A cryptocurrency exchange has made it into the Fortune 500 for the first time. What does this mean?

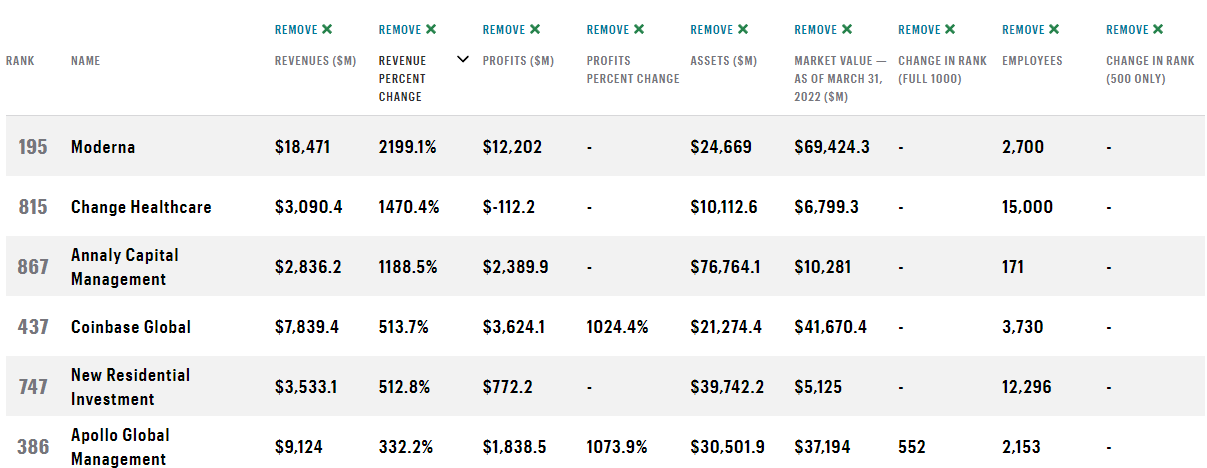

The largest US cryptocurrency exchange called Coinbase has become the first cryptocurrency company to enter the Fortune 500. As a reminder, it is a list compiled annually by Fortune magazine based on the valuation of the 500 largest corporations in America. The exchange generated $7.8 billion in revenue in fiscal year 2021, ranking 437th on the list. However, Coinbase’s revenue growth rate, which was the equivalent of almost 514 per cent, is just behind several giants in the top 500 ranking. Talk about what’s happening and its importance in more detail.

It’s not the first time the digital asset niche and its representatives have found themselves on all sorts of lists from popular publications. In particular, in April 2022, Forbes compiled a list of cryptocurrency riches, i.e., people associated with the decentralization industry.

Then the leader of the ranking was the founder of Binance, Changpen Zhao, who is not the first time he appears in this role. His fortune is estimated at $65 billion, although the year before the corresponding figure was $96 billion. You can read more about the statistics at the link.

How cryptocurrencies are getting more popular

Most interestingly, the top spot in terms of revenue growth was the pharmaceutical company Moderna, whose balance sheet revenues increased by almost 2,200 percent over the year. Moderna and Coinbase were the “lucky ones” who were able to benefit hugely from the COVID-19 pandemic. This was stated by Fortune editor Alison Shontell.

Coinbase CEO Brian Armstrong

According to Decrypt sources, cryptocurrency platform Coinbase has also taken advantage of the growing popularity of cryptocurrencies amid the pandemic. Before the total cryptocurrency market surpassed $3 trillion in November 2021, Coinbase advertised itself everywhere from the NBA to cyber sports as the best place to invest in digital assets.

The already legendary Super Bowl ad stands out. We're talking about a viral video that mimicked the old screensaver from DVD players, but with a QR code. The code led to a registration page on the platform and also promised bonuses. In the end, however, there were questions about the authorship of this campaign.

Coinbase in the Fortune 500

However, Bitcoin’s price is currently at its lowest level since Coinbase went public in April 2021. The company’s stock has fallen more than 80 per cent since its November high, and first-quarter revenue was less than half of the previous quarter’s amount. The monthly number of active users also fell by more than 2 million during that time.

For many investors, however, the market decline was not a cause for depression. Among them is the founder of hedge fund Bridgewater Associates, Ray Dalio. He confirmed earlier that he still holds a “small portion” of his investment portfolio in Bitcoin, according to CryptoPotato. In an interview with CNBC, Dalio reiterated his “cash is rubbish” thesis because of the rate at which their holders are losing purchasing power. Annual inflation in the US was 8.3 per cent in April, just 0.2 per cent below the previous month’s 40-year high.

Dalio himself mentions the crypto-asset sector quite often. Alas, one of his most recent remarks was to say that Bitcoin is not a good competitor for gold. However, as a hedge against global inflation, BTC has a good chance, the entrepreneur noted.

To combat this, the Federal Reserve has decided to raise interest rates more aggressively than in the past two decades. However, this tightening of monetary policy is already hitting equities, which Dalio said are even “crappier” than cash.

Bridgewater Associates founder Ray Dalio

The billionaire believes that the US Federal Reserve’s actions in pumping money into the economy have created unprecedented debt, which will lead to “negative real returns” across the board. In the interest of diversification, he mentioned Bitcoin, which deserves a small role in the investment portfolio as “digital gold”.

We think the event can be taken as another reminder of the youth of the digital asset industry. After all, Coinbase is the first exchange to be included in this ranking, which means that nothing like this has ever happened before. This means that there is still more than enough room for development in the industry, even in the current environment.