Billionaire David Rubenstein predicts an explosion in the popularity of cryptocurrencies among big investors. Because of what?

David Rubenstein, co-founder of private equity firm The Carlyle Group, made an interesting statement about cryptocurrencies the day before. According to him, “the genie is already out of the bottle” – we are talking about an explosion in the popularity of digital assets not only among ordinary investors, but also among large firms. Rubenstein himself has not yet bought cryptocurrencies, but judging by his words, it could happen soon. We tell you more about the investor’s point of view.

It should be noted that the cryptocurrency industry is not only attracting the attention of billionaires, but also creating them. As revealed thanks to a recent Forbes ranking, the blockchain niche represents quite a few wealthy individuals who have made a fortune thanks to their association with the coin market. The record among this figure is $65 billion.

What will happen to cryptocurrencies in the future

Here’s a quote from a billionaire in which he shares his take on what’s happening in the coin niche. The replica was published by the news outlet Decrypt.

I didn’t buy cryptocurrencies, but I did buy companies that are associated with the industry. I think the genie is out of the bottle and the cryptosphere is unlikely to go anywhere anytime soon.

Changpen Zhao, head of cryptocurrency exchange Binance, expressed a similar view the day before. As he noted on Twitter, “Bitcoin is indeed volatile, but it’s not going anywhere anymore.”

As a reminder, the volatility of Bitcoin and other cryptocurrencies - that is, dramatic changes in their value - is one of the main arguments bankers and officials have made against decentralised assets. With reminders of excessive volatility, they discourage novice investors from linking up with the coins. This is because critics of crypto fail to mention the downside of volatility, which is the ability to increase sharply in value.

Rubenstein was initially “sceptical of crypto” because he did not believe in backing the value of Bitcoin and popular altcoins like Etherium. The expert continues.

It is now clear that the younger generation similarly does not see currencies like the dollar or the euro as being sufficiently backed up.

That said, the geopolitical crisis in Ukraine has also caused Rubenstein to change his mind drastically about the crypto industry.

If you are in Ukraine or Russia, and there are a lot of problems in your country, you want to have some assets. Owning cryptocurrency is likely to make you feel more financially secure, as this asset is outside of government control.

Read also: One of Mexico's richest men revealed what percentage of his investment portfolio is in Bitcoin

Billionaire David Rubenstein

But while billionaires are only contemplating major investments in digital assets, Luna Foundation Guard (LFG) continues to accumulate Bitcoin at a rapid pace. It previously announced the permanent accumulation of the equivalent of $10 billion worth of BTC to secure its own decentralised UST stackablecoin.

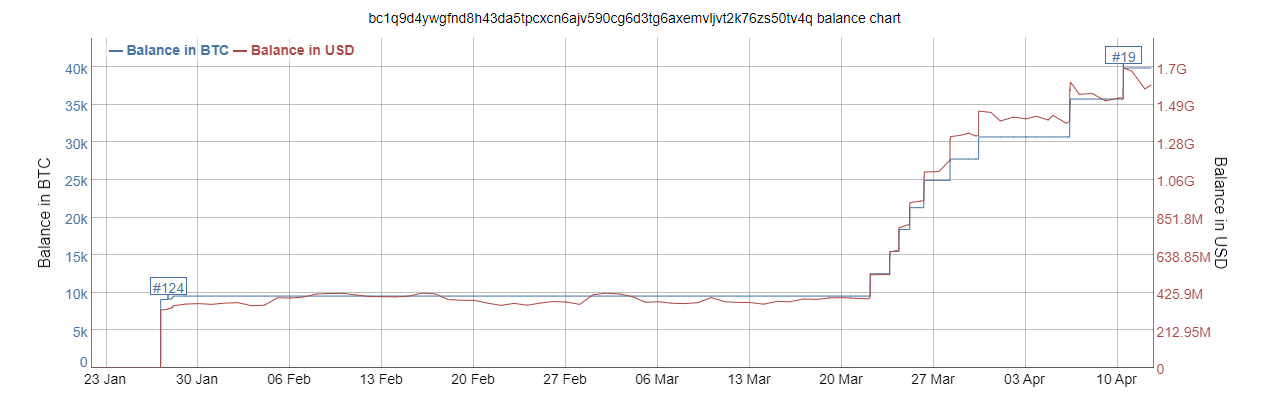

LFG cryptocurrency wallet balance

More specifically, UST is an algorithmic stabelcoin, which means there is no formal requirement to have assets as collateral to peg the dollar value of the coin. Instead, the LUNA token, which is also part of the Terra project, works to maintain parity between UST and the dollar.

Terra bought another 4,130 #BTC ($170m) today.

They now hold more than 0.2% of the current #bitcoin supply. That puts it in the top 20 wallets when ranked by holdings.

Total holdings = 39,897 BTC

– Harry 🌕 (@CryptoHarry_) April 10, 2022

The day before, LFG and affiliated Terraform Labs conducted another round of buying 4,130 BTCs with a total value of about $170 million. This brought the total balance of coins at its address to 39897.98 BTC. At the time of the transaction, this amount was valued at $1.69 billion, which means there are still massive purchases of the first cryptocurrency in terms of capitalization.

LFG is now among the top 20 largest holders of the major cryptocurrency, according to CryptoSlate. Moreover, at the time of writing, the company owns 0.2 per cent of the total amount of bitcoins mined.

By today, LFG has already spent a total of $1.73 billion. Since 26 January 2022, the company’s cryptocurrency wallet balance has grown from almost zero to almost forty thousand bitcoins in 91 transactions. If crypto accumulation continues at the same pace and LFG does indeed have 10 billion in Bitcoin, the company’s cryptocurrency wallet will still not top the list of major BTC holders. At the moment it is held by cryptocurrency exchange Binance, which has 252,597 BTC.

Welcoming $AVAX as the second major layer one crypto asset next to $BTC as part of the $UST Reserve.

The inclusion of @avalancheavax’s native token marks the start of a diverse pool of layer one crypto assets helping support the $UST peg.

It’s only just the beginning frens. https://t.co/5utdQMVAiw

– LFG | Luna Foundation Guard (@LFG_org) April 7, 2022

Bitcoin is not the only cryptocurrency on LFG’s balance sheet. The company has also started buying Avalanche tokens (AVAX) to maintain its UST reserve. Moreover, other crypto-assets will be added to the UST reserve in the future to create a more “diverse pool” of collateral for its own stackablecoin. This measure is a logical step to secure its project against the volatility of the crypto market.

We believe that the cryptocurrency niche will indeed become more popular going forward. Previously, digital assets have gained new fans with each growth cycle, so the next phase of price increases is unlikely to be an exception. In addition, there are more useful services and platforms in the coin world today than ever before, which even newcomers can profitably use. Stacking, cryptocurrency loans and decentralised asset exchanges are examples of these.

Look for even more useful and interesting information in our Millionaire Crypto Chat. There we will discuss other important developments related to blockchain.