Bitcoin balances at $30,000. How have traders and investors reacted to the collapse?

The crypto market capitalisation fell to $1.4 trillion this week, with the price of Bitcoin dropping even below the $30,000 line for a while. The dramatic collapse of almost all popular altcoins legitimately caused panic in the market. CoinShares and Glassnode analysts reviewed the behavior of individual traders, high net worth investors and entire companies with BTC on their balance sheets in more detail in their latest reports. Here’s a more in-depth look at the situation.

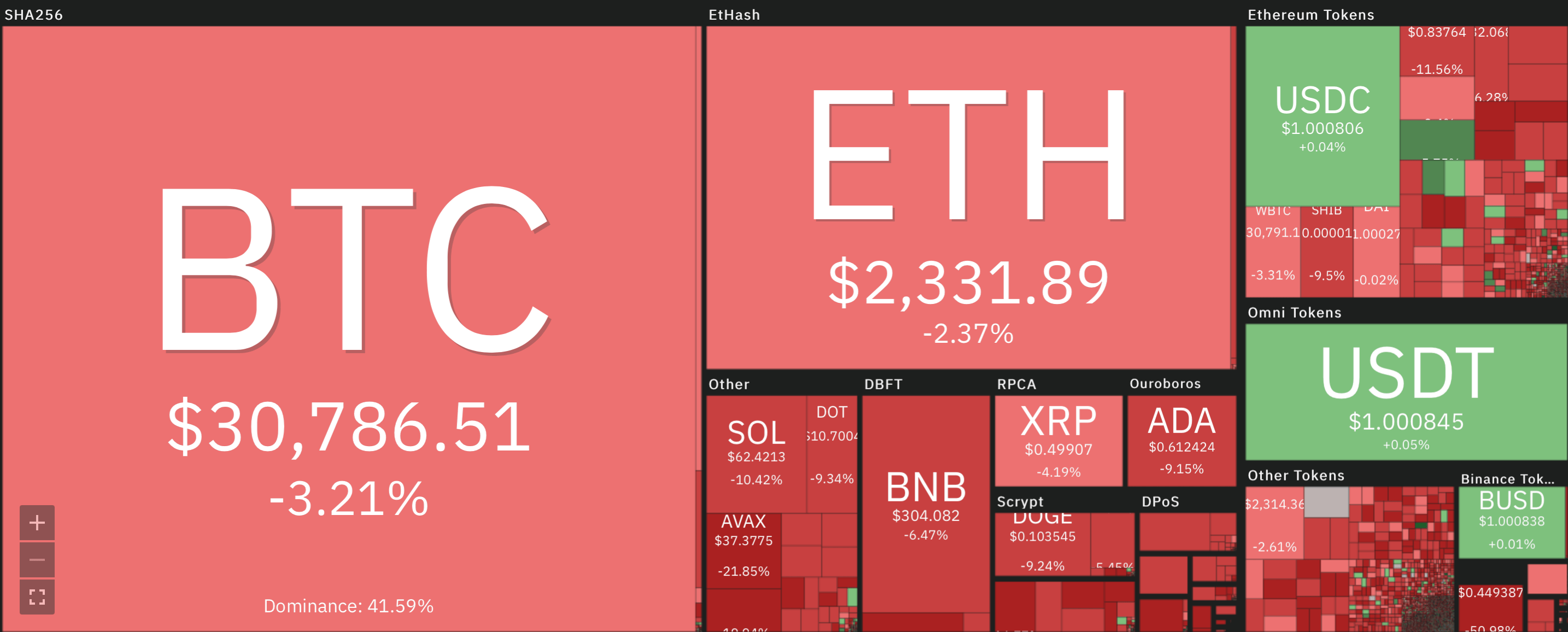

In general, what is happening in the market can be characterized by the following screenshot.

Situation in the cryptocurrency market

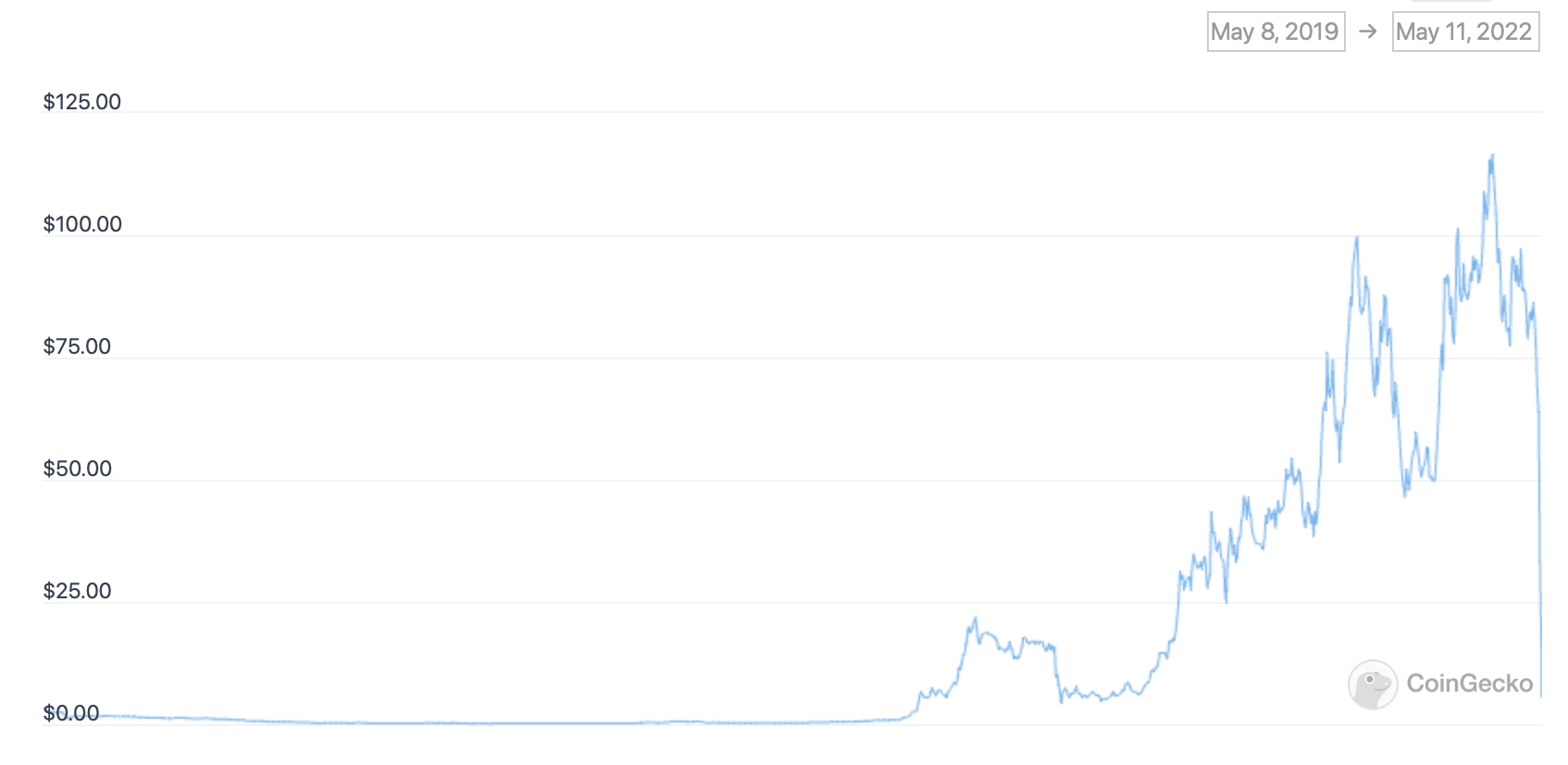

The leader of the fall due to problems with Terra and its UST stablecoin was Luna. The coin’s price dropped more than 83 per cent overnight, from $34 to the current $5. Within a week, the crypto’s exchange rate collapsed by 93 per cent altogether. Here’s a chart of the cryptocurrency over two years.

Luna exchange rate chart over time

Why did the cryptocurrency market collapse?

Analysts have looked at evidence that some investors have used price “turbulence” to move assets into Bitcoin, Etherium and exchange-traded products based on other cryptocurrencies. However, it is worth noting that, unlike individual market players, wealthier investors with more capital – often referred to as “whales” – tend to have enough of a financial cushion to weather the storm in the market. In other words, a further drop of a couple of dozen percent in the industry will not leave them hungry, something which is also important for the individual investor to bear in mind.

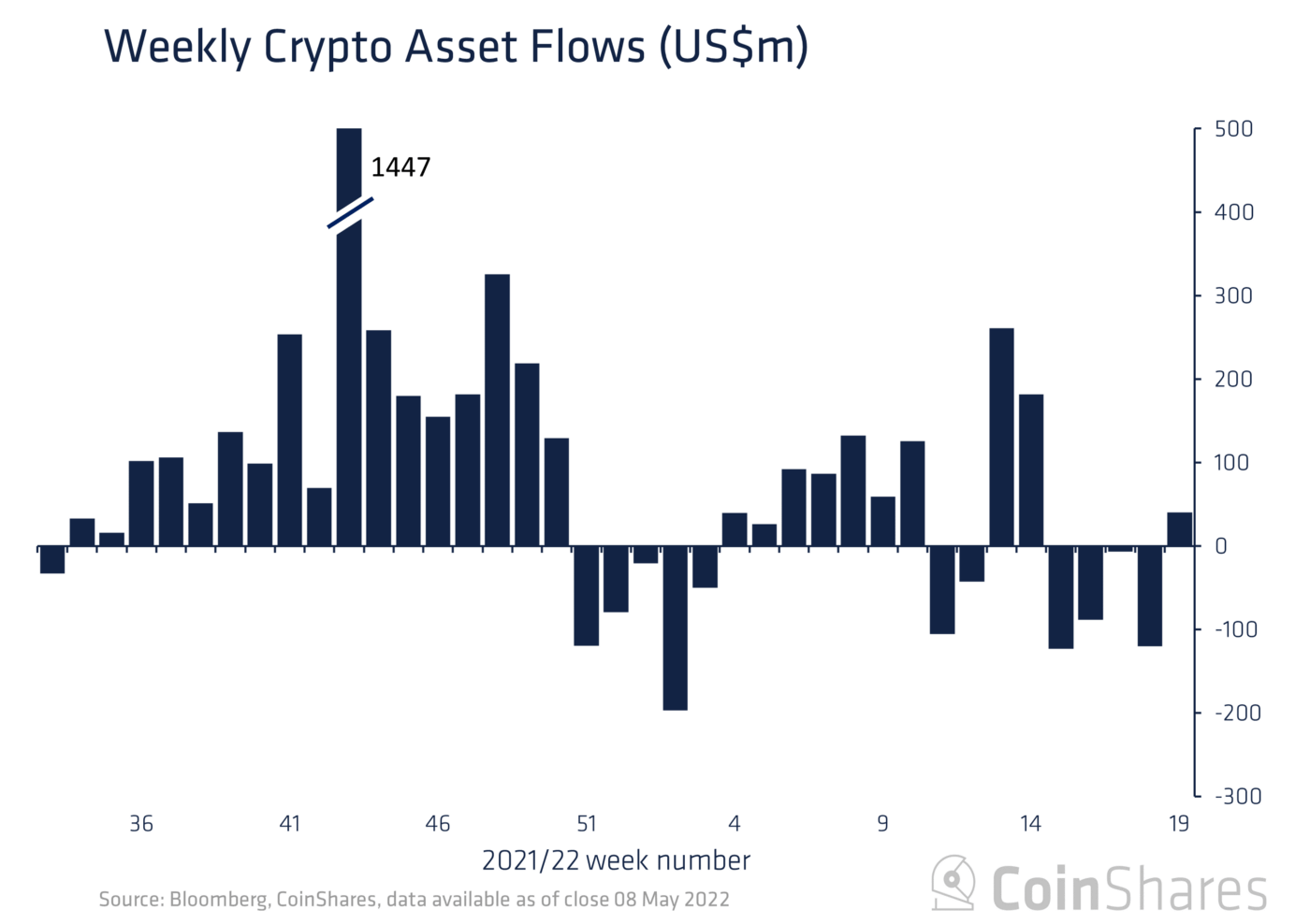

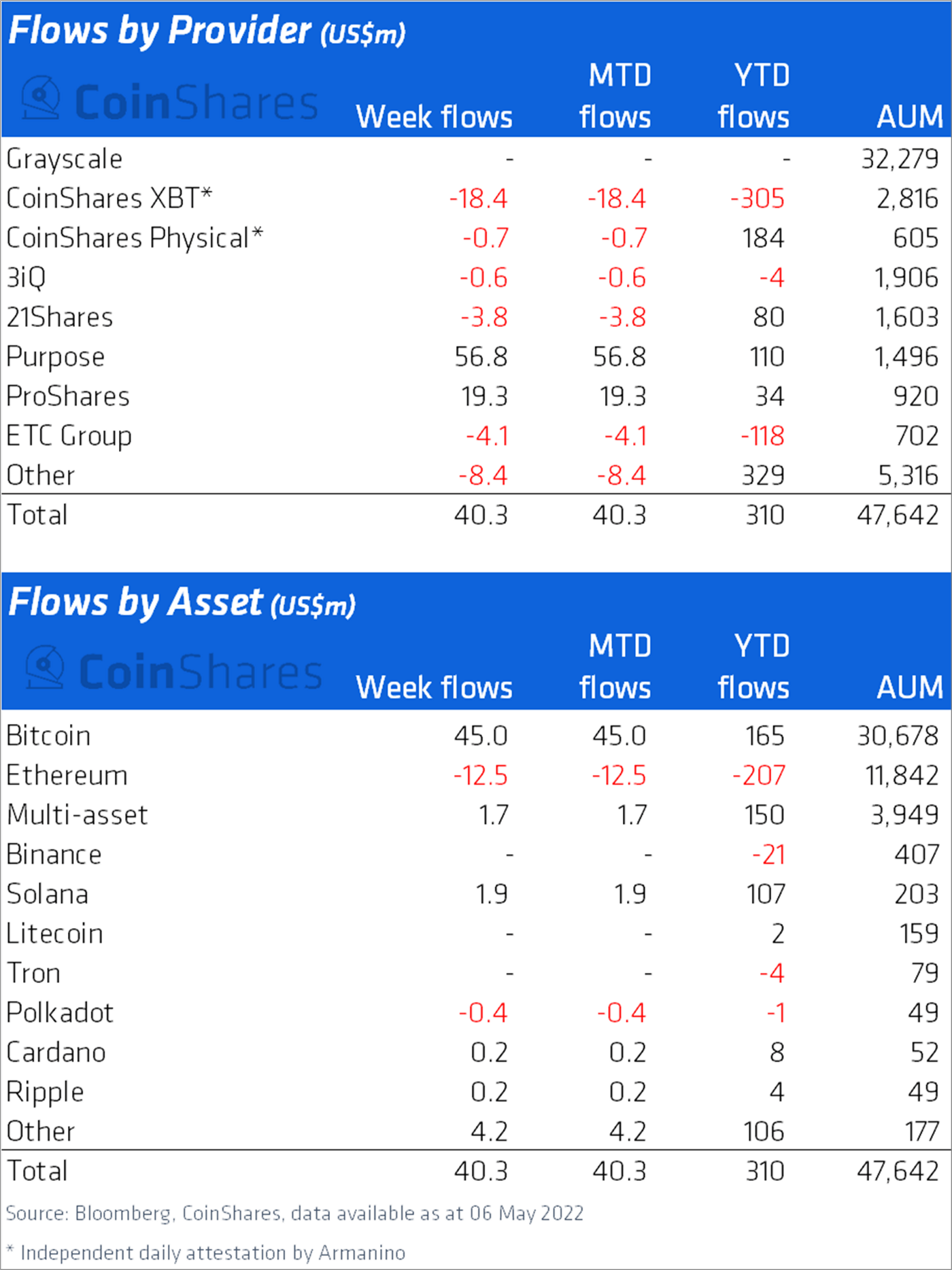

Over the past week, net inflows into investment products amounted to $40 million. Separately, about $45 million was invested in the Bitcoin ecosystem. This is a sign that investors are taking advantage of the situation to get into a limited number of investment products based on the major cryptocurrency given the collapse. Then again, however, the big players will have money to buy crypto in the coming months.

Overall inflows/outflows into the crypto industry

According to Decrypt’s sources, Grayscale Bitcoin Trust (GBTC) units could be one such investment. They fell in value by 19 per cent, while the value of Bitcoin itself fell by more than 23 per cent – all in the last five days. James Butterfill, head of research at CoinShares, commented on the situation. Here’s his rejoinder.

Interestingly, we haven’t seen as much of a surge in investment product trading activity as we’ve usually seen in previous periods of market decline. It’s too early to tell if this is the end of the 4-week period of cryptocurrency collapse.

Cash inflows and outflows across different cryptocurrencies and investment products

One possible reason for this trend is that traders believe that the current downtrend will be weaker than previous ones. In other words, one should not expect such serious collapses as during the previous “crypto-zima”, some believe. To recap, Bitcoin’s value has fallen by nearly 85 percent since reaching its all-time high. If these figures are extrapolated to the current situation, BTC could allegedly fall to almost $10,000.

Read also: Cardano's creator has claimed the start of a new "crypto-zima". Is this really the case?

But while someone is panicking, the Salvadoran government is seizing the moment to accumulate even more BTC on its balance sheet. This week, the country’s president, Nayib Buquele, announced on Twitter that the state had acquired another 500 BTC for about $15.3 million. The total amount of bitcoins in the government’s balance sheet has thus far surpassed 2,300 BTC, or $72.5 million at the current exchange rate.

El Salvador just bought the dip! 🇸🇻

500 coins at an average USD price of ~$30,744 🥳#Bitcoin

– Nayib Bukele (@nayibbukele) May 9, 2022

As a reminder, in September 2021, El Salvador became the first country in the world to make Bitcoin legal tender. While many supporters of the cryptocurrency welcomed such a bold move, it has sparked mixed reactions around the world. In particular, it has been criticised by the International Monetary Fund (IMF) and some US officials.

In addition to seeking opportunities for geothermal BTC mining, the country is also gradually building its own coin balance for its reserves. However, it is not yet clear who exactly is buying Bitcoin - Bukhele himself or the government. During the previous round of BTC buying, El Salvador already had unrealised losses because of this strategy. And a new round of coin purchases with the crypto market falling further could only make things worse.

El Salvador’s President Nayib Bukele

The bad news in the coin industry doesn’t end there. The CEO of mining and investment platform Mining Capital Coin (MCC), Luis Capucci Jr, has been charged with a $62 million fraud that has affected thousands of investors. According to a press release from the US Department of Justice, Capucci promised to use the investment to mine cryptocurrencies, but instead diverted funds to cryptocurrency wallets under his control. Capuzzi also fraudulently advertised MCC “trading bots”, claiming they were capable of performing “thousands of transactions per second” and generating profits for investors.

The indictment alleges that Capuzzi created a pyramid scheme by promising gifts to a network of promoters if they successfully attracted new investors. iPads, Apple watches and even the fraudster’s personal Ferrari were offered as rewards. Naturally, no one received the promised prizes and it is unlikely that they even existed in reality.

Luis Capucci Jr.

According to Decrypt’s sources, the suspect faces up to 45 years in prison if found guilty on all charges. He faces charges of wire fraud, securities fraud and international money laundering. Assistant Attorney General Kenneth Polight, Jr. of the US Justice Department’s Criminal Division commented on the situation.

Cryptocurrency fraud is undermining financial markets around the world as criminals defraud investors and limit the ability of legitimate entrepreneurs to innovate in this emerging sector. The department intends to monitor physical and digital money to expose criminal schemes, bring fraudsters to justice and protect investors.

Law-abiding businessmen are indeed making a useful investment in adopting innovation. Recently, a subsidiary of SBI Africa Co. Ltd called SBI Motor Japan announced that its customers can now make payments for used cars using Bitcoin and XRP.

SBI Motor Japan

According to Monday’s SBI announcement, the development marks the first use of XRP in cross-border e-commerce in Japan. BTC and XRP transactions will be settled on SBI VC Trade Co. Ltd, a cryptocurrency exchange owned by SBI. The platform, according to SBI, will use appropriate security practices to prevent money laundering and terrorist financing through cryptocurrency transactions.

We believe that the current conditions in the cryptocurrency market are far from ideal. However, this is not the first time the niche has experienced something like this, so this situation is unlikely to destroy the industry. Yes, many projects can hardly survive such tricks, but the most worthy and proven companies will not only survive the bearish trend, but will make it to the next bull run.

What do you think about this? Share your opinion in our millionaires cryptochat. We’ll talk about other topics there as well.