How many miners use green electricity: Bitcoin Mining Council’s response

Mining companies continue to increase their energy consumption from renewable, environmentally friendly sources. Mininers have managed to increase their green energy footprint by around 59 per cent compared to the previous year. The Bitcoin Mining Council (BMC), which represents 44 major mining companies with a total processing capacity of 100.9 hashes per second – almost half of Bitcoin’s entire hash rate – published its report on the latest trends in mining the major cryptocurrency the day before. Here’s a more in-depth look at the situation.

The share of renewable energy in Bitcoin mining was one of the main reasons for criticism of the first cryptocurrency in spring 2021. It was at that time that BTC mining was banned in China, and the efforts and manipulations of Ilon Musk eventually led to the market crash in May.

Renewable energy in Bitcoin mining

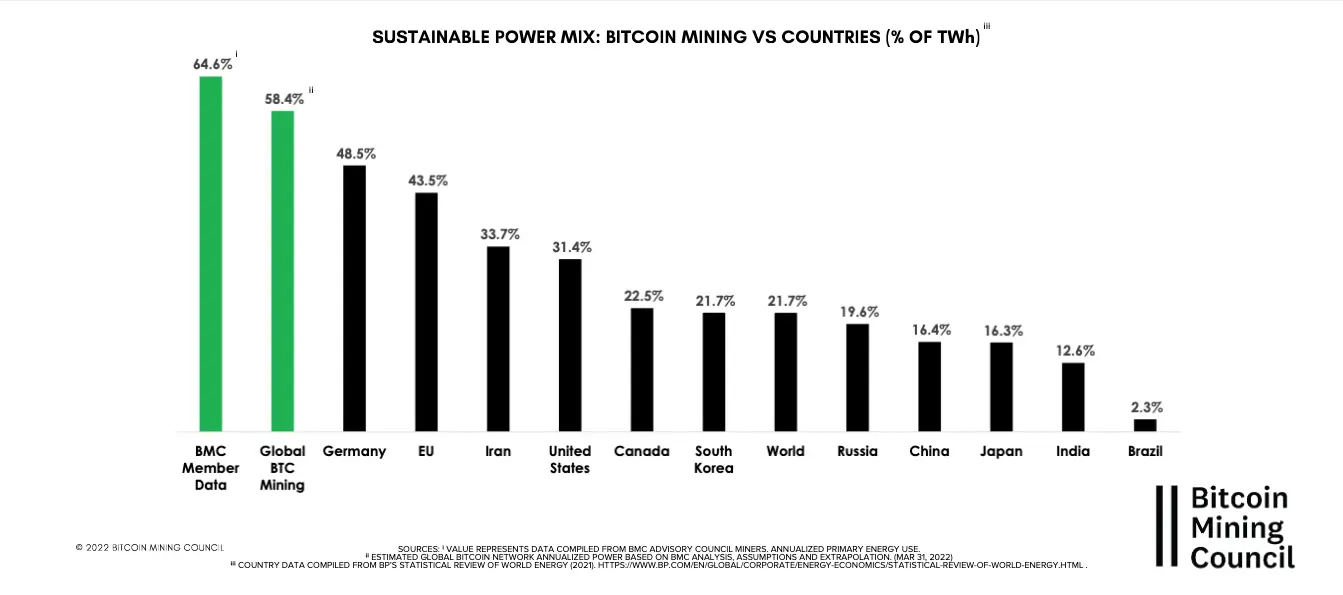

BMC surveyed its members about how much electricity their companies consume, what percentage of that electricity is generated by hydro, wind, solar, nuclear or geothermal power plants, and what their total hash rate is. The analysts concluded that green power sources account for 58.4 per cent of the mining companies’ consumption of the industry as a whole.

By the way, accepting bitcoins again as payment for Tesla cars was promised by Elon Musk. His stipulation was precisely to use more green energy when mining BTC.

Share of green energy in mining compared to some countries and regions

For miners within BMC itself, the share of green electricity is recorded at 64.6 percent. The aforementioned figures were obtained by extrapolating the survey results to the entire crypto-industry.

Back in the first quarter of 2021, BMC said that the figure was 36.8 percent. In other words, the share of renewable energy in mining companies has risen by about one and a half times in almost a year. Admittedly, the aforementioned figure of 36.8 percent is hardly very accurate, as the organisation itself was only founded in June 2021. Accordingly, the data may not be up to date.

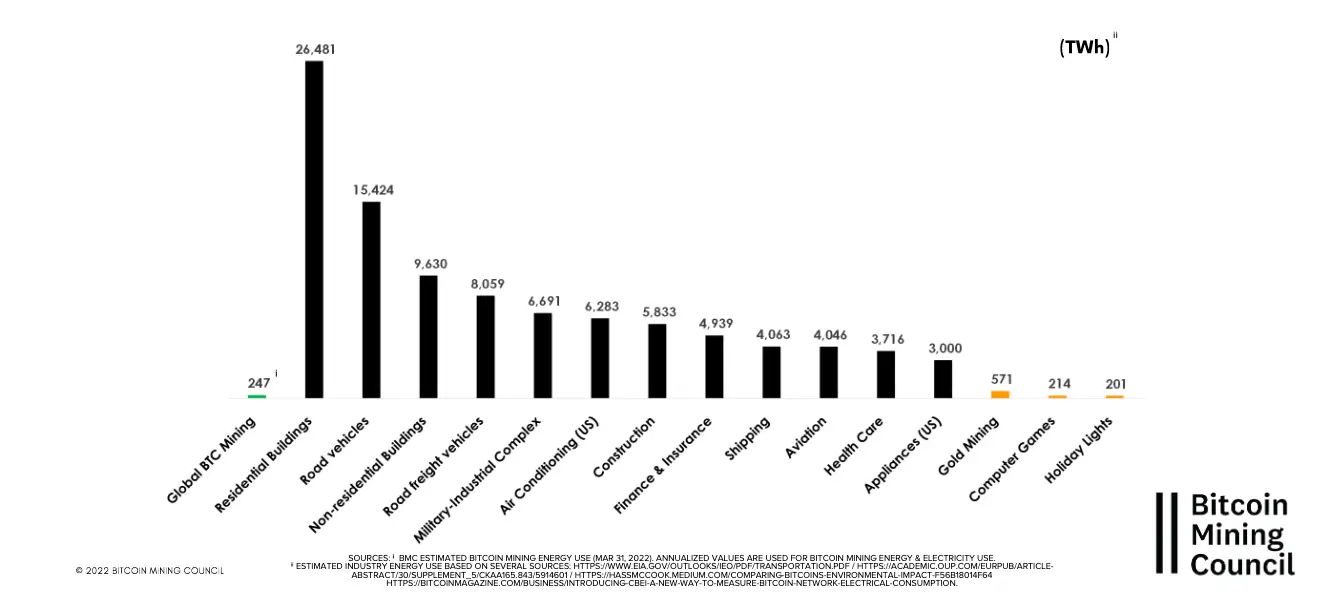

According to Cointelegraph’s sources, the report also provides an overall estimate of energy consumption across several sectors. From this information, it can be concluded that Bitcoin mining consumes approximately 247 terawatt hours per year, which is less than half of what gold mining operations consume – and 0.16 percent of the world’s total energy consumption.

Comparing the energy consumption of mining with other industries

Over the past 12 months, the energy consumption of miners has dropped by 25 per cent, while the hash rate has increased by 23 per cent, corresponding to a 63 per cent increase in mining efficiency since Q1 2021. BMC noted that mining the major cryptocurrency has become 5,814 per cent more efficient than it was eight years ago.

Mining efficiency

Read also: Russia may start developing state-level cryptocurrency mining to circumvent sanctions: IMF forecast.

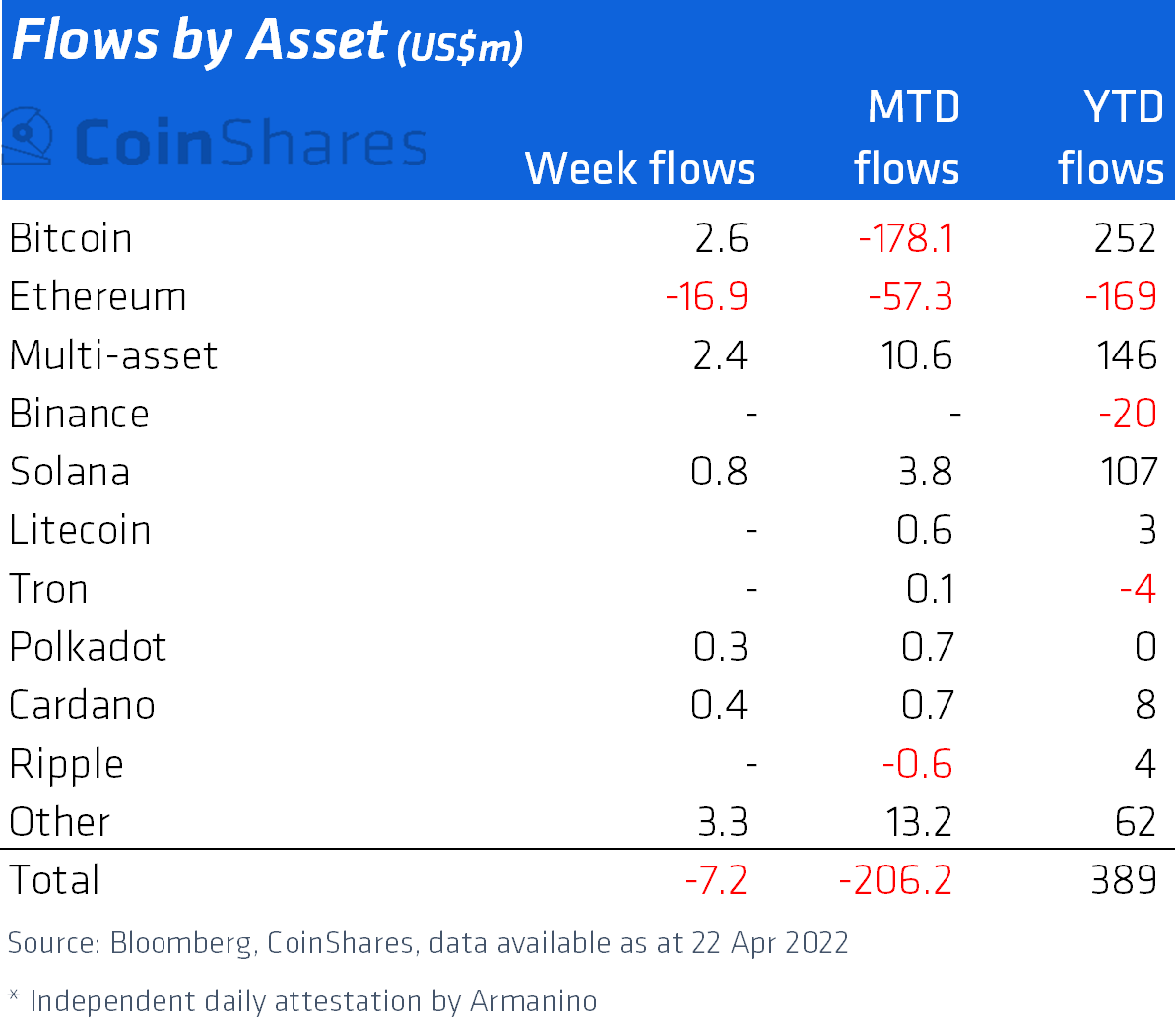

Even more interesting analytics were published by experts at CoinShares portal. It turns out that more institutional investors are turning their attention to Etherium’s competitors, as cash outflows from the ETH ecosystem have been increasing for the third week. Last week, investors were actively investing in Avalanche (AVAX), Solana (SOL), Terra (LUNA) and Algorand (ALGO). We’re only talking about $3.5 million, with capital outflows from Ethereum-based projects totaling $16.9 million in the same time frame.

Accordingly, some investors are also simply exiting their own trading positions, as the volume of withdrawals exceeds the amount invested in other alts. However, the trend is clear either way.

Inflows and outflows from various cryptocurrencies

This is the third week in a row in which there have been outflows from the Ether ecosystem, bringing the total for that time to $59.3 million, which is about 35 percent of the annual outflow of $169 million since January 1, 2022. Notably, last week saw an influx of investment into Bitcoin, albeit small, in the $2.6 million zone.

Over the past 10 weeks, inflows into the Etherium ecosystem have only reached $68.5 million, which may indicate some frustration among large professional investors with the altcoin. In contrast, Ether’s competitors have a positive news backdrop and improved fundamentals like higher throughput and low fees.

We believe that Bitcoin and other cryptocurrencies mining based on the Proof-of-Work consensus algorithm will continue to become more environmentally friendly. This is primarily in the interest of the miners themselves, as it ensures they have no problems with the authorities and regulators. And allowing further mining of crypto will make a positive contribution to the reputation of digital assets - as well as create conditions for its growth.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. We’ll talk about other topics related to blockchain and decentralisation there, too.