Experts warn of continued fall in Bitcoin price. Where could the cryptocurrency fall?

The price of Bitcoin has been hovering around $30,000 for several days now. At the same time, traders’ fears of a new cryptocurrency collapse have not yet disappeared. According to experts, the probability of this event is still quite high on the level of problems in the macroeconomy and geopolitical instability in Europe. Whalemap analysts have identified key lines on the BTC chart, which market players should keep an eye on. We are going to talk about the situation in more detail.

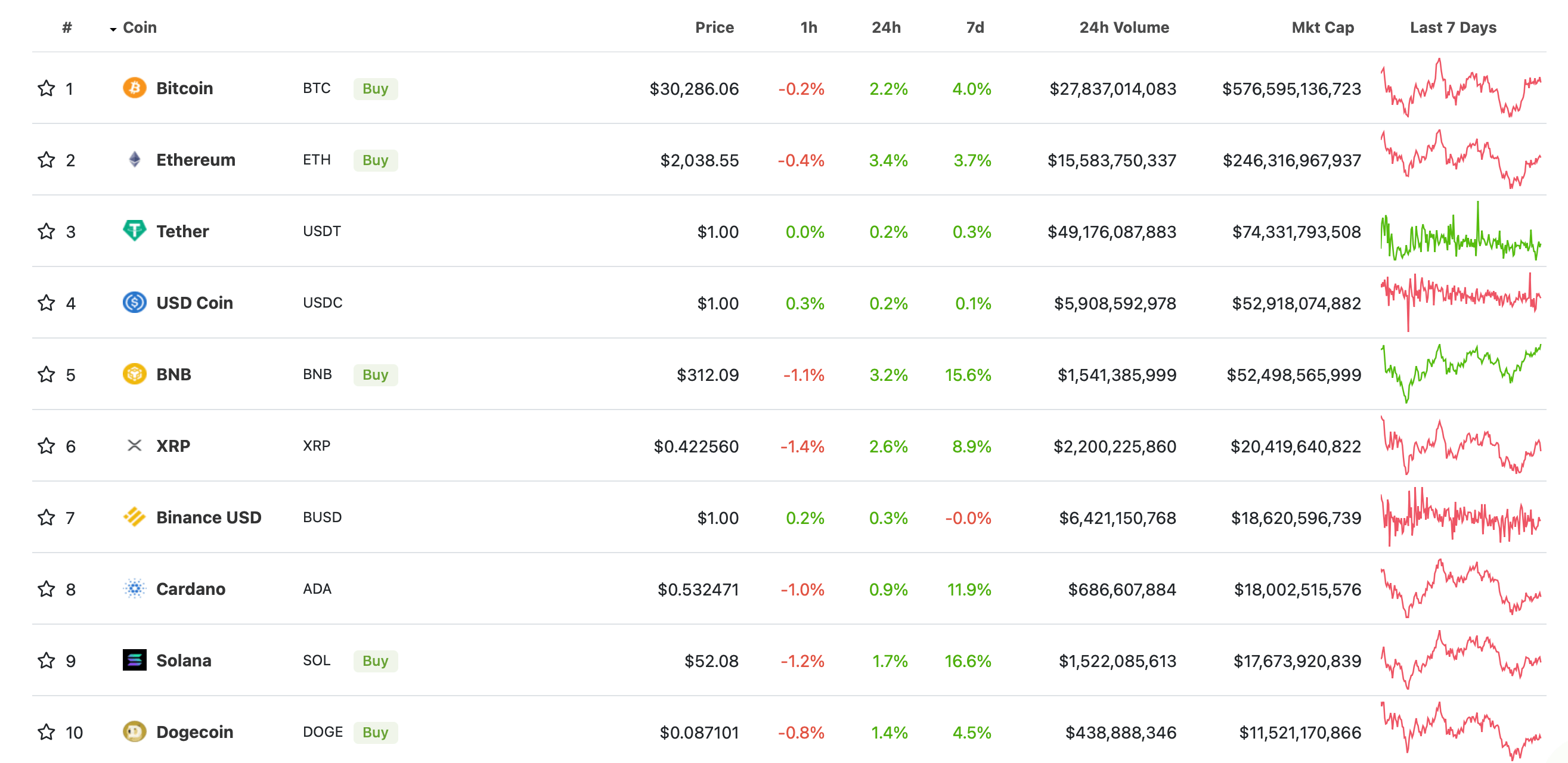

Today, the situation in the cryptocurrency market seems quite calm. In particular, coins showed a slight growth during the day, with Bitcoin holding above $30,000. The top ten coins by market capitalisation look like this.

Top ten cryptocurrencies by market capitalisation

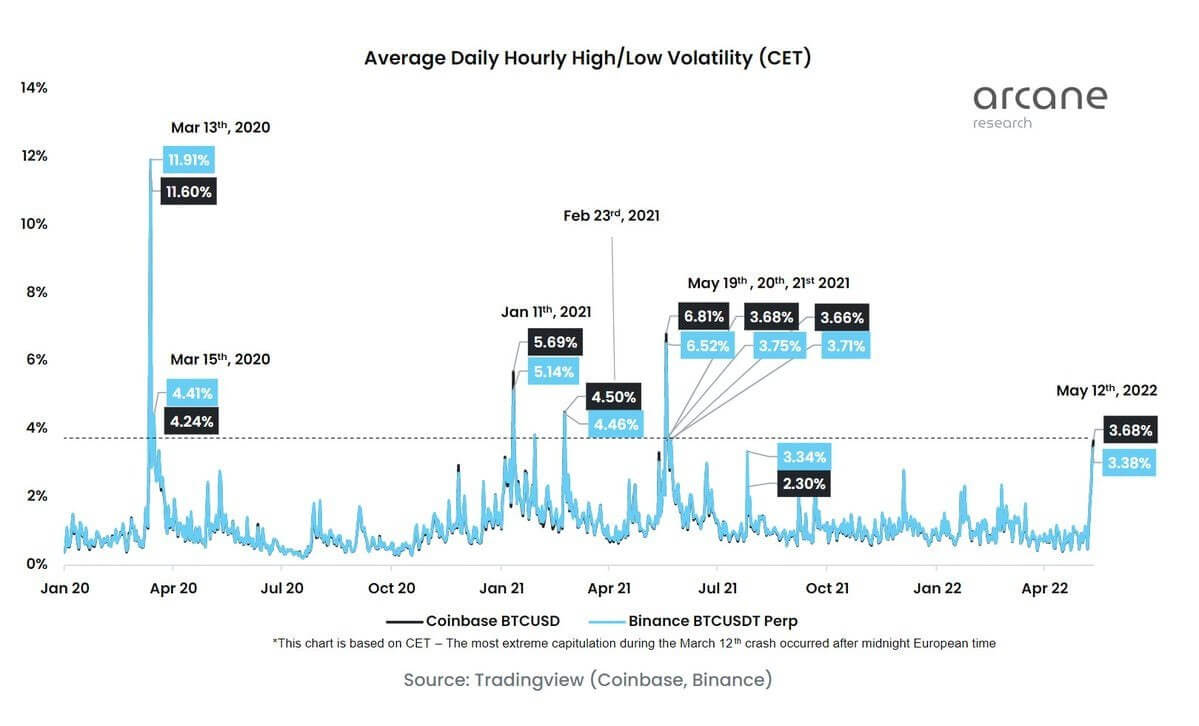

That said, last week the volatility of Bitcoin’s intraday value reached the level of May 2021, when the cryptocurrency market was noticeably collapsing. Accordingly, coin rates are generally changing quite strongly in May.

Bitcoin volatility chart

Where will Bitcoin’s price go?

The cryptocurrency’s prolonged chart movement in a horizontal channel has divided traders into two camps. Some are predicting Bitcoin to return above $32,000 followed by a smooth rise, while others are waiting for a sharp collapse down to $23,800. According to Cointelegraph sources, Whalemap experts are more inclined to the second version of events and urge to closely monitor the area from $24 to $26 thousand.

It is in this zone that a huge amount of orders to buy BTC from “whales”, i.e. large holders of the cryptocurrency are concentrated. If buyers fail to seize the initiative here as well, the price of Bitcoin may “fall” much deeper on the chart.

The $24,000 to $26,000 zone on the Bitcoin chart

However, in a separate post, Whalemap noted that since realized losses now exceed profits, Bitcoin could still expect a rebound in the near future. Here’s a rejoinder from the experts, in which they share their view of what’s happening.

Over the past couple of days, twice as many losses as gains have been recorded on the Bitcoin blockchain. The last time this happened, the price of BTC went up. Let’s see what happens this time.

This is essentially how the experts hedge their main prediction and allow the asset's price to move in the opposite direction. This confirms the fact that it is simply impossible to predict the development of the situation on such a volatile market. That is why analysts have to simply share their versions and estimate their probability.

Bitcoin holders’ profit and loss dynamics

Read also: Former US Federal Reserve Chairman criticizes Bitcoin and names cryptocurrency's 'core value'

The market situation is not encouraging, to say the least. But there are “pleasant memories” – of a period of time when it seemed that the bullish trend of Bitcoin and altcoins was unstoppable. The “victim” of such illusions was billionaire and founder of investment firm Galaxy Digital, Mike Novogratz. On January 5, the investor posted a photo on Twitter of himself posing with a new tattoo on his arm dedicated to Project Terra (LUNA).

Galaxy Digital invested in Terra in the fourth quarter of 2020, with the project itself considered one of the most successful on the crypto market. In 2021, the price of the LUNA token rose from 60 cents to almost $100, which meant a crazy profit for early investors.

Just a week ago, however, things changed dramatically, with the coin depreciating almost completely in a matter of days after problems with the TerraUSD (UST) stablecoin’s parity to the dollar. Novogratz’s tattoo on the backdrop of this unfortunate event now looks rather comical. The billionaire himself made the following statement about it.

My tattoo will be a constant reminder that venture capital investing requires humility.

In other words, the investor realized that he should not get too euphoric about the growth of an existing project in his portfolio. And the lesson was so painful that Novogratz will probably remember it even without the tattoo. He has no immediate plans to remove it, though.

Novogratz’s tattoo

However, the crypto industry has experienced some of the worst collapses in its history, so it could well survive the Terra tragedy after a period of recovery, Novogratz is confident. He continues.

This does not mean that the cryptocurrency market will bottom out and go straight up. It will take restructuring, a buyback cycle, consolidation and a renewed confidence in cryptocurrencies.

Shrewd market players were much luckier in the Terra situation. For example, one of the first investors in the project, Pantera Capital, withdrew almost 80 per cent of its investment some time before LUNA collapsed. According to Pantera partner Paul Veradittakit, the firm managed to turn $1.7 million into about $170 million.

Terra founder Do Kwon

We believe that the current market conditions are indeed not in the best of health. However, it is important to remember that Bitcoin is now as much as 56 per cent cheaper than its price high, while many altcoins are down as much as 70-90 per cent. This means that a bearish trend could indeed occur - and in a faster phase at that. Whatever the case, crypto investors should be prepared for anything and manage their own risks.