The owner of the NFT with the first ever tweet wants to sell it for $50 million. He’s only being offered a couple of thousand

The first tweet in the form of NFT was purchased by businessman Sina Estvi last year for $2.9 million. Now, Estavi hopes to resell the unique token for at least $50 million. The plans are very ambitious, but so far they are very much at odds with reality – in the token resale auction, the highest bid from buyers is recorded at just $14.4 thousand or 4.76 ETH. We tell you more about what’s going on.

To recap, a tweet with a short message “just setting up my twttr”, i.e., “setting up my twttr”, was bought by Estvi for 1630.6 ETH, or approximately 2.9 million dollars at the exchange rate of the altcoin at the time. The businessman himself compared NFT to the Mona Lisa and in addition calls himself “the owner of the first tweet in history” in his Twitter account biography.

Estvi’s Twitter account

The author of the tweet is Twitter platform co-founder Jack Dorsey, who is no longer associated with the company at the moment. Immediately after the sale, Jack converted the ethers received into bitcoins and then donated them. Apparently, this action was fundamentally necessary, as Dorsey belongs to the so-called Bitcoin-maximalists. In other words, he considers only BTC to be a worthwhile cryptocurrency, while being hostile to the Web 3.0 world, which includes NFT tokens.

Moreover, Jack voiced his position to the new generation of the Internet quite clearly. In particular, his criticism was voiced in December 2021, about which we wrote in detail.

Be that as it may, none of this prevented Dorsey from contacting NFT and using the Etherium network to make money. However, as it turns out a year later, no one is particularly interested in this tweet.

How NFT tokens are losing money

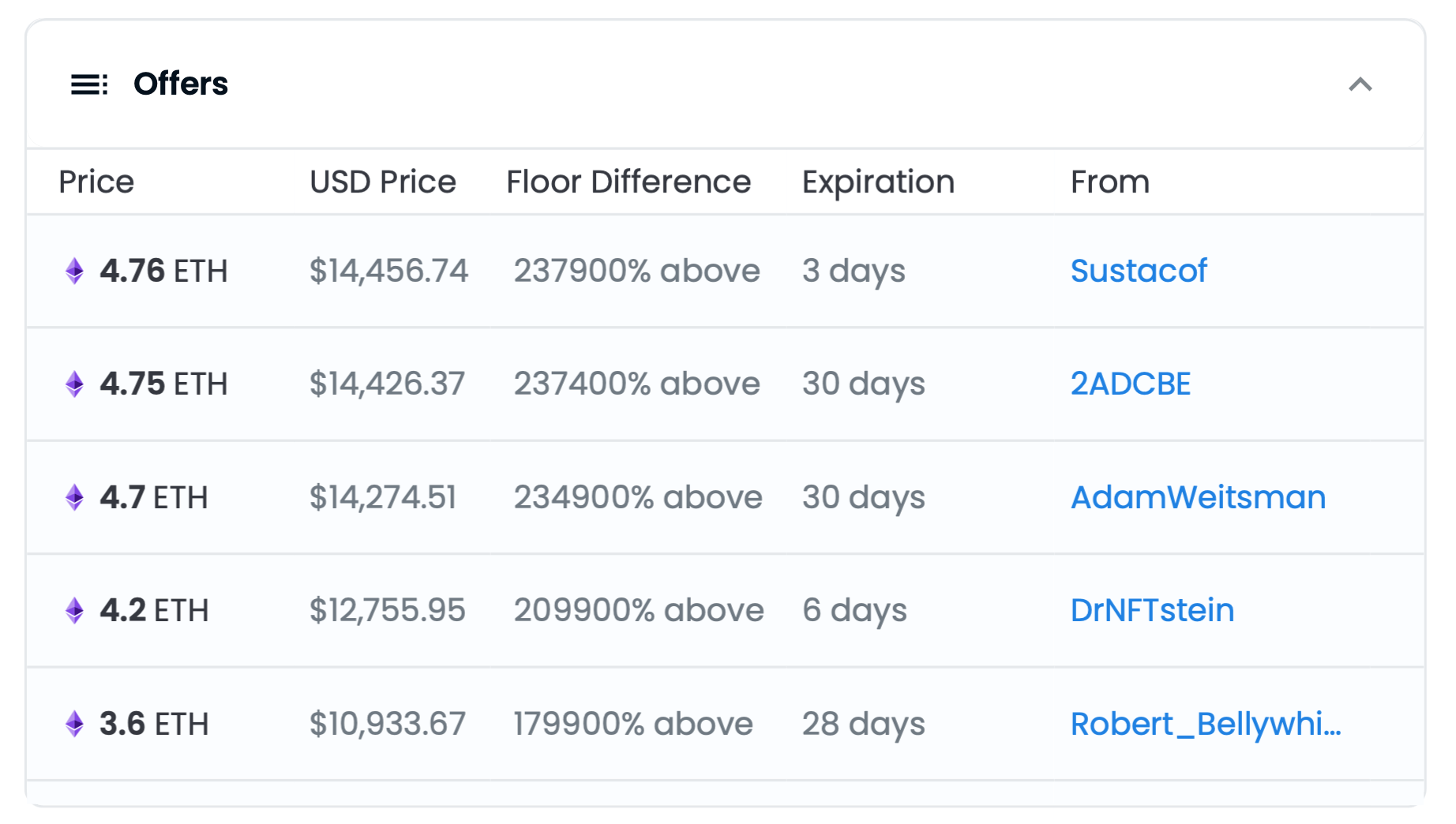

We checked the current data: as of the beginning of the weekend, the biggest offer for the first tweet in the world is a bid of 4.76 ETH, or the equivalent of $14.45 thousand. At the same time, Estvi himself, as we have already noted, expected to make at least 50 million for the unique token and part of the internet’s history.

Highest bids for NFT with the first tweet

You can see the current figures directly on the auction page.

Earlier, Estavi announced his willingness to donate half of the proceeds from the sale of NFT to the charity GiveDirectly. Asked by Dorsey himself why not donate the full 99 per cent, Estvi said he also wants to support other blockchain projects and his own company Bridge Oracle.

That NFT

According to CryptoPotato’s sources, Bridge Oracle’s reputation is far from the best: Esstavi is often accused of cheating and even fraud in his position. Moreover, last year he was arrested in Iran on charges of “damaging the economic system”.

BlackRock CEO Larry Fink

Fortunately, there may soon be a much bigger player in the cryptosphere – investment firm BlackRock. The day before, its CEO Larry Fink said that BlackRock’s management has started to take a closer look at the prospects of the crypto industry. How exactly this will end is unknown. However, analysts assume that the giant will still begin to engage with digital assets.

By the way, BlackRock representatives have previously shared positive comments about Bitcoin. For example, in November 2020, they suggested that the main cryptocurrency could well replace gold. During the same interview, the investment company's CIO, Rick Reeder, noted that digital assets themselves will no longer go anywhere, as the class has become extremely popular.

Cryptocurrency investor

We think this situation clearly shows just how powerful a trend shift the cryptocurrency industry can be. Indeed, in the spring of 2021, NFT tokens were selling like hotcakes, with real competition and competition for the first tweet in the form of a non-interchangeable token. But now - without a serious hype around the niche and not the best state of the market in general - they are offering just under $15,000 for such a hit. And this is a good lesson for investors who wanted to buy up popular NFTs on a market crash in anticipation of their rise in the next cycle. There's a chance that interest in a certain collection will simply fade.

What do you think about this? Share your opinion in our millionaires cryptochat. There we will talk about other topics related to the world of blockchain and decentralisation.