Could Tether’s USDT collapse the way Terra’s UST Stablecoin collapsed? Response from company spokesperson

The Tether (USDT) team has announced a coordinated process to transfer USDT tokens from the Tron blockchain to Ethereum and Avalanche. This comes amid the current collapse of UST and Luna. Recall that the TerraUSD (UST) algorithmic stackcoin lost its parity to the US dollar this week, with its associated coin LUNA depreciating almost completely. Should investors be nervous about the situation, or are USDT and UST completely different things? We tell you more about the situation.

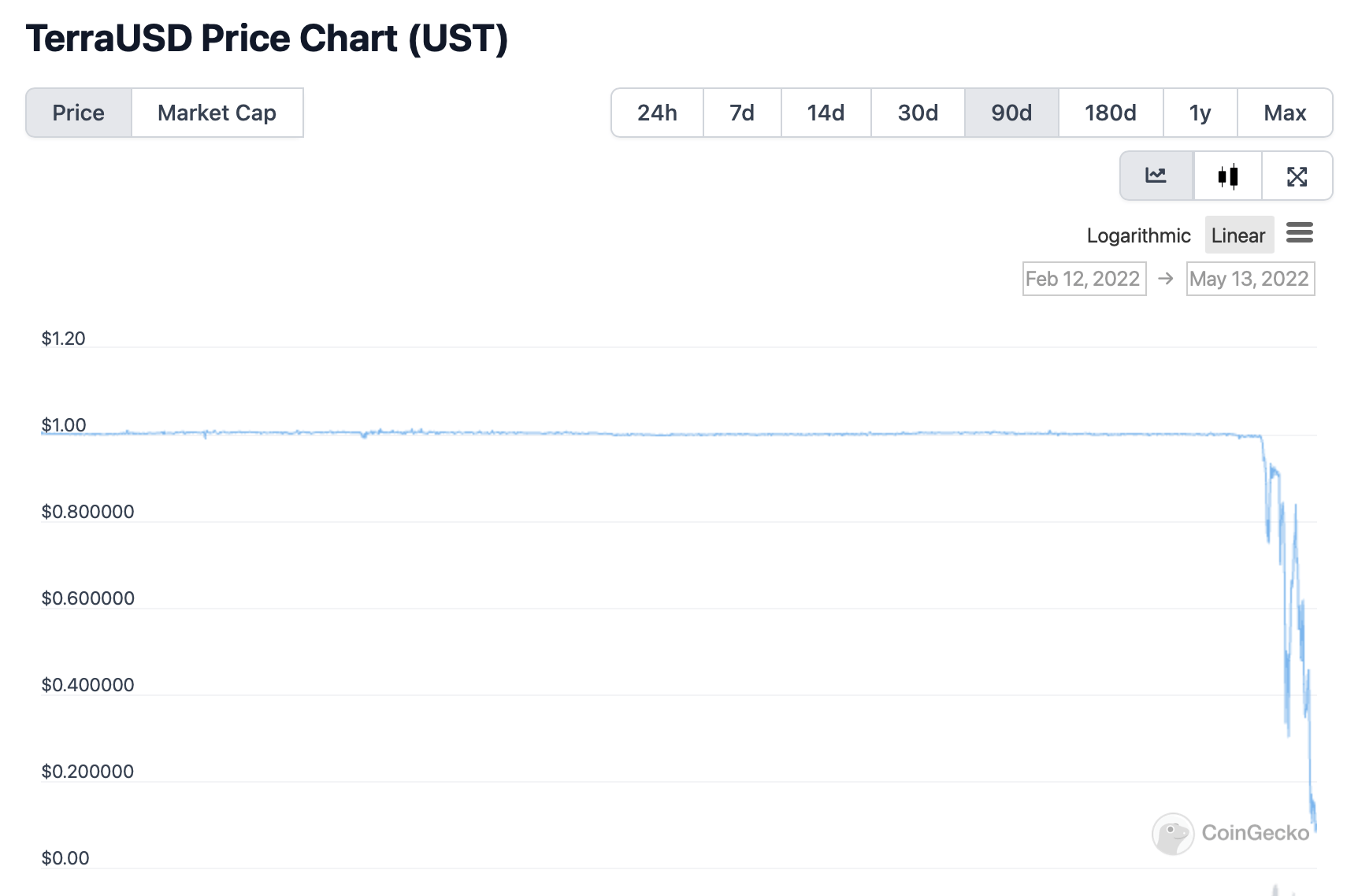

Recall that the situation with UST and Luna was simply disastrous. UST was never able to regain parity with the dollar, while Luna collapsed to a cent and continued to collapse at least a thousand times more.

Current Terra LUNA exchange rate

The UST chart doesn’t look any better. According to Coingecko, the Stablecoin’s exchange rate has fallen below 10 cents today. Consequently, holders of money in this coin have suffered serious losses.

UST exchange rate chart

Against the backdrop of the developments, exchanges have taken to delisting UST and Luna. In particular, representatives of the Woo X platform announced a decision tonight.

LUNA chart on the exchange Woo X

In the afternoon, representatives from Binance took similar action. Now when you try to enter the chart UST displays the following announcement.

Luna and UST are no longer on the Binance exchange

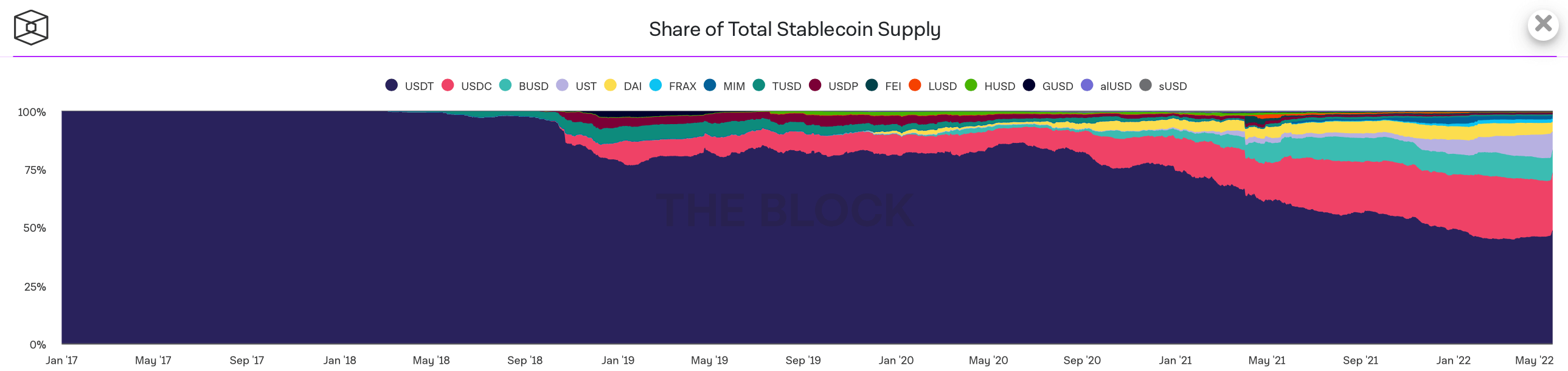

As a result, traders got nervous and for some reason shifted the situation from UST to the market leader USDT. We checked the current data: USDT from Tether (in blue) accounts for 48.52 percent of the market today.

Stablecoin niche distribution

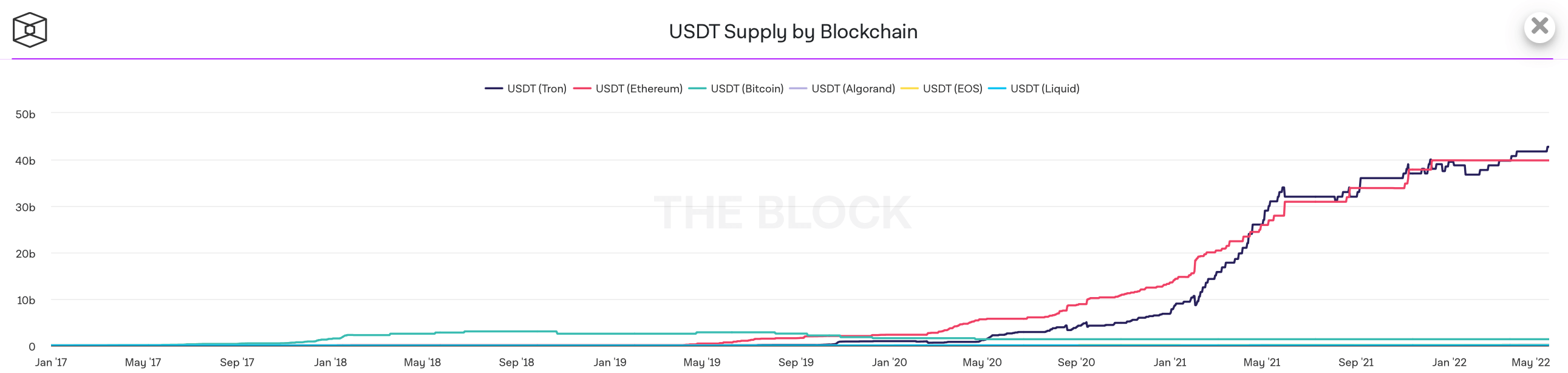

USDT has a capitalisation of $84.17 billion out of a total of $173 billion in the entire niche. According to The Block, the blockchain Tron (in blue) accounts for the largest share of the coins: we are talking about USDT 42.74 billion. Efirium comes in second with 39.82 billion.

Distribution of Tether USDT between blockchains

What’s going to happen with Tether USDT

Let’s start with information about the transfer of coins from the Tron blockchain. 1 billion USDT will be transferred from Tron to Ethereum, another 20 million will be transferred from Tron to Avalanche. Tether’s official Twitter account was quick to assure that the procedure will not affect the total number of tokens in any way. A statement to that effect was made on the company’s Twitter account.

In a few minutes Tether will coordinate with a 3rd party to perform a chain swap, converting from Tron TRC20 to Ethereum ERC20, for 1B USDt and from Tron TRC20 to Avalanche, for 20M USDt. The #tether total supply will not change during this process.

– Tether (@Tether_to) May 12, 2022

Accordingly, Tether will remain the leader in terms of USDT volume, although the gap with the Eth network will shrink. Which means Tether has no plans to "run away" from the Tron network.

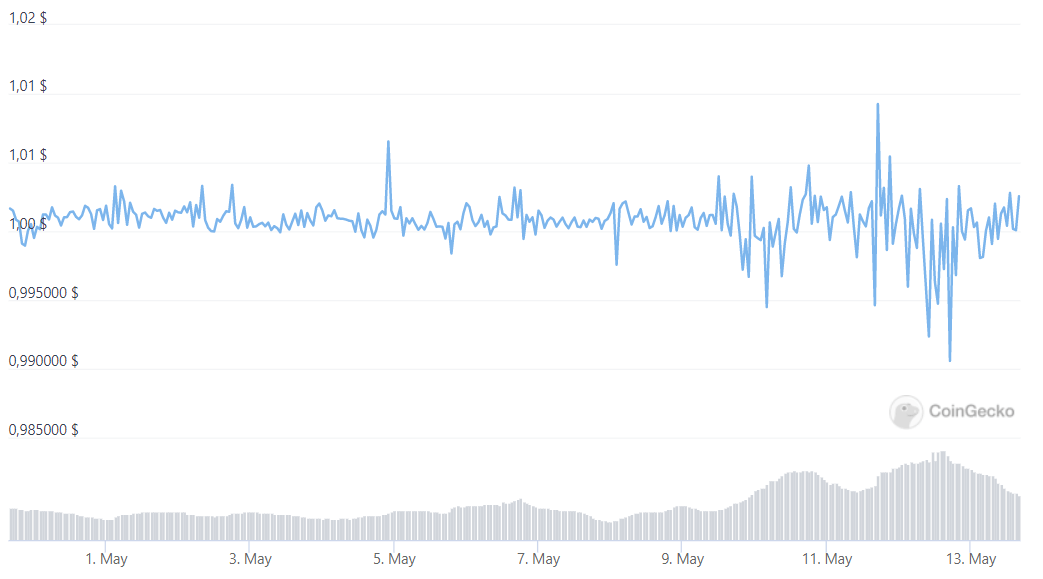

After UST lost its parity to USDT, many traders began to panic about a possible repeat of this scenario with Tether as well. This forced market participants to hastily sell their USDT, causing the value of the token to actually deviate from $1 by a few cents. However, that was the end of the “decline”.

That said, in an interview with Cointelegraph, Tether Chief Technology Officer Paolo Ardoino assured traders that USDT is different from algorithmic stackcoins like UST. Tether has a “strong, conservative and liquid asset backed token portfolio, which consists of cash and cash equivalents. This includes treasury bills, marketable funds and commercial paper.

In other words, behind each USDT is a dollar value asset. That means that there is no reason for the world's main stabelcoin to collapse, because its rate can't be collapsed by a trivial sale. And the coin itself does not work on the basis of the algorithm, so these fears are simply illogical.

Tether to dollar exchange rate

Ardoino also noted that the ongoing fear, uncertainty and doubts around stablcoin are becoming a source of income for certain traders. He explained that some are buying USDT at below $1 on exchanges and then exchanging tokens for dollars at full parity on Bitfinex and the Tether website.

In another statement, Tether stressed that verified customers can still redeem USDT on its website. The stabelcoin issuer has not encountered any problems even after 300 million USDT were withdrawn in a single 24-hour period. Ardoino, on the other hand, assures that force majeure situations like what happened with UST and LUNA will not hinder Tether’s operations in the future. Here’s his rejoinder.

Tether is pleased that the market continues to show its trust and confidence in the company. We are a fast growing industry and as an industry we will learn from these events together.

Tether chief technology officer Paolo Ardoino

We think that investors' fears of a possible USDT fall solely because of the UST situation are unsubstantiated. Certainly, Tether's stablecoin has had problems before, with terrible consequences for the market at that time. However, the two stablocoins are different in their model: the Tether product has collateral, meaning the coins are not a phantom. UST, on the other hand, is exposed to market transactions, which was the reason for the collapse.

While the prospect of trouble for Tether exists - still the cryptocurrency industry is completely unpredictable - there's no need to mix the two right now. Well, there is no reason to panic: USDT is still equal to 1 dollar.