One of Mexico’s richest men reveals what percentage of his investment portfolio is in Bitcoin

Mexican billionaire Ricardo Salinas Pliego has said that 60 per cent of his liquid investments in his portfolio are dedicated exclusively to Bitcoin. Salinas himself is the third richest man in Mexico with a fortune of $12.8 billion. During his recent speech at the Bitcoin 2022 conference, he also noted that he does not own any bonds, but instead allocates free funds to crypto. We tell you more about his take on the blockchain world.

It should be noted that it's not just the Maxican billionaire who has allocated a significant portion of his investment portfolio to cryptocurrencies. The Canadian multimillionaire Kevin O'Leary, who was once a strong critic of Bitcoin, has also done the same.

BTC now accounts for 20 percent of his portfolio, with the figure previously being only 3 percent. Read more about it in a separate article.

Where billionaires invest

Ricardo Salinas is a longtime Bitcoin fan. Back in 2020, he publicly stated that he had allocated 10 percent of his investment portfolio to Bitcoin. At the time, he said the asset “protects citizens from misuse by governments”.

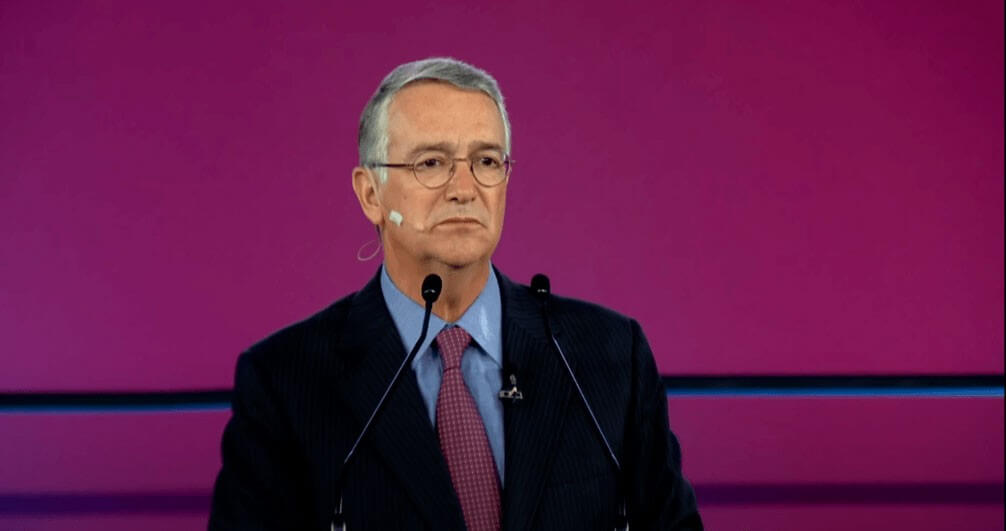

Mexican billionaire Ricardo Salinas

By today, the billionaire’s share of BTC in his total investments has grown sixfold. Here’s how he comments.

I really don’t have any bonds. I have a liquid portfolio – 60 percent in Bitcoin and assets closely related to it. Another 40 per cent in stocks of “hard” assets like oil, gas and gold – that’s enough for me.

What exactly the wording "assets closely related to Bitcoin" implies is unknown. It's likely that we're talking about shares in companies that mine BTC. Even if that is the case, such investments have arisen precisely because of a belief in the major cryptocurrency.

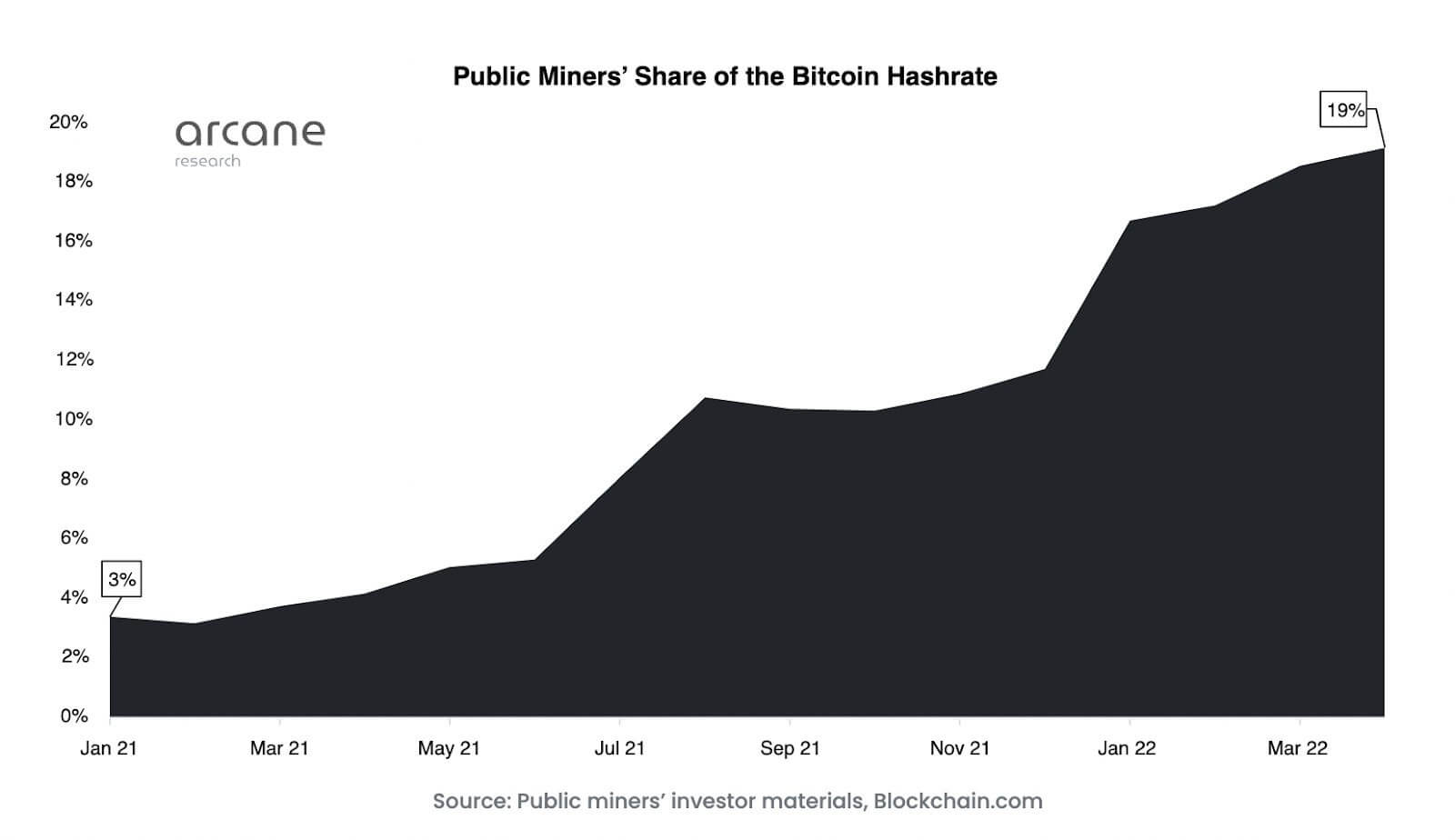

By the way, public companies now account for 19 percent of Bitcoin’s global network hash rate. That is, almost one-fifth of the total computing power of the BTC blockchain is provided by companies whose shares are traded on exchanges, Arcane Research analysts said the day before.

Share of public companies in total Bitcoin network hashray

According to Decrypt’s sources, Ricardo Salinas published a list of recommended cryptocurrency books on his Twitter account in October 2020.

These included The Bitcoin Standard by economist Saifidin Ammus. Shortly after these publications, he admitted to keeping Bitcoin in his portfolio. At first, Salinas did not disclose the exact amount of his investments in crypto, but after a while he revealed all his cards and even joined a flash mob of crypto-enthusiasts on Twitter by changing his profile description and adding a mention of the cryptocurrency there.

Mention of Bitcoin in the billionaire’s Twitter profile description

As we’ve already noted, Bitcoin is now getting more popular thanks to the Bitcoin 2022 conference being held in Miami. It has already become rich in high-profile announcements. One of them was voiced by PayPal payment platform co-founder Peter Thiel.

During his speech he sharply criticised big bankers and financiers – including Berkshire Hathaway CEO Warren Buffett, JPMorgan CEO Jamie Dimon and BlackRock CEO Larry Fink. Thiel accused the three financial tycoons of facilitating a system that has institutional and political bias against Bitcoin.

Central banks are bankrupt. We are at the end of the regime of familiar money.

That said, the co-founder of PayPal is convinced that Bitcoin is the ultimate alternative to the entire traditional financial system.

Bitcoin is not Etherium as a payment system, it is not e-gold, it is something like the S&P 500, it is the stock market in general.

PayPal co-founder Peter Thiel

Although Etherium is the second most capitalised cryptocurrency, Thiel is not sure that Vitalik Buterin’s project can sustain its status in the long term. The reasons for this are too high fees and relatively low bandwidth with high network congestion.

Bitcoin and Etherium are two extremely opposite ends of the spectrum.

Note that Bitcoin's bandwidth - that is, the number of transactions the network can handle per unit of time - is lower than that of Etherium. Therefore, the point of this claim seems unclear. In addition, the integration of so-called sharding into the Eth network after it is updated and moves to the Proof-of-Stake consensus algorithm will make the blockchain much more efficient.

In his speech, Peter Thiel did not ignore the technology industry, but also attacked liberal-minded companies like Meta. In his opinion, such companies are trying to satisfy governments as best they can, which is nothing like the philosophy of Bitcoin.

Liberal companies are sort of completely controlled by the government in a way that Bitcoin never will be.

Mark Zuckerberg and Libra

The overall view of the experts is that Bitcoin is the only powerful alternative to the shortcomings of the current financial system. And cryptocurrency has every chance of replacing it as global acceptance grows. We believe this process has already begun and is irreversible, so over time, digital assets will become more and more ubiquitous.

You can also accelerate this process by subscribing to our Millionaire CryptoChat. There we discuss all possible developments from the blockchain world.