The delights of Bitcoin: how a 28-year-old crypto investor bought a house for his mother

Cryptocurrencies can completely change a person’s life for the better. The story of a 28-year-old crypto-enthusiast named Alan, who shared his successes in an interview with the Cointelegraph news outlet, is a prime example of that. Thanks to Bitcoin, he was able to facilitate the purchase of a house for his mother as a gift. The crypto investor got the money to buy the property as a loan secured by Bitcoin. We tell you more about what’s going on.

Note that making money from cryptocurrencies is a fairly common topic. First of all, this can be guessed after analyzing the most profitable coins in 2021, some of which have grown by more than 10 thousand percent. We can also think of the ranking of the most profitable countries, which was published last week. According to the analysts' study, the record-breaking state here is Switzerland.

On average, the crypto investor made $1,268 from there over the course of a year. Here it is important to understand that the amount of initial investment is different for each person, so with $100 invested this earnings is more than decent.

How are cryptocurrencies used?

Alan first started using Bitcoin back in 2012, after learning it was a useful currency for buying things online. That’s when he purchased his first BTC through a P2P service called LocalBitcoins, a review of which we’ve already seen. Alan described the process of buying Bitcoin as a “bizarre experience”.

According to him, 10 years ago buying a cryptocurrency was really an experience, but now it’s commonplace. Still, buying crypto is much more convenient now, thanks to the plethora of platforms and exchanges.

During his university years, Alan’s interest in Bitcoin waxed and waned. This continued until 2014, as the “less than £100” or $130 that Alan had in crypto turned into “a couple of thousand”. Here’s the investor’s rejoinder with which he shares details of what happened.

Bitcoin has had real benefits, from buying things online to having real value. Now I have anonymous money, or “fairly anonymous” money, of real value.

As a reminder, Bitcoin's blockchain - that is, the distributed register of all transactions and addresses - is publicly accessible. This means that anyone can examine its contents and find out when and how much of the transactions were made by the owner of a particular wallet. By the way, this is why digital assets are not suitable for criminals, as former CIA chief Michael Morell once confirmed.

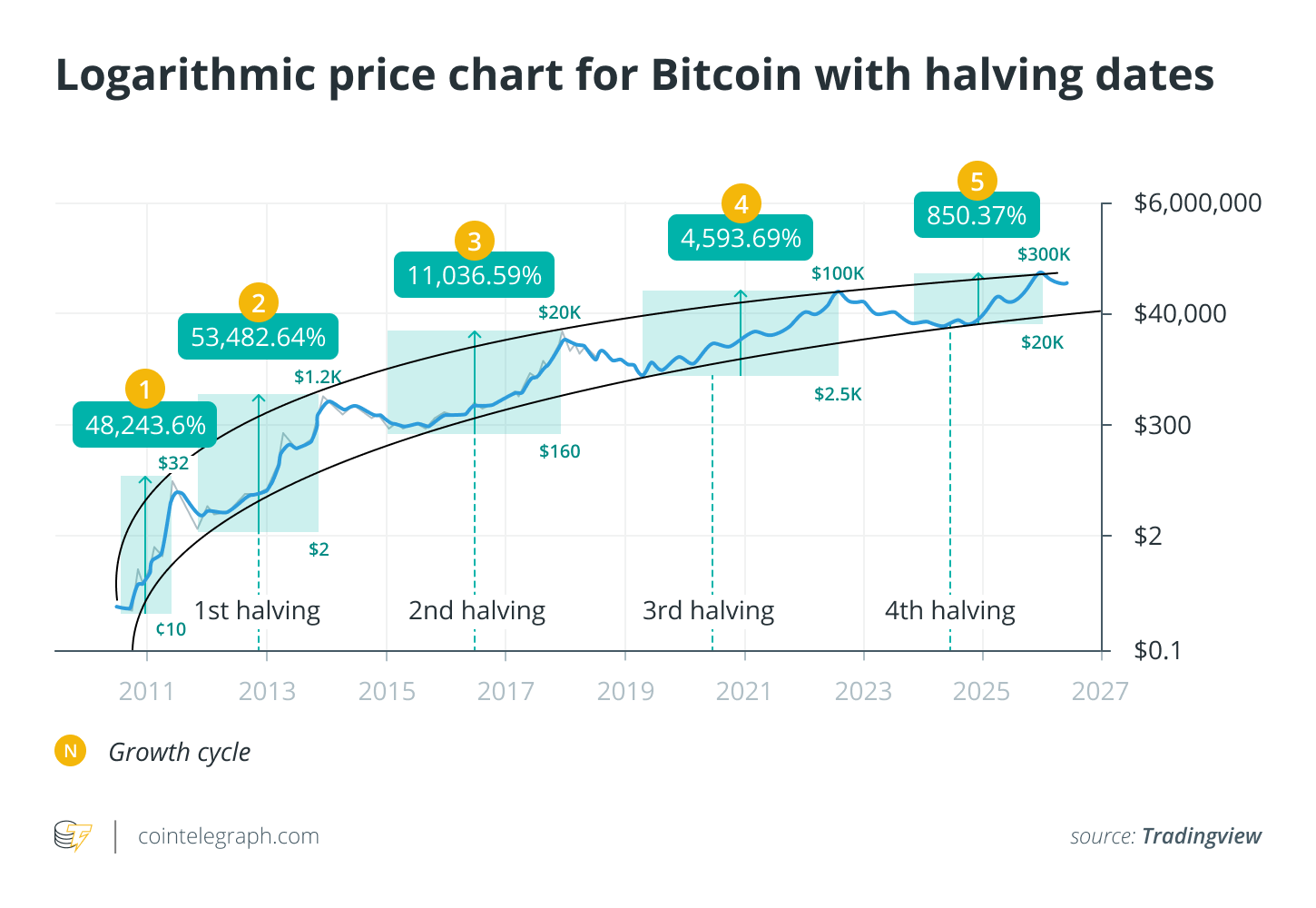

Bitcoin price rise and cryptocurrency halving cycles

Let’s take it back to 2016. The price of 1 BTC was around $750. Alan knew it was “something worth buying”, but he was still a student and had gone headlong into his exams. He continues.

I had no cash and all the bitcoins I had I used to buy the things I needed.

Later, the crypto-enthusiast spoke to his father, who was persuaded to invest in crypto. Unfortunately, Alan’s father did not go beyond promises and interest in Bitcoin: he never helped his son with a BTC investment in 2016. The following year, the Bitcoin bullpen began, and the cryptocurrency’s price reached nearly $20,000 at its peak. Consequently, Alan’s remaining cryptosavings also went up significantly in value.

In the summer of 2021, when the price of the coin reached $40,000, Alan’s family started thinking about buying real estate. He knew how he could help, and even better, he knew he could take out a loan so he wouldn’t even have to sell anything from his crypto portfolio.

He chose the Celsius platform to get the cash. Despite his interest in other cryptocurrencies and knowledge of decentralised finance, Alan explained that using a centralised financial provider offers a “lower risk perception” because they are backed by venture capital.

Centralised platforms should be a little more resilient than DeFi-protocols.

Loan in Celsius secured against cryptocurrencies

On his sister’s birthday in August 2021, Alan took out a loan on the platform for 25 percent of the value of his crypto assets at 0 percent APR, secured against bitcoins. He quickly wired the money to his mum, and as a result, the amount of money needed to buy a property was immediately collected. Alan provided 2.08 BTC as collateral to get $25,000 to buy with a loan term of 36 months.

We believe that crypto is a world of huge opportunities that everyone has a chance to realize. With digital assets, even relatively small amounts can be turned into a fortune. True, one has to be aware of the risks and intricacies of the industry, as well as be able to secure crypto. Still, even coins in the perennial hodgepodge will prove worthless if fraudsters get their hands on them.

For more information on what’s going on, check out our Millionaire Crypto Chat. There we will discuss other important news related to the world of blockchain.