Experts have assessed the security of popular cryptocurrency projects. What is the conclusion from the analysis?

Cybersecurity has been one of the hottest topics of discussion in the crypto industry almost since its inception. In the history of the crypto market, there have been many hacking attacks, fraudulent schemes, and hard-to-predict “black swans” that have caused billions of dollars in losses. One of the most recent examples is the collapse of the Terra project ecosystem, which became a “black day” for many UST and LUNA token holders, whose value plummeted to almost zero in a matter of days. We tell you more about this topic.

How to evaluate cryptocurrency security

The problem with evaluating a startup’s security is that different methods can yield completely different results. According to CryptoSlate sources, this is especially evident after the integration of the CER.live platform into the cryptocurrency tracking service Coingecko. Coingecko users can now view the ranking of crypto projects based on their security, audits, bug bounty programmes and investor insurance methods.

And here's an example of the problem: CER.live rates Binance Coin (BNB) token security at 55/100, although another audit platform rated it at 95/100. The difference between these two scores highlights significant problems in the third-party rating ability. BNB's page on Certik shows that it is the highest-rated project of all cryptocurrencies, while CER has it in only 195th place.

Cryptocurrency hacker

An argument can also be made for the methodology used by CER, which resulted in Binance Coin receiving such a low score. BNB was “punished” for not being able to actually audit the tokens and platform. Similarly, Ripple’s XRP received just 27/100 due to similar problems.

Another example is the hype token from 2021 Shiba Inu (SHIB), which has three scores: 36/100 from Defi Safety, 94/100 from Certik and 46/100 from CER. The median score is 58/100, which is 42 per cent lower than Certik’s score. So who is to be believed? To avoid such questions anymore, the crypto industry needs standardised criteria and methods for evaluating projects, experts say. In the meantime, the difference in scores will be very noticeable.

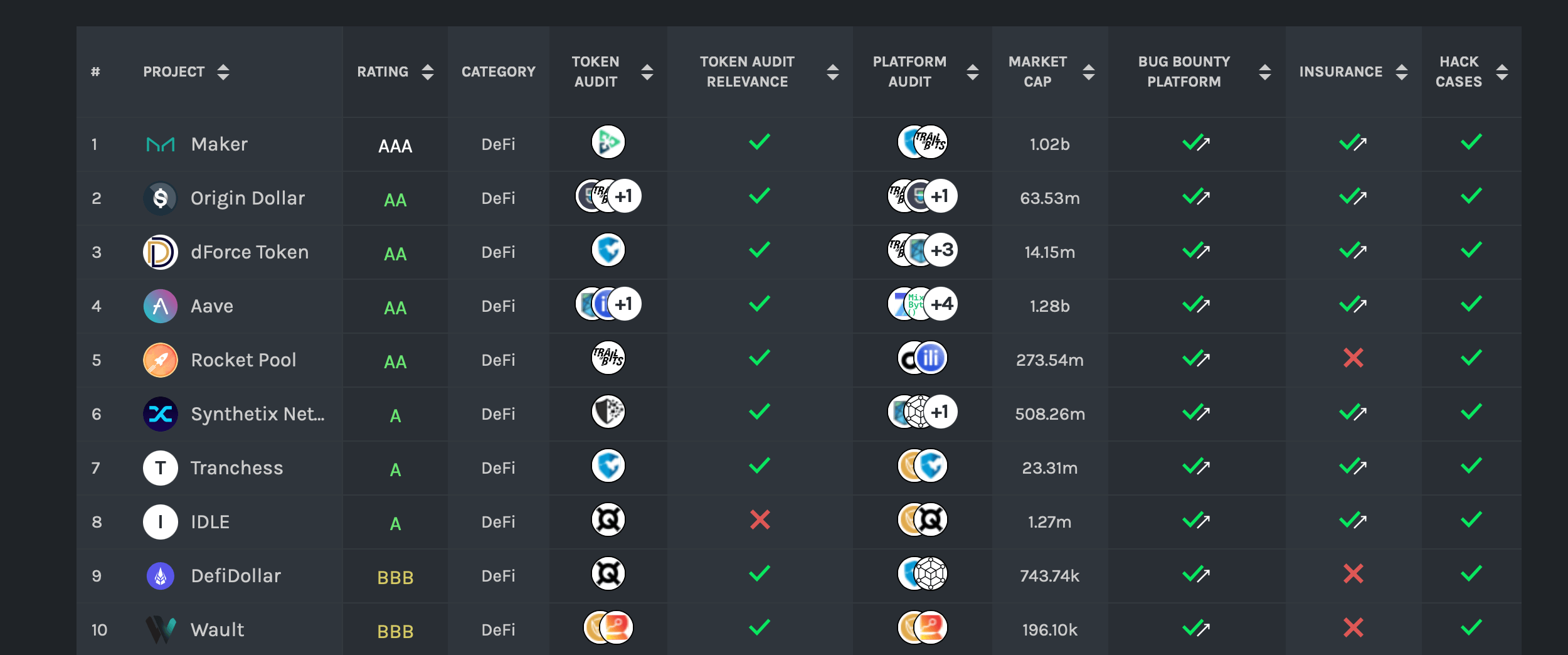

To illustrate, here is Cer’s ranking of the safest decentralised finance platforms. In this case it is worth to look at the column after the name of the project, which just clarifies the final rating.

Cer ranking of decentralised finance platforms

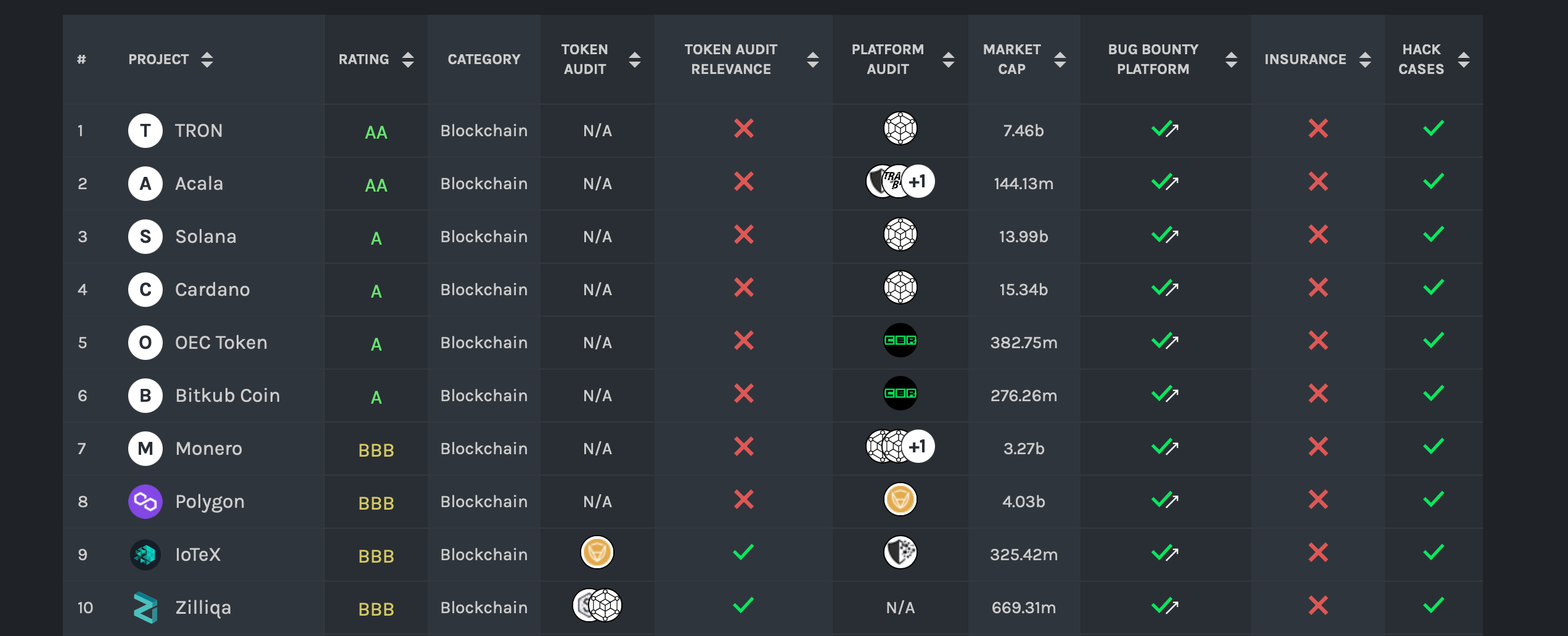

Here is the evaluation of the reliability of blockchains. The final parameter is judged by the fact that audits have been conducted, there is a bug bounty and insurance program, and much more.

Cer’s blockchain ranking

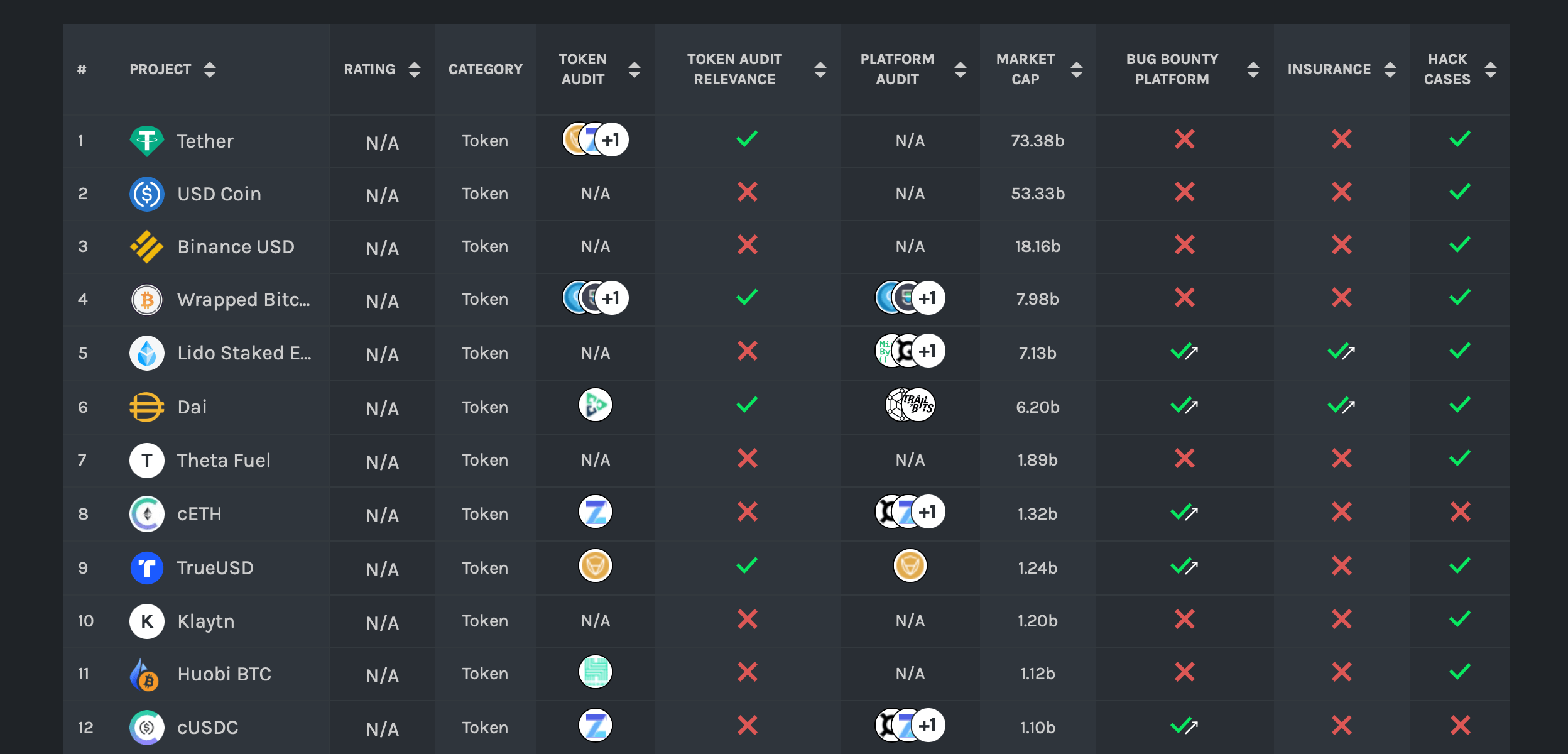

Representatives of the platform have rated some popular tokens on the same parameters, but the rating for them is not yet displayed. It looks like this.

Cer’s ranking of tokens

Unfortunately, the rating agencies have so far done nothing to protect users from masterful fraudulent schemes. The day before, a video allegedly showing billionaire Elon Musk encouraging everyone to invest in a “promising crypto project” that promises up to 30 percent dividends every day for the rest of their lives started circulating on Twitter.

Here’s the relevant video.

Elon Musk’s deep fake video promoting a new cryptocurrency scam going viral. The video claims that the trading platform is owned by Elon Musk, and offers 30% returns on crypto deposits. @elonmusk pic.twitter.com/iJeUvHYc5p

– DogeDesigner (@cb_doge) May 24, 2022

This video is a dipfake, i.e. a video created using artificial intelligence to spoof Musk’s face and voice in a rather realistic manner. The billionaire has indeed never made such a statement, as he himself confirmed on Twitter. Nevertheless, this fact will do nothing to protect the gullible user who will believe the dipfake.

It is possible to recognise a dipfake by carefully watching the video several times. However, the more sophisticated artificial intelligence technology becomes, the harder it will be to do so in the future.

Not only Musk joined the discussion around the video, but also the creator of the popular Dogecoin (DOGE) coin with a rather harsh comment. His quote is quoted by Decrypt.

Anyone foolish enough to invest in it deserves to lose their money. But at the same time, crooks deserve to spend their lives in prison. Literally anyone who watches this video and thinks it’s real will lose their money on anything.

Overall, the overall conclusion from the whole news is that the security of cryptocurrencies depends entirely on the owner, such is the “beauty” of decentralisation. If an investor expects to fully own his capital without relying on centralized authorities, he must also be responsible for his own actions and decisions. Naturally, this does not apply to those things that do not depend much on him – for example, the collapse of Terra. In that case, the industry needs actual insurance and investment protection mechanisms.

We believe that the topic of assessing the security and safety of cryptocurrencies together with blockchain platforms is really important because it is able to attract new users. The latter, as newcomers, will primarily rely on the platform itself rather than their actions. Therefore, standards for evaluating networks and coins would definitely not hurt the industry - unlike the suggestions that DraftKings betting platform co-founder Jason Robins voiced the day before.

And what suggestions do you have for this? Share them in our Millionaire Cryptochat. We’ll discuss other important developments in decentralisation there too.