MicroStrategy’s head predicts Bitcoin’s price will rise to “millions of dollars”. But for now, his company is making a loss

Bitcoin’s recent drop below $30,000 is clearly not upsetting MicroStrategy CEO Michael Saylor. During his recent interview, he stated that the major cryptocurrency has every chance to grow to “millions of dollars”. His company, which has been actively accumulating BTC since the summer of 2020, has no intention of selling the coins and is sticking to a strategy of periodic crypto purchases. We tell you more about what’s happening.

It should be noted that earlier predictions of Bitcoin’s rise to a million dollars have already been made. In particular, co-founder of BitMEX Arthur Hayes said something similar. According to him, the current global problems will force entire countries to accumulate “hard assets” like gold and Bitcoin. In addition, the recent asset freeze of the Central Bank of Russia by representatives of Europe and the U.S. could be a reason for this.

Consequently, governments will also be interested in decentralized assets that are immune to such a scenario. You can read more of Hayes’ viewpoint in the article at the link.

BitMEX co-founder Arthur Hayes

What will happen to Bitcoin’s exchange rate

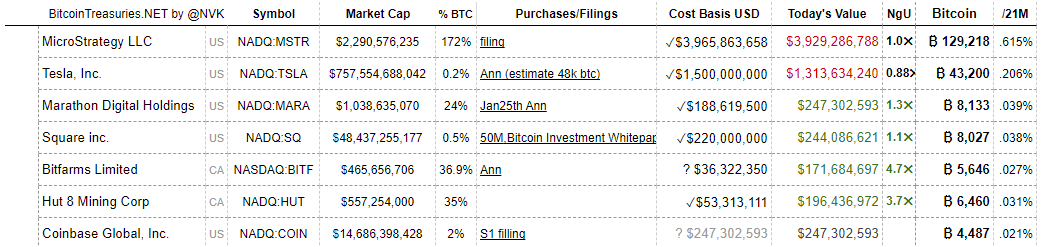

Thanks to countless rounds of bitcoin purchases, the Saylor-led company MicroStrategy is still the largest corporate holder of the cryptocurrency with 129,218 BTC on its balance sheet. Its huge Bitcoin position is currently at a bit of a disadvantage: at the time of writing, the firm has unrealised losses of around $70 million.

As a reminder, they are unrealised because the company is not disposing of the cryptocurrency at a loss. Accordingly, if BTC rises above $30,700 in the future - which is the average coin price for the giant company - then MicroStrategy will have unrealised gains. The same is true for investments in other areas. Well, the realized loss or profit becomes after the exit from the position, i.e. the sale of assets.

According to CryptoPotato sources, Saylor’s confidence has not wavered even after the recent collapse of the crypto market. He assured that there was no target price at which MicroStrategy would start liquidating its crypto assets, i.e. getting rid of them. That said, the firm had billions in unrealised profits when the price of Bitcoin rose to its all-time high.

There is no price benchmark. My expectation is that we will buy Bitcoin at the local price peak at all times. And I expect Bitcoin to appreciate into the millions of dollars. So we are very patient. We believe this is the future of money.

Sailor mentioned Bitcoin's local price peak for a reason. The fact is that the company bought BTC more than once just before the collapse of the cryptocurrency's price, making it an object of jokes within the cryptocurrency community, among other things. As a result, cryptocurrency representatives regularly claim to short the market following MicroStrategy's announcements of another batch of BTC purchases.

MicroStrategy has the highest number of bitcoins on its balance sheet among public companies

Among the billionaires, there are also those who do not invest in Bitcoin for one reason or another. One of them is Microsoft founder Bill Gates. The day before, he held a series of answers to questions from users on Reddit. When asked if he had anything to do with the crypto market, the billionaire replied that he did not own any such assets. Gates invests in things with “valuable results” – such as companies that can produce great products that justify their value.

Billionaire Bill Gates

On the other hand, in his view, cryptocurrencies are an asset whose value is determined by the purchaser himself with no additional benefit to society. That said, in early 2021, the billionaire predicted that digital assets would eventually become the world’s primary means of payment. However, he ended up taking a “neutral stance” on Bitcoin, stating that he did not own the coin, but that he was not going to short the market.

The benefits of the digital asset industry, however, are enormous. Firstly, coins allow people to truly own their money through crypto, without fear of it being seized or blocked by banks. Second, the popular field of decentralised finance makes it possible for anyone with a phone and the internet to connect to financial platforms. Still, today not all people have access to such platforms, but crypto paired with blockchain makes access to them completely unrestricted.

The power of Bitcoin

We believe that such statements about Bitcoin for millions of dollars really mean that MicroStrategy has no plan to drain the cryptocurrency's reserves in the future. And if the company's management is confident in the prospects of digital assets and even the possible replacement of fiat with them, then such a prospect is believable. And why get rid of something that could be the backbone of the financial system of the future? Especially, taking into account the fact that maximum BTC supply is still limited to 21 million coins.

What do you think about it? Share your opinion in our millionaires cryptochat. There we will discuss other important developments in the blockchain industry.