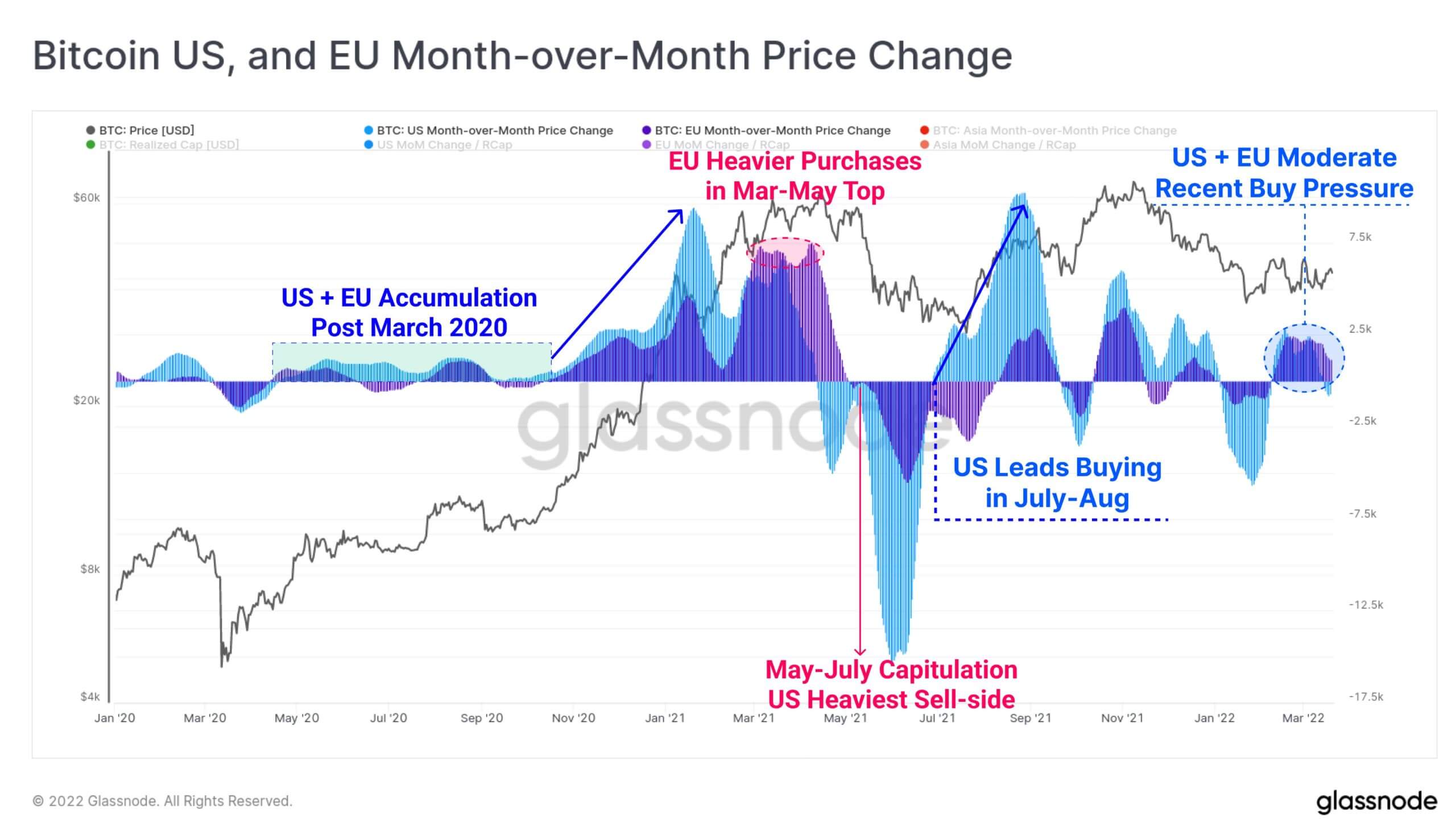

As analysts note, cryptocurrency enthusiasts from different regions show a clear difference in behaviour. In particular, residents of the US and Europe are mostly buyers, while those from Asia are sellers. According to Glassnode experts, this trend has been in place since March 2020, when markets collapsed due to the coronavirus pandemic.

Since then, the trend has remained virtually unchanged. The exception was in May 2021, when investors capitulated amid an incredible market collapse. The difference in behaviour was also noticeable in November 2021 - at that time, capital holders were predominantly buying up crypto assets.

Here’s a chart that shows these investor actions.

Purchases by crypto investors from the US and Europe

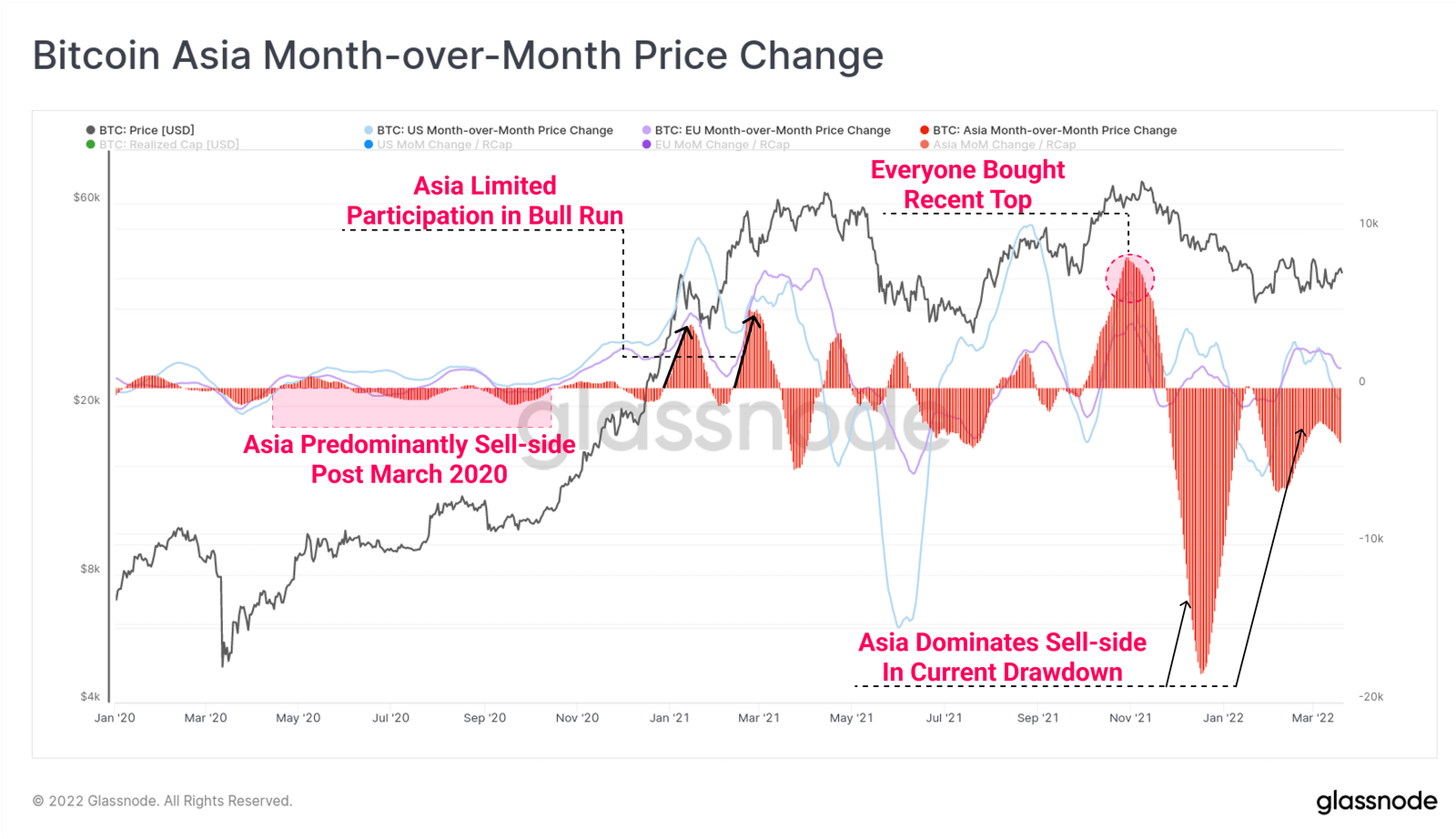

Glassnode analysts also added that people in Asia are now putting a lot of selling pressure on crypto-assets, meaning they are essentially getting rid of them. The dominance of this region in coin sales was noticeable at the end of 2021.

As a reminder, experts then linked this to the closure of cryptocurrency exchanges amid a ban on crypto interaction in China, which forced crypto investors to sell coins and get niche. Here's the chart.

Sales of crypto investors from Asia

That said, as Su Zhu, co-founder of legendary crypto fund Three Arrows Capital, noted today, “Asia is, oddly enough, the most active betting.” What is meant here is coin purchases.

Asia unironically max bidding$BTC

– Zhu Su 🔺🌕 (@zhusu) March 22, 2022

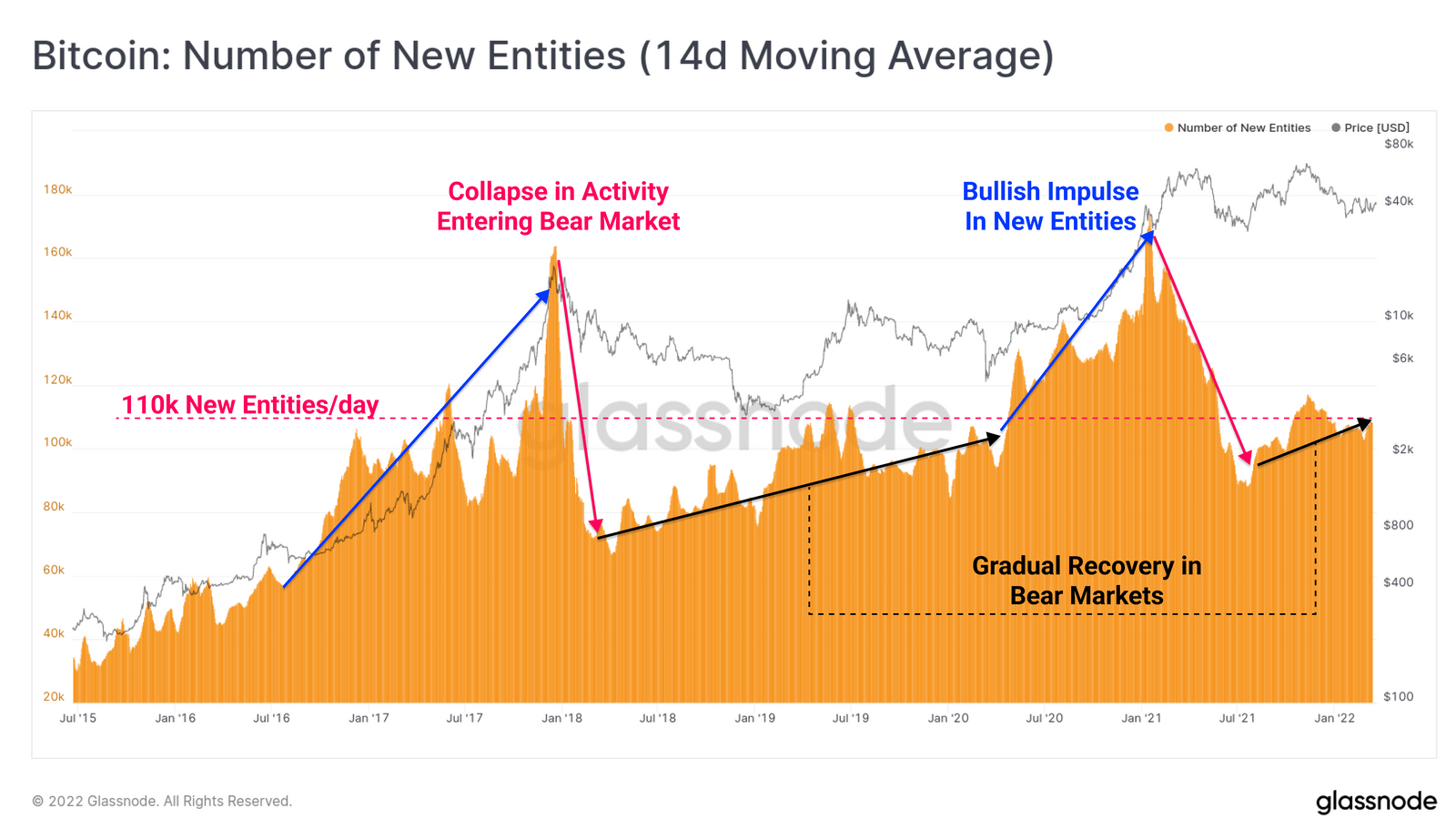

That said, some indicators on the Bitcoin network also confirm the presence of a bear market. In particular, the number of new entities – that is, new addresses that are not linked to existing wallets – has been increasing since mid-2021. As the growth rate is small, experts see this as a sign of a bearish trend. For example, a similar situation was observed from January 2018 to the first half of 2020.

The rate of new organisations now stands at 110,000 units per day. During a bullish trend, it is at a much higher level.

Graph of the Bitcoin network’s organisation rate

Various governments’ actions can be an impetus for Bitcoin’s popularity and growth. In particular, the day before Malaysian Deputy Minister of Communications and Multimedia Zahidi Zainul said that the country should recognize BTC and other cryptocurrencies as the official means of payment in the country.

In his address to parliament, Zainul said he was “hopeful that the government will be able to allow this,” Decrypt notes.

At the moment, Bitcoin is the official means of payment exclusively in El Salvador. That said, last week Honduran President Xiomara Castro said the state wanted to “avoid dollar hegemony” with Bitcoin. Accordingly, there could soon be an addition to the number of BTC-backed countries.

In the current environment, we believe it is difficult to count on both a bearish and bullish market for cryptocurrencies. On the one hand, the world is in maximum uncertainty, which could trigger a significant crisis and loss of interest in various assets - and especially risky coin-type assets. On the other hand, cryptocurrencies have shown the utmost dignity on more than one occasion shortly after global market crashes. There is a chance that 2022 will be no exception.

Share your thoughts on what’s happening in our Millionaire Crypto Chat. We’ll talk about other stories from the world of blockchain and decentralisation there too.