Ether volume on cryptocurrency exchanges has fallen to its lowest level since 2018. What does this tell us?

The number of Etherium (ETH) coins on cryptocurrency exchanges has fallen to its lowest level since September 2018. In the absence of serious growth in the crypto market, many investors are actively withdrawing ETH from trading platforms, hoping for continued growth of the coin in 2022 and beyond. Since the beginning of this year, more than 550 thousand ETH, or about $1.61 billion, have been withdrawn from exchanges. We tell you more about what’s happening in this blockchain.

Note that withdrawing ethers from cryptocurrency exchanges reduces the number of coins available for trading, which to a certain extent creates a shortage of coins. However, this is not the only way to reduce the amount of cryptocurrency available.

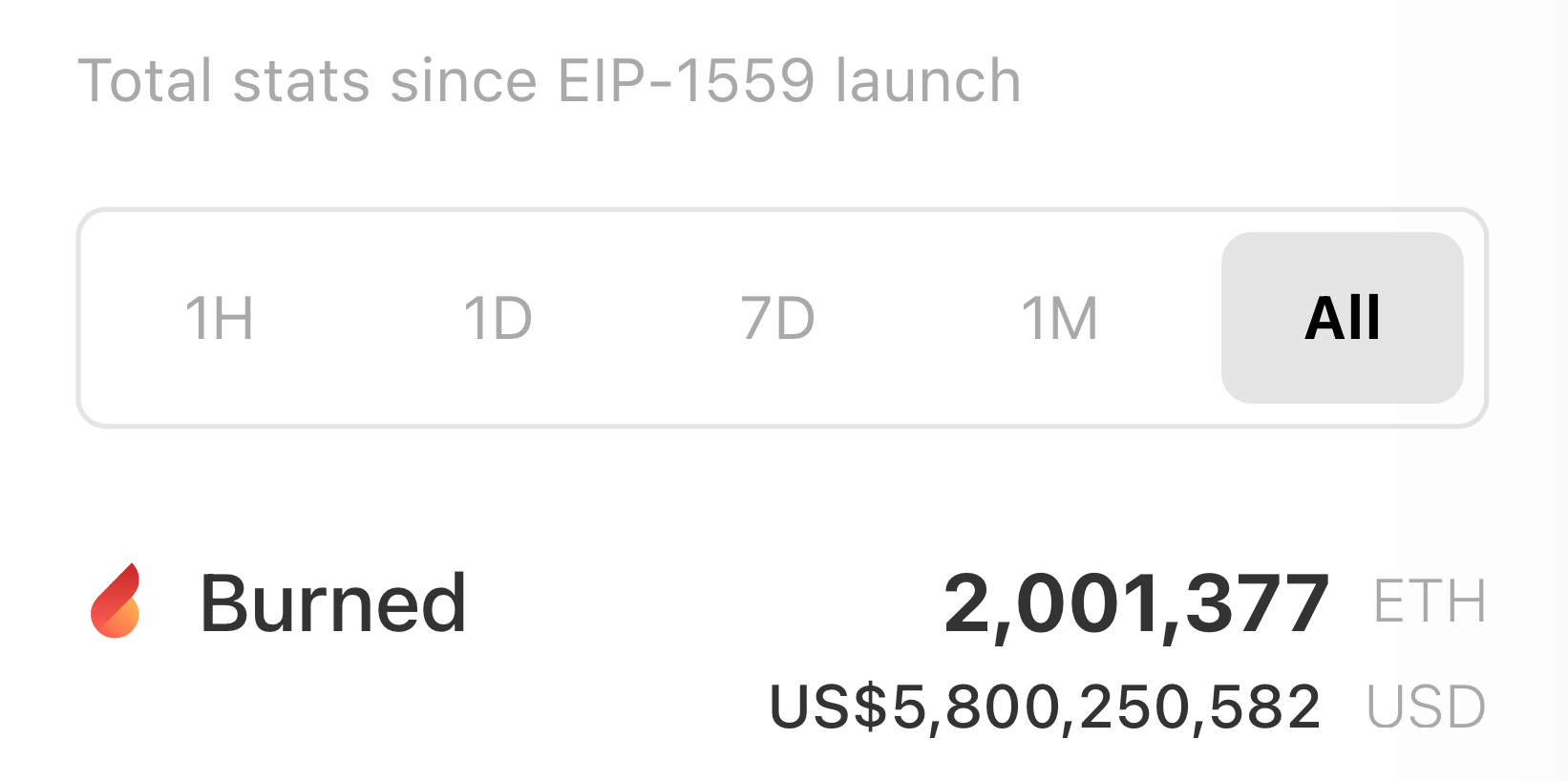

Thanks to the burn mechanism, ETH is burned with every transaction. It was introduced on August fifth, 2021 in the form of proposal EIP-1559 along with the London update. The day before, the total amount of ETH destroyed passed the 2 million units mark. Consequently, billions of dollars worth of ethers have already been eliminated from cryptocurrency circulation.

Here is the current number of destroyed ETH from Watch The Burn.

Number of ETHs destroyed as commissions

What’s going on with Etherium?

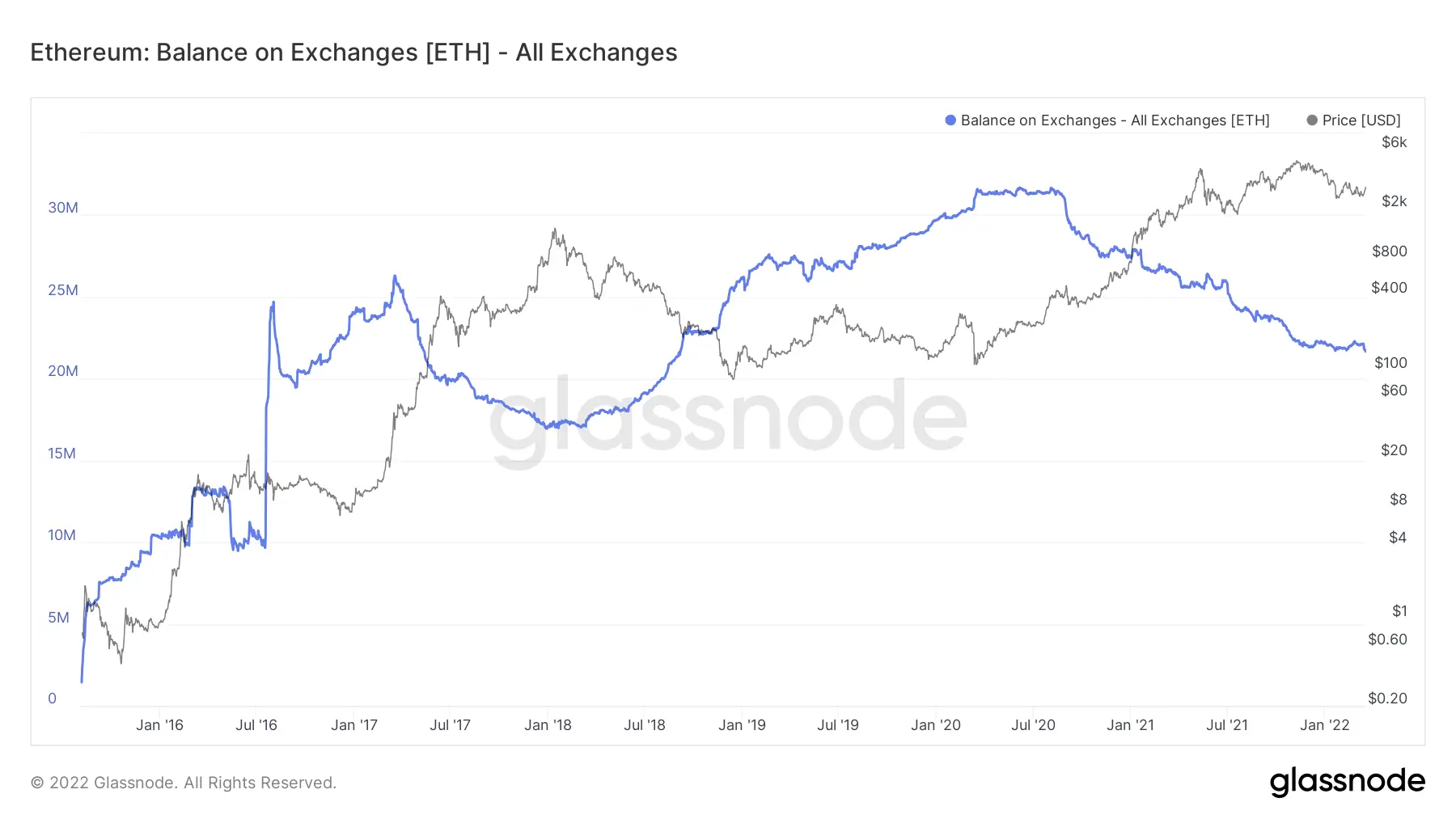

The mass exodus has reduced the total balance of ETH on exchanges to 21.72 million coins. According to Cointelegraph sources, there was a record high of 31.68 million ETH in June 2020. Notably, more than 30 percent of the total coins withdrawn in 2022 were transferred to investors’ wallets the week before last, accordingly, this trend is now extremely popular.

ETH balance on exchanges

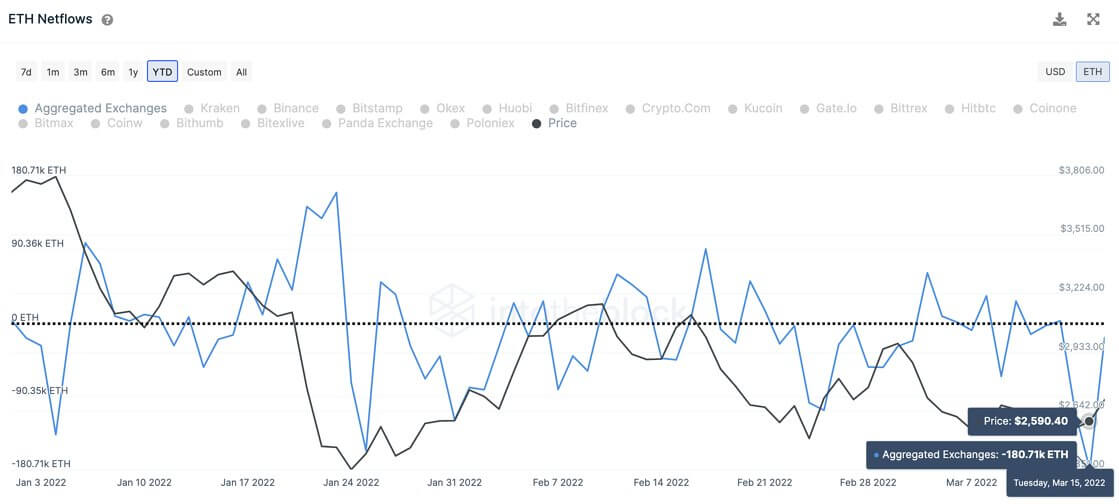

Specifically, more than 180,000 ETH left exchanges on March 15, resulting in a weekly outflow of just over $500 million as of March 18. Analysts at Chainalysis also say that, on average, about 120 thousand ETH are withdrawn from exchanges, and such rates can be seen as a prerequisite for a new wave of growth. Here’s a comment of the experts they use to comment on the developments.

The volume of assets held on exchanges increases if more market participants want to sell than buy, and if buyers simply prefer to hold their assets on trading platforms.

Such logic is indeed evident. It is still advantageous for investors to hold assets on a trading platform if they are already prepared to get rid of cryptocurrencies at a certain price level or if they are just waiting for the asset's value to jump to a predetermined level. Otherwise, it is safer to keep the coins in so-called non-custodial wallets outside exchanges or hardware wallets altogether. Still, the latter guarantees a higher level of security and avoids the risk of an exchange being hacked due to a possible vulnerability.

Dynamics of ETH outflows and inflows to exchanges lately

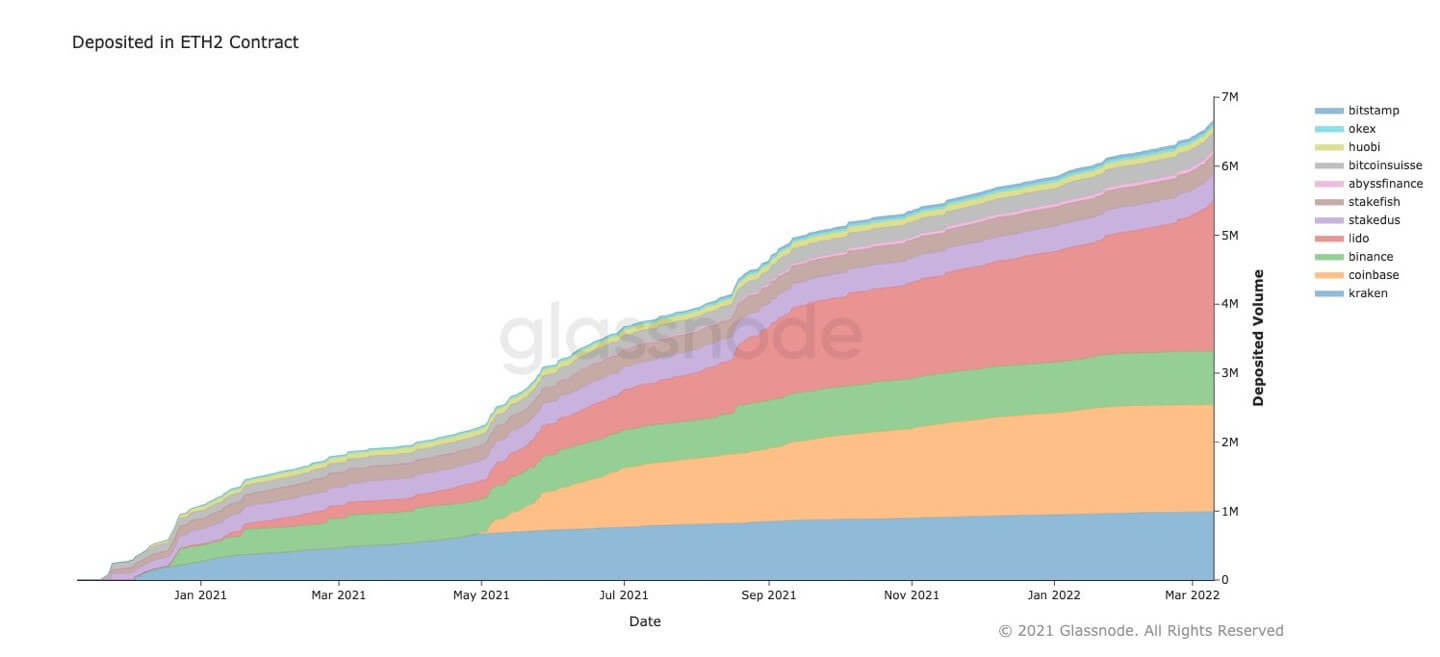

Last week’s massive withdrawal of coins coincided with the transfer of about 190 thousand ETH to a pool called stETH liquid stakin from Lido. As a reminder, Lido is a staking service that allows users to deposit coins into an Ethereum 2.0 smart deposit as a pool. That is, thanks to Lido, users can profit from staking even with an investment of less than 32 ETH, which is the minimum bar to obtain a validator role in Ethereum 2.0.

Etherium exchange rate

In the first half of March, the volume of ethers in Ethereum 2.0 stacking exceeded the 10 million unit level. 66 percent of this amount is provided by platforms that allow stackers to deposit any number of coins and earn a corresponding percentage of revenue. The aforementioned Lido platform accounts for 22 per cent of the total.

Distribution of staked ethers on the Ethereum 2.0 network

Overall, all of the above can be considered a positive sign for the price of Ethereum – the fewer coins on exchanges, the fewer sellers on the market. Consequently, a rise in the cryptocurrency’s value under such conditions is more likely, as possible seller pressure in this case has less impact on the value of the asset.

We believe that the downward trend of available traded asset volume is positive, and cryptocurrencies are no exception. If it intensifies, Etherium will become less liquid. In other words, each trade will have a stronger impact on the value of ETH than it did before. However, given the huge capitalisation of the blockchain project and the corresponding trading volumes, such changes will hardly be noticeable to the naked eye. However, the massive withdrawals are sure to have a good impact on Etherium's reputation.

And what predictions do you have for Etherium? Share them in our millionaires cryptochat. Talk about other stories affecting the world of blockchain and decentralisation there as well.