Fraud in the cryptocurrency industry is breaking records. How is it being tackled?

In 2021, the US Federal Bureau of Investigation has been very careful about crimes that involve digital assets. And this is very much to be expected: with the market booming, the activity of fraudsters in crypto has increased significantly. This fact is also confirmed by recently published data from analytics platform Chainalysis. Let’s take a closer look at the situation in the coin niche.

Cryptocurrencies are not the best vehicle for illegal transactions. And while you can't withdraw coins from non-custodial wallets outside of exchanges, depositing or withdrawing funds requires the involvement of banks, which usually keep a close eye on what's going on and easily identify suspicious transfers.

Most importantly: all crypto transfers leave an everlasting trace in a transparent blockchain, where details of every transaction are available to everyone. As such, digital assets are hardly suitable for criminals. This was stressed by former CIA chief Michael Morell back in April 2021. His point of view is available in the article at the link.

Cryptocurrency fraud

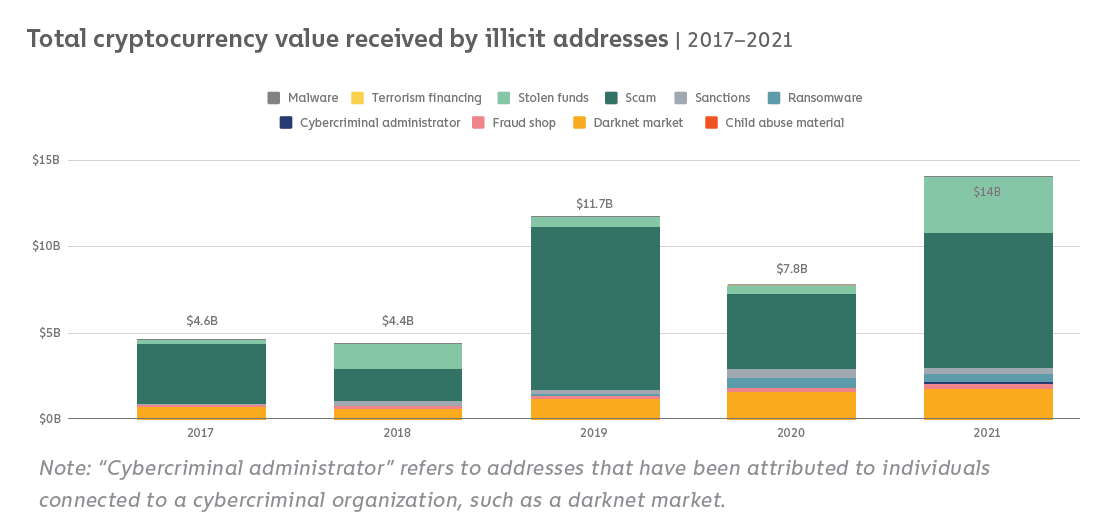

The first important point of the report: the volume of funds generated by cryptocurrencies that are linked to illegal activities. In 2021, it reached an all-time high of $14 billion, almost double the 2020 figure of $7.8 billion.

Volume of illegal crypto transactions

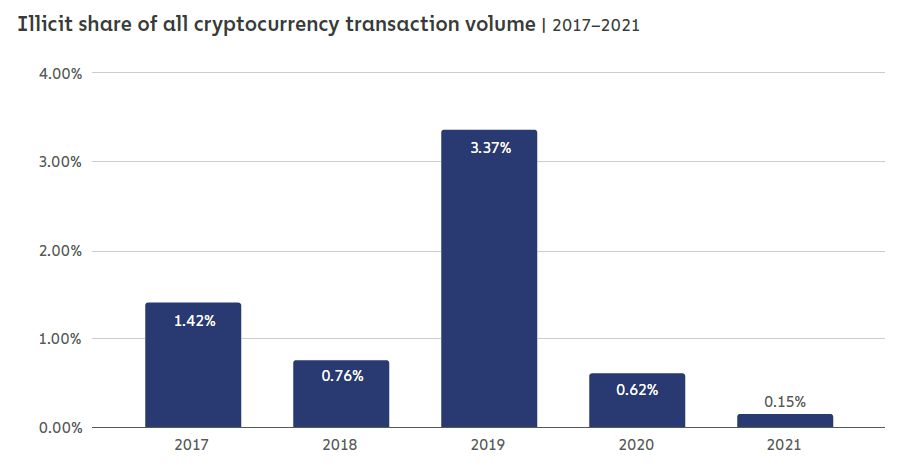

According to CryptoSlate sources, along with this there was also a record increase in the volume of cryptotransactions, but the share of illegal transfers in relation to this value dropped significantly to 0.15 percent.

In other words, the activity of fraudsters in terms of performance set a record in 2021, but against the backdrop of the growing popularity of digital assets, the share of illegal transactions was record low. The situation is easy to explain: transaction volume in 2021 is up 550 percent year-on-year to $15.8 trillion.

Despite the low percentage in the overall figure, the scale of cryptocurrency fraud has prompted the US Department of Justice to seriously intervene in the industry. In particular, the National Cryptocurrency Enforcement Team (NCET) was launched in October 2021. Here’s how the organization’s spokesperson described its main purpose.

The organisation is set up for sophisticated investigations and prosecutions for criminal use of cryptocurrencies, digital asset exchanges, transaction concealment, and crypto money laundering.

Note that the argument for the alleged active use of crypto to launder funds is becoming less and less common. The reason for this is that dealing with digital assets is closely linked to banks, which closely monitor sanctions lists and block unwanted transactions. Therefore, such claims are becoming rarer and rarer.

The same story is happening with the role of coins allegedly as a tool to circumvent sanctions. As Sam Bankman-Fried, head of the FTX exchange, said the day before, Russia will not try to avoid sanctions even with the help of the decentralised finance industry, which is known for treating all participants equally. Again, the issue here is the connection to the banks required to inject money into the crypto niche.

Share of illegal transactions in total remittances

Four months later, the Ministry of Justice took another step to further empower NCET by creating the Virtual Asset Exploitation Unit (VAXU). Officially, VAXU is part of the NCET, but the unit is primarily associated with the FBI, as it brings together various members of the agency who have gained experience in this area. U.S. Deputy Attorney General Lisa Monaco briefly explained VAXU’s primary role in the following quote.

Digital extortion, like many other crimes fueled by the crypto market, only works if the criminals get paid, which means we need to disrupt their ‘business model’.

Cryptocurrency hacker

We believe that government agencies' activism to regulate and control crypto will only make the digital asset industry more popular. Still, because of this, investors unfamiliar with the coin niche will not be afraid to get involved with it, as they will feel protected. And while there will definitely be no way to get rid of fraudsters completely, the percentage of illegal transactions will definitely go down in the future.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. Discuss curious topics and take surveys there.