A Ripple executive has called maximalism about Bitcoin foolishness. What does he mean by that?

Ripple CEO Brad Garlinghouse believes that maximalism directed towards Bitcoin or any other digital assets is actually hurting the crypto industry. According to Garlinghaus, such actions only lead to an increase in “internal animosity” between different areas of the crypto market. However, he himself owns BTC and ETH. We tell you more about what’s going on.

As a reminder, Bitcoin Maximism is a kind of worship of the first cryptocurrency, which also implies criticism of other projects. In particular, members of this culture believe that the ability to send and receive BTC is all a “normal” blockchain enthusiast needs. Meanwhile, NFT and the field of decentralised finance are simply called fraud by the most radical “maxis”.

Twitter co-founder Jack Dorsey is a prime example of this behaviour. The day before, he stated that he was not interested in any projects based on the Etherium blockchain. The reason for this is that there are allegedly a lot of weaknesses in the Eth network. However, a year ago, that didn’t stop him from using Etherium to sell his first tweet as an NFT. Read more about this story in a separate piece.

How to invest in cryptocurrencies

Bitcoin has yet to lose its status as a leader among digital assets throughout its history, with its recognition only increasing over the years. For example, in September 2021, BTC even became legal tender in a separate country, El Salvador. However, fanatical “worship” of one cryptocurrency will not lead to anything good, Garlinghaus noted in a recent interview.

Here’s the expert’s rejoinder, in which he shares his view of the situation. The quote is quoted by Cryptopotato.

In my opinion, polarisation is an unhealthy phenomenon.

That is, Garlinghaus believes that members of the cryptocurrency community should not pray exclusively to one project and ignore other coins. This is certainly correct in terms of profitability. In particular, AXS, LUNA and SOL were the best investments at the end of 2021, increasing in value by 17, 12 and 11 thousand percent respectively. At the same time, Bitcoin was up 62 per cent. So fans of the BTC cult have earned at least several times less than they could have in the case of altcoins not being linked.

Ripple CEO Brad Garlinghouse

A prime example of Bitcoin “worship” is MicroStrategy CEO Michael Saylor, who sometimes elevates the major cryptocurrency to almost cult status. He never tires of reminding everyone that it is Bitcoin that is worth the long-term attention of investors. For Garlinghouse, such tactics seem misguided; he himself recommends diversifying your investment portfolio.

I own BTC, ETH and some other cryptocurrencies. I believe the crypto industry will continue to thrive.

A key trait of Seylor is his ability to praise Bitcoin in all circumstances. In particular, he responded to Ilon Musk’s recent desire to buy Twitter with the following quote.

If you can’t buy all of Twitter, you still have the option of buying a share of Bitcoin.

Saylor mentioned Bitcoin today after a rejoinder from Ilon Musk that Tesla has achieved a market capitalisation of $1 trillion without any marketing costs. As Michael noted, “Bitcoin and Tesla have the same advertising strategy.”

MicroStrategy CEO Michael Saylor

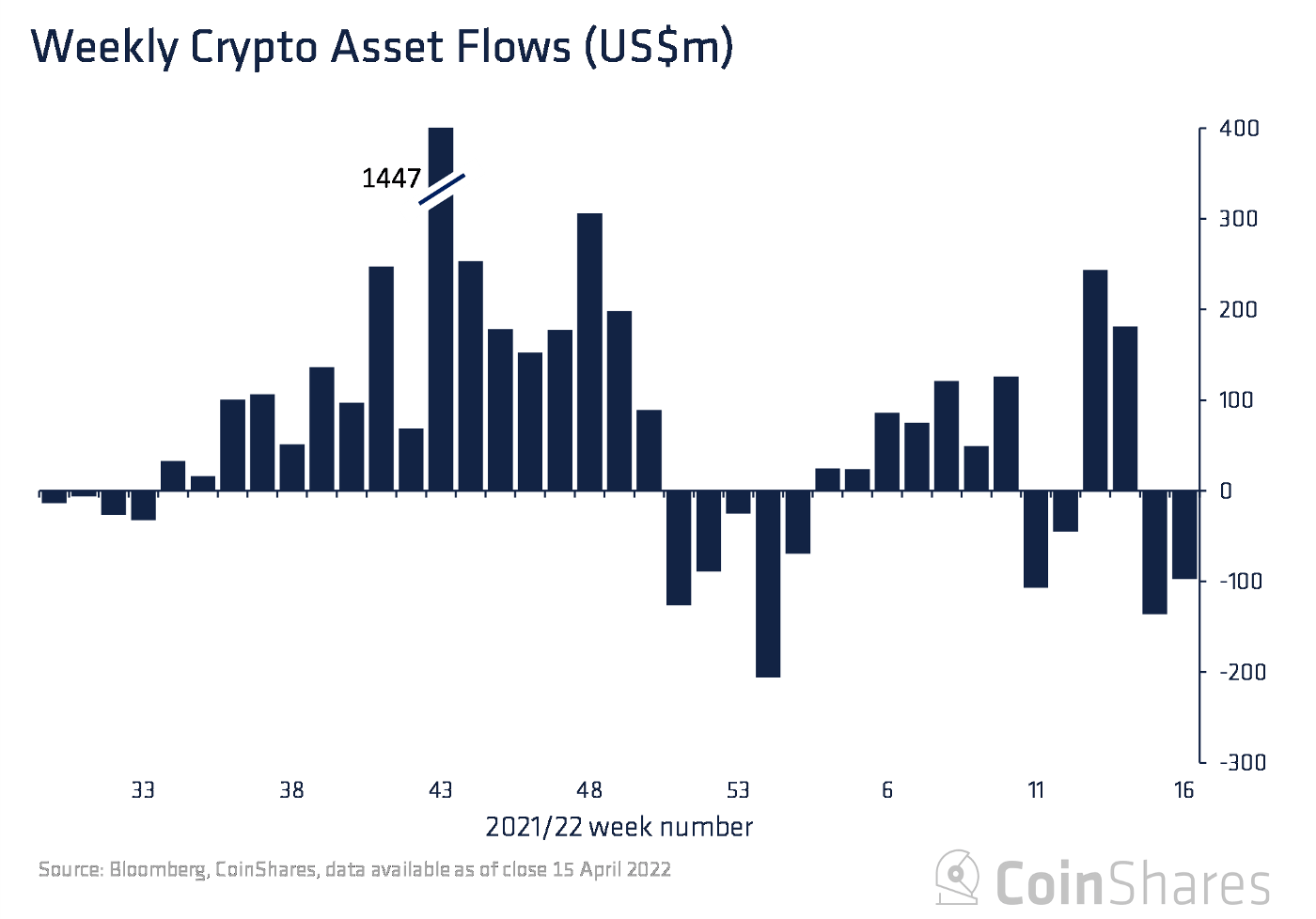

However, despite MicroStrategy’s CEO’s positivity, some large investors were withdrawing their money from crypto the day before – as evidenced by the outflow of almost $97 million last week in large institutional investment projects. Notably, it was European market players that accounted for 88 per cent of the amount.

Dynamics of inflows and outflows in crypto projects

CoinShares analysts suggest that the outflows were a “delayed reaction” to a tough statement from the US Federal Open Market Committee (FOMC). Recall that in February, FOMC officials adopted new rules prohibiting senior Fed officials from buying cryptocurrencies, individual stocks and foreign currencies. These rules will officially take effect on May 1, according to Decrypt.

We believe Brad Garlinghouse's position is true. In the world of cryptocurrencies, there is no reason to engage with just one cryptocurrency while criticising all other cryptoprojects. Such a strategy can only be suitable for those investors who hate money. And in the case of Jack Dorsey mentioned above, he probably doesn't need it anymore.

What do you think about it? Share your opinion in our millionaire cryptochat. There we will discuss other news from the world of decentralized assets.