Analysts at Grayscale have compared the Ethereum blockchain to New York City. What do they have in common?

Investment firm Grayscale has published a report on decentralised smart contract platforms, making a very interesting comparison. It turns out that Ethereum’s blockchain, the most popular in this sector of the crypto market, is very similar to New York City. Like a big city, Eth’s network has plenty of problems, but overall there is a huge amount of promise to be found in it. Let’s take a closer look at the experts’ views.

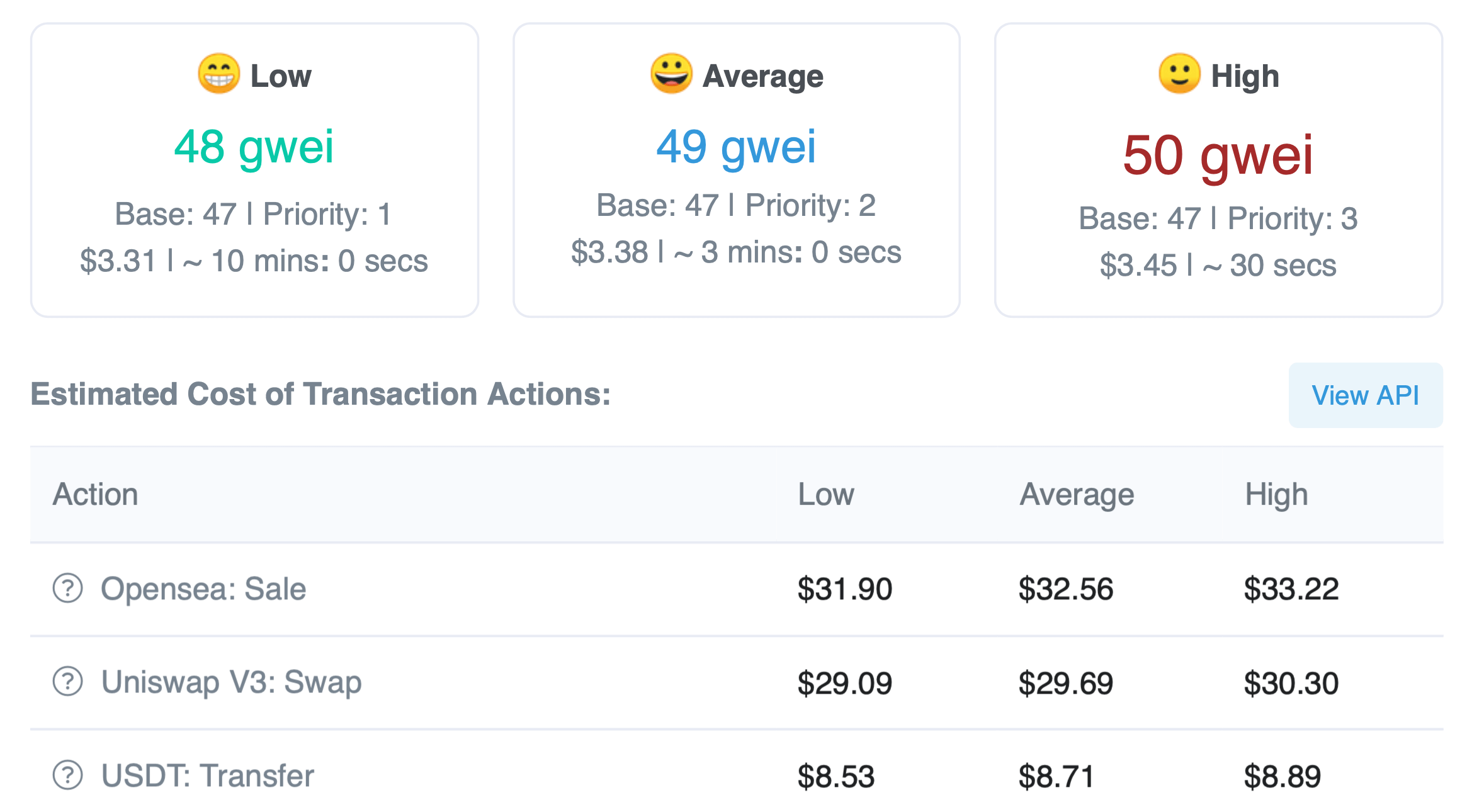

In their study, the experts paid special attention to commissions in various blockchains. We checked the current data: the cost of making transactions in Ethereum is now gradually increasing. For example, to quickly send ETH you will need to pay $3.45, while transferring ERC20 tokens will cost almost $9. And you’ll have to pay the equivalent of $30 for the coin exchange procedure on the decentralized exchange.

Transaction fees on the Etherium network

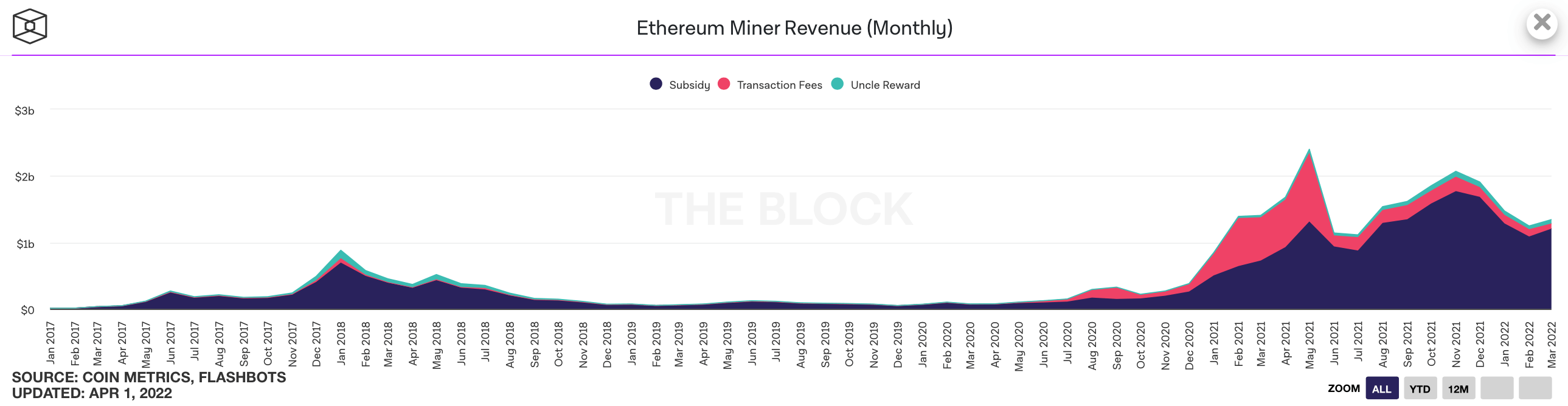

The increase in fees has a direct impact on revenue for ETH miners, which stood at $1.34 billion in March 2022. This is the first increase in the figure since November 2021. Accordingly, the digital asset niche is slowly starting to recover after a series of collapses this winter.

Graph of Etherium mining yields

What’s going to happen to Etherium

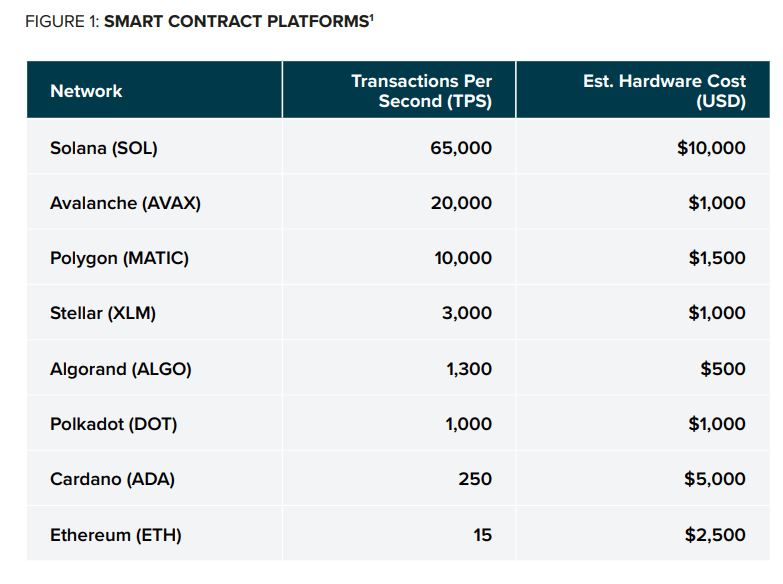

The report looks at Etherium compared to newer competing blockchains like Solana, Avalanche, Polkadot, Cardano and Stellar. Note that the report was published after the company launched a crypto fund dedicated to smart contract platforms, with the exception of Eth itself.

Throughput and cost of maintaining a node on a different blockchain network

According to Cointelegraph sources, Grayscale analysed Ethereum, Avalanche and Solana in a section called Digital Cities. The firm compared Ethereum to New York City, noting that they share similarities and challenges arising from their imposing size.

Ethereum is similar to New York: it is huge, expensive and congested in some areas. But it also has the richest app ecosystem, with more than 500 decentralised apps, with a total value of more than $100 billion – at least ten times that of any other competing network.

Analysts believe that Etherium’s current success in its arena stems in large part from the cryptocurrency enthusiasts’ great credit to the project. Moreover, it’s unlikely that anyone will be too disappointed in the altcoin anytime soon – especially amid news of its move to the Proof-of-Stake algorithm, which will make Ether much more efficient at maintaining the network. Experts continue.

Users and developers are reassured that Etherium is likely to continue to be a centre of gravity for innovation and application liquidity due to the size of the community and the amount of capital locked up in the network’s smart contracts.

In other words, blockchain will be enjoyed because of the sheer number of users. Many of them, however, are not confused by the size of the fees for the various transactions, which may frighten away less well-off investors in the process.

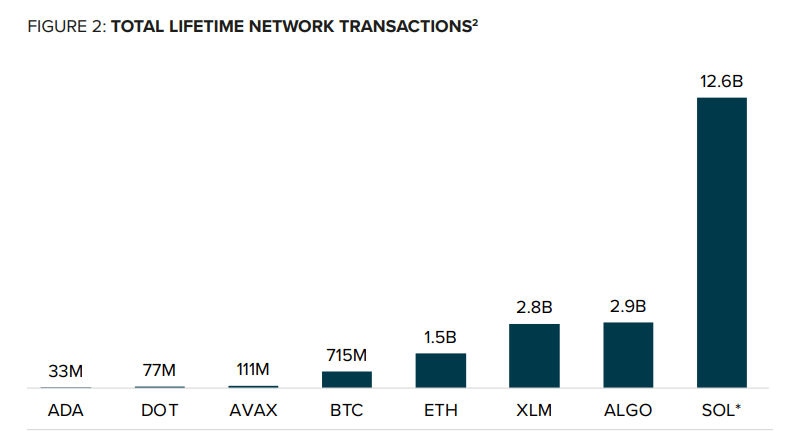

Total number of transactions on the blockchain in question

The experts further suggested that switching users to competing blockchains is like moving to a cheaper city because of high petrol fares and congestion caused by excessive demand for services.

When the average transaction fee on Ethereum began to exceed $10 per transaction, platforms like Stellar, Algorand, Solana and Avalanche experienced a strong increase in the daily number of transfers on the blockchain.

Interestingly, Grayscale described Solana as Los Angeles. The analysts noted that it is “a structurally separate network that is faster and geared towards different usage scenarios”. Here’s their quote.

The Solana architecture is based on a different consensus mechanism that prioritises speed and low fees, albeit at the cost of greater centralisation. Instead of scaling through layer 2 chains, Solana runs transactions through a high-speed L1 chain. As of 15 March 2022, its throughput is around 2,300 transactions per second.

As a reminder, the Solana network has occasionally been accused of being centralised due to too many demands on the node operators that power the blockchain. In this case, they require advanced and very expensive hardware that not everyone can afford.

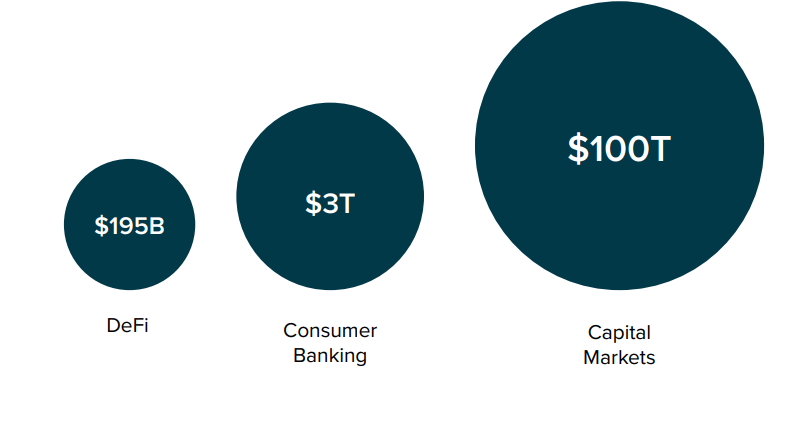

Comparison of DeFi volumes, user banking and the market as a whole

Avalanche has been compared to Chicago because the economics of the project are similar to New York, but the network itself is smaller, “transactions are cheaper and less congested, and the platform is more centralised”.

Specific subnets like Crabada and partnerships with firms like Deloitte should provide greater differentiation from applications on other networks, which will help Avalanche establish its identity as a project in the future.

Bottom line – even leaving all comparisons aside, Grayscale calls the aforementioned platforms an important part of the fast-growing trend of meta-universes and decentralised finance. Therefore, investing in them is highly likely to yield good returns in the long term.

We believe that different blockchains do have different disadvantages. However, in this case, the advantage of the digital asset niche in its current state is the choice. In other words, holders of small capital do not necessarily need to use Etherium: they can interact with Solana or Avalanche without any problems. That means the blockchain industry is suitable for everyone, which will guarantee its further development.

What do you think about different blockchains? Share your opinion in our millionaires’ crypto-chat. We will discuss other important news there as well.