Experts believe Bitcoin could rise as high as $4.8 million. But under what conditions?

US investment firm VanEck is making very optimistic predictions about the future growth of Bitcoin’s price. According to its analysts, the main cryptocurrency could go as high as $4.8 million, which will supposedly happen after Bitcoin becomes a global reserve asset. In the meantime, however, the dollar’s hegemony in this matter has another much stronger competitor – the Chinese yuan. Let’s take a closer look at the experts’ views.

Note that it's not the first time there's been talk of Bitcoin at a million dollars or more, and some of it is well-founded. A case in point is the musings of BitMEX cryptocurrency exchange co-founder Arthur Hayes. In his publication titled Energy Cancelled, he shares a detailed analysis of the world after the US and Europe froze the Central Bank's assets amid Russia's current activities.

Arthur believes that this will be a reason for countries - primarily in Asia - to gradually abandon active interaction with the dollar. Well it will force them to move to gold. And because the total reserves of the precious metal around the world are unknown (after all, transactions with it are most often only on paper), it could cause problems with supply. And even if they don't, sooner or later the world's banks will face excessive costs in transporting gold.

In the end, Arthur suggests that the world will move to Bitcoin after all. The cryptocurrency has an open and known limited maximum supply, and its transfers anywhere in the world are incomparably cheaper than transactions in gold. We recommend reading this material if you speak English and have an hour of free time.

Bitcoin for millions of dollars

According to Cointelegraph sources, the forecast was published by Eric Fine, head of Emerging Market Active Debt, and Natalia Gurushina, chief economist at VanEck. They modelled a situation in which Bitcoin and gold could become the backbone of countries’ international reserves.

The analysis showed that the estimated price of BTC in such a case ranged from $1.3 million to $4.8 million. The low end of the forecast was based on a scenario using BTC as the M0 monetary aggregate, which includes the entire circulating stock of currency and bank deposits, but is not a commonly accepted metric for economists.

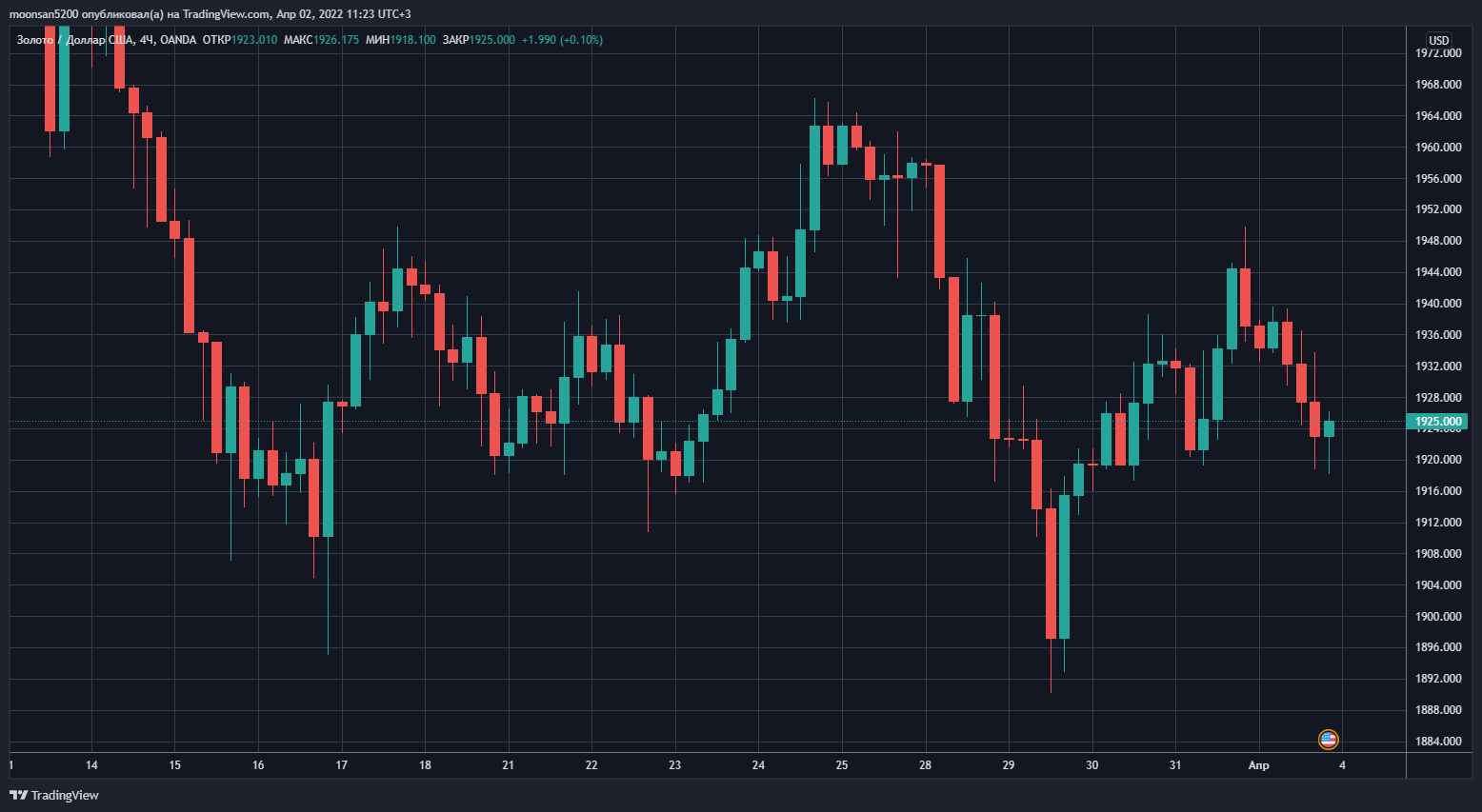

A daily chart of the Bitcoin exchange rate

The level of $4.8 million was determined based on Bitcoin's acceptance of the M2 monetary aggregate, which includes cheques, demand deposits, local currency balances in corporate checking accounts and term deposits.

By the way, in the case of gold forecast was based only on a scenario for M0, in which the price of the precious metal may rise to 31 thousand dollars per ounce. Recall, at the moment the price of gold fluctuates in the range of 1925 dollars. Furthermore, the recent geopolitical turmoil has forced Russia to consider using other national currencies to pay for oil with its “friendly” partners.

Gold price development

This trend could spread to other central banks, and the dominance of the USD is likely to suffer even more. Well, that could pave the way for the rise of BTC and similar assets. Fine and Gurushina believe that the Chinese renminbi should be seen as a major contender for a new reserve currency.

Central banks are likely to change their reserve structure to the detriment of dollars and in favour of something else to varying degrees. As a result, some central banks and private entities will continue to diversify.

Bitcoin versus the dollar

Most recently, Bitcoin showed its first significant jump in price since the beginning of this year. It coincided with an announcement from Terraform Labs CEO Do Kwon: he had earlier announced that BTC had accumulated in the company’s accounts up to the equivalent of $10 billion. These reserves will be needed to secure the UST Stablecoin being issued.

Recently, Do Kwon explained in more detail what would happen to UST if the price of Bitcoin suddenly starts to plummet. Here’s his quote.

The worst case scenario would be Bitcoin falling in about six months, leading to a drop in demand for UST. I’m sort of betting that a long-term scenario of Bitcoin growth and having sufficiently strong reserves is more likely to allow us to weather the crisis.

In other words, Do Kwon will continue to “squeeze” the market from buyers by constantly buying bitcoins. This leaves too little “room for manoeuvre” for the bears, who may be looking at ways to artificially lower the price. So Terraform Labs’ initiatives are another notable reason for the global bullrun to continue.

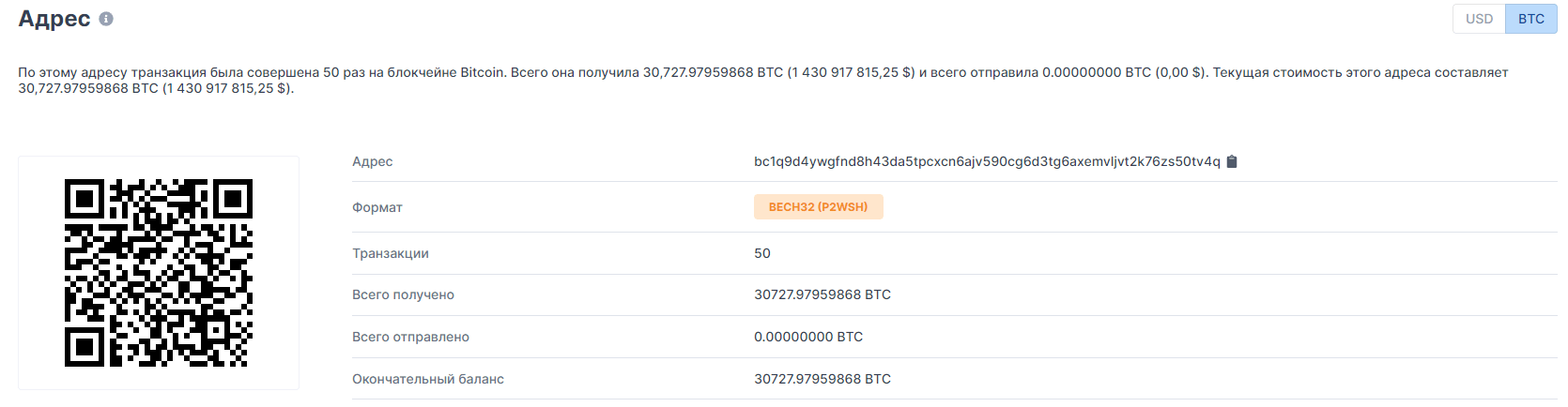

Terraform Labs wallet

We believe that such a sharp rise for Bitcoin is only possible over a long period of time and under acceptable conditions for the first cryptocurrency amid global doubts about the dollar's potential. However, counting on this prediction from experts is definitely not a good idea, especially with its latest money. Still, in the digital asset industry - as well as the global economy as a whole - things could change at any time.

What do you think about this? Share your opinion in our millionaires’ crypto-chat. There we will talk about other topics related to blockchain and decentralisation.