Vitalik Buterin clarifies why he does not like NFT tokens in particular

On the cover of the recent issue of the world-renowned Time magazine is Vitalik Buterin, co-founder of Etherium and one of the most popular people in the entire cryptosphere. On this occasion, Buterin gave an exclusive interview in which he talked about his vision for the future of cryptocurrencies and the negative aspects associated with them. Some of Vitalik’s quotes about NFT-tokens particularly caught the attention of the community, so a little later he clarified the position in more detail. We describe the situation in more detail.

We should note that there are more than enough problems in the NFT sphere. An example of this is the NeoNexus project. Its founders raised several million dollars from investors, but a few months later they reported a lack of funding. At the same time, the founder of the project also posed with supercars, which became a cause for doubt in the cryptocurrency community. We wrote more about it here.

What are the advantages of NFT tokens

We’re talking about the following quote from Vitalik’s interview, in which the developer touched on the topic of non-interchangeable tokens.

The danger is that you have these $3 million monkeys and it becomes another form of gambling.

Vitalik Buterin on the cover of Time

Logically, it quickly caught the attention of so many crypto-enthusiasts, as unique tokens have become a major industry trend of the past year. The volume of NFT transactions during this period passed the $25 billion mark, meaning that the trend was incredibly strong. That said, it seemed to some in the blockchain community that Buterin was openly bucking the trend in his words.

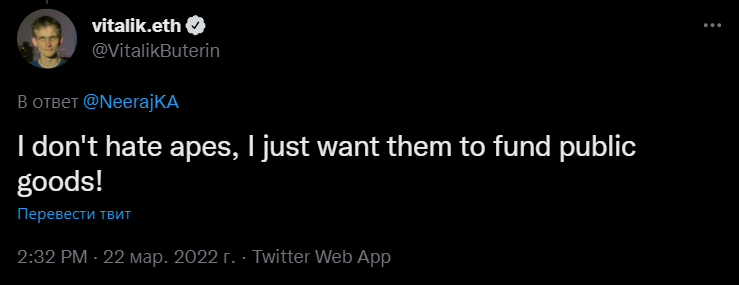

Moreover, according to news outlet Decrypt, Vitalik was suspected of criticizing the famous NFT collection Bored Ape Yacht Club (BAYC). Not so, he tweeted the following message the day before.

I don’t hate the ‘monkeys’ I just want them to help develop the public good.

Vitalik Buterin’s tweet

Public goods in the cryptosphere should be understood as open source technologies and infrastructure that can potentially benefit anyone. Buterin has previously discussed this topic at length – he believes that the Ethereum ecosystem should support initiatives that help advance the project ecosystem while helping people.

To achieve this goal, Vitalik co-created the concept of so-called quadratic funding. Its essence is that projects with a large number of supporters get a larger share of the available funds for their own development. This model is used in Gitcoin, the leading public goods project in the Ethereum ecosystem. To date, Gitcoin has helped raise more than $55 million for various initiatives in development.

In addition, Vitalik himself is known for his lack of ambition to make money. Firstly, he has already become a billionaire amid the rise of coins in the spring and autumn of 2021. Secondly, he is often sent serious sums of money, which the developer ends up donating or even burning. For example, last year he got rid of billions of dollars worth of SHIB tokens by first transferring their share to donations. Read more about this story in a separate piece.

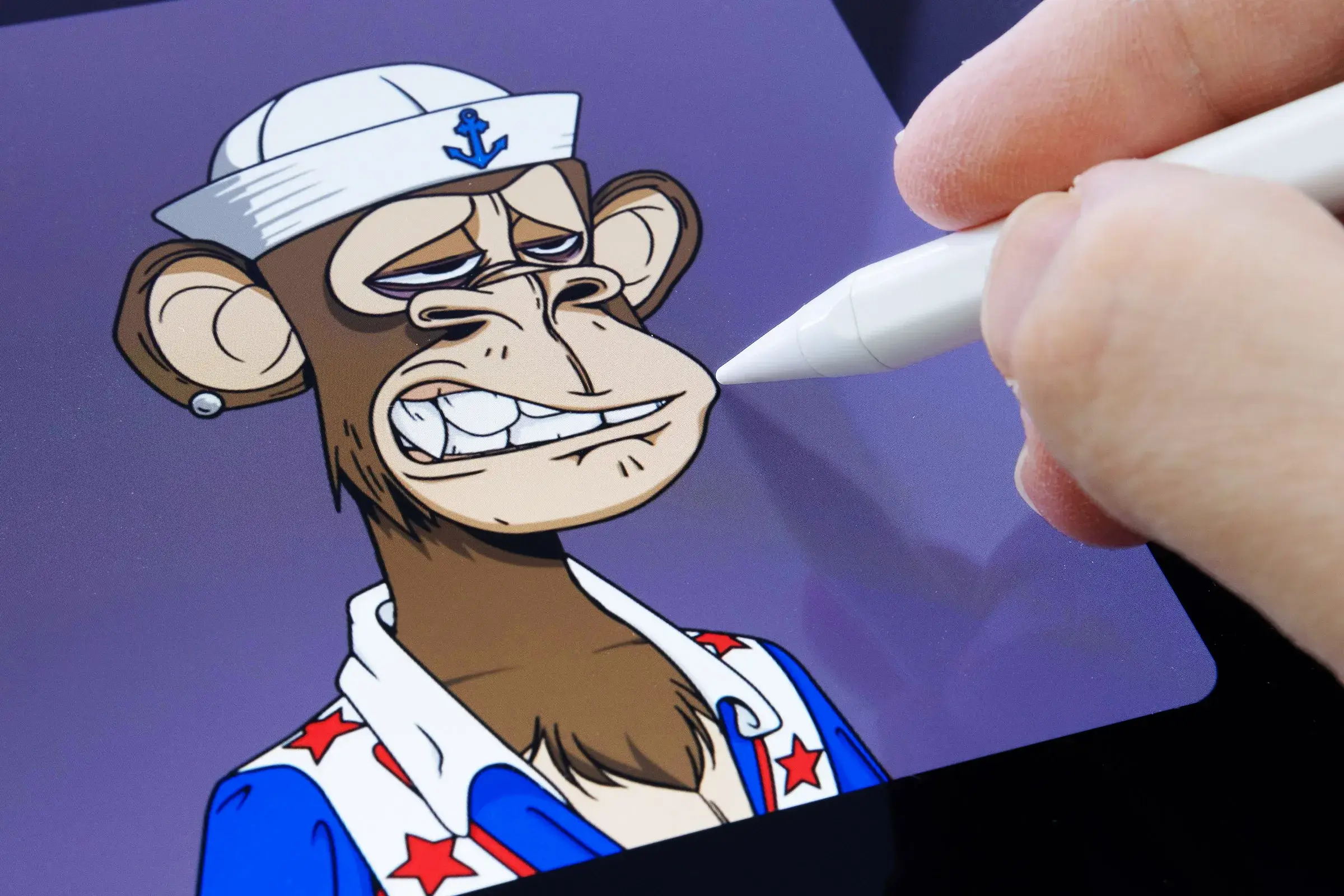

Regarding Bored Ape Yacht Club and NFT in general, another line from Vitalik’s interview is worth mentioning.

Ultimately, the goal of cryptocurrencies is not to play million-dollar monkey picture games, but to do things that have a significant impact on the real world.

Bored Ape Yacht Club

To recap, Bored Ape Yacht Club is a series of 10,000 unique images of virtual monkeys that are linked to their NFT. Token holders get access to the closed BAYC club, as well as additional privileges in the form of various virtual events or even coin giveaways. The latest was the ApeCoin token airdrop, which amounts to tens of thousands of dollars for each BAYC holder.

The cheapest available copy of the collection on the OpenSea trading platform is valued at 101 ETH, or about $304,000 at today’s exchange rate. The volume of resales of BAYC tokens is also noteworthy, because the day before it exceeded the mark of $3 billion. That said, the NFT collection isn’t all that “useless” when it comes to impacting the real world: recently, the Bored Ape Yacht Club community donated a million dollars in humanitarian aid to Ukraine amid a terrible situation inside the country.

The BAYC community’s initiatives were supported by a crypto-enthusiast under the pseudonym Farokh in a tweet to Buterin.

I can assure you that there are a lot of us in this part of the crypto space, trying to help fund public good by coming together as individual communities and also promoting fundraising! Thank you for all that you do!

Gm @VitalikButerin! As an Ape, Punk, Cool Cat, and wtv other animal jpeg, I can reassure you that there are a lot of us in this pocket of the space trying to help fund public goods by getting together as communities and raising money, and much more! Thank you for all you do!

– Farokh.eth (🎙, 🎙) (@farokh) March 22, 2022

We believe that NFT is an important tool in promoting Etherium as a basis for unique tokens, and by that fact alone, the trend deserves recognition from crypto-enthusiasts. However, Vitalik's point of view is also quite logical. Investors should not get "too" involved in unique tokens, turning an entire aspect of the cryptosphere into a bubble. Investing in risky assets - which is how most coins could be characterised - should only be something that investors are able to lose without any problems.

What do you think about this? Share your opinion in our millionaires’ cryptochat. There we will talk about other important topics related to the blockchain and digital asset industry.